In my dialog with James Connor on Wealthion, I stroll via the value, quantity, and money-flow patterns that proceed to point out rising stress beneath the floor of this market. The foremost indexes should still be close to their highs, however whenever you examine the conduct of the main tech and AI names, together with weakening market breadth and sector rotation, the construction appears more and more just like the late phases of previous topping formations. I break down what the charts of Nvidia, Microsoft, Micron, SanDisk, the S&P 500, and the Nasdaq are telling us, and why these circumstances have traditionally led to sharp pullbacks when momentum begins to fade.

We additionally dive into the longer-term alternatives establishing in valuable metals, the place gold and silver proceed to construct the identical sort of basing buildings which have preceded main advances in previous cycles. I define the degrees I’m watching, together with key dangers in Bitcoin, MicroStrategy’s strategy, leveraged ETFs, and why high-dividend and “secure” shares can nonetheless expertise vital draw back throughout broad market resets. This dialogue focuses on staying goal, understanding the technical panorama, and getting ready for what the charts are signaling earlier than the group reacts.

Join my free Investing e-newsletter right here

The subjects that James and I mentioned are as follows:

- 0:59 – “The Sickest Market in A long time?” Jeffrey Gundlach’s Troubling Warning

- 6:56 – Is the Nasdaq Flashing a Main Purple Alert?

- 8:07 – AI Mania Uncovered: How Lengthy Can the Nvidia Bubble Final?

- 10:52 – Micron’s 180% Explosion: Breakout… or Final Breath?

- 11:49 – SanDisk’s 600% Rocket Experience: Basic Bubble or Actual Pattern?

- 13:41 – Is the Large Tech Unwind Already Underway?

- 19:18 – If Shares Crack, Does Gold Change into the Solely Protected Haven?

- 30:08 – Silver Smashes $50: The Begin of a Tremendous-Spike?

- 32:06 – Bitcoin: Bull Market Damaged or Simply Getting Began?

- 35:34 – MicroStrategy’s Bitcoin Empire: Sensible Guess or Catastrophe Loading?

- 41:32 – Ought to Defensive Buyers Flee to Lengthy Bonds (TLT)?

Able to be taught extra about what I do to remain calm throughout chaos? Click on the hyperlinks under!

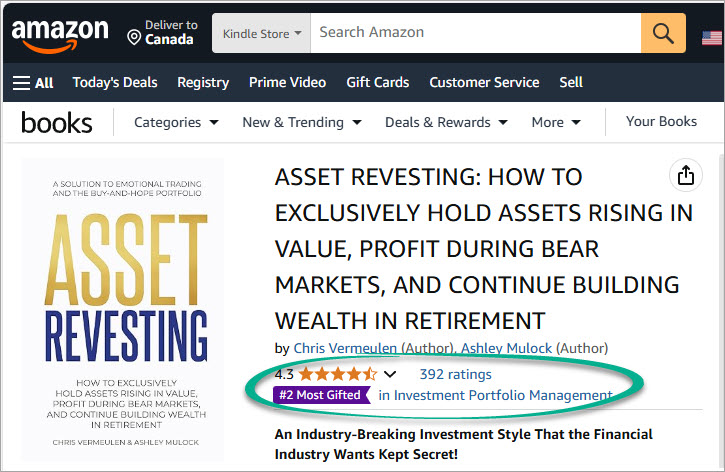

CHRIS VERMEULEN’S PREMIUM ASSET REVESTING SIGNALS:

https://thetechnicaltraders.com/investment-solutions/

Espresso cheers!

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

Disclaimer: This e mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Change Fee or any state regulator. The content material supplied doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to vary with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions might change at any time with out discover. Readers are solely chargeable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced might embody each dwell buying and selling knowledge and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t mirror precise buying and selling. No illustration is being made that any account will or is prone to obtain income or losses just like these proven. Testimonials and endorsements included on this communication is probably not consultant of all customers’ experiences and aren’t ensures of future efficiency or success. We might obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material supplied is common market commentary and never tailor-made to any particular person’s monetary state of affairs. Previous efficiency will not be indicative of future outcomes. Investing entails danger, together with the potential lack of capital.