By RoboForex Analytical Division

Gold costs held near 4,200 USD per ounce on Friday, with traders targeted on a major, delayed inflation report forward of subsequent week’s Federal Reserve coverage resolution.

All consideration is on the discharge of the September Private Consumption Expenditures (PCE) index, the Fed’s most popular inflation gauge. The information could possibly be decisive in shaping expectations for the timing and scale of upcoming financial easing.

Earlier within the week, additional indicators of a cooling labour market emerged. ADP reported an surprising decline of 32,000 in non-public sector payrolls, whereas the Challenger report recorded 71,000 layoffs in November – bringing the year-to-date complete to almost 1.17 million.

This mixture of sentimental employment figures has strengthened investor conviction that the Fed will minimize charges as early as subsequent week, with the market-implied chance now standing at roughly 87%.

Including to the dovish narrative are studies that White Home financial adviser Kevin Hassett could succeed Jerome Powell as Fed Chair in Could. Markets interpret this as a possible tilt in direction of extra aggressive coverage easing.

Regardless of a reasonably decrease weekly shut, gold stays well-supported heading into the important information launch.

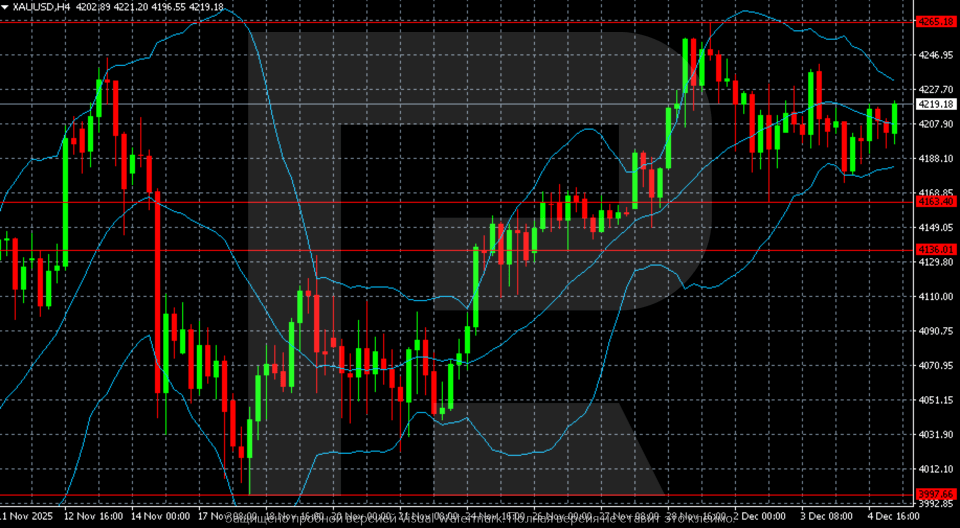

Technical Evaluation: XAU/USD

H4 Chart:

On the H4 chart, gold (XAU/USD) is consolidating after its current advance towards 4,220–4,230 USD. The value stays above the center Bollinger Band, with the higher band turning barely upward, suggesting an try and get well from current weak point.

Key resistance is round 4,265 USD, a stage the market has repeatedly examined with out securing a decisive breakout. A sustained transfer above this stage would clear the trail in direction of 4,300 USD and past.

Rapid assist is marked at 4,163 USD. A break beneath this stage would improve promoting strain and lift the chance of a decline in direction of the following demand zone close to 4,136 USD. An in depth beneath 4,136 USD would sign a transition right into a deeper corrective part.

H1 Chart:

On the H1 chart, XAU/USD is buying and selling inside a tightening vary between 4,188 USD and 4,220 USD, reflecting blended short-term momentum. The center Bollinger Band is offering near-term equilibrium, confirming the absence of a transparent directional bias.

The higher Bollinger Band is capping advances close to 4,220–4,225 USD, with a number of rejections from this zone indicating native overbought situations. The decrease band is providing assist round 4,185–4,190 USD.

A sustained transfer above 4,220 USD would sign a resumption of bullish momentum, initially focusing on 4,235–4,240 USD, and probably 4,265 USD. Conversely, a break beneath 4,185 USD would open the best way in direction of 4,163 USD. A lack of this assist might intensify corrective strain and expose the 4,136 USD stage.

Conclusion

Gold stays in a holding sample close to 4,200 USD as merchants await the delayed PCE inflation report. Whereas labour market softness has bolstered expectations for Fed easing, the technical image displays consolidation inside an outlined vary. A decisive response to at present’s information is prone to set the tone forward of subsequent week’s FOMC assembly, with a break above 4,265 USD opening the door to additional features, whereas a drop beneath 4,163 USD dangers a deeper correction.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s explicit opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and critiques contained herein.

- Pure gasoline worth nears $5/MMBtu. German DAX hits three-week excessive Dec 5, 2025

- Gold Regular Close to 4,200 USD as Markets Await Key Information Dec 5, 2025

- GBP/USD Extends Good points as Curiosity Price Divergence Captures Focus Dec 4, 2025

- The US labor market is displaying indicators of job losses Dec 4, 2025

- USD/JPY Declines as Market Focus Shifts to Financial institution of Japan Coverage Dec 3, 2025

- Bitcoin climbs again above $93,000. Palladium rises to $1,460/oz Dec 3, 2025

- EUR/USD Holds Floor Amid Agency Deal with Fed Coverage Dec 2, 2025

- Digital property beneath strain after PBoC statements. Oil costs soar amid rising geopolitical dangers Dec 2, 2025

- Silver hits an all-time excessive. The US pure gasoline costs attain a 2-year peak Dec 1, 2025

- Gold Hits 5-Week Excessive on Dovish Fed Bets Dec 1, 2025