First, on-line banking permits for split-second transfers from one financial institution to a different financial institution or monetary establishment. Second, not like the Despair, this silent financial institution run has been gradual and lacks media protection.

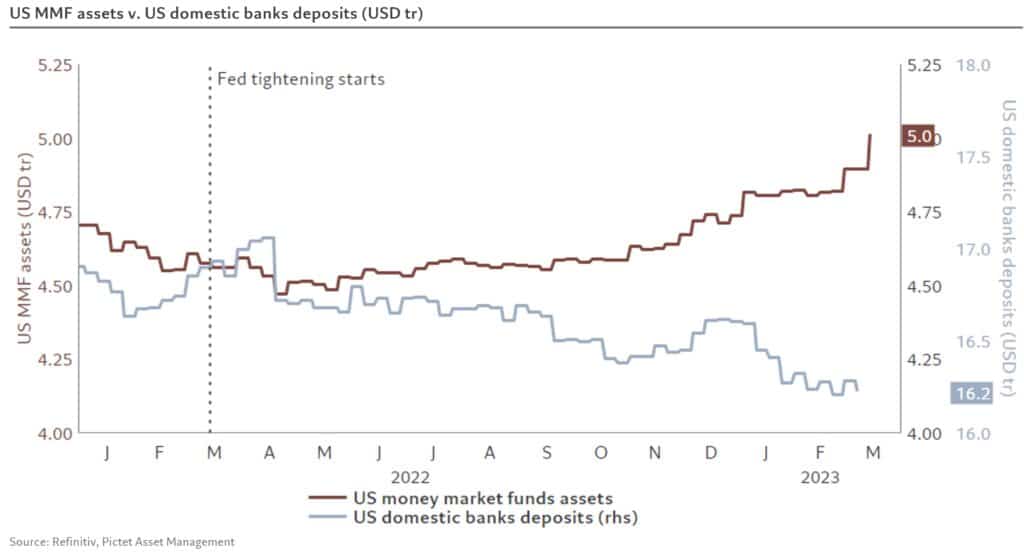

Till the final week, the silent financial institution run has not been about solvency issues such because the Despair. As a substitute, clients moved cash from banks to higher-yielding choices outdoors the banking sector. The graph under from Pictet Asset Administration reveals that cash market belongings and home financial institution deposits have trended in reverse instructions for the reason that Fed began mountaineering rates of interest. Because of the silent financial institution run, banks should tighten lending requirements and promote belongings. That is already occurring. To wit: “The first mortgage market looks like a Scooby Doo ghost city – not too long ago abandoned and a bit haunted.” – Scott Macklin -AllianceBernstein. As a result of the financial system closely relies on rising quantities of credit score to develop, this silent financial institution run will possible result in a recession.

![]()

Bull Market Is Again – Purchase Indicators Gentle Up

In early February, we really useful decreasing publicity as all the “promote alerts” triggered.

“Whereas that promote sign does NOT imply the market is about to crash, it does counsel that over the subsequent couple of weeks to months, the market will possible consolidate or commerce decrease. Such is why we lowered our fairness threat final week forward of the Fed assembly.”

After all, since then, the market did commerce decently decrease. Nonetheless, with the rally yesterday because the “banking disaster” was laid to relaxation, the market not solely confirmed the check of the December low assist however rallied above key short-term resistance and triggered each our MACD and Cash Stream “purchase alerts,” as proven.

The one problem for the market between yesterday’s shut and the February highs is the 50-DMA which is short-term resistance. The 200-DMA is now confirmed assist. If the market breaks above the 50-DMA tomorrow, there’s loads of “gasoline” for the market to push to 4200-4400.

![]()

Main MoneyFlow Indicator Registers Purchase Sign

![]()

We might be rising publicity to portfolios pretty rapidly, beginning most certainly tomorrow following the Fed announcement. The market is sniffing out a reasonably dovish take from the Fed, so we are going to see if they’re proper.

Investor Conditioning vs. Actuality

Lance Roberts leads his newest ARTICLE with a vital query.

“QE” or “Quantitative Easing” has been the bull’s “siren track” of the final decade, however will “Not QE” be the identical?

Whether or not the newest financial institution bailout is technically QE or not, traders appear conditioned to imagine that any Fed-related bailout is QE. If that holds this time, the newest bounce in Fed belongings, proven under, might be bullish. In a single week, the Fed offset over 4 months’ price of QT. The second graph from the article reveals the strong correlation between the expansion of the Fed’s stability sheet and the expansion of the S&P 500. Whereas the financial outlook might not be good, liquidity or perceived liquidity can drive markets increased for prolonged intervals.

![]()

![]()

Insuring All Deposits

The Fed and Treasury are considering guaranteeing the banking system’s $17.6 trillion of deposits. The issue is the FDIC solely has $128b of capital. Whereas insuring deposits might make sense, banks should elevate capital to construct the right quantity of FDIC insurance coverage to cowl all deposits. If the Treasury decides to insure deposits, will they concern trillions of debt to create a backstop? Or may they depend on funding from the market when the insurance coverage is required? Whether or not it’s bigger deficit funding or capital funding from banks, the consequences are regarding.

![]()

Excessive Two-Yr Notice Volatility Might Stick Round

As proven under, the two-year be aware not too long ago fell by about one % over the previous couple of weeks. A disaster of types accompanied every prior vital decline. For those who discover, the big declines have a tendency to not be one-time strikes. Volatility tends to stay round. Thus, the latest decline is probably going not the final huge transfer up or down. Price volatility could also be right here to remain for some time.

![]()

![]()

Michael Lebowitz, CFA is an Funding Analyst and Portfolio Supervisor specializing in macroeconomic analysis, valuations, asset allocation, and threat administration. Michael has over 25 years of monetary markets expertise. On this time he has managed $50 billion+ institutional portfolios in addition to sub $1 million particular person portfolios. Michael is a accomplice at Actual Funding Recommendation and RIA Professional Contributing Editor and Analysis Director. Co-founder of 720 World. You possibly can observe Michael on Twitter.