A bullish turnaround nonetheless isn’t unthinkable at this level, even when it’s slipping additional out of attain. It’s going to take some severe work from the bulls although, and shortly. And given the form, situation, and placement of the indexes after the current motion, it’s unlikely the bulls are going to be ok with diving again in. Another unhealthy day may break the tentative help that’s nonetheless in place, in actual fact, opening the flood gates of profit-taking. (And fact be advised, that could be finest for shares in the long term.)

The chief frustration? We’re headed into per week that’s sometimes — even when lethargically — bullish. The professionals aren’t plugged in, however retail traders with a little bit extra time than normal on their arms are literally extra plugged in than normal. It’s conceivable they may maintain the market propped up lengthy sufficient to ascertain a false sense of safety that makes it appear to be the bulls are holding the road and organising a restoration for the next week.

Or, possibly it gained’t be false.

No matter’s within the playing cards, we’ll weigh all of it in a second. Let’s first take a look at the financial information we did and didn’t get, and preview what we could or could not get this week.

Financial Information Evaluation

The federal authorities shutdown has been over for greater than a full week now. Nevertheless, a lot of the overdue information nonetheless isn’t in-hand. The Federal Reserve didn’t give us the tentatively-scheduled capability utilization and industrial manufacturing numbers for October final week, as an example, nor did we get housing begins and constructing permits information from the Census Bureau.

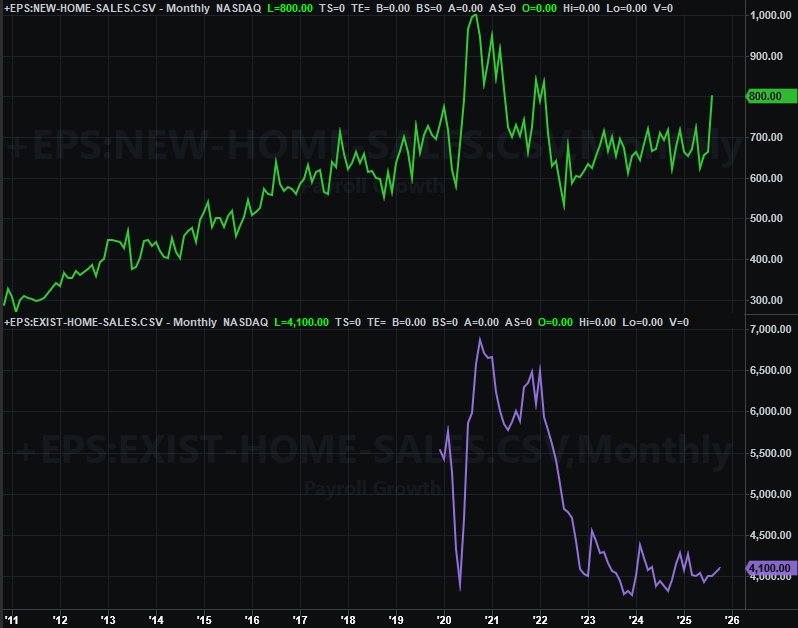

We did, nonetheless, get some numbers, like final month’s gross sales of current houses from the Nationwide Affiliation of Realtors. They edged a little bit increased, to an annualized tempo of 4.1 million. However, that’s nonetheless fairly weak.

New, Current Dwelling Gross sales Charts

Supply: Census Bureau, Nationwide Assn. of Realtors, TradeStation

There’s truly no phrase as to once we’ll get the newest new-home gross sales figures, which are actually two months behind. Given every thing that’s occurred within the meantime although, August’s surge more and more appears to be like like an anomalous one-off.

We additionally obtained the third and remaining studying on client sentiment from the College of Michigan for November final week. It understandably fell only a bit (though this isn’t but proven on our chart beneath.)

Shopper Confidence Charts

Supply: Convention Board, College of Michigan, TradeStation

The Convention Board’s comparable measure for November is approaching Tuesday of this week. Search for a slight dip of this quantity as effectively.

Final month’s biggie after all was the roles report for September, posted on Thursday. It was higher and worse than anticipated. We ended up including 119,000 jobs versus expectations of solely 50,000, however the unemployment price nonetheless ticked as much as 4.4% as a substitute of holding at 4.3%. That is nonetheless truly fairly good although, all issues thought of.

Payroll Progress and Unemployment Charges Charts

Supply: Bureau of Labor Statistics, TradeStation

There’s not going to be an October jobs report, by the best way. We’ll merely must fill within the blanks utilizing November’s numbers.

All the things else we obtained (which isn’t a lot) is on the grid.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

This week’s going to be a busy one made even busier by the truth that it’s all going to be condensed into the three buying and selling days earlier than Thursday’s Thanksgiving break.

On Tuesday search for the newest numbers on retail gross sales. Forecasts are calling for extra ahead progress for September’s numbers, though retail spending has grown fairly persistently whatever the financial backdrop or client confidence on the time.

Retail Gross sales Charts

Supply: Census Bureau, TradeStation

Additionally on Tuesday we’re more likely to hear September’s inflation numbers… not that it means a lot now. The Fed appears to have already determined what it desires to do with rates of interest for the remainder of the yr. That’s okay although. Regardless of the heated rhetoric, inflation charges appear to be holding at moderately wholesome ranges.

Shopper, Producer Inflation Fee Charts

Supply: Bureau of Labor Statistics, TradeStation

No inflation report can be given for October both, by the best way.

The Case-Shiller Dwelling Worth Index can even be up to date on Tuesday, though that’s solely as of September, and we’re nonetheless lacking the FHFA’s comparable measure (with no phrase on it will likely be up to date). Both method, house costs appear to a minimum of be peaking. They could even be on the cusp of a measurable, significant correction. We’d identical to to have a little bit extra information on the matter earlier than making that decision.

Dwelling Worth Index Charts

Supply: Customary & Poor’s, FHFA, TradeStation

Inventory Market Index Evaluation

For the third week in a row we kick issues off with a take a look at the weekly chart simply because it’s vital to color the larger image first. Particularly, we wish to spotlight how shortly the rally began to unravel, and the diploma to which it’s completed so. Because the weekly chart of the NASDAQ Composite exhibits us, all it took was a kiss of that long-established ceiling (crimson, dashed) late final month to tip issues in a bearish course. As soon as it did, the bears didn’t look again and the bulls didn’t get of their method. The NASDAQ is now a little bit greater than 7% off of its peak, and seemingly nonetheless shifting decrease. We obtained out first bearish MACD crossunder since early this yr, in actual fact, when the market was beginning what changed into a sizeable correction.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

It’s not as if all hope is misplaced although. When you can considerably inform on the weekly chart above, because the each day chart of the composite beneath illustrates much more clearly, the promoting lastly stalled when the 100-day shifting common line (grey) at 22,071 was met. It even appears to be like just like the bulls try to push up and off it. The each day chart additionally exhibits us, although, Thursday’s big intraday reversal into a serious loss. That was the bulls’ finest likelihood of bringing an finish to this weak spot. After they obtained shut, they flinched. Maybe the arrogance simply isn’t there proper now.

NASDAQ Composite Every day Chart, with Quantity and VXN

Supply: TradeNavigator

Nearly evidently, a detailed underneath the 100-day shifting common line may show devastating, by advantage of wiping away any hope that this rally remains to be salvageable and renewable.

And the each day chart of the S&P 500 appears to be like just about the identical, with the identical final interpretation. That’s, the bulls had an ideal likelihood of pushing their method again above the 20-day shifting common line (blue) at 6,769 with Thursday’s robust open. They only didn’t. They went the opposite course as a substitute, and whilst you may argue headlines are in charge, this feels prefer it was going to occur it doesn’t matter what.

S&P 500 Every day Chart, with Quantity and VIX

Supply: TradeNavigator

Regardless of the case, the S&P 500’s 100-day shifting common line (grey, at 6,545) seems to be a psychological line within the sand. In the identical vein, the S&P 500 Volatility Index (VIX) can be bumping right into a ceiling at 29 (purple, dashed) the best way you’d count on it to at a market low. It simply stays to be seen if this ceiling is definitely going to carry the VIX again. If it doesn’t, don’t be stunned to see the S&P 500’s 100-day shifting common line to fail as a ground, opening the floodgates, so to talk. Subsequent cease? The 200-day shifting common line (inexperienced) at 6,162.

The difficult half is the timing. Thanksgiving week is normally a bit bullish, even when solely a bit. If the sample repeats itself, it might give the bulls sufficient time to regroup and restore their confidence sufficient to rekindle the rally subsequent week.

Simply don’t presume that’s going to be the end result if shares merely maintain their floor within the week forward although. Each of the indexes might want to combat their method again above their 20-day averages (blue, on the charts above) to convincingly rekindle the rally. Something much less, and the matter stays in query.

And fact be advised, as uncommon as it will be for this time of yr, a sizeable correction ahead of later could be simply what the market wants right here. It’s actually overdue. We’ll discuss draw back targets if-and-when it issues.