By RoboForex Analytical Division

The EUR/USD pair rallied sharply to 1.1735 on Friday, propelled by a sustained sell-off within the US greenback. The transfer adopted a extensively anticipated Federal Reserve price minimize, which was accompanied by steerage that proved extra accommodative than markets had anticipated.

Chair Jerome Powell explicitly dominated out additional price hikes, and the Fed’s up to date “dot plot” projections now point out just one further minimize for 2026 – a extra measured path of easing than beforehand anticipated.

Including to greenback weak spot, the Fed introduced it could start buying short-term Treasury payments to bolster banking system liquidity – a measure that pushed Treasury yields decrease. This was compounded by financial knowledge exhibiting preliminary jobless claims rose final week at their quickest tempo in almost 4 and a half years, reinforcing the case for a extra supportive coverage stance.

The broader exterior atmosphere is popping more and more unfavourable for the buck. Whereas the Fed alerts a slower tempo of easing, markets are concurrently pricing in a comparatively tighter coverage trajectory for central banks in Australia, Canada, and the Eurozone. This divergence has pushed the greenback decrease towards most main currencies this week, with its most pronounced decline coming towards the euro.

Technical Evaluation: EUR/USD

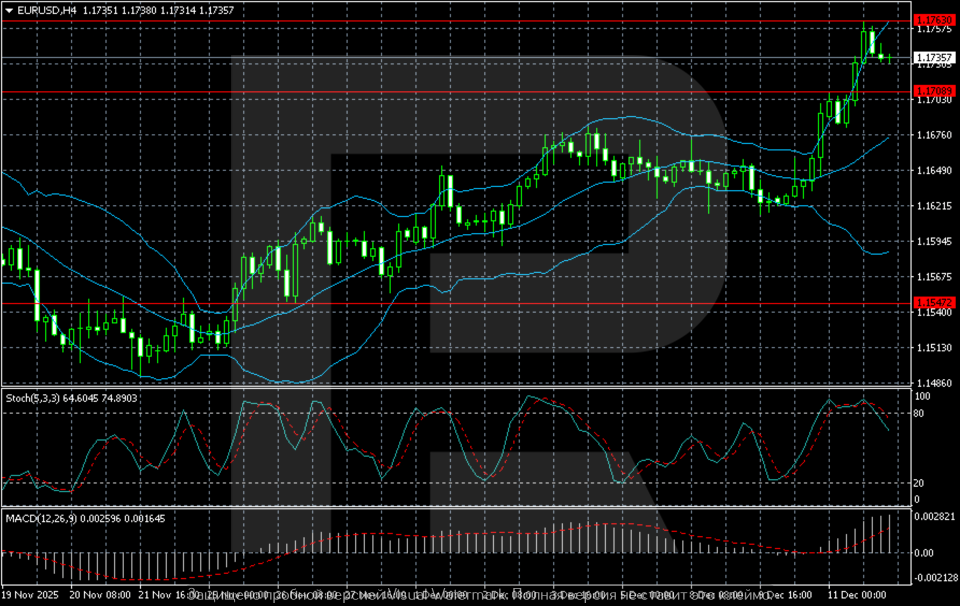

H4 Chart:

On the H4 chart, EUR/USD reveals a sturdy bullish development, buying and selling close to a key resistance zone at 1.1760–1.1780. The pair is holding firmly above the center Bollinger Band, confirming purchaser dominance. The upward slope and gradual widening of the higher band sign rising volatility and sustained momentum following a breakout to new highs.

Offered the worth stays above the 1.1709 assist, the market retains robust potential to problem the 1.1780 ceiling. A decisive breakout and shut above this zone would open a transparent path in the direction of 1.1850. Ought to a pullback materialise, the closest vital assist lies at 1.1650, the earlier breakout level. A break beneath 1.1547 could be required to sign a deeper correction in the direction of the decrease Bollinger Band.

H1 Chart:

On the H1 chart, the pair is consolidating after a robust impulse wave that focused the 1.1760–1.1780 resistance space. The present correction is discovering preliminary assist at 1.1709, a degree from which the newest acceleration originated.

The Stochastic oscillator is declining from overbought territory, growing the chance of a near-term pause or shallow pullback. Nonetheless, the underlying construction stays bullish, with the worth buying and selling above the center Bollinger Band, which now serves as dynamic assist.

A confirmed breakout above 1.1780 would sign a continuation of the uptrend, with subsequent targets at 1.1820 and 1.1850. Conversely, a sustained transfer beneath 1.1709 would offer the primary technical indication of fading bullish momentum, doubtlessly triggering a correction in the direction of the subsequent demand zone within the 1.1650–1.1620 vary.

Conclusion

EUR/USD has damaged out decisively on the again of a dovish Fed pivot and a shifting world price differential. The technical image is firmly bullish, with the pair now testing a significant resistance cluster close to 1.1780. A profitable breakout above this degree would probably speed up features in the direction of 1.1850. Within the close to time period, the 1.1709 assist is vital; holding above it retains the fast upward bias intact, whereas a break beneath would counsel a interval of consolidation is required earlier than the subsequent directional transfer.

Disclaimer:

Any forecasts contained herein are primarily based on the writer’s specific opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- SNB retains the speed at 0%. WTI crude oil costs drop to a seven-week low Dec 12, 2025

- EUR/USD Surges on Dovish Fed Indicators and Shifting Expectations Dec 12, 2025

- As anticipated, FOMC minimize rate of interest. The Financial institution of Canada retains the speed unchanged at 2.25% Dec 11, 2025

- GBP/USD Approaches Native Excessive, Bolstered by BoE Stance Dec 11, 2025

- Silver rises above $60/ounce. Australian greenback holds close to three-month excessive Dec 10, 2025

- USD/JPY Pauses as Yen Resists Downward Strain Dec 10, 2025

- The Reserve Financial institution of Australia saved its rate of interest unchanged as anticipated. Pure fuel costs fell by 7% on Monday Dec 9, 2025

- Gold on Pause Awaiting the Fed’s Verdict Dec 9, 2025

- Canadian greenback hits 2‑month excessive. Mexican peso rises on carry commerce enchantment Dec 8, 2025

- EUR/USD Features as Market Focus Fixes on the Fed Dec 8, 2025