TL;DR abstract:

-

China delivered minimal price cuts regardless of expectations for aggressive easing.

-

The PBOC has prioritised monetary stability and focused liquidity instruments.

-

Fiscal stimulus is predicted to hold the majority of coverage help into 2026.

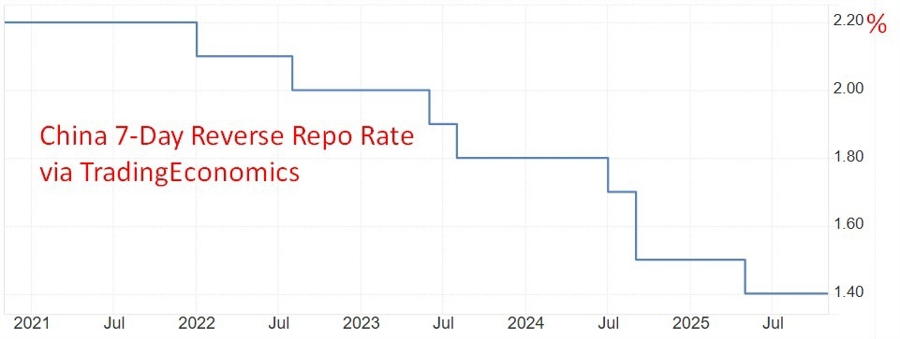

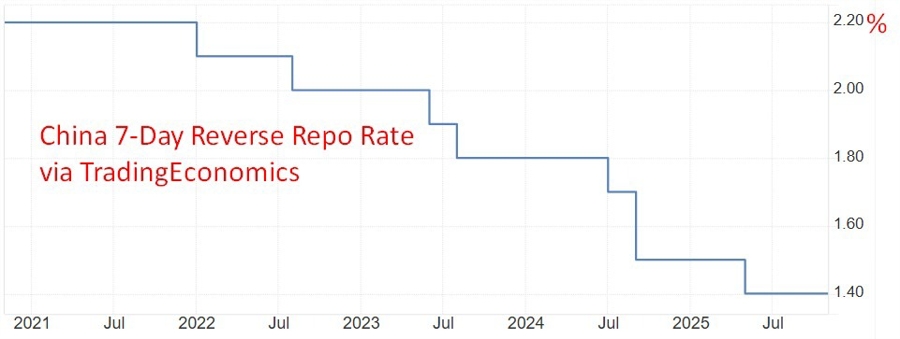

China’s central financial institution has taken a notably restrained strategy to financial easing, defying widespread expectations for aggressive price cuts because the financial system grapples with weak home demand, deflationary stress and structural imbalances. Over the previous 12 months, the Individuals’s Financial institution of China trimmed its coverage price solely as soon as, by 10 foundation factors, the smallest annual discount since 2021, regardless of forecasts from main Wall Avenue banks calling for relieving of as much as 40 foundation factors.

Information comes by way of a Bloomberg report, gated.

The warning has shocked markets, notably after Beijing signalled a shift to a “reasonably free” financial stance for the primary time in 14 years because it ready for escalating commerce tensions with the US. What economists underestimated was the resilience of China’s export sector, considerations over banking-system stability, and the influence of a robust equity-market rally, all of which decreased the urgency for sweeping price cuts.

In contrast with world friends, China’s stance stands out. Whereas advanced-economy central banks have minimize coverage charges by a mean of 1.6 proportion factors over the previous two years, the PBOC has delivered solely a fraction of that. Adjusted for inflation, Chinese language rates of interest have moved again into constructive territory, underscoring Beijing’s reluctance to observe the ultra-loose playbook adopted by the Federal Reserve, European Central Financial institution and Financial institution of Japan throughout downturns.

As a substitute, policymakers have leaned on focused and fewer standard instruments. Liquidity injections via short- and medium-term operations, selective relending packages, help for fairness markets and renewed authorities bond purchases have saved funding situations free with out slashing benchmark charges. These measures have pushed interbank borrowing prices, such because the seven-day repo price, to their lowest ranges since early 2023.

Officers see restricted scope for additional cuts, with the important thing coverage price, the 7-day reverse repo, at 1.4% and considerations that deeper reductions may compress financial institution margins, weaken credit score development and gas “Japanification” fears. In consequence, fiscal coverage is ready to play the dominant position in 2026, with financial coverage centered on sustaining liquidity and preserving authorities borrowing prices low somewhat than driving a demand-led rebound.

—

The 7-day reverse repo price, now thought-about a key coverage sign, was minimize from 1.5% to 1.4% on Might 9, 2025.

The 1-year LPR was trimmed to three.0% from 3.1%, and the 5-year LPR was lowered to three.5% from 3.6% in Might also..

Through TradingEconomics