We’ll additionally present some tips about the best way to choose the fitting technique in your buying and selling objectives and threat tolerance. So whether or not you’re seeking to make a fast revenue or hedge your portfolio in opposition to draw back threat, learn on for the perfect choices methods to commerce throughout earnings season!

This text was first printed on Epsilon Choices (now a part of SteadyOptions).

The 5 Greatest Choices Methods for Buying and selling Earnings

In case you’re like most traders, you most likely get a little bit anxious when earnings season rolls round. In spite of everything, something can occur when an organization stories its quarterly outcomes.

The inventory may hole up or down, and you may end up on the improper facet of a commerce. However there are methods to commerce earnings that may take the guesswork out of the equation and even provide you with an opportunity to revenue regardless of which manner the inventory strikes.

Listed here are 5 of the perfect choices methods for buying and selling earnings.

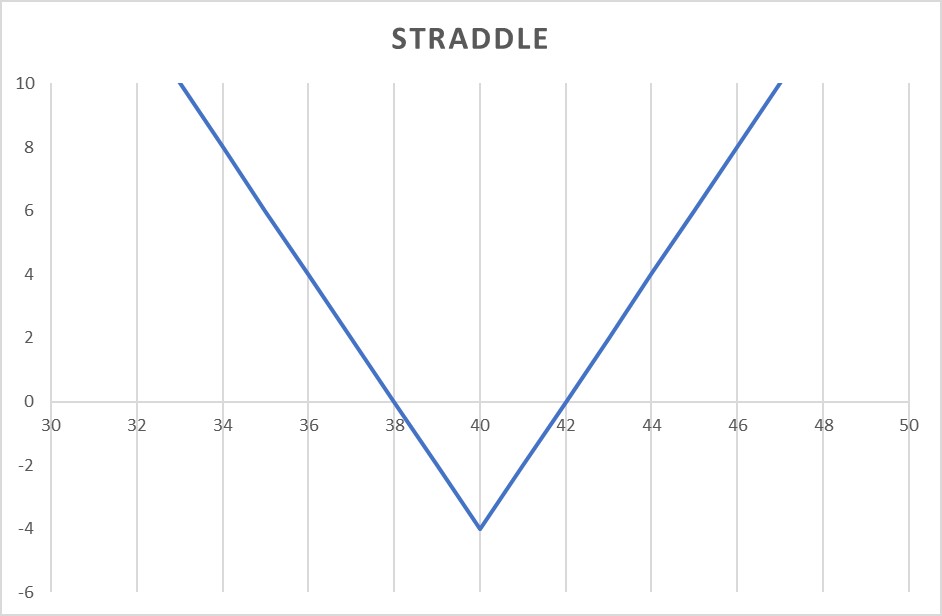

1. Straddle

A lengthy straddle is an choices technique that entails shopping for each a name and a placed on the identical inventory with the identical strike value and expiration date. The concept behind a straddle is to revenue from a giant transfer in both course.

If the inventory strikes loads, you’ll make cash. If it doesn’t transfer in any respect, you’ll lose cash.

And if it strikes just a bit bit, you’ll additionally lose cash. So, you really want to have deal with on the place the inventory is more likely to transfer with a view to commerce a straddle efficiently.

Right here’s extra on the best way to commerce straddles into earnings.

2. Strangle

A Lengthy Strangle is similar to a straddle, besides that the strike costs of the decision and put usually are not the identical.

As a substitute, the decision is often bought with a strike value that’s decrease than the present inventory value, and the put is often bought with a strike value that’s increased than the present inventory value.

The concept behind a strangle is to revenue from a giant transfer in both course, similar to with a straddle. However as a result of the strike costs are additional away from the present inventory value, strangles are often cheaper to commerce than straddles.

3. Put Ratio Backspread

A put ratio backspread is a bearish choices technique that entails shopping for places and promoting extra places at a decrease strike value. The concept behind this technique is to revenue from a giant transfer down within the inventory value.

The put ratio backspread will be worthwhile even when the inventory doesn’t transfer as a lot as you anticipate. That’s since you’re promoting places at a decrease strike value, which implies you’ll preserve the premium even when the inventory doesn’t transfer as a lot as you hoped.

4. Name Ratio Backspread

A name ratio backspread is the mirror picture of a put ratio backspread. It’s a bullish technique that entails shopping for calls and promoting extra calls at the next strike value.

The concept behind this technique is to revenue from a giant transfer up within the inventory value. Just like the put ratio backspread, the decision ratio backspread will be worthwhile even when the inventory doesn’t transfer as a lot as you anticipate.

That’s since you’re promoting calls at the next strike value, which implies you’ll preserve the premium even when the inventory doesn’t transfer as a lot as you hoped.

5. Iron Condor

An iron condor is an choices technique that entails shopping for and promoting each calls and places. The concept behind this technique is to revenue from a inventory that doesn’t transfer a lot in any respect.

Iron condors are often traded with the expectation that the inventory will keep inside a sure vary. If the inventory does transfer outdoors of that vary, then the commerce will begin to lose cash.

After all, there aren’t any ensures on the subject of buying and selling earnings. However these 5 choices methods may also help you navigate the waters and even revenue regardless of which manner the inventory strikes.

Key Takeaway: 5 choices methods for buying and selling earnings: straddle, strangle, put ratio backspread, name ratio backspread, iron condor.

How We Ranked the Earnings Methods

However do you know that there are other ways to commerce earnings?

And that some methods are higher than others?

We’ll talk about what earnings are and the way they’ll impression inventory costs. We’ll additionally contact on the various kinds of earnings releases and the best way to commerce them.

Earnings are the monetary stories that public corporations launch on a quarterly foundation. They embody info reminiscent of income, bills, and earnings.

Buyers use earnings to gauge an organization’s monetary well being and to make selections about whether or not or to not purchase or promote the inventory.

There are two varieties of earnings releases:

Constructive and adverse. Constructive earnings releases often end in a inventory value enhance, whereas adverse earnings releases often end in a inventory value lower.

The most effective choices technique to commerce a constructive earnings launch is to purchase name choices. This technique permits you to revenue from a inventory value enhance with restricted draw back threat.

The most effective choices technique to commerce a adverse earnings launch is to purchase put choices. This technique permits you to revenue from a inventory value lower with restricted draw back threat.

In case you’re undecided which technique to make use of, you may at all times hedge your bets by shopping for each name and put choices. This fashion, you’ll make cash if the inventory value goes up or down.

Whichever technique you select, ensure you do your homework earlier than earnings season. This fashion, you’ll be ready to make the very best commerce.

Key Takeaway: Earnings are vital to inventory costs and there are other ways to commerce them. Some methods are higher than others.

Quantity One: Purchase Straddles Earlier than an Earnings Announcement

In case you’re seeking to reap the benefits of an earnings announcement, shopping for a straddle is without doubt one of the finest choices methods on the market.

By shopping for a straddle, you’re basically shopping for a name and a put on the similar time, supplying you with the potential to revenue regardless of which manner the inventory value strikes.

There are some things to bear in mind when buying and selling earnings bulletins. First, ensure you know when the announcement is scheduled.

Second, pay attention to the potential for elevated volatility across the announcement. And eventually, have a plan in place for a way you’ll commerce the announcement.

The most secure technique can be to exit the straddle earlier than the earnings are out to keep away from the IV Crush. In case you maintain the straddle via earnings, and the inventory does not transfer sufficient, the losses will be vital.

Quantity Two: Promote calls on Overpriced Shares Publish-Earnings Announcement

By “overpriced” we imply shares which might be buying and selling at costs which might be considerably increased than their intrinsic worth.

And by “intrinsic worth” we imply the true underlying worth of the corporate, as decided by elements like its earnings, money circulate, and property.

The rationale this technique will be worthwhile is as a result of when a inventory is overpriced, there’s a larger probability that it’s going to fall after its earnings are introduced.

And if you happen to promote a name on a inventory, you’re basically betting that the inventory is not going to enhance above a sure value.

So, if the inventory does fall after earnings are introduced, you may revenue from the distinction between the strike value of the decision and the brand new, lower cost of the inventory.

After all, this technique isn’t with out threat. If the inventory doesn’t fall after earnings are introduced, the brief calls will lose cash.

Due to this fact, it’s vital to do your homework earlier than promoting calls on overpriced shares. It’s essential to guarantee that the inventory is actually overpriced and that there’s a good probability that it’s going to fall after earnings are introduced.

In case you’re on the lookout for a solution to revenue from earnings bulletins, promoting calls on overpriced shares is one technique you may contemplate.

Key Takeaway: Promoting places on overpriced shares will be worthwhile if the inventory falls after earnings are introduced.

Quantity Three: Get Lengthy a Inventory Previous to its Incomes Launch

This fashion, you’ll be capable of profit from any upside that will happen from the discharge.

There are some things that you just want to pay attention to earlier than getting lengthy a inventory previous to its earnings launch. First, it’s essential to guarantee that the inventory is in place to learn from the discharge.

Which means that the inventory needs to be in a robust uptrend main as much as the discharge. Second, you want to pay attention to the potential draw back threat that comes with getting lengthy a inventory previous to its earnings launch.

It is because the inventory may doubtlessly hole down after the discharge if the outcomes usually are not as constructive as anticipated. Lastly, it’s essential to have a plan in place in case the inventory does hole down after the discharge.

This fashion, you’ll know the best way to exit the place if issues don’t go as deliberate. General, getting lengthy a inventory previous to its earnings launch is a good way to learn from the discharge.

Simply remember to preserve the potential dangers in thoughts in an effort to exit the place if wanted.

Key Takeaway: It’s finest to get lengthy a inventory previous to its earnings launch to learn from any upside. Nonetheless, pay attention to the potential draw back threat of the inventory gapping down after the discharge.

Conclusion

Every of those methods has the potential to make fast earnings or hedge in opposition to draw back threat. So choose the technique that most closely fits your buying and selling objectives and threat tolerance!

In case you’re on the lookout for choices buying and selling training, SteadyOptions is the proper place to start out. We provide quite a lot of free assets in addition to paid buying and selling companies that may allow you to study choices buying and selling and the best way to make cash from it. Whether or not you’re a newbie or an skilled dealer, we have now one thing for everybody. So what are you ready for? Examine us out as we speak!

Concerning the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and currently in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Occasions (of London). He determined to carry this information to a wider viewers and based Epsilon Choices in 2012.

Associated articles