By RoboForex Analytical Division

The GBP/USD pair superior to 1.3367 on Thursday, stabilising close to its highest stage since 22 October. Sterling is drawing help from a confluence of things: a broadly weaker US greenback and a market reassessment that has scaled again expectations for added Financial institution of England (BoE) financial easing in 2026.

This follows yesterday’s Federal Reserve assembly, the place the US central financial institution delivered a extensively anticipated 25-basis-point price reduce. Crucially, the Fed signalled a possible pause in its easing cycle as early as January, emphasising the necessity for extra financial knowledge earlier than figuring out the following steps.

Expectations for the BoE’s assembly subsequent week stay firmly anchored. The market continues to cost in an 84% likelihood of a 25-basis-point reduce, largely overlooking current knowledge exhibiting accelerating wage progress and protracted inflationary pressures. Moreover, buyers are nearly totally pricing in a second price reduce by June, with a 75% likelihood assigned to an preliminary transfer as quickly as April.

Market focus now shifts to the UK’s month-to-month GDP report, due on Friday, which may immediate a ultimate adjustment to financial coverage expectations forward of the BoE determination.

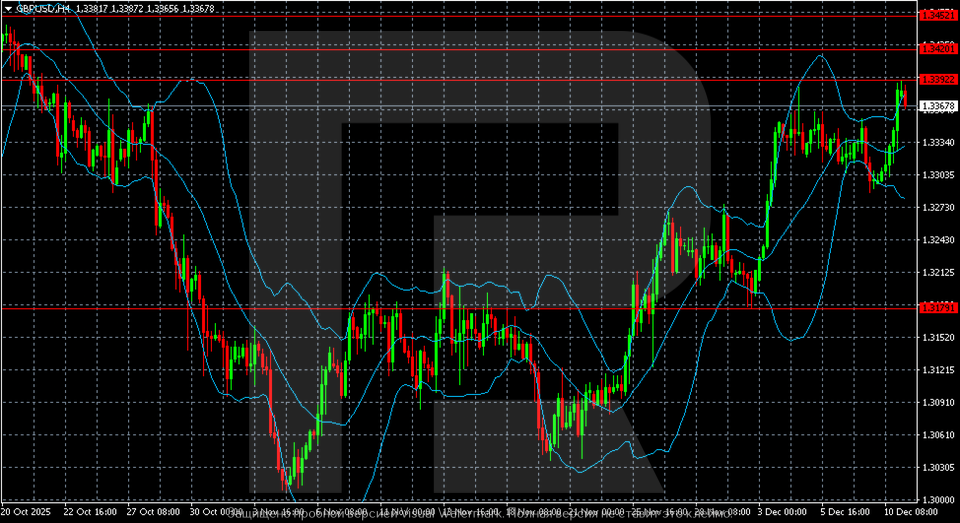

Technical Evaluation: GBP/USD

H4 Chart:

On the H4 chart, GBP/USD displays a powerful upward bias, buying and selling slightly below the important thing technical resistance at 1.3392. The pair’s place firmly above the center Bollinger Band confirms the dominance of patrons. The growth of the higher band alerts rising volatility and suggests the market is constructing momentum for an additional try and breach this barrier.

A decisive breakout and shut above 1.3392 could be a major bullish improvement, opening the trail in the direction of the following resistance zone of 1.3420–1.3452. Ought to a reversal happen, the closest notable help is at 1.3280. A breach of this stage would point out a deeper corrective section, doubtless focusing on the decrease Bollinger Band.

H1 Chart:

On the H1 chart, the pair is present process a near-term correction following its impulsive rise to the 1.3390–1.3392 resistance zone. It’s at present discovering help above 1.3360, a stage from which a previous restoration originated.

The higher Bollinger Band has flattened after a interval of sharp growth, indicating short-term overbought circumstances and rising the probability of a consolidation or shallow pullback. Regardless of this, the general H1 construction stays bullish, with the value above the center band and the decrease band offering dynamic help.

A sustained break above 1.3392 would sign a resumption of the uptrend, focusing on 1.3420 and probably 1.3450. Conversely, a lack of the 1.3360 help could be the primary technical signal of weakening bullish momentum, probably triggering a correction in the direction of the following demand zone within the 1.3300–1.3280 vary.

Conclusion

GBP/USD is buying and selling with conviction, supported by shifting central-bank dynamics which have turned modestly in sterling’s favour. The technical setup is bullish however faces a vital take a look at on the 1.3392 resistance stage. A profitable breakout would validate the energy of the present transfer, whereas a rejection may see the pair retreat to consolidate current features. The upcoming UK GDP knowledge will present the ultimate elementary cue earlier than the extremely anticipated BoE assembly subsequent week.

Disclaimer:

Any forecasts contained herein are primarily based on the writer’s explicit opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- GBP/USD Approaches Native Excessive, Bolstered by BoE Stance Dec 11, 2025

- Silver rises above $60/ounce. Australian greenback holds close to three-month excessive Dec 10, 2025

- USD/JPY Pauses as Yen Resists Downward Stress Dec 10, 2025

- The Reserve Financial institution of Australia stored its rate of interest unchanged as anticipated. Pure gasoline costs fell by 7% on Monday Dec 9, 2025

- Gold on Pause Awaiting the Fed’s Verdict Dec 9, 2025

- Canadian greenback hits 2‑month excessive. Mexican peso rises on carry commerce enchantment Dec 8, 2025

- EUR/USD Good points as Market Focus Fixes on the Fed Dec 8, 2025

- Pure gasoline value nears $5/MMBtu. German DAX hits three-week excessive Dec 5, 2025

- Gold Regular Close to 4,200 USD as Markets Await Key Information Dec 5, 2025

- GBP/USD Extends Good points as Curiosity Price Divergence Captures Focus Dec 4, 2025