Introduction

Synthetic intelligence (AI) has taken the buying and selling world by storm. All over the place you look—boards, social media, dealer web sites—you’ll discover “AI-powered” knowledgeable advisors (EAs) promising regular earnings with zero effort. The pitch is irresistible: let a sensible algorithm commerce for you whilst you sleep, journey, or deal with different issues.

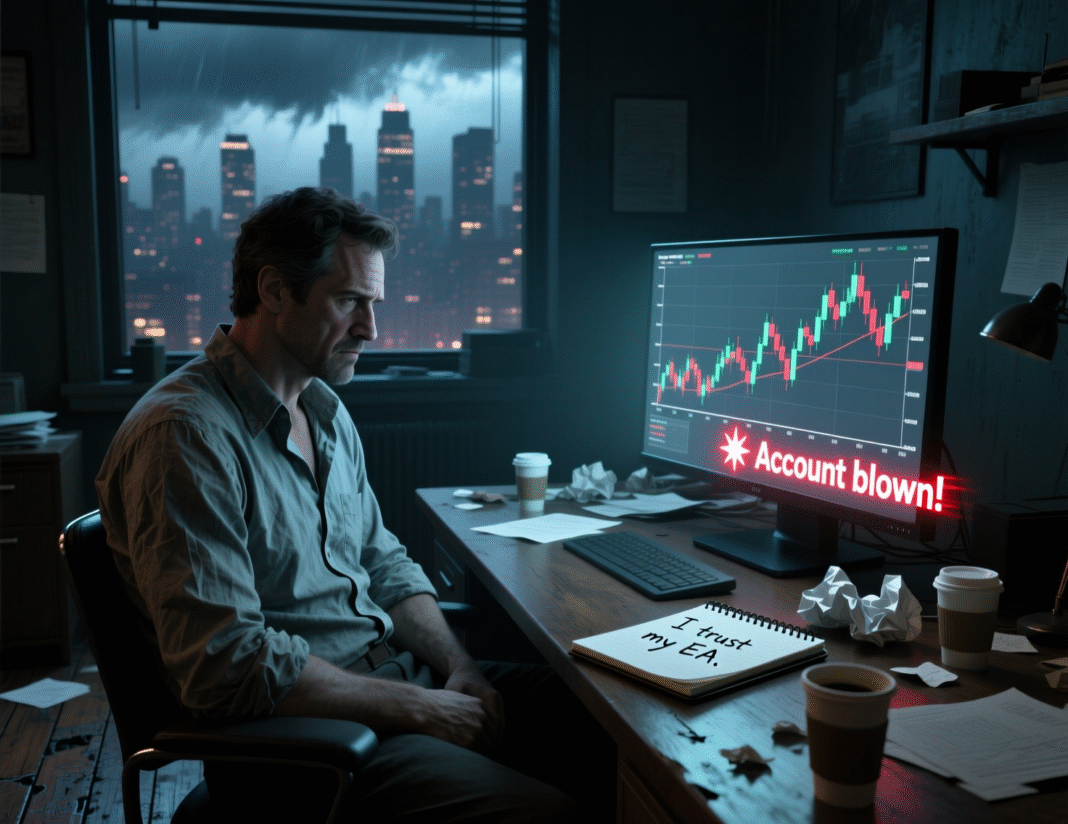

However behind the shiny advertising and futuristic buzzwords lies a harsh actuality: many of those AI-based buying and selling bots find yourself draining merchants’ accounts as a substitute of rising them. On this article, we’ll lower by way of the hype and study why AI knowledgeable advisors so usually result in deposit losses—not as a result of AI is inherently flawed, however due to the way it’s misunderstood, misapplied, and oversold.

What an AI Knowledgeable Advisor Actually Is

Regardless of the futuristic label, most “AI knowledgeable advisors” will not be sentient robots or oracles of the market. In sensible phrases, they’re superior algorithms—usually primarily based on machine studying fashions like determination bushes, random forests, or shallow neural networks—that analyze historic value knowledge to establish patterns and generate commerce indicators.

The time period “AI” is steadily used as a advertising shortcut. True synthetic intelligence able to reasoning, adapting to unseen market regimes, or understanding macroeconomic context merely doesn’t exist in retail buying and selling instruments as we speak. As an alternative, these techniques be taught from previous knowledge and repeat behaviors that have been worthwhile in that particular historic context.

“Synthetic intelligence” sounds good—however is it actual intelligence or simply intelligent overfitting? We’ll unpack the terminology and present you what’s actually occurring.

Crucially, AI does not predict the longer term. It extrapolates from the previous. And as each skilled dealer is aware of, monetary markets are non-stationary: what labored yesterday could fail catastrophically tomorrow. An AI EA is simply nearly as good as the information it was skilled on—and the assumptions constructed into its design.

Principal Causes Why AI Knowledgeable Advisors Lose Deposits

Some of the frequent pitfalls is overfitting—when an AI mannequin is skilled so exactly on historic knowledge that it “memorizes” previous market noise as a substitute of studying real patterns.

