Choices Theta Defined

Choices Theta Math

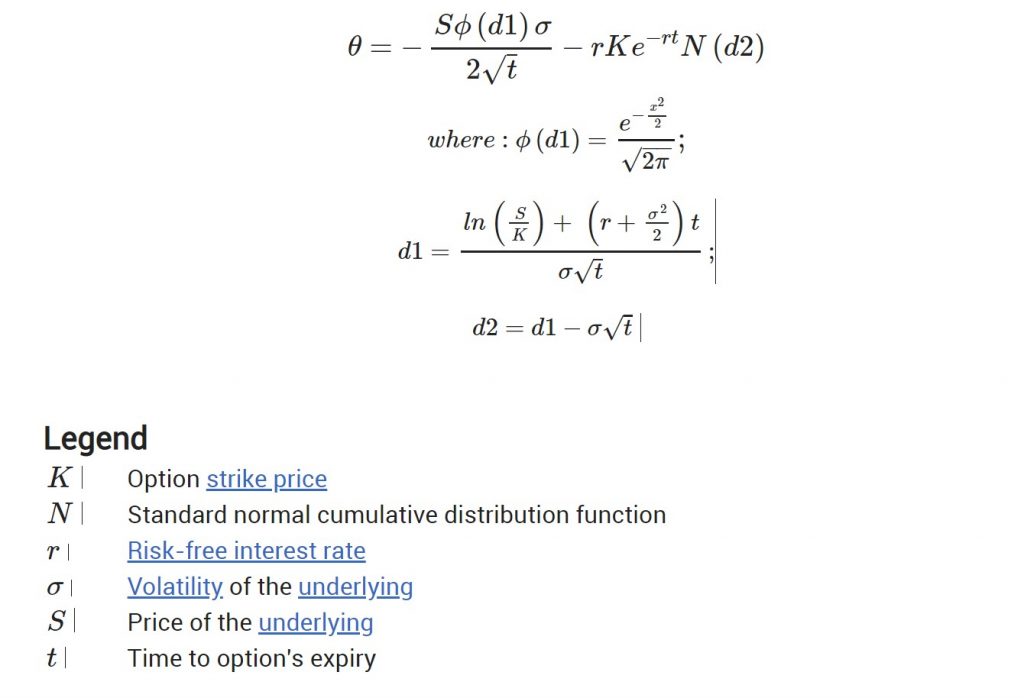

It is not needed to know the maths behind theta (please be at liberty to go to the following part if you need), however for these theta is outlined extra formally because the partial spinoff of choices worth with respect to time.

The formulation for a name choice is beneath (some information of the traditional distribution is required to know it).

Whether or not you’re an choices holder or author, it is advisable perceive theta.

This Greek metric will enable you make the best selections and see a profitable funding.

As theta has completely different meanings in different fields (together with in economics, the place it refers back to the reserve ratio of banks), it is necessary that you just be taught what theta means in regard to choices buying and selling.

How Is Theta Totally different from the Different Greeks?

All the opposite Possibility Greek metrics measure how the value of an choice is delicate to a selected variable. As an example, vega measures how worth is delicate to a change in implied volatility by one share level.

Possibility Delta signifies how the value of the choice is delicate to each $1 change within the underlying asset and Possibility Gamma reveals how a change of $1 to the underlying safety impacts the delta.

Lastly, rho measures sensitivity to a change in rates of interest.

Theta, not like all of the above, shouldn’t be about worth sensitivity. As a substitute, it measures time decay.

What Is Theta?

Theta measures how the worth of an choice deteriorates over the passage of time. Put merely, it’s the time decay of an choice as represented as a greenback or premium quantity. Whereas you possibly can calculate the theta on a weekly foundation, it’s extra widespread for theta to symbolize a day-to-day time decay.

When all different components are fixed, the choice will lose worth because it approaches its expiry date. For that reason, the theta is normally a detrimental worth. Nevertheless, you at all times want to keep in mind {that a} important enhance or drop within the worth of the underlying asset or a change in implied volatility will even impression choice worth.

To calculate how theta impacts choice worth, let’s think about {that a} name choice is presently $3 and the theta is -0.06. Because of this the choice will drop in worth by $0.06 per day. After at some point, the value of the choice can have fallen to $2.94. After one week, the value shall be $2.58.

How the Passage of Time Impacts Theta

Longer-term choices have a theta near 0 since, there’s no lack of worth each day. Choices with a shorter time period have the next theta, because the time worth is at its highest and there may be extra premium to lose on a day-to-day foundation.

The theta is at its highest when choices are on the cash and lowest when they’re out of the cash or within the cash. The theta worth rises for choices at or close to the cash as the choice nears expiration.

Nevertheless, in choices which are deep in or out of the cash, the theta worth falls as the choice approaches expiration.

Moreover, when an choice is out of the cash, the time decay is especially noticeable. Keep in mind that when an choice is out of the cash, the underlying asset is decrease than the strike worth within the case of a name and better than the strike within the case of a put.

