Hey merchants. As our members know we have now had many advantageous buying and selling setups not too long ago. On this technical article, we’re going to speak about one other Elliott Wave buying and selling setup we obtained in Invesco NASDAQ ETF. Not too long ago the ETF made a transparent three-wave correction. The pull again accomplished as Elliott Wave Double Three sample and made a good rally. On this dialogue, we’ll break down the Elliott Wave sample and current targets. Let’s begin by explaining the sample.

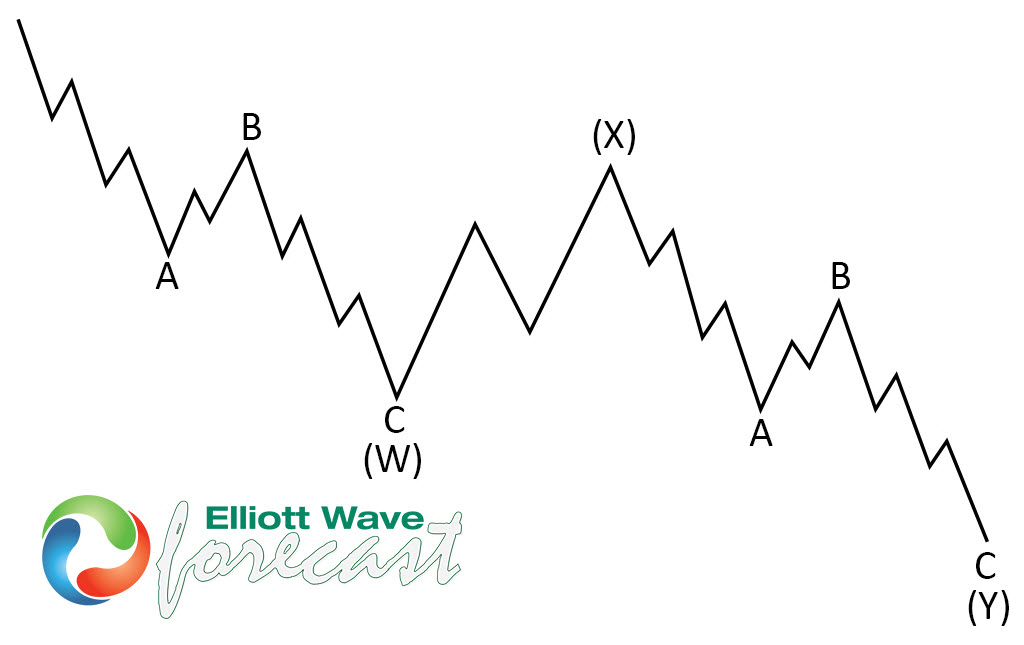

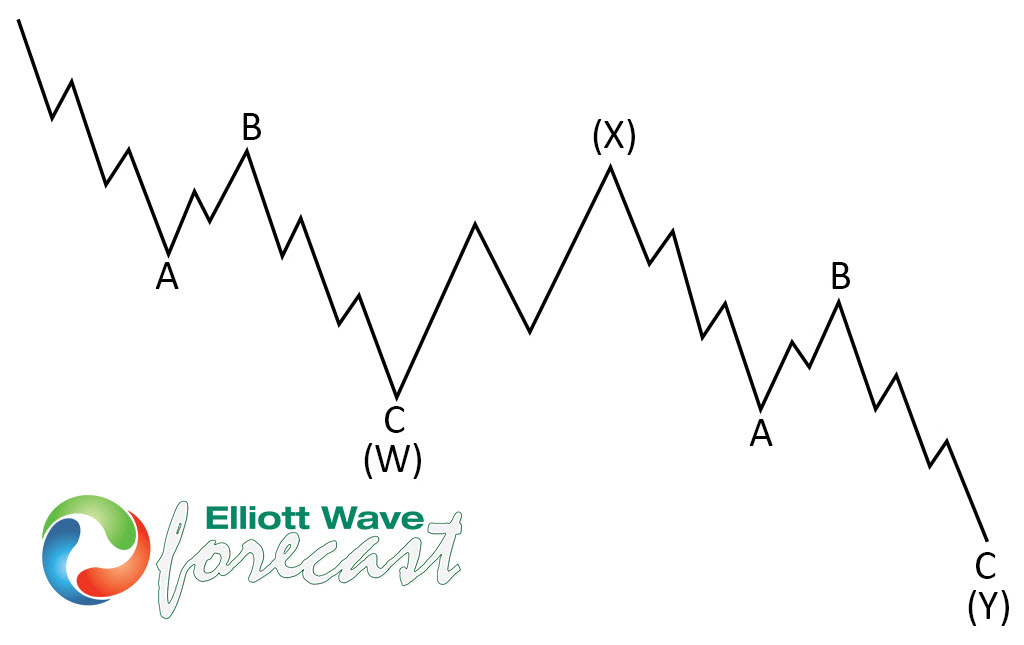

Elliott Wave Double Three Sample

Double three is the frequent sample available in the market. It’s a dependable sample which is giving us good buying and selling entries with clearly outlined invalidation ranges.

The image under presents what Elliott Wave Double Three sample appears like. It has (W),(X),(Y) labeling and three,3,3 inside construction, which implies all of those 3 legs are corrective sequences. Every (W) and (Y) are made of three swings , they’re having A,B,C construction in decrease diploma, or alternatively they’ll have W,X,Y labeling.

Now, let’s have a look at how this sample seems in an actual market instance.

QQQ Elliott Wave 4 Hour Chart 11.18.2025

The ETF is forming a 3-wave pullback, unfolding as a Double Three sample. For the time being, we are able to see incomplete sequences in each cycles: from the principle peak on October twenty ninth, labeled as wave (3) blue, and from the smaller cycle beginning on November twelfth, labeled as X purple. Our members know that we always emphasize the significance of incomplete sequences, as these decide the market’s path.

The construction suggests extra weak point towards the Equal Legs space at 586.28–561.62, the place we wish to re-enter as consumers. We count on not less than a three-wave bounce from the Blue Field space. As soon as the worth reaches the 50% Fibonacci retracement in opposition to the purple X connector, we are going to make the place risk-free by shifting the cease loss to breakeven and reserving partial earnings.

Do you know ? 90% of merchants fail as a result of they don’t perceive market patterns. Are you within the prime 10%? Check your self with this superior Elliott Wave Check

Official buying and selling technique on Find out how to commerce 3, 7, or 11 swing and equal leg is defined in particulars in Academic Video, accessible for members viewing contained in the membership space.

QQQ Elliott Wave 4 Hour Chart 11.26.2025

QQQ discovered consumers as anticipated on the Blue Field space, making respectable bounce. Whereas above the final low 580.31 low we depend (4) blue correction accomplished. Wave (5 ) might be in progress towards new highs, concentrating on 652.32 space.

Reminder for members: Our chat rooms within the membership space can be found 24 hours a day, offering professional insights on market developments and Elliott Wave evaluation. Don’t hesitate to achieve out with any questions concerning the market, Elliott Wave patterns, or technical evaluation. We’re right here to assist.

Supply: https://elliottwave-forecast.com/stock-market/qqq-trading-setup-explained/