By RoboForex Analytical Division

The EUR/USD pair declined additional on Tuesday, edging in the direction of 1.1512. This downward motion persists regardless of a latest bout of US greenback weak point, which was triggered by a sequence of dovish feedback from Federal Reserve officers that considerably elevated the probability of an imminent charge lower.

The shift in sentiment was led by Governor Christopher Waller, who expressed assist for a December lower, citing mounting dangers to the labour market. Different officers, together with Mary Daly and John Williams, echoed his stance. Waller additionally emphasised that coverage selections in 2026 can be contingent upon a big quantity of delayed financial knowledge, which companies at the moment are starting to publish following the top of the federal government shutdown.

This coordinated messaging has brought about a dramatic repricing in rate of interest futures. The market-implied chance of a 25-basis-point lower in December has surged to 81%, a considerable enhance from simply 42% per week in the past.

Regardless of this dovish tilt, the US greenback has demonstrated resilience. Investor focus is now shifting to a slew of upcoming knowledge releases, together with studies on retail gross sales, PPI, sturdy items orders, and weekly jobless claims, which is able to present a clearer image of the US financial system’s well being.

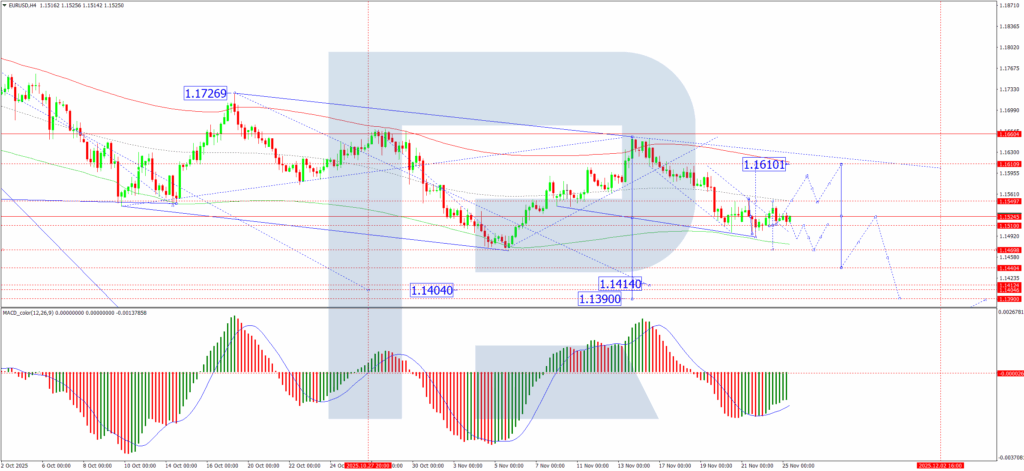

Technical Evaluation: EUR/USD

H4 Chart:

On the H4 chart, EUR/USD is forming a decent consolidation vary above the important thing assist at 1.1510. The present construction suggests a excessive chance of a technical correction in the direction of 1.1588, with the potential to increase this rebound to 1.1616. Nonetheless, a decisive downward breakout from this vary would sign the resumption of the first downtrend, activating the subsequent bearish impulse with an preliminary goal at 1.1488. The MACD indicator technically helps this state of affairs. Its sign line is beneath zero however is pointing upwards, indicating constructing momentum for a short-term correction throughout the broader bearish atmosphere.

H1 Chart:

On the H1 chart, the pair accomplished a progress wave to 1.1549 earlier than declining to 1.1510, forming a consolidation vary round 1.1530. An upward breakout might provoke one other leg larger in the direction of 1.1568, probably extending to 1.1616. It’s essential to view any such power as a corrective rally earlier than the bigger downtrend resumes, focusing on a transfer again in the direction of 1.1500. Conversely, a downward breakout would immediately activate the bearish potential for a decline to 1.1488, a stage that would mark the completion of the primary part of the third wave throughout the broader downward pattern. The Stochastic oscillator aligns with the near-term corrective view, as its sign line has turned up from the 20 stage, suggesting room for a bounce in the direction of 80.

Conclusion

Whereas dovish Fed rhetoric has injected volatility and capped the greenback’s positive aspects, the EUR/USD stays in a fragile technical place. The fast outlook hinges on the pair’s potential to carry the 1.1510 assist. A break larger would set off a corrective rally in the direction of 1.1616, providing a possible promoting alternative. Nonetheless, a failure to carry this stage would open the trail for a extra pronounced decline in the direction of 1.1488 and presumably decrease, reaffirming the underlying bearish pattern.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s explicit opinion. This evaluation might not be handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- EUR/USD Extends Losses as Greenback Energy Is Questioned Nov 25, 2025

- Fed officers trace at a December charge lower. Hong Kong’s Hold Seng breaks six‑day dropping streak Nov 25, 2025

- Europe’s manufacturing sector continues to battle. Oil costs fell beneath $58 per barrel Nov 24, 2025

- Yen Underneath Sustained Stress, Igniting Intervention Fears Nov 24, 2025

- Issues concerning the synthetic intelligence sector triggered a world promote‑off of property Nov 21, 2025

- Gold Treads Water Amid Combined Indicators Nov 21, 2025

- The PBOC saved rates of interest unchanged as anticipated. Nvidia’s report beat projections and eased issues about AI investments Nov 20, 2025

- GBP/USD Weakens Quickly Amid Dovish Information and Exterior Pressures Nov 20, 2025

- German DAX (DE40) fell to a 5‑month low. Traders stay cautious forward of key financial releases Nov 19, 2025

- Gold Dips in Wholesome Correction Nov 19, 2025