- The EUR/USD outlook stays optimistic above 1.1700 amid softer greenback.

- The markets await key US NFP knowledge as any shock may shake the markets both approach.

- ECB’s maintain and dovish Fed proceed to assist the EUR/USD within the close to time period.

The euro trades close to latest highs in opposition to the US greenback as markets watch for key US knowledge. EUR/USD holds above the 1.1700 stage, whereas the Greenback Index (DXY) stays below stress close to 98.25 throughout European session.

–Are you interested by studying extra about copy buying and selling platforms? Examine our detailed guide-

The greenback stays weak as traders concentrate on the delayed US employment report. The Nonfarm Payrolls knowledge for October and November is due later right now, which may form expectations for US rates of interest. Merchants anticipate job progress of round 40,000 in November, with the unemployment fee seen holding at 4.4%. Wage knowledge may also entice consideration after common earnings rose 3.8% YoY in September.

Any signal that the labor market is dropping momentum would reinforce expectations of additional Fed cuts subsequent 12 months. Such an final result would doubtless hold the greenback on the defensive and assist EUR/USD. Nevertheless, a stronger report may gradual the euro’s advance by pushing again in opposition to aggressive easing bets.

Final week’s FOMC assembly set the tone because the Fed delivered its third fee minimize of the 12 months, decreasing charges to a 3.50%–3.75% vary. Chair Jerome Powell acknowledged indicators of cooling within the labor market and famous the central financial institution is now effectively positioned to attend and assess incoming knowledge. Markets interpreted his remarks as dovish, despite the fact that a number of officers later warned about inflation dangers.

Current US knowledge has added to considerations about slowing employment. Preliminary jobless claims rose sharply, non-public payrolls fell unexpectedly, and providers exercise confirmed solely modest progress. Layoff bulletins have additionally elevated. These indicators have stored stress on the greenback and helped the euro regain floor.

On the European facet, consideration turns to flash PMI knowledge from Germany and the broader Eurozone. The providers sector is anticipated to gradual barely, whereas manufacturing stays in contraction. Even so, total enterprise exercise may keep above the enlargement threshold. Merchants see these figures as necessary for near-term euro sentiment, although they don’t anticipate them to shift European Central Financial institution coverage.

Markets broadly anticipate the ECB to maintain charges unchanged via 2026. Policymakers proceed to argue that the present stance is acceptable and have averted sturdy steering on future strikes. This regular strategy has diminished volatility within the euro, particularly in opposition to a softer greenback.

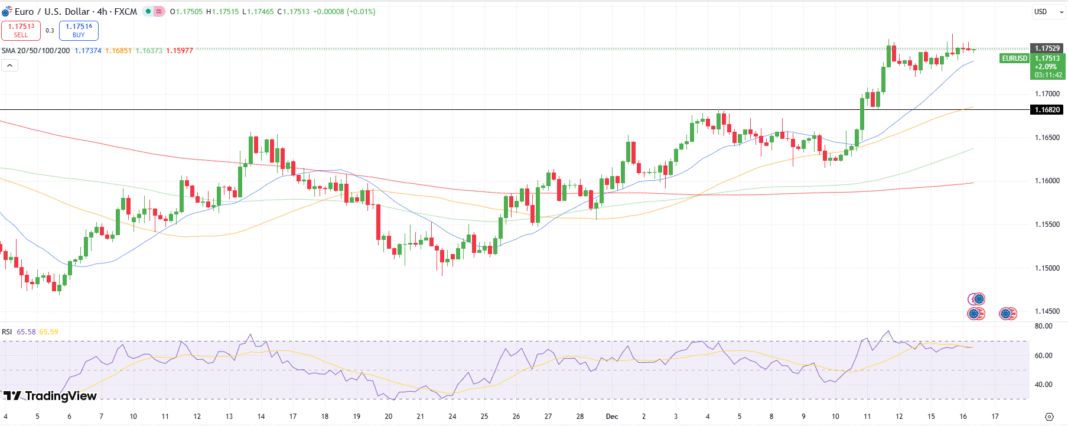

EUR/USD Technical Outlook: Correction Amid Overbought RSI

The EUR/USD 4-hour chart displays the chances of a corrective draw back because the pair fashioned a minor doji candle, with RSI retreating slowly from the overbought space. Nevertheless, the value remains to be above the 20-period MA close to 1.1735, maintaining the upside bias intact.

–Are you interested by studying extra about scalping foreign exchange brokers? Examine our detailed guide-

In case of a bearish flip, the value may discover satisfactory assist at 1.1685, a horizontal stage coincided with the 50-period MA. In the meantime, on the upside, fast resistance lies at yesterday’s high round 1.1770 forward of 1.1800.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you possibly can afford to take the excessive threat of dropping your cash.