A Powder Keg of Divergence: FIIs Escalate Bearish Assault as Purchasers Abandon All Concern

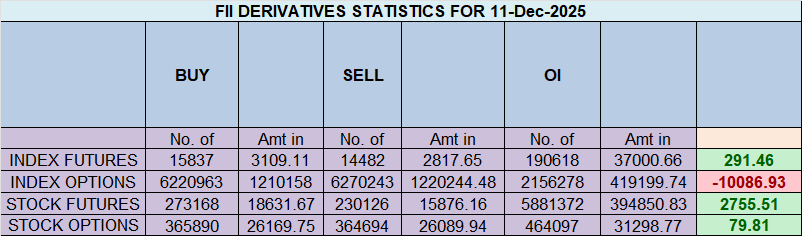

On December 11, 2025, the Nifty Index Futures market reworked right into a high-stakes enviornment of utmost and opposing convictions. Whereas International Institutional Buyers (FIIs) relentlessly escalated their bearish marketing campaign, shorting a internet 1,676 contracts, essentially the most beautiful growth was the conduct of the retail shoppers, who aggressively shed their draw back safety.

This head-on collision of sentiment, backed by a major surge in Open Curiosity of 1,452 contracts, alerts a market that isn’t simply trending, however is being wound into a good, explosive coil.

Decoding the Knowledge: Two Armies on Reverse Sides of the Universe

The granular information reveals one of the vital excessive and harmful divergences between institutional and retail sentiment.

1. The FII Bears: Unwavering and Aggressive Conviction

The FIIs continued to press their assault with methodical drive. By including to their brief positions, they’re signaling their absolute disbelief available in the market’s present valuation. This has pushed their positioning to a historic and profoundly bearish excessive: 11% lengthy versus 89% brief. A protracted-short ratio of 0.12 is at rock-bottom and represents a state of most institutional pessimism. They’ve positioned a monumental guess that the market is on the verge of a major decline.

2. The Primary Occasion: The Purchasers’ Nice Hedge Unwinding

Probably the most stunning information of the day got here from the consumer phase. They didn’t simply purchase the dip; they displayed a stage of supreme confidence that borders on euphoria. By masking an enormous 3,165 brief contracts, they’ve basically deserted all draw back safety. This isn’t the motion of a cautious participant; it’s the motion of a dealer who believes {that a} fall is unimaginable and that holding any sort of hedge is a waste of capital. This has cemented their positioning at a extremely bullish 68% lengthy versus 32% brief (ratio 2.13).

3. The Essential Sign of Rising OI

That is the important thing that unlocks your entire narrative. The rise in Open Curiosity proves that that is an escalating battle. New capital is flowing in to take sides. The FIIs’ promoting is being met with sufficient new shopping for curiosity to not solely take in their provide however to create 1,452 brand-new, energetic contracts. This isn’t a market that’s consolidating; it’s a market that’s actively loading up for a serious battle.

Key Implications

-

A Historic and Unstable Divergence: The positional chasm between the FIIs (0.12) and the Purchasers (2.13) is now at a most, unsustainable excessive. The market can’t show each side proper.

-

The Final Contrarian Sign is Blaring: This can be a textbook “good cash vs. dumb cash” setup at its most potent. When retail merchants are this euphoric (shedding all safety) on the similar time establishments are this bearish, historical past exhibits it’s a signal of a serious market prime.

-

Impending Volatility Explosion: This stage of rigidity and new position-building can’t be resolved peacefully. The market is primed for a pointy, high-velocity transfer designed to drive one facet right into a catastrophic capitulation.

-

The “Ache Commerce” is Apparent: The market is now dangerously saturated with unprotected retail lengthy positions. A transfer down from right here would set off a devastating liquidation cascade. That is the trail of most monetary ache.

Conclusion

This isn’t a market to be trifled with. It’s a powder keg. The FIIs have drawn their line within the sand with most bearish conviction, and the retail shoppers have responded with most bullish euphoria. The rising OI confirms this battle is constructing, not fading. A serious, violent decision is now a matter of “when,” not “if.”

Final Evaluation could be learn right here

The market has as soon as once more demonstrated the exceptional precision of our analytical mannequin. The bulls efficiently mounted a essential protection on the 25,700 assist zone, a battle received beneath the risky affect of the Mercury signal change as anticipated. This profitable maintain has led to a decent shut at 25,822, however the conflict is way from over. The market has merely moved from its defensive position right into a high-stakes, impartial territory the place the decisive battle for the week’s pattern is now set to be fought.

The Essential Weekly Shut: Defining the Subsequent Main Development

In the present day’s session isn’t just about intraday path; it’s a strategic struggle to “paint the weekly chart.” The closing worth at this time will set the psychological and technical tone for the approaching week, and it will likely be fought over two clearly outlined and important worth ranges.

-

The Bullish Breakout Set off (A Shut > 25,948): That is the final word goal for the bulls. A decisive weekly shut above this stage would accomplish a number of issues: it could validate the profitable protection of 25,700, negate the current bearish stress, and entice the sellers who shorted into the current lows. A detailed above 25,948 would sign {that a} important backside has been shaped and a brand new, highly effective trending transfer to the upside is starting.

-

The Bearish Management Stage (A Shut < 25,711): The bears haven’t been defeated, solely momentarily checked. Their mission is to invalidate the current restoration and reassert their management. A detailed again beneath 25,711 can be a serious victory for them. It could flip yesterday’s rally right into a failed “bull entice” and sign that the market is able to resume its major downtrend.

The Coming Storm: Setting the Stage for the Mars Signal Change

The result of at this time’s battle is made much more essential by the immense astrological occasion looming subsequent week: Mars, the “ruler of the yr,” will probably be altering indicators.

Mars is the planet of power, aggression, and decisive motion. Its signal change is without doubt one of the strongest catalysts for initiating main, high-velocity developments. In the present day’s weekly shut is subsequently the essential setup. It can decide the directional bias of the market proper earlier than this large injection of Martian power. A robust shut will imply this power will gas a robust rally. A weak shut will imply this power will ignite a brutal and accelerated decline.

Conclusion

The Nifty is at a pivotal inflection level. The bulls have efficiently defended their territory, however now they have to launch a profitable counter-attack. The complete battle for the essential weekly shut will probably be fought between 25,948 on the upside and 25,711 on the draw back. The result won’t solely determine the victor of this week’s wrestle however may even set the stage for what guarantees to be an especially thrilling, and probably very highly effective, trending transfer within the week to come back.

Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 25888 for a transfer in direction of 25968/26048. Bears will get energetic beneath 25808 for a transfer in direction of 25729/25666

Merchants could be careful for potential intraday reversals at 09:30,11:04,12:51,02:51 Learn how to Discover and Commerce Intraday Reversal Occasions

Nifty Dec Futures Open Curiosity Quantity stood at 1.62 lakh cr , witnessing liquidation of 5.7 Lakh contracts. Moreover, the rise in Price of Carry implies that there was addition of SHORT positions at this time.

Nifty Advance Decline Ratio at 38:12 and Nifty Rollover Price is @26320 closed beneath it.

Within the money phase, International Institutional Buyers (FII) offered 2020 cr , whereas Home Institutional Buyers (DII) purchased 3796 cr.

The Nifty choices market is signaling a transparent and decisive return to a bearish sentiment, with name writers aggressively seizing management of the pattern. An unmistakably bearish Put-Name Ratio (PCR) of 0.84 confirms this shift. This means that the open curiosity in name choices is considerably increased than in places, reflecting a market the place individuals are extra assured in promoting the rallies than in supporting the dips. This heavy name writing is creating a major provide overhang that can act as a serious brake on any bullish aspirations.

This cautious surroundings has pinned the Nifty in a good gravitational orbit across the Max Ache level of 25,900. This stage is the fulcrum of the present market, the worth at which the utmost monetary ache can be inflicted on possibility patrons. This creates a robust incentive for the massive institutional sellers to maintain the market contained on this zone, resulting in a interval of risky, range-bound worth motion.

The choices chain clearly defines the high-stakes battlefield that has been established:

-

Resistance: A formidable “Nice Wall of Calls” is situated on the main psychological 26,000 strike, which serves as the final word ceiling. The rapid and most crucial resistance zone is the 25,900 pivot itself.

-

Help: On the draw back, the primary important assist flooring, defended by put writers, is situated at 25,800. The ultimate line of protection and the final word basis for the present market construction stays the large wall of Put OI at 25,500.

In conclusion, the Nifty is locked in a bearish stalemate. The trail of least resistance is now sideways to down, with sellers in agency management. A serious catalyst can be required to interrupt the market free from its present jail, outlined by the assist at 25,800 and the immense resistance at 26,000.

For Positional Merchants, The Nifty Futures’ Development Change Stage is At 26181 . Going Lengthy Or Brief Above Or Under This Stage Can Assist Them Keep On The Similar Aspect As Establishments, With A Larger Threat-reward Ratio. Intraday Merchants Can Preserve An Eye On 25950, Which Acts As An Intraday Development Change Stage.

Nifty Spot – Intraday Chart Statement

Technical Setup: The index is approaching essential breakout ranges. Watch these zones for worth motion affirmation:

-

Power (Upside): Momentum is anticipated to choose up if Nifty sustains above 25918. On this situation, the rapid resistance ranges are 25950, 25999, and 26037.

-

Weak point (Draw back): The pattern technically weakens if the index slips beneath 25864. This might open the trail in direction of assist ranges at 25840, 25816, and 25777.

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators