QuantumScape (QS) enters the following quarter at a pivotal second. The corporate strikes from lab‑scale improvement to actual‑world validation after transport its B1 pattern cells, a key milestone famous in current studies. This step strengthens its lengthy‑time period case for strong‑state battery management because it improves power density, charging velocity, and security. Even so, QuantumScape stays pre‑income and continues to refine its manufacturing processes. These processes nonetheless face value and scalability challenges. As well as, its partnership with a prime‑10 world automaker provides credibility, but traders ought to nonetheless anticipate volatility as QS strikes by capital‑intensive phases.

From a market perspective, analysts maintain a cautious view for the following 12 months. They preserve a consensus “Promote” ranking and set a median value goal close to $9, which suggests doable draw back from present ranges. In consequence, the inventory could react extra to execution threat and broader EV sentiment than to fundamentals, because the firm lacks close to‑time period income catalysts. Whereas a breakthrough in strong‑state commercialization might spark momentum, the extra sensible outlook factors to regular and gradual progress. Subsequently, merchants ought to view QS as a speculative know-how play the place timing, threat tolerance, and shifting narratives matter most.

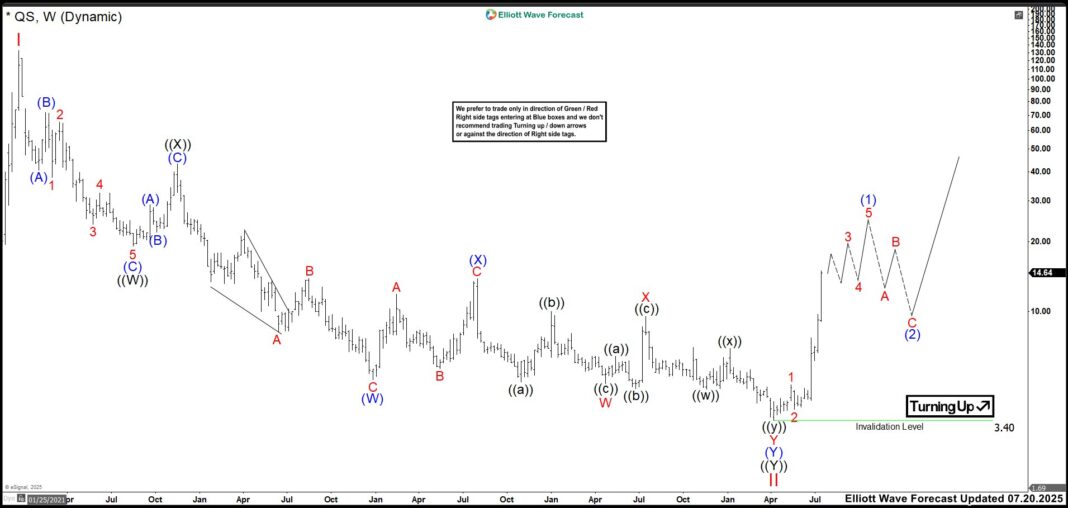

Elliott Wave Outlook: QuantumScape (QS) Weekly Chart July 2025

In July, QuantumScape (QS) accomplished a significant pullback that marked the tip of Wave II on the 3.40 low. Shortly after, the value broke above 9.52 after which 13.86, which strongly signaled that the bearish cycle had possible ended and a brand new upward section had begun. In consequence, the market seemed to be forming an impulsive construction, recognized as Wave (1). Nonetheless, it was nonetheless too early to substantiate the place Wave (1) will end, so merchants ought to keep alert and look ahead to a clear, excessive‑likelihood sample.

As soon as Wave (1) completes, the chart ought to transition right into a corrective transfer in 3, 7, or 11 swings to kind Wave (2). After that, the following bullish leg can develop. This complete outlook stays legitimate so long as the value holds above the three.40 low.

