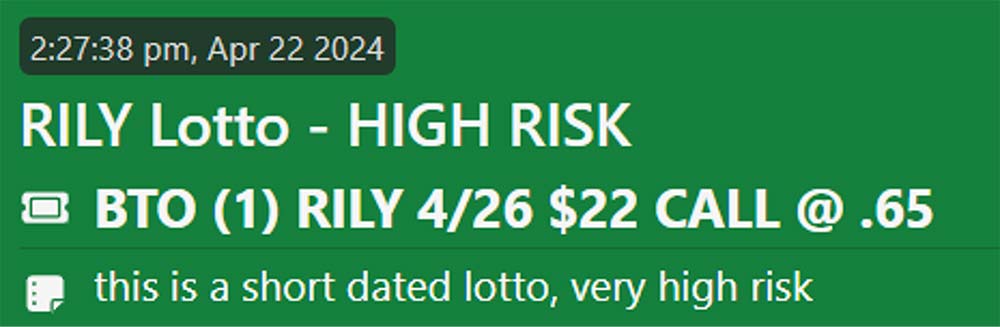

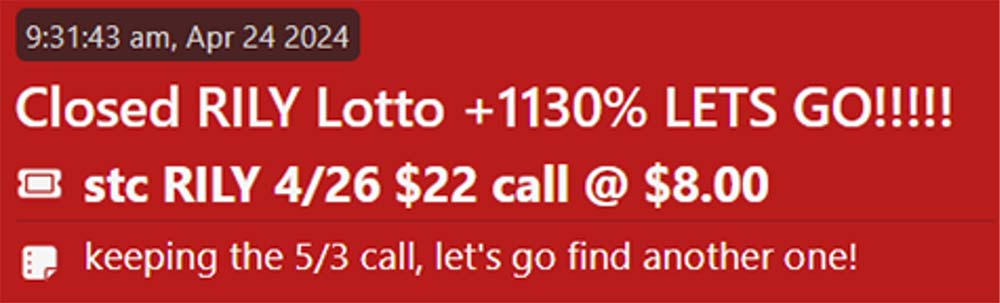

1,130%.

That was the quantity that scrolled throughout my display after I offered shares on B. Riley Monetary (RILY) again in April of 2024.

It was considered one of my greatest winners ever, turning $65 into $800 in simply two days, reside in my Each day Earnings Stay Buying and selling Room.

So what precisely brought on the transfer, and how are you going to put together to make the most of performs like this sooner or later?

That’s what I’ll be discussing with you in the present day.

The Commerce Setup

Earlier than I acquired positioned on RILY, the market was choosing up momentum after some oversold situations. And I used to be searching for some shares that had the potential to squeeze.

One of many principal causes RILY caught my consideration is as a result of the inventory had a heavy brief curiosity.

On the time I positioned the commerce, the brief curiosity in RILY was 75%. After a current monster rally, it has come all the way down to 65%.

Let’s break it down step-by-step.

Brief Curiosity: Within the inventory market, when somebody believes {that a} explicit inventory’s worth will lower, they will interact in what’s referred to as “brief promoting.” Right here’s the way it works:

- They borrow shares of a inventory from somebody who owns it (sometimes by their dealer).

- They promote these borrowed shares available on the market on the present worth, hoping to purchase them again later at a cheaper price.

- If the worth does certainly drop, they purchase again the shares on the cheaper price and return them to the lender, pocketing the distinction as revenue.

Excessive Brief Curiosity: This merely refers to a scenario the place numerous traders are partaking in brief promoting for a selected inventory. So, a inventory with excessive brief curiosity implies that there are various traders betting that its worth will go down.

Brief Squeeze: Now, think about the other occurs – as a substitute of the inventory worth taking place, it begins going up. When this happens, it places stress on brief sellers.

Right here’s why:

Because the inventory worth rises, brief sellers begin dropping cash as a result of they offered shares at a cheaper price and want to purchase them again at the next worth to return them.

Brief sellers could begin feeling the warmth if the inventory worth rises considerably. They could reduce their losses and purchase again the shares they borrowed earlier than the worth goes even larger.

When many brief sellers rush to purchase again shares to cowl their positions (generally known as “masking their shorts”), it creates extra demand for the inventory, additional driving its worth up.

This sudden surge in shopping for exercise, particularly from brief sellers making an attempt to exit their positions, can result in a speedy improve within the inventory’s worth, referred to as a brief squeeze.

If you happen to don’t know the story, RILY has been below assault by brief sellers, alleging the corporate dedicated fraud.

The inventory declined from its final 12 months’s excessive of $91.24 all the way down to a low of $14.26 in February.

So what brought on the spike?

The corporate filed its annual report, it confirmed minimal changes to its monetary numbers. Extra importantly, the corporate confirmed by a second regulation agency, there was no wrongdoing.

That information despatched the shorts scrambling, pushing it to a excessive of $35 yesterday.

Under you may see my pre-market plan I posted within the Each day Earnings Stay Buying and selling Room:

Final Phrase

It’s laborious to commerce efficiently should you are available in with a bias. RILY was attacked by shorts for months. Nonetheless, I let the worth motion and the chart dictate whether or not or not I ought to take a place.

As retail merchants, we don’t have entry to the identical data as the professionals on Wall Avenue. That’s why it’s crucial that we base our choices on worth motion.

For instance, I had no clue that RILY can be releasing their annual report yesterday, however on a threat vs. reward foundation, the commerce made sense to me.

While you do comply with the worth motion, typically you “get fortunate.” I can’t inform you what number of occasions I’ve purchased name choices on a robust chart, solely to see the subsequent day the corporate catches an improve from a Wall Avenue agency, sending the inventory hovering.

![]()

YOUR ACTION PLAN

Click on right here to login to Each day Earnings Stay to see my newest trades.

FUN FACT FRIDAY

New Highs and Sector Rotations: The S&P 500 and Dow each hit contemporary closing data this week, even because the tech-heavy Nasdaq slipped.

The highs got here as traders shift cash away from tech and into sectors tied to the broader economic system, with sectors like financials, supplies, industrials and a few shopper names are all doing extra heavy lifting.