Due to this fact, when an choice that’s out of the cash strikes nearer to expiration, the probability that it’ll ever be within the cash diminishes.

Theta Curve

An essential level to make is that, even when all the opposite components do stay equal, time decay shouldn’t be a linear descent. The theoretical time decay turns into better (which means the theta will increase dramatically) as choices close to their expiration date as a result of there may be much less time for the choice to maneuver when it’s near expiration. This leads to what’s known as the theta curve — the place there’s a gradual decay early on and an accelerated decay as the choice approaches expiration.

Pricing fashions take weekends and buying and selling holidays under consideration, both by adjusting volatility or time expiration. Because of this you’ll see a decay over seven days, irrespective of what number of buying and selling days are literally within the week. It additionally implies that you can’t cheat the system, comparable to by opening a brand new quick place late on Friday and shutting it early on Monday to gather two free days of time decay.

For a similar purpose, it may be a good suggestion to shut a place on Friday if it’s exhibiting an inexpensive revenue — you’re unlikely to see a better payoff should you wait till Monday. Plus, it’s typically attainable on the Monday to reenter the place for nearly the identical worth as you exited, do you have to change your thoughts.

Nonetheless, the shortage of a standardized methodology of representing the time decay of choices means that you could be see a distinct time decay in response to which mannequin you employ.

Why Does Theta Matter?

Theta offers a numerical worth to the chance that choices consumers and writers will face as a result of passage of time. This danger exists since you solely have the best to purchase or promote the underlying asset of an choice at strike worth earlier than the expiry date in choices buying and selling.

Due to this fact, within the case that two choices have related traits however one has an expiry date additional sooner or later, the longer choice shall be extra worthwhile. It’s because there’s a better likelihood that the choice will exceed the strike worth as a result of longer period of time it has.

That is all right down to the truth that the worth of an choice has intrinsic and extrinsic worth. Intrinsic worth refers back to the revenue from an choice primarily based on the distinction between strike worth and market worth.

Extrinsic worth refers to all the remainder of the premium: the worth of holding the choice and the prospect for the choice to develop in worth because the underlying inventory worth strikes. When all else is equal, the extrinsic worth of choices will drop over time, leaving solely the intrinsic worth at expiration.

Volatility and Theta

Sometimes, an choice with a larger volatility of its underlying asset can have the next theta than an analogous choice with a low-volatility inventory. The rationale for that is the upper time worth premium of high-volatility choices, which suggests the potential loss every day is bigger.

To place this into context, let’s use one other instance. This time, think about that our name choice is presently $5 and that the underlying inventory is buying and selling at $1,030 with a strike worth of $1,045. Let’s additionally say that the choice will expire in 10 days and has a theta of -0.5, which means that the worth of the choice will lower by $0.50 every day.

If every part stays the identical, the choice will have already got misplaced $2.50 by the tip of 5 days. Nevertheless, if volatility leads the underlying inventory to extend in worth, this might offset the loss for the choice holder that the theta calculated. Within the above instance, the value of the underlying asset would wish to extend to no less than $1,050 to present the choice $5 in intrinsic worth.

Constructive and Unfavorable Theta

We beforehand talked about that theta is mostly detrimental — it follows, then, that theta can be constructive. It’s because each choice consumers and choice writers can use theta.

Theta is detrimental when you find yourself in internet lengthy ready. To see a revenue as a purchaser, due to this fact, one among two issues is important: you possibly can both reply shortly and be directionally proper otherwise you want implied volatility to be in your facet. For the latter, you need to see implied volatility increase greater than the theta is ready to decay the worth of your choice.

Unfavorable theta is a purpose why it’s essential to hedge your lengthy choices with quick choices. As an example, it’s higher to go for calendar spreads, vertical spreads, and diagonal spreads than lengthy bare choices, as this may permit you to get rid of some (or maybe all) of the time decay.

Theta is constructive when you find yourself internet quick ready. Since choice writers need their place to lose worth, constructive theta is favorable. As well as, it’s cheaper to purchase again an choice to shut out a brief place.

Learn how to Use Theta

As we already talked about, theta drops day by day when all different components stay equal. This implies you lose cash day by day after you purchase an choice. Once you select to purchase an choice, then, you expect that components won’t stay equal — that the value of the underlying asset will transfer considerably.

Alternatively, should you consider that you just’ll see little change within the underlying asset worth, theta offers you a very good alternative to quick the choice. Time decay will convey you a revenue, as the choice’s worth will drop.

Of all of the Greeks, theta is essentially the most indefinite. Because the calculation has to imagine that implied volatility and worth motion is regular (when, in fact, it may be something however), theta is commonly inaccurate.

For that reason, it’s needed to contemplate theta as a part of the larger image and by no means in isolation.

Listing of constructive theta choices methods

Listing of detrimental theta choices methods

Concerning the Creator: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and recently in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Occasions (of London). He determined to convey this information to a wider viewers and based epsilonoptions.com in 2012.

Associated articles: