We’ll undergo precisely what a coated name is, how it may be used, the dangers and some variations to mitigate these threat.

(We’ve additionally simply printed a publish on selecting nice shares with which to commerce coated calls: Finest Shares To Write Coated Calls)

What Is A Coated Name?

A coated name includes bought shares and the sale of a name choice with the shares because the underlying. Let’s illustrate this with an instance:

Suppose you purchased 100 Apple(AAPL) shares at $430 every, a complete of $43,000, in April. After which bought a AAPL 450 Could name choice for $10, or $1000 in whole. You’d then have paid a internet $42,000.

So what occur for numerous expiry AAPL costs? Effectively if AAPL is lower than $450 on expiry the decision choice would expire nugatory and also you’d be $10 a share higher off than when you’d carried out nothing.

If the share worth is above $450, nonetheless, the decision choice purchaser will train the choice and your 100 shares can be ‘referred to as away’. Suppose, for instance, that AAPL has risen to $470.

As a result of you may have bought a name choice giving the purchaser the suitable to buy shares at $450 you’ll, in impact, be pressured to promote your shares at $450, slightly than the $470 you can get within the open market.

You’ve gotten due to this fact forgone the $20/share of revenue you can have made (ignoring any premium you obtained initially) when you hadn’t bought the choice.

Discover that on this state of affairs you’ve nonetheless made an honest revenue. You’ve gotten purchased shares at $430, obtained $10 in premium from the bought name choice, after which bought them at $450; a pleasant $30 whole revenue. It’s simply not as a lot as you’d have made when you’d merely purchased the shares and bought them for $470 (ie $40).

Month-to-month ‘Earnings’ From Coated Calls

This commerce off, foregoing giant earnings for premium obtained even when the shares don’t do nicely, is enticing to many traders.

Certainly hottest choices commerce might be the sale of name choices for premium on shares already held, or bought with a view to the long run.

Let’s say you personal 100 Apple shares and promote name choices $20 above the present share worth each month.

You’d obtain $10 a month premium until Apple rose over $20 in worth if you’d be pressured to promote your shares, however at a pleasant revenue.

This looks as if a heads I win, tails you lose proposition, and is definitely introduced as such by lots of the coated name choice advisory companies on the market. Certainly coated calls are often introduced as a low threat choices technique.

Nonetheless, as we’ll see later, this isn’t fairly true. There are vital dangers that should be managed for the technique to achieve success.

What May Go Incorrect With The Coated Name Technique?

Threat

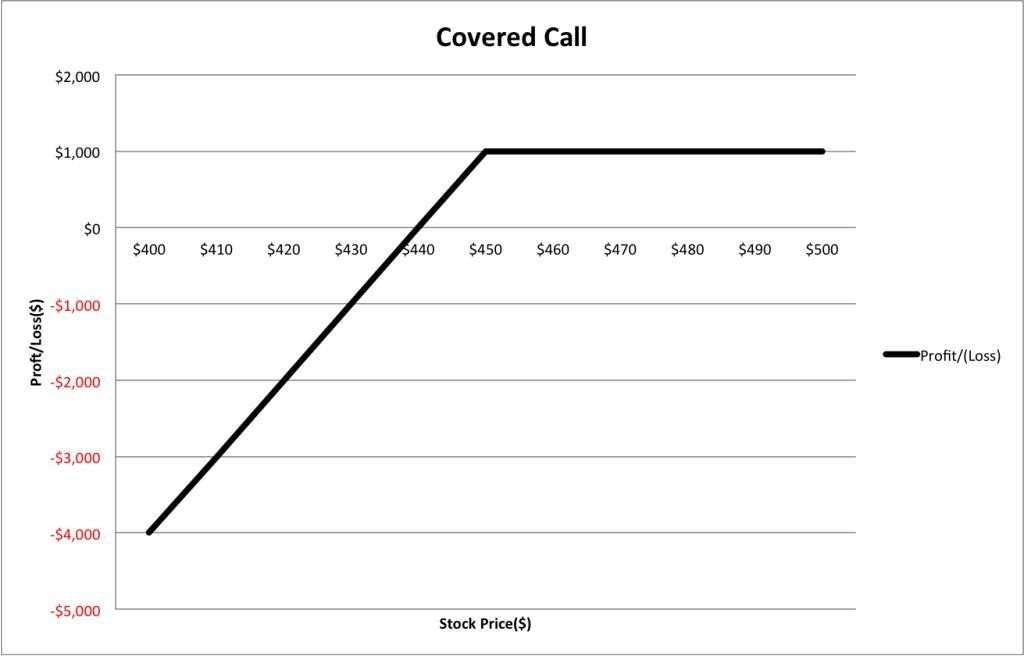

And so what’s the catch? Are coated calls actually low threat? Let’s have a look at a the Revenue & Loss diagram for this commerce:

Do you acknowledge the form? It’s precisely the identical as a bought $450 put choice. And since the P&L graphs are the identical, it’s precisely the identical commerce.

It is a good instance of the ‘artificial’ choices phenomenon: typically the combos of shares and/or choices can be utilized to ‘synthetically’ create one other choices place. On this case 100 AAPL shares mixed with the sale of a $450 name is strictly the identical as simply promoting a $450 AAPL put choice.

Now, if I requested you whether or not you’d be prepared to promote an uncovered put choice what could be your reply? Effectively, hopefully, you’d be very involved in regards to the threat. Any uncovered choices sale is inherently dangerous because it produces limitless (or near it) draw back ought to the commerce go in opposition to you.

The sale of a $450 put choice expiring in 30-40 days would internet you approx. $30 in premium.

Nonetheless you can, theoretically, lose as much as $450 ought to AAPL fall.

So do you continue to assume coated calls are low threat? Hopefully I’ve satisfied you that unmanaged they’re truly very dangerous certainly.

Volatility

Earlier than we have a look at methods of managing this threat, let’s have a look at implied volatility. No choices commerce must be evaluated with out contemplating volatility however, on this case, it’s much less necessary than traditional.

Traders often maintain bought calls to expiry and both simply promote subsequent month’s (if this month’s expired nugatory) or quit their shares (at a pleasant revenue) after which arrange a brand new place (purchase shares and promote subsequent month’s choice).

Nonetheless volatility does have an effect on the worth of the commerce in the course of the month and so would have an effect on the ‘purchase again’ worth ought to the investor want to shut the commerce earlier than expiry.

Threat Administration

So how do you handle the chance of the commerce?

Effectively, that’s the topic of the subsequent part.

Coated Calls Threat Administration

Recap

Beforehand, we’ve learnt what a coated name is, how it may be used and the way it’s, unmanaged, riskier than many individuals assume. Let’s full our coated name issues, due to this fact, by some threat administration strategies:

Listed below are the important thing methods threat might be managed.

Cease loss

The very first thing you can do is about a cease loss. Ought to your inventory fall sufficiently to provide a 20% (say) fall in worth, shut the commerce.

This has the benefit of being easy, and probably automated relying on which dealer you utilize. It additionally removes 80% of the chance.

Like all cease loss techniques it may nonetheless produce losses needlessly. In case your inventory have been to get better you’d have taken a 20% loss when, doubtlessly, you’d needn’t achieve this. There’s nothing extra annoying than being stopped out of a commerce solely to see it reverse into profitability.

Promote within the cash name choices

The above instance, and the most typical practiced coated name technique, is to promote out of the cash calls; $20 out of the cash in our instance.

An alternate is to promote within the cash calls. Let’s say you have been to purchase AAPL at $430 after which promote a $410 name choice as a substitute of $450. You’d obtain approx. $30.

On this technique you’d count on the shares to be referred to as away more often than not (ie if AAPL expires above $410) for a ‘loss’ of $20. However you’ve obtained $30 and so have made a a lot decrease threat $10 revenue. Certainly the inventory must fall to $400 for a loss to be made.

What you’ve forgone is any upside on the shares themselves. However many traders could be ready to do that for a (on this case) 2% month-to-month acquire.

