A Misleading Sign: FIIs Start Bullish Pivot as Market Sees Mass Exodus

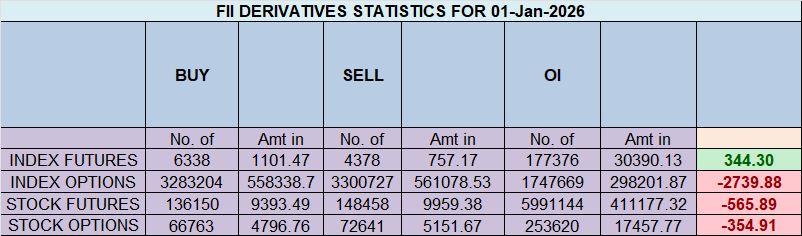

On the primary buying and selling day of the brand new 12 months, January 1, 2026, the Nifty Index Futures market introduced a traditional and highly effective end-of-trend sign. Whereas the headline deceptively exhibits International Institutional Buyers (FIIs) as web consumers of 1,072 contracts, the actual, extra profound story lies within the full deleveraging of the broader market, confirmed by a big collapse in Open Curiosity (OI) of 1,084 contracts.

This isn’t the information of a brand new, wholesome bull run beginning. That is the textbook signature of an previous, exhausted bear pattern ending in a remaining wave of place closures and a strategic institutional pivot.

Decoding the Information: The Pivot vs. The Exodus

The important thing to this evaluation is the stark distinction between what the FIIs are actively doing versus what the remainder of the market is doing.

1. The FIIs: A Clear and Decisive Bullish Pivot

The granular FII information reveals a big and strategic shift of their conduct. This was not simply passive shopping for; it was a robust, two-pronged bullish assault:

-

They added 1,024 new lengthy contracts, initiating contemporary bullish bets for the primary time in an extended whereas.

-

Concurrently, they coated 936 brief contracts, starting the method of dismantling their large, worthwhile bearish marketing campaign.

This twin motion of constructing new longs whereas closing previous shorts is probably the most highly effective sign of a change in institutional view. Nonetheless, it’s essential to notice that their legacy positioning stays extraordinarily bearish (13:87 ratio). This is sort of a big battleship attempting to show; the rudder has simply been turned laborious, however the large ship will take time to vary its heading. The lively movement is bullish, however the historic place remains to be bearish.

2. The Foremost Occasion: The Nice Market Unwinding

Essentially the most essential sign of the day is the collapse in Open Curiosity. Which means that whereas FIIs had been actively including positions, the remainder of the market was fleeing en masse. Purchasers, specifically, confirmed excessive however conflicted participation, including each longs and shorts, however the general market noticed an enormous variety of gamers from each side shut their books. This signifies:

-

Profound Pattern Exhaustion: The contributors who outlined the earlier pattern (each the entrenched bears and the hopeful bulls) are closing their positions. The power that fueled the final main transfer is now gone.

-

A “Hole” Market Construction: A market the place the value is steady or rising however general participation is shrinking is a market that’s turning into “hole” and brittle. It’s vulnerable to excessive volatility as liquidity thins out.

Key Implications for the Market

-

The Bear Pattern is Formally Over: The first engine of the decline—aggressive FII shorting—has now formally reversed. This removes the one largest supply of promoting strain from the market.

-

The Threat has Inverted to a Brief Squeeze: The FIIs nonetheless maintain a colossal legacy brief place. Their very own lively shopping for is now working in opposition to their previous place. If they’re pressured to speed up their brief protecting, it may ignite a violent and self-sustaining rally (a brief squeeze).

-

It is a Bottoming Course of, Not a New Bull Market (But): That is the information signature of a market attempting to carve out a significant backside. This course of is never clear or linear. Count on excessive volatility, sharp rallies, and probably deep retests of the lows because the market works to discover a new equilibrium.

Conclusion

Disregard the headline FII “purchase” determine as an indication of broad market power. The dominant story is the strategic bullish pivot by FIIs occurring inside a massively deleveraging and hollowed-out market. The previous bear pattern has simply ended, however the basis for a brand new bull pattern remains to be fragile and has but to be constructed. The danger of a significant decline has evaporated, changed by the very excessive threat of a risky and painful brief squeeze for anybody remaining aggressively brief.

Final Evaluation might be learn right here

The Nifty is at present in a state of profound and excessive consolidation, signaling {that a} main directional breakout isn’t just attainable, however imminent. The market has simply fashioned a traditional and uncommon NR21 sample, confirming that the buying and selling vary on January 2nd was the narrowest it has been within the final 21 buying and selling periods. This highly effective technical signature represents a market at a degree of peak equilibrium and indecision—a “coiled spring” that has been wound to most stress.

This second of maximum value compression is converging completely with a big astrological catalyst, the latest Mercury signal change. This highly effective confluence of a selected value sample with a key timing occasion creates a traditional “price-time assembly.” This is likely one of the most dependable setups for forecasting an imminent and explosive launch of power, which is anticipated to occur both in the present day or on Monday.

The Definitive Fulcrum: The 26,054 Line within the Sand

This highly effective “coiled spring” setup has created an unambiguous and significant battleground. The complete future course of the market’s subsequent main pattern now hinges on a single, pivotal value stage. The market’s subsequent transfer might be a direct response to this fulcrum.

-

The Bullish State of affairs (Maintain > 26,054): The bulls have a transparent and direct mission: they have to defend the 26,054 help stage. So long as this important stage is held, they keep management, and there’s a excessive chance that the immense power saved throughout the NR21 sample might be unleashed to the upside. A profitable protection of this stage targets a robust, trending transfer in direction of 26,250 and a extra important goal of 26,385.

-

The Bearish State of affairs (Breakdown < 26,054): The bears’ goal is to interrupt this essential help and seize management. A failure by the bulls to keep up the 26,054 stage can be a decisive technical failure. It will sign that the saved power is resolving to the draw back, seemingly triggering a fast, cascading fall in direction of the preliminary help at 25,945 and a extra important decline in direction of 25,800.

Conclusion

The Nifty is at a significant inflection level, wound tight by an exceptionally uncommon sample of maximum vary compression and timed by a potent cyclical catalyst. The circumstances at the moment are completely aligned for a big growth in volatility. The battle traces are drawn with mathematical precision at 26,054. The aspect that wins management of this pivotal stage will seemingly dictate the market’s pattern for the approaching days and weeks. Put together for a big and directional breakout.

Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 26199 for a transfer in direction of 26280/26360. Bears will get lively beneath 26119 for a transfer in direction of 26038/25958

Merchants could be careful for potential intraday reversals at 09:30,11:48,12:40,01:23 The way to Discover and Commerce Intraday Reversal Occasions

Nifty Dec Futures Open Curiosity Quantity stood at 1.40 lakh cr , witnessing liquidation of two.2 Lakh contracts. Moreover, the rise in Price of Carry implies that there was closuer of SHORT positions in the present day.

Nifty Advance Decline Ratio at 38:12 and Nifty Rollover Price is @26141 closed above it.

Within the money phase, International Institutional Buyers (FII) offered 3268 cr , whereas Home Institutional Buyers (DII) purchased 1525 cr.

The Nifty choices market is radiating a robust and assured bullish sentiment, signaling that bulls are in agency management of the market’s course. A really wholesome Put-Name Ratio (PCR) of 1.13 is the clearest proof of this, indicating that the overall open curiosity of put choices has decisively surpassed that of calls. It is a traditional signal of a market that has shed its concern, pushed by aggressive put writers who’re confidently promoting draw back safety, thereby constructing a formidable help construction beneath the index.

This bullish sentiment is powerfully bolstered by the market’s structural evolution. The Max Ache level has shifted larger to a brand new pivot of 26,150. This upward migration signifies that probably the most influential gamers—the massive institutional choice sellers—at the moment are anchoring their positions at this elevated stage, accepting the upper value vary as the brand new establishment and creating a robust gravitational pull in direction of it.

The participant information reveals that International Institutional Buyers (FIIs) are the architects of this stability, appearing as important web sellers of put choices. This exhibits institutional confidence and is creating the very basis upon which the rally stands. Retail merchants are additionally collaborating optimistically, primarily as web consumers of calls.

This has established a transparent battlefield for the week:

-

Resistance: The first resistance ceilings are situated at 26,250 and, extra considerably, at 26,500.

-

Help: The 26,150 Max Ache stage now acts because the rapid pivot and help. The essential psychological stage of 26,000 has develop into a significant help flooring.

In conclusion, the Nifty is in a sturdy, “purchase on dips” atmosphere. The trail of least resistance is firmly to the upside, with the market more likely to consolidate round 26,150 earlier than attempting to beat the subsequent main resistance ranges.

For Positional Merchants, The Nifty Futures’ Pattern Change Degree is At 26215 . Going Lengthy Or Brief Above Or Beneath This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Increased Threat-reward Ratio. Intraday Merchants Can Maintain An Eye On 26299 , Which Acts As An Intraday Pattern Change Degree.

Nifty Spot – Intraday Chart Remark

Technical Setup: The index is approaching essential breakout ranges. Watch these zones for value motion affirmation:

-

Energy (Upside): Momentum is anticipated to choose up if Nifty sustains above 26166 . On this situation, the rapid resistance ranges are 26200, 25240, and 26299.

-

Weak point (Draw back): The pattern technically weakens if the index slips beneath 26108 . This might open the trail in direction of help ranges at 25075, 25029, and 24980.

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable selections based mostly on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your strategy.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators