- The GBP/USD forecast edges greater as UK employment information relieves strain.

- The BoE’s potential charge lower expectations restrict the upside strain.

- UK PMI and US NFP information are key to look at for contemporary impetus.

GBP/USD traded modestly up as contemporary UK labor information confirmed easing pressure within the jobs market. The ILO unemployment charge rose to five.1% within the three months to October, up from 5.0% beforehand. The studying met expectations however confirmed a gradual lack of momentum in employment circumstances.

–Are you curious about studying extra about copy buying and selling platforms? Test our detailed guide-

In the meantime, claimant counts elevated by 20,100 in November, reversing October’s revised decline. Employment change remained unfavourable, with payrolls down by 17,000 in October. Whereas the tempo of job losses slowed, the pattern nonetheless factors to weaker labor demand.

Wage progress stayed elevated however confirmed early indicators of cooling. Common earnings excluding bonuses rose 4.6% YoY, barely under the prior studying. Earnings together with bonuses elevated 4.7%, beating forecasts however nonetheless decrease than earlier ranges. Pay progress stays effectively above inflation, but the route now not helps additional coverage tightening.

Therefore, these figures reinforce expectations that the Financial institution of England will lower charges at its upcoming assembly. Markets now view a coverage transfer as possible, limiting upside strain on sterling. Merchants stay cautious forward of the choice, particularly with current information failing to justify a hawkish stance.

Consideration is now shifting to incoming UK PMI information, which can supply clues on enterprise exercise and hiring tendencies. Nonetheless, central financial institution steerage stays the dominant driver for the pound within the close to time period.

On the US facet, the greenback continues to commerce below strain as a result of uncertainty round Fed coverage. Markets anticipate deeper charge cuts in 2026 than the Fed has signaled. This hole leaves the greenback susceptible to sudden repricing.

The upcoming US Non-Farm Payrolls report will play a key function. It would embody two months of information and comes after disruptions from a authorities shutdown. Forecasts level to modest job progress in November, although dangers lean to the draw back following weak non-public payroll figures.

Buyers will focus much less on the unemployment charge and extra on payroll positive aspects and wage progress. Common hourly earnings stay the clearest sign for inflation threat and future Fed choices.

GBP/USD Technical Forecast: Patrons Eying 1.3440

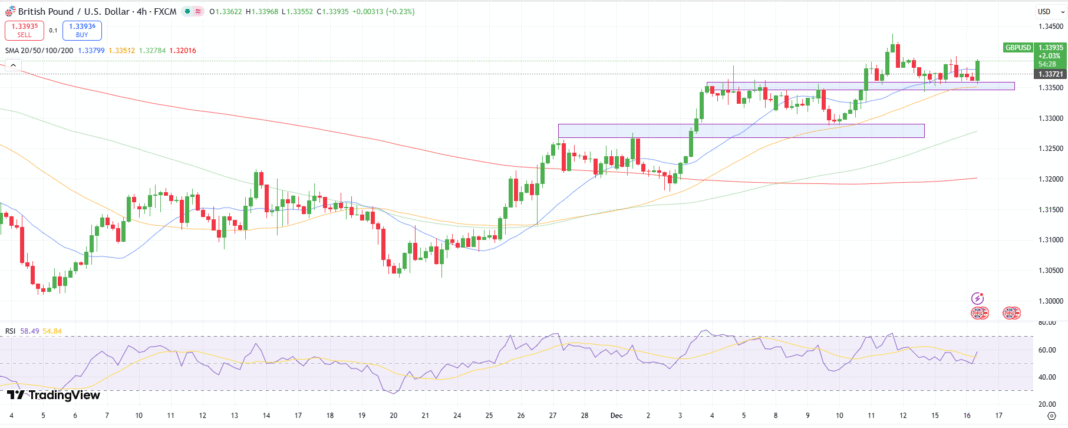

The GBP/USD chart reveals a modest rebound from the 1.3350 demand zone, coinciding with the 50-period MA, surging above the 20-period MA close to 1.3380. Now the pair is eying the resistance at current swing excessive close to 1.3440 because the RSI climbs effectively above the 50.0 stage.

–Are you curious about studying extra about scalping foreign exchange brokers? Test our detailed guide-

On the flip facet, any dip under the 1.3350 confluence may alter the pound’s bullish outlook. The pair may dip additional all the way down to 1.3300 spherical quantity forward of 100-period MA assist at 1.3280.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must take into account whether or not you possibly can afford to take the excessive threat of shedding your cash.