By RoboForex Analytical Division

The most recent UK GDP knowledge confirmed annualised development of 1.3%, consistent with market expectations and barely under the earlier studying of 1.4%. The report had a broadly impartial impression on sterling, because it confirms the UK economic system continues to broaden, albeit at a average tempo, with out indicators of acceleration.

For the GBP/USD pair, the shortage of shock is the important thing takeaway. With the information matching consensus forecasts, buyers have little motive to reassess their present macroeconomic outlook. In such circumstances, the pound tends to not appeal to recent shopping for momentum but additionally avoids sharp promoting strain.

However, the slight deceleration in development from the prior interval creates a modestly cautious backdrop for sterling. The softer determine could sign that the economic system stays delicate to elevated rates of interest and subdued home demand. This interpretation may mood expectations of additional financial tightening from the Financial institution of England and restrict the scope for extra hawkish communication.

Within the close to time period, the direct market impression of this GDP launch is assessed as largely impartial, albeit with a gentle draw back bias for the pound. Subsequent route will doubtless rely on upcoming UK inflation and labour market reviews, alongside evolving US charge expectations and broader world threat sentiment.

Technical Evaluation: GBP/USD

H4 Chart:

On the H4 chart, the pair has entered a broad consolidation zone round 1.3418. We anticipate a doable extension of the vary in the direction of 1.3500 within the close to time period, adopted by a corrective pullback to 1.3418. Upon completion of this retracement, the broader upward pattern is predicted to renew, concentrating on 1.3520, with potential for additional extension in the direction of 1.3550.

This outlook is supported by the MACD indicator, with its sign line positioned above zero and pointing firmly upward.

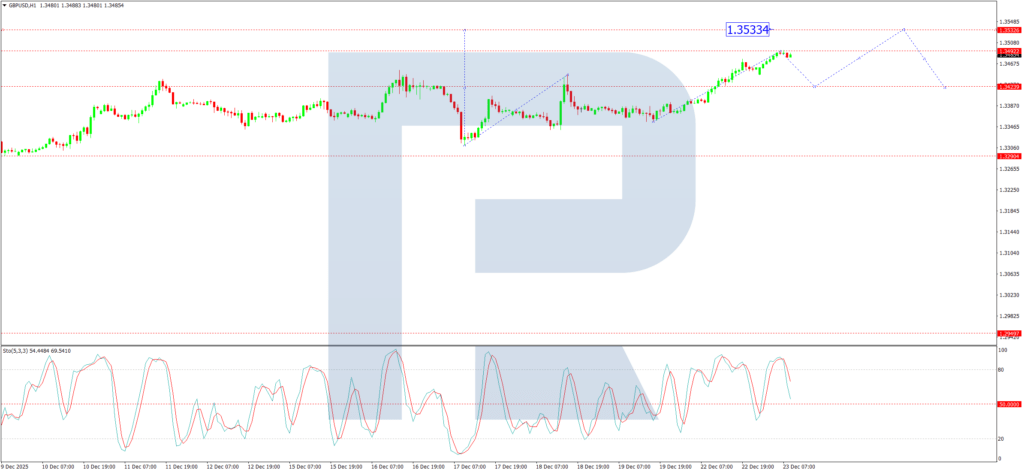

H1 Chart:

On the H1 chart, value motion shaped a good consolidation round 1.3424 earlier than breaking larger and advancing to 1.3492 (an area goal). We now anticipate a corrective decline to retest the 1.3424 stage from above. As soon as this correction concludes, the main focus will shift to the potential for a subsequent development wave towards 1.3533.

This state of affairs is validated by the Stochastic oscillator, whose sign line is above 80 and has begun to show decrease in the direction of the 20 stage, indicating near-term corrective momentum.

Conclusion

The GBP/USD pair is prone to stay range-bound within the wake of in-line GDP knowledge, which neither strengthens nor weakens the sterling narrative decisively. Whereas the technical construction favours additional upside within the medium time period, near-term value motion suggests a interval of consolidation or delicate correction could precede any renewed bullish impulse.

Disclaimer:

Any forecasts contained herein are based mostly on the creator’s explicit opinion. This evaluation might not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes based mostly on buying and selling suggestions and critiques contained herein.

- GBP/USD: UK GDP Progress Matches Forecasts Dec 23, 2025

- Valuable metals are hitting new all-time highs. The Individuals’s Financial institution of China saved its lending charges unchanged Dec 22, 2025

- EUR/USD: ECB Coverage Stance Fails to Shock Markets Dec 22, 2025

- ECB, Riksbank, and Norges Financial institution saved charges unchanged. BoE proceeded with a charge lower. Dec 19, 2025

- Euro Holds Close to 1.1700 Following ECB Coverage Stance Dec 19, 2025

- The US tech sector is beneath sell-off. Platinum hits a 17-year excessive Dec 18, 2025

- Pound Holds Its Breath Forward of Financial institution of England Determination Dec 18, 2025

- Weak labor market knowledge fueled expectations of further Fed coverage easing in 2026 Dec 17, 2025

- Oil dropped to a 2021 low. The Canadian greenback hit a three-month excessive Dec 16, 2025

- Brent Crude Slides on Peace Speak Optimism and Demand Issues Dec 16, 2025