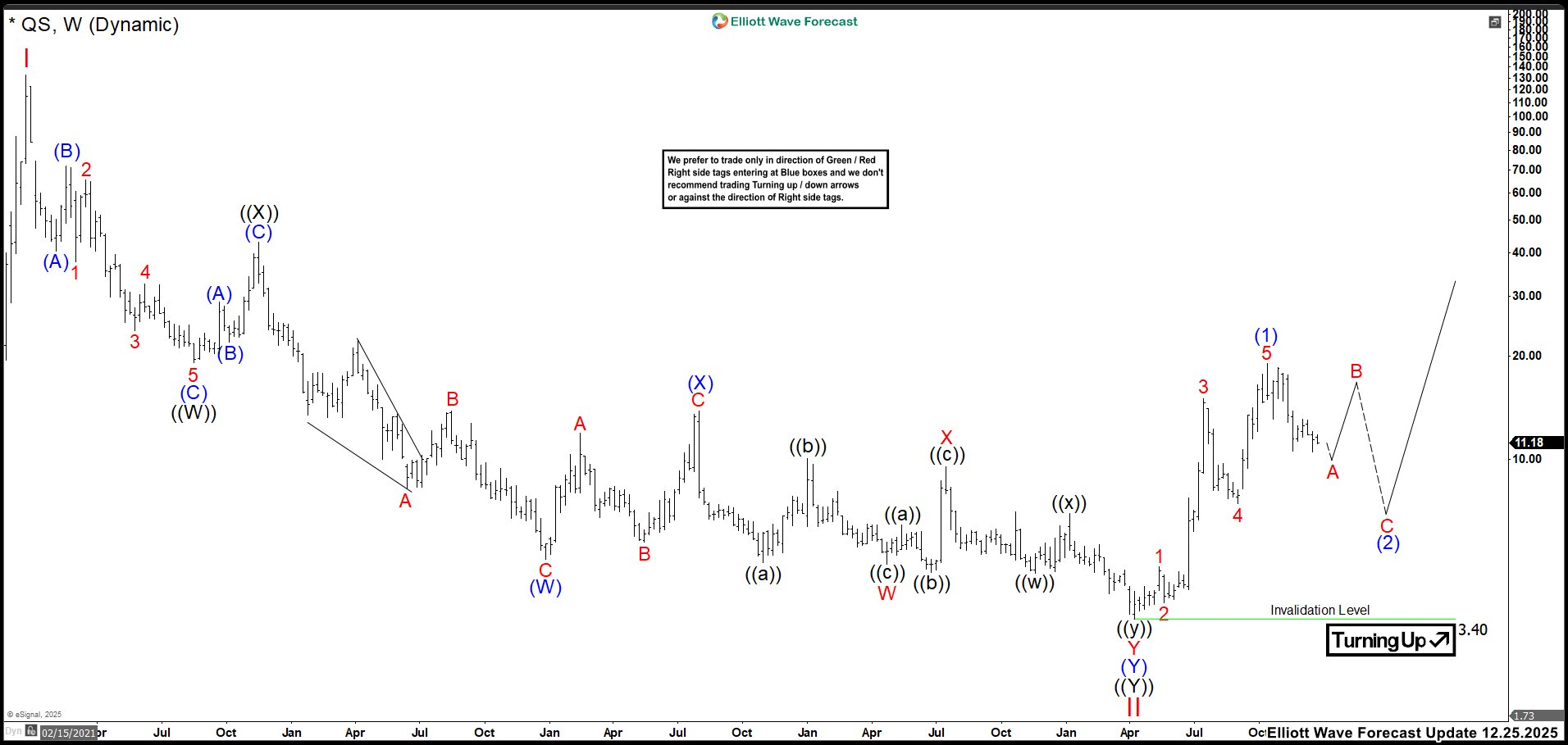

Elliott Wave Outlook: QuantumScape (QS) Weekly Chart December 2025

On the finish of the yr, Wave (1) ended on the 19.07 excessive again in October, and the chart then shifted right into a corrective section as Wave (2) started. We imagine Wave (2) might drop into the 6–7 greenback zone earlier than the rally continues above 19.07. Nonetheless, whether or not the value makes yet one more low to finish Wave A of (2) or not, we nonetheless anticipate a rebound as Wave B. This bounce might attain the 15–17 space earlier than the chart resumes its decline into Wave C of (2). Finally, solely a break above the Wave (1) excessive would verify that Wave (2) has already completed and that QS has began a brand new bullish cycle.

Supply: https://elliottwave-forecast.com/stock-market/traders-watching-qs-closely-than-ever/