It’s vital to know what these phrases imply. As well as, it’s best to know underneath what circumstances you can purchase to open and when you can purchase to shut.

(We now have comparable publish on the alternative commerce: Promote To Open vs Promote To Shut)

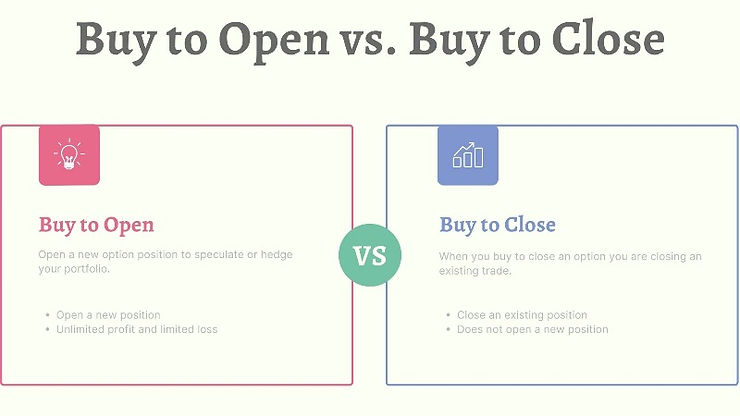

What Is Purchase to Open?

The time period “open” comes from the truth that you’re opening a place if you enter a commerce. Purchase to open, subsequently, means you’re shopping for an choice to open a place.

You have to use a buy-to-open order everytime you wish to buy a brand new lengthy name or lengthy put. This may occasionally point out to different contributors available in the market that you simply’ve noticed potential available in the market, particularly if you happen to’re making a big order. Nevertheless, if you happen to’re solely making a small order, it’s equally attainable that you’re utilizing the buy-to-open order for spreading or hedging.

Let’s put this into actual phrases. Think about you wish to buy a name possibility the place the underlying inventory is buying and selling for a $1.30 premium and the expiry date is 2 months sooner or later. Let’s say the buying and selling worth is $50 with a strike worth on the decision of $55. To purchase this name possibility by your brokerage, you would wish to make use of a buy-to-open order.

When the time involves exit the place, you’ll want to make use of a sell-to-close order. You are able to do this at any time — even the day after you employ the buy-to-open order. Within the above instance, you could select to promote to shut if the underlying inventory worth will increase to maybe $57 earlier than it reaches expiry date. If you use a sell-to-close order, the open possibility turns into closed.

Keep in mind {that a} buy-to-open order could not at all times execute. This could occur when an trade limits to closing orders solely throughout sure market circumstances. One instance of such a market situation is when the underlying inventory for the choice you are attempting to purchase to open is scheduled for delisting. One more reason could possibly be that the trade is not going to be buying and selling the inventory for a while.

What Is Purchase to Shut?

As you noticed above, purchase to open (and promote to shut) applies to lengthy calls and places. For brief positions, you might have purchase to shut (and promote to open). In different phrases, you want a sell-to-open order to ascertain a brand new place with quick calls and places.

To have the ability to promote to open, you want collateral for the place. This may be within the type of the corresponding inventory shares or the equal worth in money. Within the case you might have the shares, you’ll be sharing a coated place. For those who don’t have shares, you’re shorting the choice or promoting a unadorned place.

Then, if you wish to shut the place, you’ll want to make use of a buy-to-close order.

Promoting to open is easy sufficient. Let’s look in better element at what we imply by shopping for to shut.

First, it’s good to keep in mind that, in choices, promoting quick means writing a contract to promote to a different purchaser. Your intention is to see the underlying inventory worth drop, which is able to carry you a revenue when the commerce closes.

The commerce will finish both when it reaches maturity, with you shopping for again the place, or with the client exercising the choice. (Exercising the choice includes changing it into inventory, which is uncommon.) You’ll make a revenue if the promoting or shorting worth is larger than the acquisition or cowl worth.

If you purchase to shut, you exit a brief place that already exists. Put one other manner, you might have an open place for which you might have acquired internet credit score. By writing that possibility, you’re closing that place.

Promote To Open And Purchase To Shut Instance

Let’s put all this (each promote to open and purchase to shut) into one other instance. Say you determine that ABC inventory is more likely to enhance in worth and wish to use the chance to make a revenue. Subsequently, it’s good to promote to open a put contract for $1.50. On this state of affairs, let’s think about that you’re proper: the inventory does enhance. This leads to making the put price $0.75. Your revenue would subsequently be:

$1.50 – $0.75 = $0.75

Now, let’s say the place is not going to expire for 2 weeks. You wish to safe your revenue, that means it’s good to shut the place. This implies you’ll want to make use of a buy-to-close order. And that’s it. You obtain your $0.75 revenue.

Purchase to Cowl

One factor to notice: purchase to shut isn’t the identical as purchase to cowl. The distinction is purchase to shut is often for choices and typically for futures, whereas purchase to cowl is just for shares. Nevertheless, they each lead to shopping for again the asset you initially offered quick, that means you find yourself with no publicity to the asset.

Purchase to Open vs Purchase to Shut: When to Use Every

Now that you simply perceive the distinction between purchase to open and purchase to shut, all that’s left is to be clear about when to make use of them.

When Ought to Buyers Purchase to Open?

Everytime you wish to purchase a name or put to learn from a change in worth of an underlying asset, you can purchase to open. Taking buy-to-open positions is helpful for hedging or offsetting dangers in your portfolio. It’s significantly efficient if you happen to use a purchase to open a put possibility that’s out of the cash concurrently buying the underlying inventory.

General, shopping for to open provides the chance to see important positive aspects. Plus, if there are losses, these can be minimal. After all, there may be at all times the chance that the buy-to-open place will develop into nugatory by its expiration date because of time decay.

When Ought to Sellers Purchase to Shut?

As an possibility vendor, time decay is in your favor. All the identical, there could also be instances if you’ll wish to shut the place earlier than it expires. One occasion of when this could possibly be true is within the case of a worth enhance to the underlying asset. When this occurs, shopping for to shut could allow you to entry earnings earlier.

For instance, think about you’re promoting at-the-money places that final 12 months. Then, after two months, the underlying asset will increase by 15 p.c. You may use the chance to purchase to shut and entry nearly all of your earnings instantly.

Alternatively, shopping for to shut may cut back your potential losses. Let’s return to the identical state of affairs above of promoting at-the-money places. Nevertheless, this time, as an alternative of the underlying asset rising by 15 p.c, let’s say it decreases by that quantity. You may determine to purchase to shut at this level to keep away from even better losses that you could be incur by ready longer.

Lengthy and Quick Choices within the Identical Place

Some methods will let you carry each a protracted possibility of an asset and a brief possibility of an asset on the identical time. That is helpful for supplying you with the alternative place while not having to shut the unique open place. In different phrases, you acquire when the underlying asset worth strikes in the correct path, however you additionally cut back threat in comparison with simply shopping for a single possibility.

Whereas you can purchase your lengthy and quick choices individually, if you happen to’re utilizing a brokerage that makes a speciality of choices, the prospect is you may enter the technique as a single commerce.

So, when you might have a technique that incorporates a number of lengthy and quick choices, what must you use? Must you purchase to open (and promote to shut) or purchase to shut (and promote to open)? The reply is: it relies upon.

For methods like a bull name unfold, bear put unfold, lengthy straddles, and lengthy strangles, you’ll use buy-to-open orders. It is because you open these methods with internet debit, that means you’re paying to open the place. You’ll additionally use sell-to-close orders — it’s identical to with lengthy positions.

On the flip aspect, any time you acquired internet credit score in your technique, you’ll want to make use of sell-to-open and buy-to-close orders — identical to with quick positions. Methods that fall into this class embrace bull put spreads, bear name spreads, quick straddles, quick strangles, and iron condors.

Deciding when to purchase to open and purchase to shut sounds easy sufficient. Nevertheless, like the whole lot in choices buying and selling, it does contain some calculating to foretell how the worth of the underlying asset is more likely to change. That is additional sophisticated when you might have an possibility technique that features each lengthy and quick choices. In these circumstances, you’ll want to contemplate your total place to make sure you make the correct choice.

In regards to the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and recently in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Instances (of London). He determined to carry this data to a wider viewers and based Epsilon Choices in 2012.