- Fed anticipated to chop charges for third time in 2025

- Up to date dot plot and financial projections in focus

- Dealer’s pricing 27% likelihood of one other minimize by January 2026

- RUS2000: Fed resolution forecasted to set off strikes of ↑ 1.8% & ↓ 2.5%

- XAGUSD & Bitcoin to see contemporary volatility?

The Fed’s resolution on December tenth might be the largest occasion in This fall!

Such an occasion is prone to set off contemporary alternatives throughout markets.

To be clear, US charges are anticipated to be minimize for the third time this yr however the outlook for 2026 is tougher to find out.

Contemplating the numerous variables at play, something is on the desk…

Earlier than we take a deep dive, here’s a calendar of occasions for the week forward:

Monday, eighth December

- CNY: China Steadiness of Commerce (Nov)

- EUR: Germany Industrial Manufacturing (Oct)

- JPY: Japan GDP (Q3 ultimate)

- CHF: Swiss Client Confidence (Nov)

Tuesday, ninth December

- GBP: BRC Retail Gross sales Monitor (Nov)

- AUD: RBA Curiosity Charge Resolution; NAB Enterprise Confidence (Nov)

- EUR: Germany Steadiness of Commerce (Oct)

- USD: US JOLTs Job Openings (Sep & Oct); ADP Employment Change Weekly; Nonfarm productiveness (Q3)

- WTI: API Crude Oil Shares Change (w/e Dec 5)

Wednesday, tenth December

- CNY: China Inflation Charge (Nov); PPI (Nov)

- USD: Fed Curiosity Charge Resolution; FOMC Financial Projections

- CAD: BoC Curiosity Charge Resolution

- SPN35: Spain Client Confidence (Nov)

- WTI: US EIA Crude Oil Shares Change (w/e Dec 5)

Thursday, eleventh December

- GBP: RICS Home Worth Steadiness (Nov)

- CHF: SNB Curiosity Charge Resolution

- USD: US Steadiness of Commerce (Sep); Preliminary Jobless Claims (w/e Dec 6); PPI (Oct & Nov)

- NZD: New Zealand Enterprise PMI (Nov)

- Brent: OPEC Month-to-month Report

Friday, twelfth December

- GBP: UK GDP (Oct); Industrial Manufacturing (Oct); Manufacturing Manufacturing (Oct)

- USD: Fed Goolsbee Speech

Why is the December Fed assembly a giant deal?

Lacking financial knowledge attributable to the federal government shutdown and a deeply divided committee have left most scratching their heads over what to anticipate in 2026.

The absence of October’s NFP report and the most recent CPI will pressure officers to resolve based mostly on incomplete data, at a time when the FOMC is extra divided than in recent times.

Amidst the uncertainty, the Fed additionally publishes its up to date financial projections and dot plot which can set the tone for coverage in 2026.

Market expectations…

Merchants are pricing in a 98% likelihood of a charge minimize in December and anticipating as much as 4 charge cuts in 2026.

However these expectations could also be closely influenced by Fed Chair Powell’s press convention and the up to date dot plot.

Will the dot plot tilt extra in favour of hawks or doves? Regardless of the consequence, it may rock monetary markets.

Potential market influence…

Dovish tilt: helps threat property (US equities), softens USD, lowers yields; bullish for gold/silver and Bitcoin.

Hawkish tilt: pressures equities, boosts USD, lifts yields; headwind for valuable metals and cryptos.

Right here is how these property are forecasted to react in a 6-hour interval after the Fed resolution.

Supply: Bloomberg.

- USDInd: ↑ 0.6 % or ↓ 0.2%

- NAS100: ↑ 1.6 % or ↓ 1.5%

- US500: ↑ 1.3 % or ↓ 1.3%

- XAUUSD: ↑ 0.3 % or ↓ 1.0%

- BITCOIN: ↑ 2.0 % or ↓ 1.8%

- RUS2000: ↑ 1.8 % or ↓ 2.5%

- XAGUSD: ↑ 0.5 % or ↓ 1.4%

Wanting on the charts, RUS2000, BITCOIN and XAGUSD might be set for vital value swings. Key value ranges have been recognized on the charts.

RUS2000

FXTM’s RUS2000 tracks the smallest 2000 publicly listed US corporations which can be extra reflective of true financial circumstances.

It has gained roughly 13% year-to-date, buying and selling roughly 1% away from its all-time excessive.

Key ranges of curiosity will be discovered at 2547.6, 2500. and 2465.0.

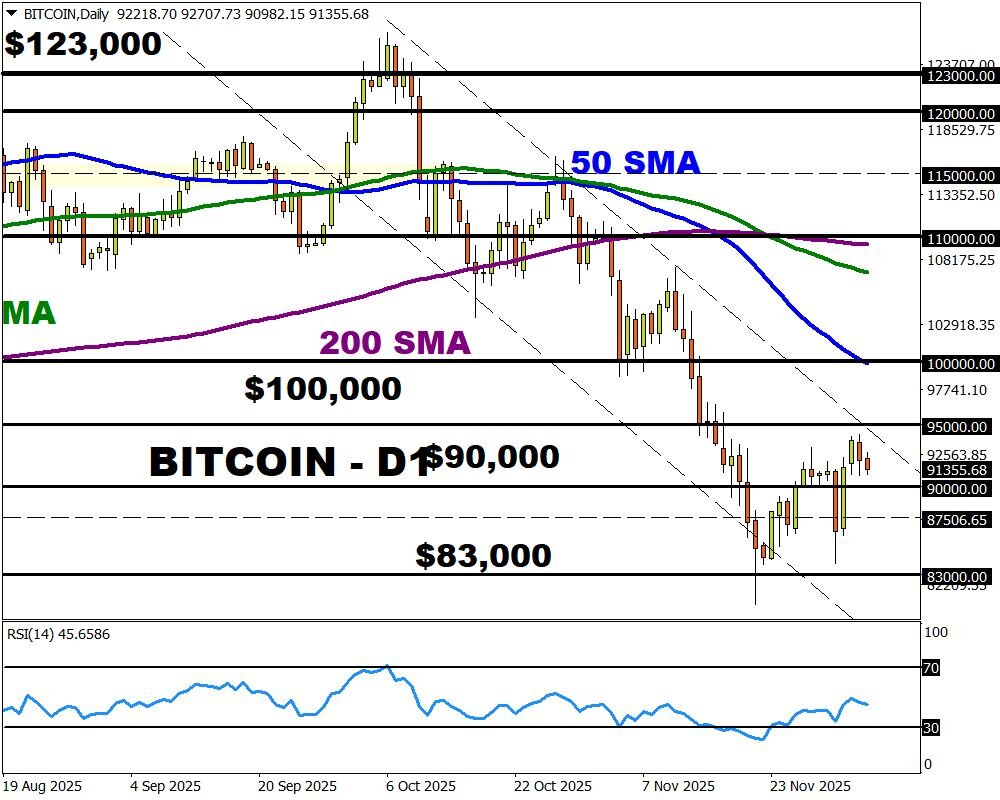

BITCOIN

Bitcoin is again above $90,000 however bulls have to take out the psychological $100,000 to regain again management.

As highlighted earlier, a dovish tile could enhance costs greater whereas a hawkish tilt could spark a selloff.

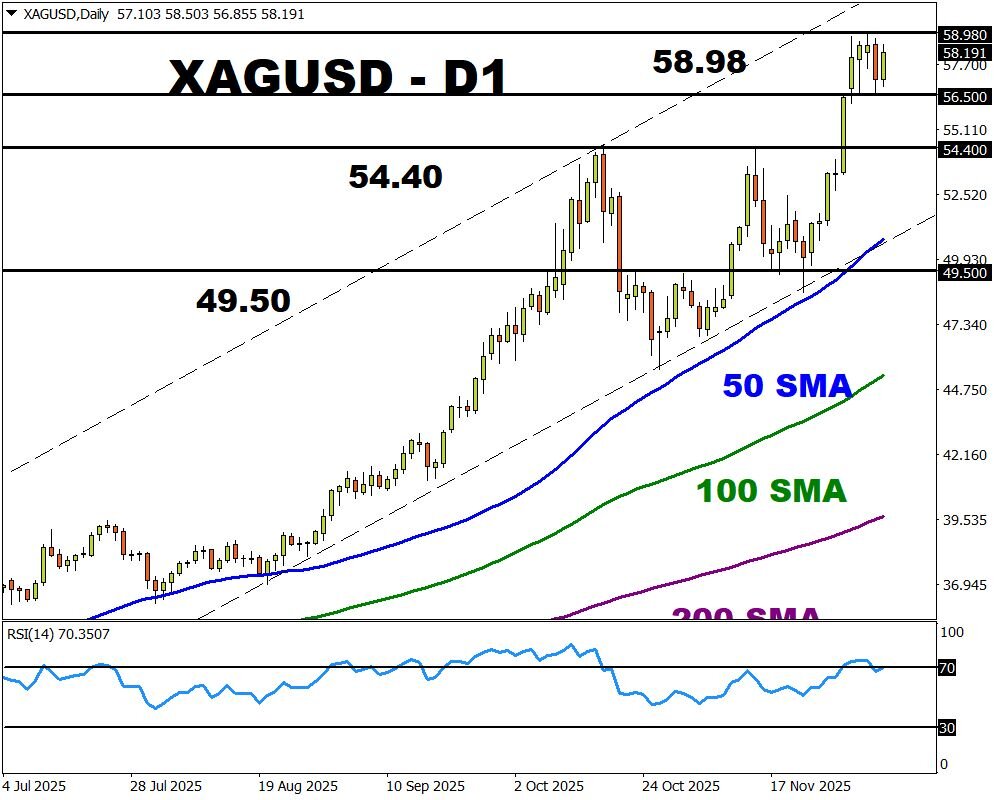

XAGUSD

Silver is up nearly 100% year-to-date, hitting an all-time excessive earlier within the week.

If the Fed indicators additional charge cuts in 2026, this might gas the rally – opening a path to contemporary highs.

Key ranges will be discovered at $58.90, $54.40 and $49.50.

ForexTime Ltd (FXTM) is an award profitable worldwide on-line foreign exchange dealer regulated by CySEC 185/12 www.forextime.com