Hiya,

On this submit I’d prefer to share the forward-test outcomes of my gold long-only grid Skilled Advisor,

Image: XAUUSD (GOLDmicro) – demo account

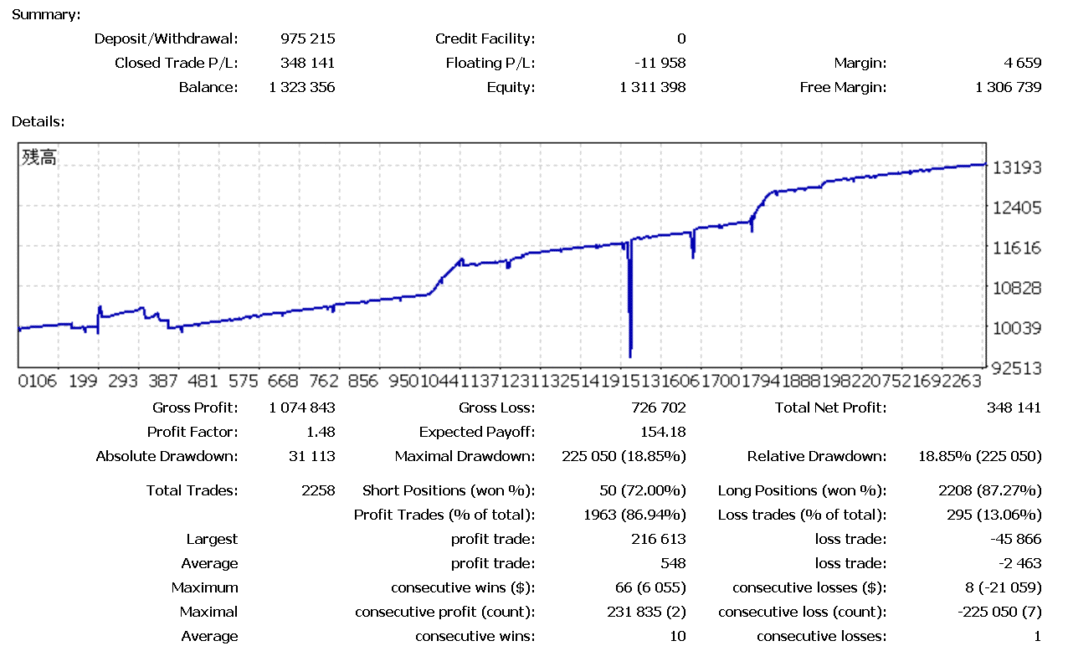

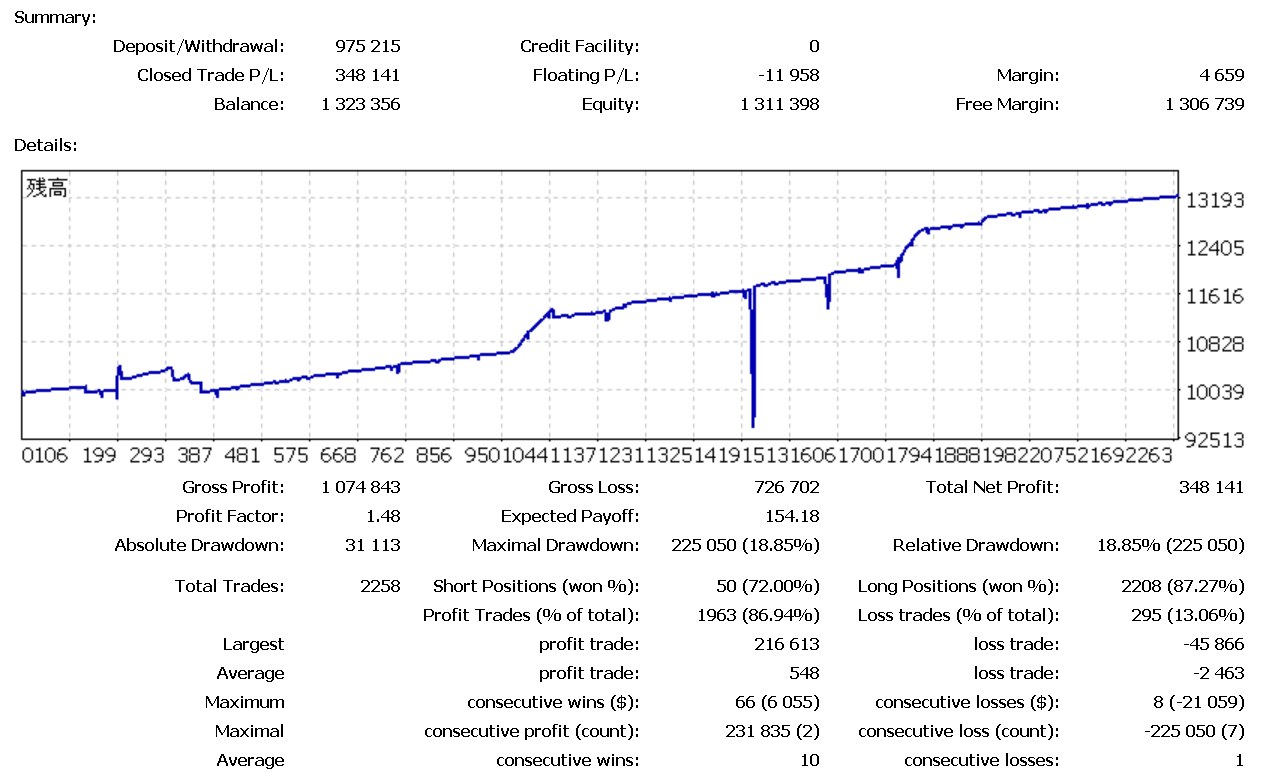

Under you will note two fairness curves:

-

The full historical past from 20 October till now

-

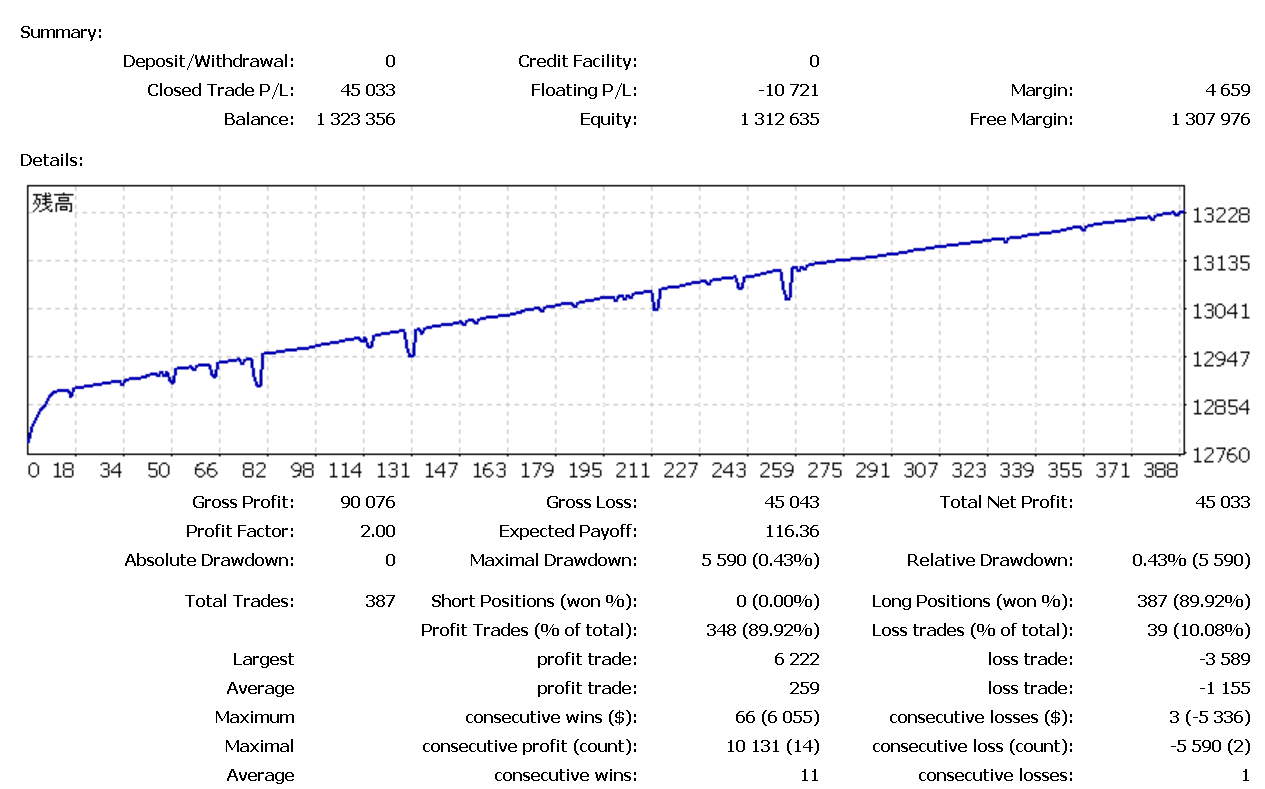

The fairness curve for this month solely

Each exams are pure ahead buying and selling, not backtests.

EA idea

This EA will not be designed as a “get wealthy fast” scalper.

The principle thought is:

-

Purchase dips on GOLD utilizing a long-only grid

-

On bullish days, let the basket develop and take revenue in steps

-

On heavy down days, give attention to surviving and ready for a bounce, fairly than forcing trades

Model 1.5 focuses on three risk-management instruments:

-

Time-of-day filter – buying and selling is allowed solely between 00:00 and 15:00 (server time)

-

No new trades / no martingale exterior buying and selling hours

-

Good martingale skip logic – if situations look unhealthy, the EA merely doesn’t place the subsequent averaging order

This mix makes the EA behave like:

-

“Exploit robust bullish classes”, and

-

“Keep small and affected person when the market appears to be like harmful”.

About 2 months of ahead outcomes

Wanting on the full fairness curve from 20 October, you may clearly see one deep dip:

this was throughout a ~300 USD one-way drop in GOLD.

Aside from that occasion, the curve is sort of clean and stair-like:

-

fairness climbs in steps on bullish days

-

small short-term drawdowns seem when the market pulls again

-

then the grid closes in revenue and the stability makes a brand new excessive

-

From the report for the latest interval, the important thing stats are roughly:

-

Revenue Issue: 2.00

-

Win charge: about 90% (348 successful trades out of 387)

-

Maximal drawdown: 0.43% (about 5,590 in account foreign money)

Up to now I’m proud of how ver1.5 behaves:

it “accepts” the occasional deep dip when GOLD developments one-way,

however in any other case retains drawdown comparatively calm whereas pushing the stability upward.

This month’s efficiency

For those who zoom in on this month solely, the fairness curve turns into even cleaner:

-

light, virtually linear uptrend in stability

-

a number of small pullbacks the place the grid needed to sit by drawdown

-

fast recoveries adopted by new fairness highs

In my view, the largest contributors are:

-

proscribing buying and selling to 0–15h solely, avoiding probably the most chaotic late-US / rollover hours

-

disabling new grid and martingale entries exterior these hours

-

letting the skip logic forestall “over-averaging” when volatility or construction appears to be like harmful

It gained’t win each single day, however the total conduct matches the EA’s idea nicely:

“generate profits on good lengthy days, survive the unhealthy ones”.

Threat issues

In fact, that is nonetheless a grid + averaging EA on XAUUSD.

There’s all the time a danger that:

-

GOLD developments exhausting in opposition to the lengthy path, or

-

the market stays in a deep downtrend longer than anticipated

For that motive, I strongly advocate:

-

utilizing conservative beginning lot sizes

-

conserving sufficient free margin for prolonged drawdowns

-

understanding the most basket measurement / whole lot earlier than utilizing it on a dwell account

Even with time filters and skip logic, danger can by no means be fully eliminated.

Closing ideas

“Gold Solely Win World” has steadily grow to be an EA that:

-

captures income on robust bullish classes

-

avoids pointless publicity in harmful hours

-

and prioritizes survival over over-aggression

I’ll proceed to watch the ahead outcomes and alter danger settings if wanted,

however for now I’m fairly glad with how ver1.5 performs below real-time situations.

In case you have any questions in regards to the setup, danger parameters or the logic behind this EA,

be happy to depart a remark or ship me a message.

https://www.mql5.com/en/market/product/157834