A Market on the Brink: FIIs Escalate Bearish Assault as a Excessive-Stakes Battle Begins

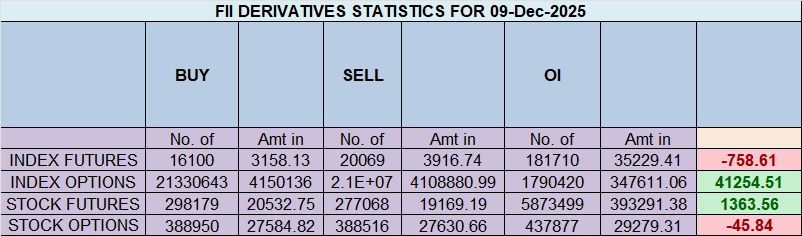

On December 9, 2025, the Nifty Index Futures market revealed a dramatic and ominous escalation within the battle between institutional bears and retail bulls. Overseas Institutional Buyers (FIIs) didn’t simply keep their detrimental stance; they launched an aggressive new assault, shorting a internet 3,376 contracts price ₹623.85 crore.

Critically, this new wave of promoting was met with decided shopping for, inflicting the online Open Curiosity (OI) to surge by 2,572 contracts. It is a highly effective and unambiguous sign of a market in battle. It proves that this isn’t a quiet downtrend, however an energetic, high-stakes struggle the place each side are bringing recent capital to the battle.

Decoding the Information: Two Armies Constructing for a Main Confrontation

The granular information paints an image of two market contributors with diametrically opposed views, each digging in for a significant confrontation.

1. The FIIs: Most Bearish Conviction

The FIIs’ actions have been a masterclass in bearish aggression. Their technique was a strong two-pronged assault:

-

They added 1,530 new brief contracts, actively urgent their benefit.

-

Concurrently, they liquidated 2,439 lengthy contracts, demonstrating an entire abandonment of any upside case. That is way more bearish than simply shorting; it’s a strategic retreat from the lengthy facet mixed with an assault on the brief facet.

This has pushed their positioning to an excessive 12% lengthy versus 88% brief (ratio 0.12), probably the most bearish readings on document. It is a high-conviction, institutional wager on a major market decline.

2. The Purchasers: A Divided however Nonetheless Bullish Camp

The consumer section, whereas nonetheless overwhelmingly bullish of their legacy positioning, is exhibiting the primary indicators of inside battle:

-

The Hopeful Bulls: One group stays defiantly optimistic, including a large 6,657 new lengthy contracts, willingly absorbing the institutional promoting.

-

The Nervous Bears: For the primary time, a major variety of shoppers are exhibiting worry, including 3,097 new brief contracts, probably as a hedge or a panicked flip.

Whereas their total positioning stays bullish at 67:33, the energetic move exhibits a home divided, an indication of weakening conviction.

Key Implications for the Market

-

A Excessive-Conviction Bearish Development: The rising open curiosity is the market’s stamp of validation. This isn’t a drained, exhausted downtrend. It’s a new, aggressive, and well-funded bearish marketing campaign led by the market’s strongest gamers.

-

A Market at an Excessive Divergence: The positional hole between the institutional FIIs (ratio 0.12) and the retail shoppers (ratio 2.07) is at a historic, unsustainable excessive. Such large divergences are virtually at all times resolved violently.

-

The “Ache Commerce” is Apparent: The market is now dangerously loaded with retail lengthy positions. A continued transfer down will set off a large liquidation cascade from this extremely uncovered group. That is the trail of most ache and, due to this fact, the very best likelihood.

-

Rallies are Now Suspect: Any try at a aid rally will probably be met with recent, aggressive promoting from the extremely convicted FIIs.

Conclusion

The Nifty is now in a high-stakes, harmful state. The important thing takeaway is the surge in Open Curiosity, which confirms that this can be a new, constructing battle, not an previous, fading development. The FIIs have declared all-out struggle with most conviction, and whereas retail continues to be combating again, the primary cracks of their resolve are starting to indicate. The market is a powder keg, and the chance of an accelerated, high-velocity transfer to the draw back is now exceptionally excessive.

Final Evaluation could be learn right here

The Nifty is in a state of high-stakes, coiled pressure. The earlier session noticed a basic wrestle for management, with the bears efficiently driving the market all the way down to a low of 25,728, solely to be met by a spirited intraday restoration. Nevertheless, essentially the most crucial piece of data from the day was the bulls’ failure to safe an in depth above 25,800, confirming that the sellers nonetheless maintain the tactical benefit.

The market is now balanced on a razor’s edge on the critically necessary 25,711 Gann octave level. It is a mathematically important pivot, a structural line within the sand that may probably outline the market’s subsequent main development. This technical standoff is now set to be hit by an ideal storm of a extremely unstable astrological facet and a significant world financial occasion.

1. The Twin Engines of Volatility

The market will probably be compelled out of its present state of indecision by two highly effective and unpredictable catalysts:

-

The Astrological “Shock” Side (Mercury Opposition Uranus): It is a basic facet for sudden, sudden, and high-velocity strikes. It typically brings stunning information, technological glitches or breakthroughs, and abrupt reversals. Your directive to observe IT shares is the important thing to decoding this transit. With Mercury (data/communication) in a tense standoff with Uranus (know-how/innovation/shocks), the IT sector would be the epicenter of this vitality. The efficiency of main IT shares as we speak would be the “inform”—the market’s true inside response.

-

The Elementary Verdict (The Fed Coverage Final result): Performing because the in a single day macro hammer is the US Federal Reserve’s coverage resolution. This occasion has the ability to dictate world market sentiment and can virtually definitely result in a important hole opening in tomorrow’s session. As your evaluation properly warns, heading into such an occasion with unhedged positions is a high-risk gamble. Hedging is the skilled’s selection.

2. The Clearly Outlined Battleground

The technical image is now a battlefield with crystal-clear targets for each side, all centered across the Gann pivot.

-

The Bullish Protection and Counter-Assault: The bulls’ first and most crucial mission is to defend the help zone of 25,711-25,729 in any respect prices. A failure right here can be a catastrophic loss. To regain management of the development, they have to then launch a profitable assault to realize an in depth above 25,920, which might open the trail again in direction of 26,000.

-

The Bearish Goal (The Knockout Blow): The bears are able of power. Their goal is straightforward and direct: break the 25,711 help stage. A decisive transfer and shut under this Gann octave level can be a significant technical breakdown, probably triggering a speedy and high-momentum decline in direction of 25,500.

Conclusion

The Nifty is completely coiled at a crucial technical fulcrum. The approaching 24 hours will unleash a strong wave of volatility, pushed by the unpredictable Mercury-Uranus facet and the decisive Fed coverage announcement. The degrees that matter are unambiguous. The battle for 25,711 will decide the instant victor, however all merchants should respect the immense in a single day danger from the Fed. Hedge your positions, and watch the IT sector for the primary indicators of the cosmic storm.

Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 25888 for a transfer in direction of 25968/26048. Bears will get energetic under 25808 for a transfer in direction of 25729/25666

Merchants might be careful for potential intraday reversals at 09:38,10:43,12:29,01:08 How you can Discover and Commerce Intraday Reversal Instances

Nifty Dec Futures Open Curiosity Quantity stood at 1.64 lakh cr , witnessing ADDITION of 4.9 Lakh contracts. Moreover, the rise in Price of Carry implies that there was addition of SHORT positions as we speak.

Nifty Advance Decline Ratio at 18:32 and Nifty Rollover Price is @26320 closed under it.

Within the money section, Overseas Institutional Buyers (FII) bought 3760 cr , whereas Home Institutional Buyers (DII) purchased 6224 cr.

For Positional Merchants, The Nifty Futures’ Development Change Degree is At 26224 . Going Lengthy Or Quick Above Or Under This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Greater Threat-reward Ratio. Intraday Merchants Can Hold An Eye On 25956 , Which Acts As An Intraday Development Change Degree.

Nifty Intraday Buying and selling Ranges

Purchase Above 25840 Tgt 25872, 25916 and 25963 ( Nifty Spot Ranges)

Promote Under 25800 Tgt 25777, 25729 and 25685 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to carefully monitor market actions and make knowledgeable choices based mostly on a well-thought-out buying and selling plan and danger administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators