- The EUR/USD outlook stays regular underneath 1.1750, with eyes on the US CPI and the ECB price determination.

- A softer greenback forward of knowledge retains the EUR/USD draw back restricted.

- Weaker German IFO knowledge and bearish pin bars proceed to cap the features, protecting the pair inside a broad vary.

The EUR/USD worth is buying and selling beneath 1.1750 as markets await the US CPI knowledge for November, due right this moment. The discharge carries further weight because it excludes October figures and doesn’t embody month-on-month knowledge for November following the federal government shutdown. Consequently, buyers are centered on the annual headline and core readings.

–Are you interested by studying extra about copy buying and selling platforms? Test our detailed guide-

Headline CPI is predicted to rise to three.1% YoY from 3.0%, whereas core inflation is forecast to stay unchanged at 3.0%. Some analysts see a threat of a mildly stronger headline quantity as a consequence of larger power costs. Nonetheless, underlying inflation is predicted to remain regular. With restricted element within the report, even small deviations from forecasts may transfer markets and reshape expectations for Fed coverage.

The US greenback stays delicate forward of the info, with the Greenback Index (DXY) holding beneath 98.50 after a short rebound earlier within the week. Latest feedback from Fed officers haven’t shifted the broader outlook. Atlanta Fed President Raphael Bostic stated development ought to stay strong into 2026, whereas Fed Governor Christopher Waller reiterated assist for additional easing subsequent 12 months. This leaves the greenback uncovered if inflation doesn’t present renewed momentum.

The EUR/USD pair slipped towards 1.1700 on Wednesday however recovered a lot of the losses throughout the US session, ending close to unchanged. The pair continues to carry above current highs, pointing to consolidation slightly than a reversal.

On the euro facet, softer Eurozone inflation and weak German sentiment have restricted upside. Germany’s IFO enterprise local weather index declined for a second month, highlighting ongoing development considerations. Even so, the European Central Financial institution is predicted to maintain charges unchanged at its December assembly, with no sturdy sign to ease additional subsequent 12 months. President Christine Lagarde’s feedback are unlikely to shift expectations.

Close to-term route for EUR/USD will depend on the CPI final result. A softer studying would strain the greenback and assist the pair, whereas firmer inflation may set off a pullback.

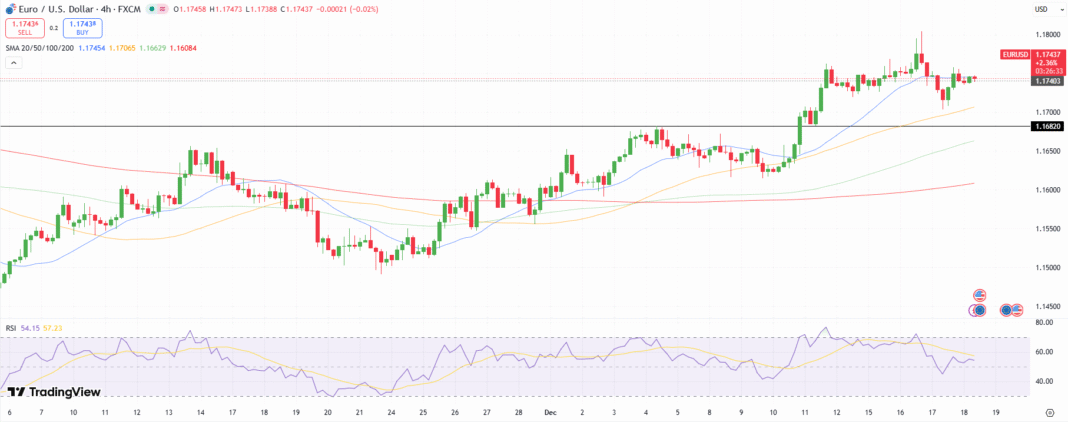

EUR/USD Technical Outlook: Caught Round 20-MA

The EUR/USD worth wobbles close to the 20-period MA at 1.1740. The 2 consecutive bearish pin bars on the chart reveal promoting strain, however the 50-period MA close to 1.1700 supplies sufficient assist. Therefore, the worth is predicted to oscillate between the 1.1700 and 1.1800 ranges.

–Are you interested by studying extra about scalping foreign exchange brokers? Test our detailed guide-

A breakout of 1.1700 may discover assist close to 100- and 200-period MAs at 1.1660 and 1.1610, respectively. In the meantime, an upside breakout of 1.1800 may collect shopping for traction to purpose for yearly highs across the 1.1900 space.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you may afford to take the excessive threat of shedding your cash.