- The EUR/USD forecast stays bullish amid a weaker greenback and a resilient Eurozone financial system.

- ECB officers spotlight the EU’s steady inflation, pointing to a chance of a price hike subsequent 12 months.

- All eyes are on the FOMC press convention and labour knowledge to supply contemporary impetus to the market.

The EUR/USD pair opened the week on a agency footing, buying and selling above 1.1650 because the Greenback Index (DXY) slips beneath the 99.0 degree after two consecutive weekly losses. The softening greenback highlights rising hypothesis of a 25-basis-point price lower by the Ate up Wednesday. The CME FedWatch Instrument signifies a likelihood of practically 90%, up from 70% final week.

If you’re all for automated foreign currency trading, test our detailed guide-

The euro obtained an extra increase from upbeat German industrial output for October, displaying a 1.8% MoM rise in industrial manufacturing in opposition to the estimate of a 0.4% contraction and September’s 1.3% acquire. The information contradicts This fall PMIs that recommend stagflation, serving to the pair to tick up.

The sentiment was additional improved by ECB member Isabel Schnabel’s commentary, which said that she is comfy with the bets on the following ECB transfer as a hike, given the Eurozone financial system’s confirmed resilience. These remarks confirmed a transparent divergence from the Fed’s dovish path, reinforcing the upside for EUR/USD.

However, the US Treasury yields are wobbling inside a well-known vary, searching for a breakout in both course. The course will decide the greenback’s trajectory. In the meantime, German yields are surging as a consequence of widening price differentials.

final week’s US knowledge, the PCE inflation confirmed that inflation stays elevated close to 3%, whereas core inflation eased to 2.8% from earlier 2.9%. Mixed with weaker labour knowledge, the Fed is poised to start its full easing mode.

But, the trail after Wednesday’s Fed price lower stays unsure because the break up between members supporting price cuts and warning of tariff-driven inflation shall be tight. Political dynamics with a brand new rate-friendly Fed Chair add one other layer of complexity. If the lower seems politically motivated, the long-term yields might rise fairly than fall, posing a draw back danger for EUR/USD.

Key Occasions to Watch This Week

- US JOLTs Job Openings

- FOMC Price Determination

- ADP Weekly Employment

- US Jobless Claims

With EUR/USD supported above 1.16 however dealing with a binary Fed consequence midweek, volatility is predicted to rise sharply. A dovish Fed might speed up the rally towards 1.1750, whereas a hawkish shock or yield spike might drag the pair again towards 1.1550.

EUR/USD Technical Forecast: Consolidating Good points

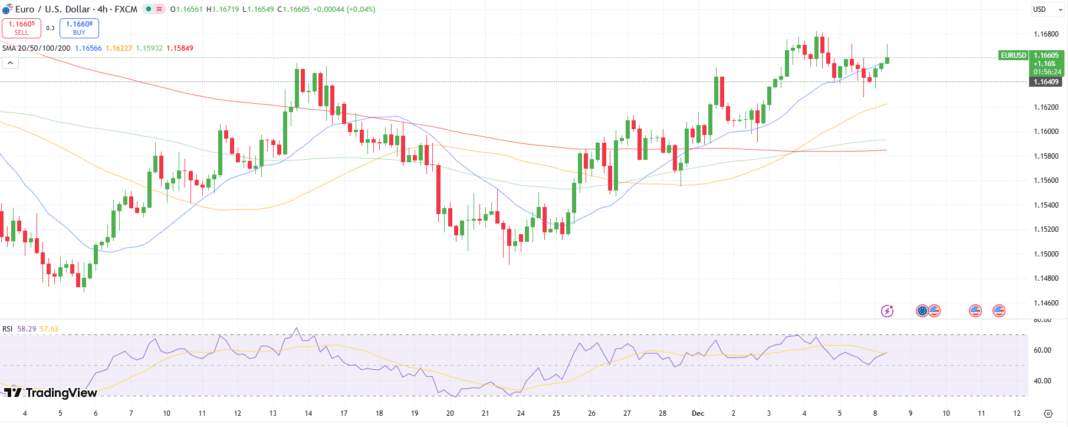

The EUR/USD 4-hour chart exhibits a slight downtick from the each day highs, close to the 20-period MA at 1.1660. Although the general development stays beneficial for the pair, a correction to the order block zone at 1.1630-40 is probably going. The upside goal for the bulls stays intact at 1.1720.

–Are you to be taught extra about foreign exchange choices buying and selling? Examine our detailed guide-

On the flip aspect, the pair might discover promoting bias beneath the 1.1630 space, heading to the 200-period MA at 1.1585 forward of 1.1550. An additional draw back might pose a menace to the 1.1500 degree, however the likelihood of it being examined is low.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to think about whether or not you may afford to take the excessive danger of dropping your cash.