- The AUD/USD forecast seems impartial after the dismal Chinese language knowledge.

- Australian employment knowledge revealing weak spot places RBA in doubts about maintaining tighter financial coverage.

- The markets await US NFP knowledge due on Tuesday for additional impetus.

The AUD/USD value opened the week barely decrease, buying and selling close to mid-0.6600 in Asian hours on Monday as weak Chinese language financial knowledge dampened sentiment. The transfer adopted a disappointing set of November releases from China, Australia’s largest buying and selling accomplice, reinforcing considerations about fragile demand situations.

–Are you curious about studying extra about copy buying and selling platforms? Examine our detailed guide-

China’s retail gross sales rose simply 1.3% YoY, effectively under expectations for a near-3% improve, whereas industrial manufacturing slowed to 4.8% from October’s 4.9%. Fastened asset funding additionally missed forecasts, pointing to ongoing hesitation amongst customers and companies regardless of repeated coverage help measures. Aussie got here underneath delicate stress, as a response to dismal Chinese language progress knowledge.

Home components have additionally weighed on the forex. The Australian greenback has eased over the previous two classes after labor market knowledge confirmed a pointy deterioration in November. Employment fell by 21.3k jobs, in comparison with anticipated stable positive aspects, elevating questions on whether or not earlier financial resilience is beginning to fade.

Though the Reserve Financial institution of Australia has just lately warned that inflation dangers stay elevated, the weak jobs report has lowered confidence within the near-term tighter coverage.

Even so, AUD/USD losses stay contained by a broadly softer US greenback. The buck continues to battle as traders place for a extra accommodative Fed path than policymakers presently sign. Though the Fed’s newest projections level to only one price lower subsequent 12 months, market pricing suggests prolonged easing additional into 2026, particularly if labor market situations proceed to chill. That expectation has stored US yields underneath stress and restricted the greenback’s capacity to rebound.

The following key take a look at for the pair will come from US labor knowledge, with the delayed Nonfarm Payrolls report due on Tuesday. Forecasts heart on a modest rise in employment. Any draw back shock would reinforce expectations for additional Fed easing, including stress on the greenback. In that situation, AUD/USD might stabilize regardless of weak home fundamentals. Then again, a stronger-than-expected jobs report would give the greenback a elevate and will drag the pair again towards latest lows.

Past the US knowledge, merchants will proceed to look at developments in China after authorities signaled plans to difficulty ultra-long-term bonds in 2026 to help progress initiatives. This gives some longer-term reassurance, however markets stay targeted on near-term exercise knowledge, the place momentum continues to be missing.

For now, AUD/USD sits on the intersection of soppy China-linked fundamentals and a hesitant US greenback, leaving the pair delicate to incoming knowledge short-term swings relatively than a transparent development.

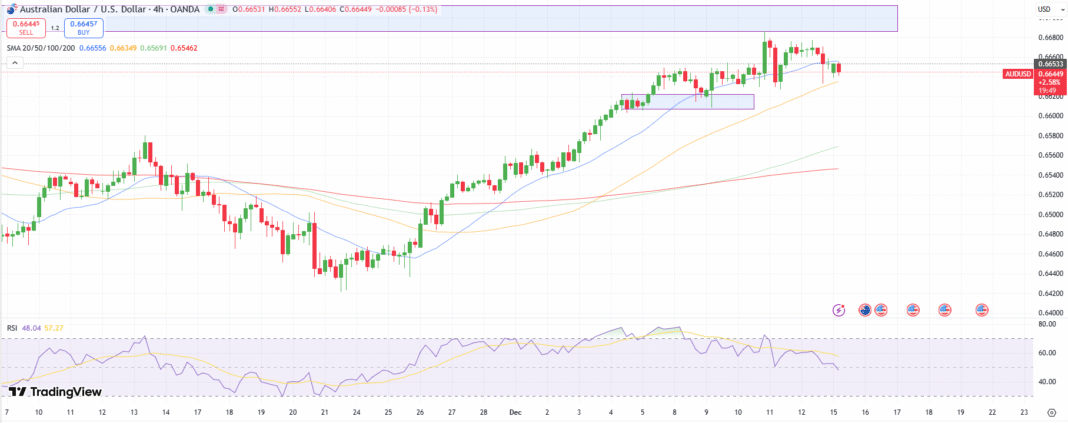

AUD/USD Technical Forecast: Caught Between 20 and 50 MAs

The 4-hour chart exhibits the value trapped between the 20-period and 50-period MAs close to the 0.6650 space. In the meantime, the RSI stays across the 50.0 stage, revealing no clear bias. Although the pair stays supported by 50-period MA and order block zone, the upside development lacks momentum under 0.6700.

–Are you curious about studying extra about scalping foreign exchange brokers? Examine our detailed guide-

The speedy help for the pair lies at 0.6630 minor demand space forward of December swing lows close to 0.6610 after which 100-period MA round 0.6570. On the upside, the speedy resistance seems at 0.6655 (20-MA) forward of 0.6685 (swing excessive) after which 0.6700 (spherical quantity).

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you may afford to take the excessive threat of shedding your cash.