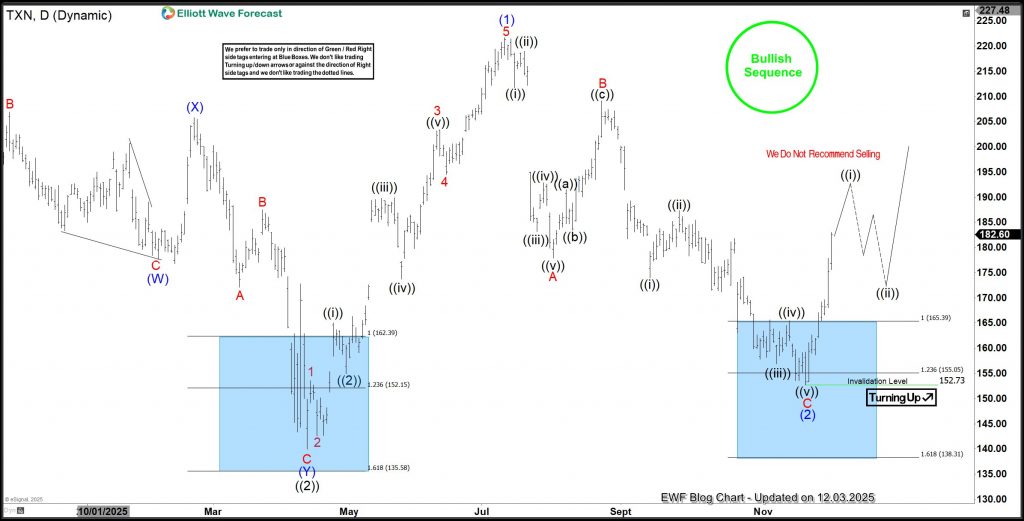

TXN accomplished a zigzag correction from the July 2025 excessive, ending proper contained in the blue-box assist space the place new shopping for curiosity emerged. The inventory has since launched into a powerful rally from that zone, placing consumers solidly in revenue.

Texas Devices (TXN) is a worldwide semiconductor firm identified for designing and manufacturing analog and embedded processing chips. With merchandise utilized in the whole lot from industrial gear to private electronics, TXN performs a vital function in powering fashionable expertise. Its constant innovation and robust market presence make it a intently watched inventory within the tech sector.

TXN accomplished its long-term grand supercycle wave ((II)) in October 2002, bottoming close to $13. From there, the inventory launched into a robust two-decade advance as grand supercycle wave ((III)) unfolded. Wave (I) of ((III)) peaked in August 2007 at $39.6, adopted by a deep wave (II) correction that pulled costs again to round $13.4 in December 2008.

The following main advance—wave (III)—started in December 2008. TXN turned decisively bullish as soon as it broke above its March 2000 all-time excessive at $99.8, ultimately reaching a brand new peak at $202.2 in October 2021. This excessive accomplished wave III of (III) of ((III)). A corrective wave IV adopted, lasting till October 2023, after which the inventory resumed its climb and posted a contemporary excessive of $220.38 in November 2024.

From the November 2024 peak, TXN pulled again in a 7-swing sequence to finish wave ((2)). That correction ended within the blue-box assist space, the place consumers stepped again in as anticipated. The inventory then rallied sharply in a clear 5-wave advance, finishing wave (1) of ((3)) on July 11, 2025.

A wave (2) pullback adopted: wave A bottomed on August 1, 2025, wave B peaked on August 22, 2025, and within the September 1, 2025 replace, the chart highlighted expectations for wave C to proceed decrease.

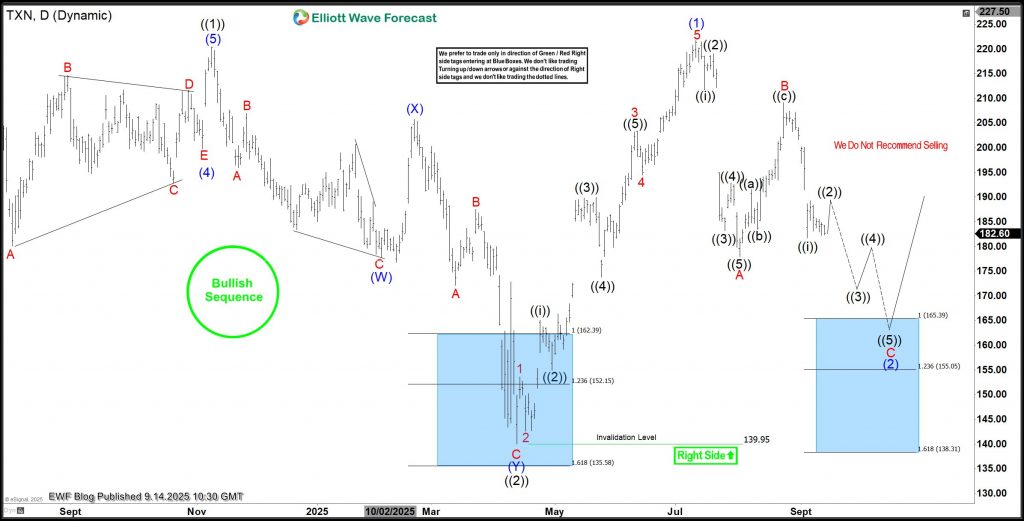

TXN Elliott Wave Evaluation – 9/14/2025

On 14th September, I shared one other up to date weblog exhibiting how wave C of (2) was evolving. Thus, I marked the 165.39-138.31 because the blue field shopping for zone. At this zone, consumers ought to revive their pursuits.

For many who learn the final weblog, the plan was to purchase at 165.39 and set cease at 138.3 whereas anticipating income above $220.

TXN Elliott Wave Evaluation – 12.03.2025 Replace

Because the chart above exhibits, wave C of (2) dropped straight into the blue-box assist space and accomplished a full 5-wave decline. This confirmed the top of wave (2), which then produced the anticipated rebound. With worth already reaching the preliminary goal at 180.8, consumers ought to take partial income and transfer the cease for the remaining place to 152.73. This locks in positive aspects and converts the commerce right into a risk-free setup. Wanting forward, projections counsel wave (3) might prolong towards the 253–284 space, with potential for even greater ranges.

Supply: https://elliottwave-forecast.com/stock-market/txn-rebounds-strongly-off-blue-box/