Most merchants wrestle as a result of they chase breakouts, react to headlines, or leap into trades based mostly on emotion.

The consequence?

Inconsistent efficiency, blown-up accounts, and a continuing feeling of uncertainty.

Now…

What if there’s a approach to revenue by understanding the market’s tendency to snap again to its common?

That’s the ability of imply reversion buying and selling.

It’s a buying and selling technique that works as a result of markets usually overreact within the brief time period earlier than correcting themselves.

By systematically capturing these swings, you’ll be able to generate constant returns with out counting on guesswork.

That’s why in as we speak’s article, you’ll uncover:

- What imply reversion buying and selling is (how and why it really works)

- The secrets and techniques of imply reversion buying and selling success

- A imply reversion buying and selling system that has generated 2834% over the past 25 years

- Information and backtest outcomes

- Professionals and cons of imply reversion buying and selling

Sound good?

Then let’s get began…

Imply reversion buying and selling defined

Imply reversion buying and selling relies on a easy concept: when the value makes an excessive transfer, it tends to snap again in the direction of the historic common.

This implies a imply reversion system would purchase when a inventory is oversold and promote it on the subsequent bounce increased.

But you could be questioning…

“Why does imply reversion buying and selling work?”

It’s as a result of the market usually overreacts to the information, which causes the value to drop greater than it ought to. However as soon as emotion cools, the value tends to maneuver again in the direction of its honest worth.

This creates buying and selling alternatives for a imply reversion dealer to “purchase low and promote excessive”—the identical technique my spouse makes use of when she goes buying!

Now, earlier than I provide the guidelines of the imply reversion buying and selling system, you first want to grasp the ideas behind it so you understand how it really works.

6 ideas of imply reversion buying and selling

1. Determine shares in an uptrend

Shares in an uptrend are more likely to proceed increased. It might be resulting from stable fundamentals, optimistic sentiment, a well-managed firm, and so on. You don’t must know the precise motive. In any case, who has time to scrutinise the basics?

I barely have time to learn the directions on my shampoo bottle, which explains quite a bit about my hair scenario.

2. Await a pullback

A inventory doesn’t go up in a single straight line. As an alternative, it strikes increased, pulls again, after which resumes its upward development. As a imply reversion dealer, you at all times purchase on the dip, not on the rally.

3. Purchase when it’s oversold

You’re most likely questioning…

“How do I do know when a inventory is oversold?”

Visually, it seems like a giant fats crimson candle on the chart. Typically, there are even a number of crimson candles in a row—like my bank card payments after my spouse’s on-line buying sprees.

The extra bearish it seems, the extra oversold it’s. Nonetheless, this may be subjective. That’s why later, you’ll study a particular buying and selling rule to outline when a inventory is oversold.

4. Promote the rally

A imply reversion system seems to seize a swing (or one transfer). This lets you generate constant income and have a excessive successful fee.

5. Commerce a number of shares

Something can occur to a single inventory. An organization may change into fraudulent and its inventory value may go to zero. That’s why you shouldn’t allocate all of your capital to a single place.

As an alternative, unfold your bets throughout a number of shares so that you scale back your threat and have the next likelihood of creating a revenue. It’s like having a number of youngsters—if one disappoints you, you’ve nonetheless bought backup.

(Simply kidding, all of my youngsters are good… in the event you’re studying this.)

6. Deal with massive market capitalization shares

Imply reversion buying and selling works higher on large-cap shares as a result of they’re broadly adopted by establishments and analysts. This implies more often than not, the value motion is short-term noise and never a giant elementary change. This “noise” is what permits a imply reversion buying and selling system to thrive.

These six ideas type the spine of imply reversion buying and selling. However ideas alone aren’t sufficient— you want clear goal buying and selling guidelines.

That’s why I’ll now stroll you thru the foundations of a imply reversion buying and selling system (backed by knowledge)…

A imply reversion buying and selling system that works

Markets traded:

Shares within the Russell 1000 index

Timeframe:

Every day

Threat administration:

20% capital for every inventory and a most of 5 positions

Buying and selling guidelines

- The inventory is above the 200-day transferring common (standards to outline an uptrend).

- The inventory closes beneath the decrease Bollinger Band (standards to outline the pullback).

- Place a 3% purchase restrict order (standards to determine oversold shares).

- In case your order is stuffed, promote when the 2-day RSI crosses above 50 or after 10 buying and selling days (standards to outline the promote sign).

- If there are too many shares to select from, choose those which have elevated essentially the most in value over the past 150 days (standards to rank shares from strongest to weakest).

* Bollinger Band settings: 20-day transferring common and a couple of.5 commonplace deviation

Right here’s an instance…

Kirby Company (Kex)

Kex is in an uptrend because the inventory value is above the 200-day transferring common.

On 1st August 2024, the inventory made a pullback and closed beneath the decrease Bollinger band.

The following day, the inventory value traded decrease and would have stuffed your purchase restrict order.

Two days later (on 6th August), the 2-day RSI crossed above 50 (which is the exit sign). This implies you’d exit the place for a revenue of two.5% on this commerce.

Backtest outcomes: Imply reversion buying and selling system

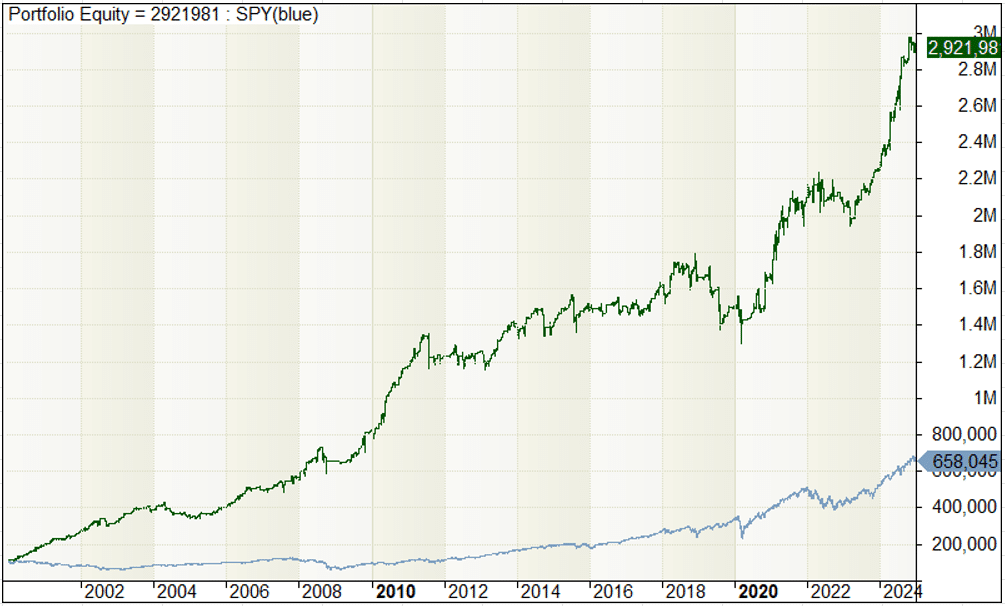

Right here’s the consequence over the past 25 years…

- Complete return: 2821% (since 2000)

- Annual return: 14.47%

- Profitable fee: 66.16%

- Dropping fee: 33.84%

- Payoff ratio: 0.77 (common revenue / common loss)

- Most drawdown: 27.43%

Right here’s the fairness curve of the buying and selling system…

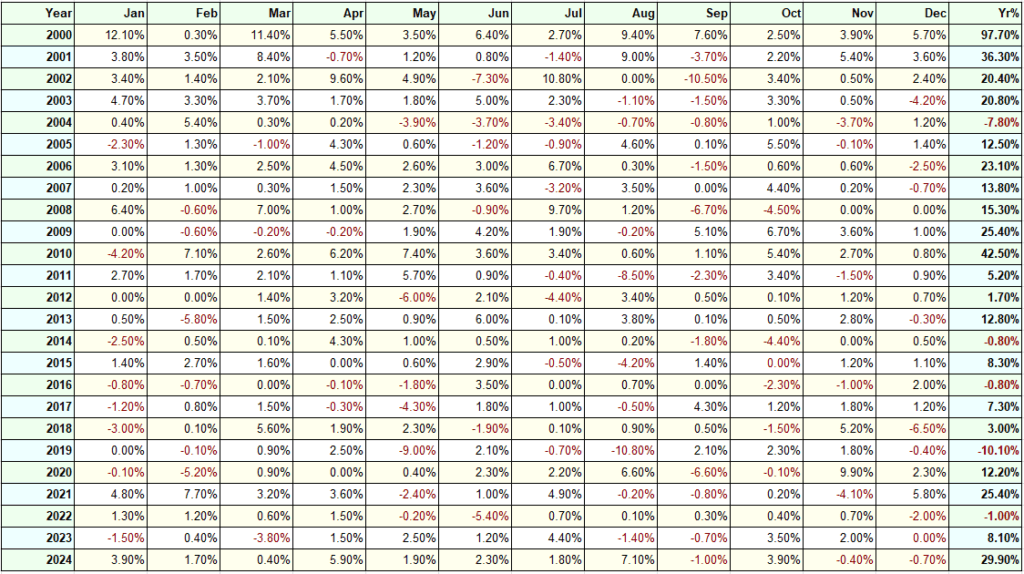

And the yearly returns…

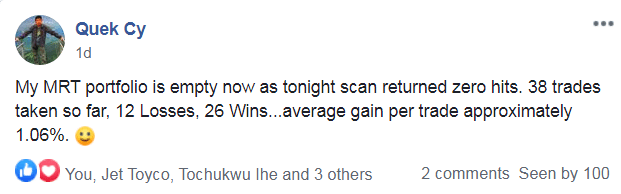

Right here’s what one among my college students, Quek (from The Final Techniques Dealer), has to say a couple of imply reversion buying and selling strategy…

“38 trades taken to this point. 12 losses and 26 wins. Common achieve of round 1.06% per commerce.” — Quek

Shifting on, let’s discuss concerning the professionals and cons of imply reversion buying and selling…

Professionals and cons of imply reversion buying and selling

First, the benefits of imply reversion buying and selling…

Benefits of imply reversion buying and selling

- Excessive successful fee

- Makes cash in most years

Imply reversion buying and selling techniques are fast to take revenue (sooner than I seize the final piece of cake earlier than anybody notices). This explains the excessive successful fee (above 60%), which is psychologically simpler for many merchants to deal with.

It makes a revenue when the general market situation is bullish or range-bound. And for the reason that inventory market is mostly in a long-term uptrend, it makes cash in most years.

Subsequent, the disadvantages…

Disadvantages of imply reversion buying and selling

- Common loss is bigger than common revenue

- Underperforms throughout a bear market

Typically, the shares you purchase don’t make a bounce and proceed to say no for a lot of days in a row. Such losses may erode the features of a number of successful trades.

Throughout a bear market, most shares might be in a steep decline. A imply reversion buying and selling system is susceptible throughout these declines, because it solely income when a inventory makes a bounce increased. In a bear market, the bounce would possibly by no means come or occur at a a lot lower cost.

So now the query is…

Is imply reversion buying and selling appropriate for you?

Right here’s my tackle it…

Imply reversion buying and selling is NOT for you if…

- You possibly can’t afford the time to put trades every single day.

- You need your common revenue to be bigger than your common loss.

- You need returns not correlated to the inventory market.

Imply reversion buying and selling is FOR you if…

- You’re prepared to put trades every single day.

- You possibly can settle for that your common loss is bigger than your common revenue (like how I’ve accepted my hair is abandoning ship sooner than passengers on the Titanic.).

- You need a excessive successful fee so it’s simpler in your buying and selling psychology.

Now, you may have a good suggestion whether or not imply reversion buying and selling fits your persona and targets.

Nonetheless, you may need just a few questions. So let’s deal with among the frequent ones I get from merchants…

Steadily requested questions

Imply reversion buying and selling vs development following, which is best?

These are two totally different buying and selling methods.

A imply reversion buying and selling strategy has the next successful fee, however the common loss is bigger than the common revenue. Like courting somebody who compliments you every day however sometimes maxes out your bank card.

A development following strategy has a decrease successful fee, however the common revenue is bigger than the common loss. Like that buddy who not often calls however at all times brings costly whiskey after they go to.

Primarily, the “finest” strategy depends upon your targets, as what works for one dealer could not go well with one other.

Does imply reversion buying and selling nonetheless work as we speak?

Sure, imply reversion buying and selling nonetheless works even as we speak (as you’ll be able to see from the backtest outcomes).

Nonetheless, the sting has reduced in size lately.

What markets does imply reversion buying and selling work on?

I’ve examined it on massive market capitalization shares, and it really works. I’ve additionally seen it utilized efficiently within the crypto markets. Nonetheless, I didn’t discover success with smaller market capitalization shares.

Can imply reversion buying and selling work for the brief facet?

Sure, the strategy can work for shorting shares. However you want totally different buying and selling guidelines for it.

Conclusion

Markets revert to their imply, like how I at all times return to my fridge, regardless of what number of diets I begin.

Imply reversion buying and selling is about exploiting the tendency of costs to swing again towards their common. By figuring out these alternatives, you’ll be able to revenue from short-term mispricings within the inventory market.

This buying and selling technique performs properly in a bull and range-bound market, however faces challenges in a bear market. That’s why threat administration, place sizing, and system guidelines are important to long-term success.

Anyway, if you wish to learn to implement a imply reversion buying and selling system to your portfolio, then take a look at The Final Techniques Dealer. It’s a 1-year teaching program that exhibits you easy methods to earn an additional 15% a 12 months in quarter-hour a day, so you’ll be able to generate one other supply of earnings.