Rolling down

Let’s say you’ve placed on the above out of the cash coated name (ie purchased shares and bought a $450 name choice) however the inventory has fallen from $430 to $410.

Your bought $450 name is now, in all probability, price little or no ($2 say). You could possibly take the chance to purchase again this feature and promote a $430 choice (for $8 say) netting an additional $6 a share for the month.

The hazard is, after all, that AAPL recovers again to over $430 and you’re pressured to promote at $430 slightly than the potential revenue as much as $450.

Rolling Out

You could possibly roll out as a substitute of rolling down. So, within the above instance, as a substitute of rolling down from a Could $450 name to a Could $430, you as a substitute roll to a Jun $450 name. This lets you protect the $450 strike worth in your calls.

Dividend

It is a favorite tactic of mine: select a inventory with a dividend payable earlier than choices expiry (or extra precisely: when the file date is earlier than expiry). This provides to the revenue from the commerce.

In idea the dividend must be priced into the decision worth – i.e. the decision premium obtained is much less – however I’ve discovered that usually this isn’t precisely the case.

Coated Calls: Commerce Plan

Let’s put all the pieces we’ve learnt collectively and set out the complete recreation plan for buying and selling coated calls, the Epsilon Choices approach…

Step 1: Select An Underlying

Select a ‘boring’ inventory with a dividend due inside the subsequent 2 months. The inventory must be priced above $50 and have a historic volatility lower than 25%. It ought to have an annual yield above 1.5% (2% is even higher)

Shares corresponding to Walmart(WMT), IBM(IBM), Union Pacific(UNP and so forth are nice.

Step 2: Purchase 100 shares

Purchase 100 shares (or multiples of 100 you probably have a bigger funds) on this underlying.

Step 3: Promote In-The-Cash Name Choice

On the similar time promote a 1 name choices contract per 100 shares purchased.

Now for the difficult bit: The strike worth for this name choice must be the primary strike within the cash and be the primary expiry after the dividend file date:

Let’s illustrate with an instance:

IBM is $187 in October 2013

Its subsequent dividend’s file date is 10 November 2013.

The strike worth of the bought name is 2 strike costs under the $187. IBM choices are in $5 increments ($180, $185, $190, $195 and so forth) and so the first strike worth within the cash (ie under $187) is $185.

The primary choices expiry date after the dividend is the November 2013 choice.

Subsequently we’d promote the Nov13 185 name choice.

Tip: It’s greatest to place steps 2 and three on on the similar time. That is referred to as a ‘buy-write’; your dealer ought to have the option that can assist you with this.

Set Up Your Exit Plan

Take away the place if at anytime you may have made a 20% loss

Take away the place if at anytime you make a 25-30% revenue (a little bit of wiggle room right here: you possibly can make your selection)

That’s it!

The intention is to do a number of these over the course of a 12 months and make a number of p.c on every commerce.

This could outweigh any 20% you might make alongside the way in which.

In contrast to many choices trades we must always count on to carry most of those trades to expiry when the shares are referred to as away (ie bought) on the strike worth.

(NB We cowl two alternate options to the normal coated name:

The artificial coated name right here >>> The Artificial Coated Name Choices Technique Defined

and The Coated Name LEAP >>> Coated Name LEAPs | Utilizing Lengthy Dated Choices In A Coated Name Write )

Conclusion

We’ve seen from the three programs on coated calls that they can be utilized to acquire a small, however dependable revenue each month of 2-3%. This can be seen to be fairly small, nevertheless it’s repeatable and most traders would love to have the ability to financial institution annualized 40%+ features.

This return comes at a major threat, nonetheless, if unmanaged. Fortunately, there are a number of strategies obtainable to handle that threat, as now we have seen.

The Epsilon Choices coated calls methodology makes use of these strategies (however not rolling down for the explanations steered above).

In regards to the Writer: Chris Younger has a arithmetic diploma and 18 years finance expertise. Chris is British by background however has labored within the US and these days in Australia. His curiosity in choices was first aroused by the ‘Buying and selling Choices’ part of the Monetary Instances (of London). He determined to deliver this data to a wider viewers and based Epsilon Choices in 2012.

Associated articles: