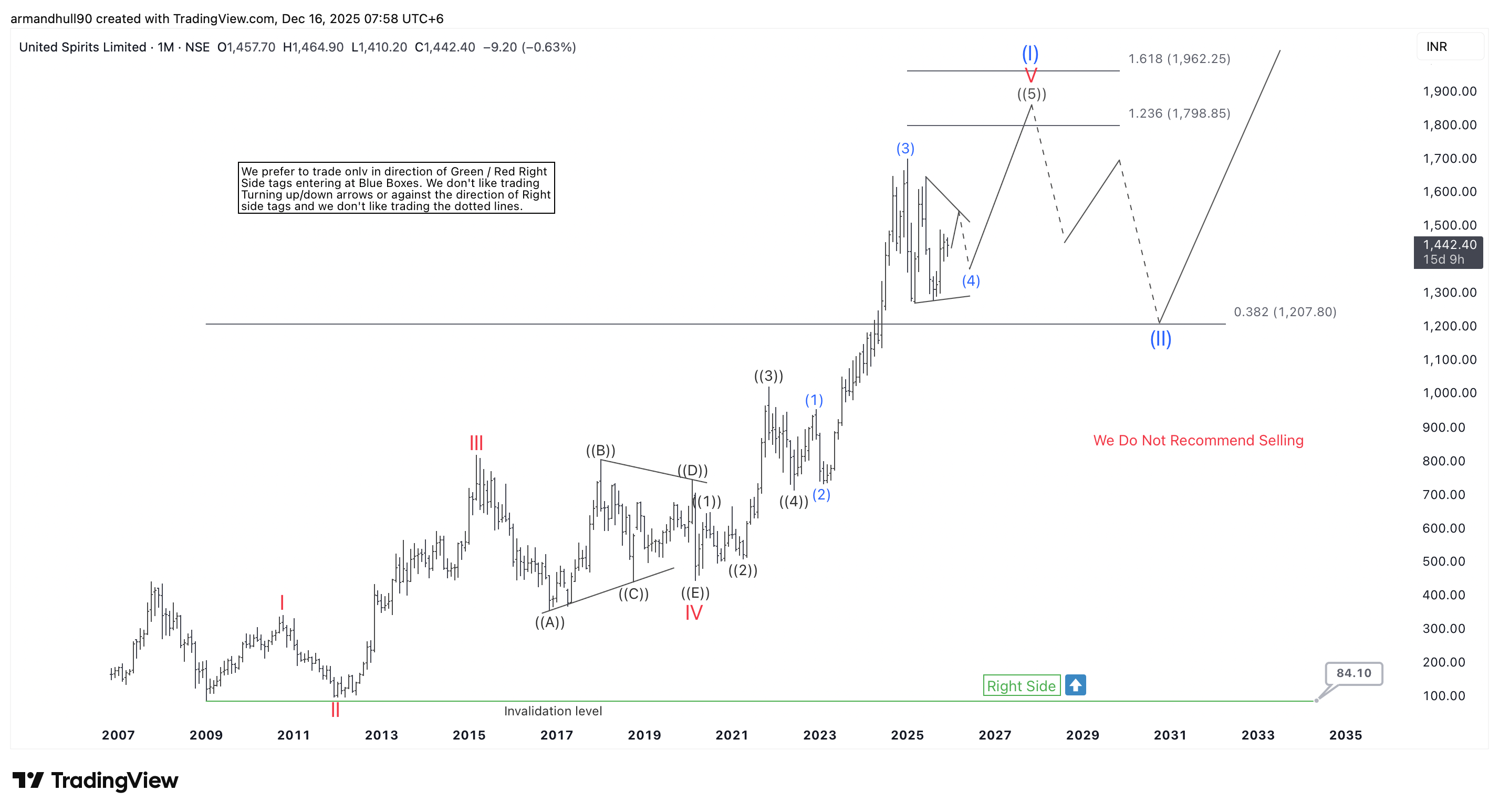

Month-to-month Elliott Wave evaluation reveals Wave I nearing completion, key Fibonacci targets forward, and a corrective pullback earlier than the subsequent main rally.

United Spirits Restricted (NSE: UNITDSPR) continues to commerce in a robust long-term bullish Elliott Wave construction on the month-to-month chart. The broader pattern stays optimistic regardless of short-term value swings. For the reason that 2020–2021 interval, value motion has shifted clearly from correction to impulse. This shift suggests the market has entered a brand new bullish cycle fairly than forming a long-term high.

Impulse Construction and Fibonacci Targets:

From the Wave IV low, value moved greater in a transparent five-wave construction. Waves (1) and (2) set the course of the pattern. Wave (3) adopted with sturdy upside momentum, which is typical in Elliott Wave patterns. Wave (4) is now unfolding as a sideways construction, most certainly a contracting triangle. As soon as this consolidation completes, value is predicted to show greater once more within the last Wave (5), concentrating on key Fibonacci projection ranges.

Fibonacci extensions from the sooner impulse outline the upside targets. The zone close to ₹1,798 represents the 1.236 extension and will acts as a conservative fifth-wave goal. An extra extension towards ₹1,962 aligns with the 1.618 Fibonacci stage. Value could pause or react close to these zones as Wave I approaches completion.

As soon as Wave I finishes, the market ought to enter a corrective Wave II. Fibonacci retracement evaluation factors to help close to the 0.382 retracement stage round ₹1,208. This space additionally matches prior value construction, which will increase the prospect of a technical response. Such a pullback would stay corrective in nature and wouldn’t sign a pattern reversal.

The chart clearly states that promoting isn’t really useful. The Proper Aspect Tag stays lively and favors the bullish course. The long-term invalidation stage stands a lot decrease close to ₹84. So long as value stays above this stage, the bigger Elliott Wave construction stays legitimate.

Conclusion:

In conclusion, United Spirits Restricted continues to carry a bullish Elliott Wave setup supported by clear Fibonacci relationships. Brief-term corrections could seem, however they type a part of a broader upward cycle. The general construction continues to favor long-term bullish alternatives fairly than weak spot.