My options on MQL5 Market: Evgeny Belyaev’s merchandise for merchants

Such a mannequin performs flawlessly in backtests however collapses in reside buying and selling as a result of actual markets by no means repeat precisely. Overfitted EAs usually present spectacular fairness curves on previous knowledge, making a false sense of safety—till the primary surprising value transfer wipes out the account.

AI knowledgeable advisors sometimes analyze solely value and quantity knowledge. They lack consciousness of elementary drivers—central financial institution choices, geopolitical occasions, financial shocks, or shifts in market sentiment. When such occasions happen (e.g., an surprising rate of interest hike or battle outbreak), the market regime adjustments immediately. An AI skilled on “regular” situations can not interpret these shifts and continues buying and selling as if nothing occurred—usually with disastrous outcomes.

Markets alternate between tendencies, ranging (flat) intervals, and high-volatility crises. Most AI EAs are skilled on a selected kind of market habits and fail to acknowledge regime shifts. For instance, a method optimized for a robust trending surroundings will hold opening positions throughout a sideways market, accumulating small losses that finally grow to be giant drawdowns. True adaptability requires specific logic to detect and reply to altering market states—one thing most retail AI techniques lack.

AI is simply as dependable as the information it learns from. Many builders practice their fashions on clear, idealized historic knowledge—ignoring real-world components like unfold measurement, slippage, partial fills, or dealer execution delays. Consequently, the EA performs nicely in backtests however underperforms (or fails completely) in reside situations. Moreover, tick knowledge inaccuracies or survivorship bias in value feeds can additional distort the mannequin’s understanding of actuality.

Many AI EAs are optimized purely for revenue maximization, not capital preservation. They hardly ever embody dynamic place sizing, volatility-based cease losses, or correlation controls. When a shedding streak begins, the system doesn’t cut back threat—it retains buying and selling with the identical aggression, turning a manageable drawdown into a complete loss. True threat administration requires guidelines that override efficiency targets throughout stress intervals—one thing most AI-driven techniques will not be designed to do.

Psychological and Advertising Elements

Many merchants consider that utilizing an “AI-powered” system provides them an edge—and even removes threat completely. In actuality, they’re outsourcing choices with out understanding them. This creates a harmful phantasm: the dealer feels in management as a result of they “selected” the AI, however has no perception into why it opens or closes trades. When losses mount, they’re caught off guard—emotionally unprepared and technically helpless to intervene.

The time period “AI” is commonly used as a magic label to promote buying and selling merchandise—no matter whether or not actual machine studying is concerned. A easy moving-average crossover script could also be rebranded as an “AI Quantum Bot” with glowing graphics and guarantees of “predictive intelligence.” This exploits merchants’ belief in know-how and obscures the dearth of real innovation or testing behind the product.

Promotional supplies steadily showcase doctored backtests, demo accounts with unrealistic leverage, or short-term successful streaks offered as long-term success. Testimonials and “verified” MyFXBook hyperlinks could also be fabricated or cherry-picked. This manufactured social proof tips patrons into believing the EA is confirmed and dependable—when in actual fact, it has by no means confronted actual market stress.

When AI Can Really Assist

Synthetic intelligence just isn’t a magic answer—nevertheless it could be a highly effective assistant when used accurately. As an alternative of handing full management to an AI-driven EA, good merchants use AI to improve their decision-making: filtering noise, figuring out hidden correlations, or flagging uncommon market regimes. On this position, AI acts like a high-precision radar—not an autopilot.

- Adaptive parameter tuning: AI can alter technique inputs (like stop-loss distance or take-profit ranges) primarily based on present volatility or liquidity.

- Market regime detection: Machine studying fashions can classify whether or not the market is trending, ranging, or breaking out—permitting merchants to change methods accordingly.

- Anomaly detection: AI can spot irregular order move or value motion that may precede information occasions or institutional strikes.

- Sturdy backtesting validation: AI-driven walk-forward evaluation helps guarantee a method isn’t overfitted by testing it throughout a number of unseen market segments.

A reliable AI-based system ought to meet a number of standards:

- Skilled on out-of-sample knowledge and validated with walk-forward testing.

- Consists of specific threat controls (e.g., max drawdown limits, place scaling).

- Avoids claims of “100% accuracy” or “assured earnings.”

- Is clear about its logic—or a minimum of its statistical edge and limitations.

Most significantly: it enhances human judgment, not replaces it.

AI-powered knowledgeable advisors will not be inherently flawed—however they’re steadily misunderstood and misused. The core drawback isn’t the know-how itself; it’s the idea that automation equals profitability, or that algorithms can exchange disciplined buying and selling. Monetary markets are advanced, adaptive techniques formed by human habits, information, and uncertainty. No mannequin, regardless of how “clever,” can absolutely predict them.

The true hazard lies in abandoning judgment in favor of phantasm. When merchants deal with AI EAs as infallible oracles—quite than restricted instruments skilled on imperfect knowledge—they set themselves up for failure. Success in buying and selling nonetheless is dependent upon the identical timeless ideas: threat administration, adaptability, steady studying, and emotional management. AI can help these—however by no means substitute for them.