There’s a sure college of thought that means the inventory market proactively tries to frustrate and even confuse as many individuals as potential more often than not. And, whereas clearly “the market” is an inanimate thought in and of itself that doesn’t have emotions, opinions, or aims, the truth that it’s finally pushed by those who do have emotions, opinions, and aims is why — at the least on some methods — it may possibly appear to attempt to create sufficient confusion and uncertainty to steer many of the crowd astray. That’s what appears to be occurring right here and now. You’ll need to navigate issues very rigorously from right here, as a result of shares as a complete do certainly appear to be attempting to idiot a complete lot of individuals.

We’ll present you ways and why beneath, and focus on find out how to finest deal with it. First although, let’s have a look at a number of the extra vital financial knowledge we heard final week, and preview what’s within the lineup for this week.

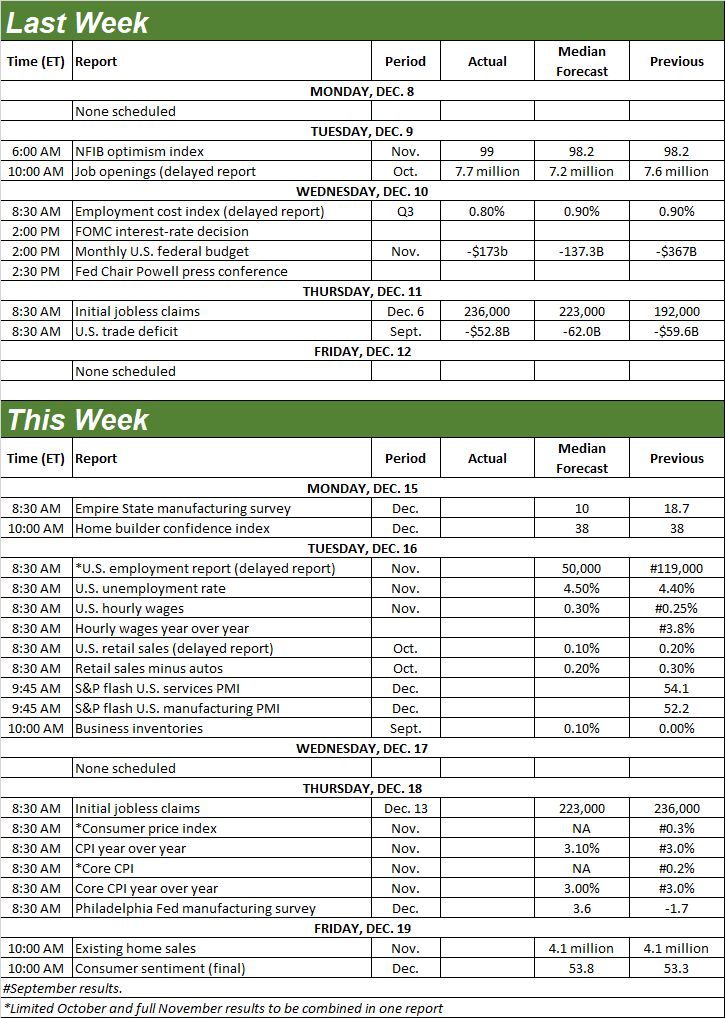

Financial Information Evaluation

Nothing to chart this week, however as you already possible know, the Federal Reserve’s Open Market Committee gave us the anticipated quarter-point rate of interest lower on Wednesday. The goal Fed Funds Price now stands between 3.5% and three.75%. That is what most buyers thought they wished. Now we’ll see if they will abdomen all the explanations behind the idea that we really wanted a charge lower right here. The following scheduled alternative to vary rates of interest is in late January. Most merchants are betting the FOMC stands pat.

The whole lot else is on the grid.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

An vital handful of financial experiences that had been delayed due the federal authorities’s shutdown will proceed to floor this week, starting on Tuesday with a have a look at final month’s jobs report. Economists imagine we solely added 50,000 new jobs final month, which gained’t be sufficient to forestall the unemployment charge from ticking up ten foundation factors to 4.5%. And truthfully, all issues thought of, that’s nonetheless fairly good.

Unemployment Price, Payroll Development Charts

Supply: Bureau of Labor Statistics, TradeStation

Additionally on Wednesday we’ll lastly be listening to October’s end result gross sales knowledge. They need to be up, though solely modestly. Nonetheless, even sluggish and regular shallow progress is a win on this difficult atmosphere.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

On Thursday search for final month’s shopper inflation knowledge, kind of telling us if the FOMC made the suitable resolution final week to chop rates of interest. It most likely didn’t, given expectations that each core and non-core inflation is prone to maintain at 3.0%, which is barely above the Fed’s goal vary (decrease rates of interest might simply gasoline inflation), except the FOMC sees an financial headwind or hiccup on the horizon stemming from the current authorities shutdown or turbulence in China… or rekindled financial commerce tensions.

Client, Producer Inflation Price Charts

Supply: Institute of Provide Administration, TradeStation

We’re assuming November’s producer inflation numbers are coming subsequent week, though they’re not on any schedule but.

Lastly, on Friday we’ll hear November’s present dwelling gross sales, though there’s not prone to be any change from October’s tempo of 4.1 million. In fact, that’s nonetheless fairly low within the grand scheme of issues.

New, Current Dwelling Gross sales Charts

Supply: Nationwide Assn. Realtors, Census Bureau, TradeStation

There’s no phrase on once we’ll hear September’s (or October’s, or November’s) new-home gross sales figures from the Census Bureau, which is able to inform us if August’s surge was a fluke. Actually, there’s an opportunity we simply gained’t be getting a few of these numbers in any respect to assist put the existing-home gross sales numbers in perspective. There’s a meals likelihood we’ll hear them the week after the one forward.

Additionally on Friday search for the third and last studying on the College of Michigan’s sentiment measure for December. It needs to be up only a bit, however nonetheless at unusually low ranges.

Client Sentiment Charts

Supply: Nationwide Assn. Realtors, Census Bureau, TradeStation

The Convention Board’s have a look at shopper confidence is slated foe the week after this one.

Inventory Market Index Evaluation

If you happen to don’t usually imagine that the inventory market is a residing entity that tries to confuse and frustrate you into making a mistake, final week’s motion — notably following the motion for the previous few weeks — simply may change your thoughts.

We kick issues off this week with a considerably zoomed-in have a look at the each day chart of the NASDAQ Composite, because it plainly makes the purpose. What was a help line (yellow, dashed) has clearly changed into technical resistance, however the now converged 20-day and 50-day shifting common strains (blue and purple, at 23,100) are additionally now apparent help, halting Friday’s sizeable selloff in its tracks. It even pushed the index up and off a little bit from its intraday low. The NASDAQ is now very a lot “caught within the center,” and will nonetheless simply transfer past both of these limitations. In fact, it isn’t doing so but.

NASDAQ Composite Day by day Chart, with Quantity and VXN

Supply: TradeNavigator

The each day chart of the S&P 500 seems to be related, even when not an identical. Its technical ceiling as a horizontal one at 6,909, the place it peaked in late-October after which once more late final week. Clearly merchants don’t need to push past that market, retreating from it fairly aggressively on Friday with none specific clear prompting apart from some profit-taking on inflated AI shares headed into the weekend. In fact, easily-triggered profit-taking is what you’d anticipate to see from a market that’s on the lookout for a cause to undergo a much-needed correction.

S&P 500 Day by day Chart, with Quantity and VIX

Supply: TradeNavigator

Additionally be aware the S&P 500 stays above its also-now-converged 20-day and 50-day shifting common strains (blue and purple), at 6,771. Additionally additionally discover neither of the volatility indexes popped on Friday, nor did quantity surge to above-average ranges. Regardless of the dimensions of the selloff, it’s not like this dip will be referred to as a convincing majority choice. It seems most individuals are ready on the sidelines to see whether or not it’s the technical ceilings or the technical flooring that break first.

Here is the weekly chart of the NASDAQ Composite for some extra perspective. As you possibly can see right here, even when the index had damaged beneath the help at its 50-day shifting common line there’s nonetheless potential help on the midline of the bullish channel that extends all the way in which again to 2023. That’s bullish. The lingering MACD crossunder isn’t. Actually, the MACD indicator is more and more bearish.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

Simply don’t learn an excessive amount of into something right here. The composite might fall all the way in which again to the decrease boundary of the long-term bullish channel — the place the 200-day shifting common line (inexperienced) at present is — and nonetheless not shift from a bull market right into a bear market. That might solely be a couple of 13% tumble from the current peak. That being stated, a 13% pullback is perhaps precisely what’s wanted right here to take some froth off the market right here, and act as a proverbial “reset” for the larger bull market that’s nonetheless properly underway. It’s nonetheless going to be robust to tack on extra features from the place the market presently sits.