By RoboForex Analytical Division

Gold edged decrease to 4,060 USD per ounce on Friday, positioning the steel for a modest weekly decline. The shift in sentiment follows a stronger-than-anticipated delayed US employment report, which has tempered expectations for a Federal Reserve charge lower in December.

The Labour Division’s information, delayed by the latest authorities shutdown, considerably exceeded forecasts: September non-farm payrolls rose by 119,000, properly above the anticipated 50,000. Markets interpreted the report as confirming the Fed’s October evaluation—that the labour market is cooling steadily however stays essentially steady. Nonetheless, the unemployment charge climbed to 4.4%, its highest stage since 2021, whereas wage progress got here in barely above expectations at 3.8%.

Notably, the October employment report won’t be printed individually; the Bureau of Labor Statistics will mix the information with November’s launch.

Amid these combined labour market indicators and cautious commentary from Fed officers, markets now value the chance of a December charge lower at simply 40%, sustaining downward strain on gold.

Apparently, regardless of a broad shift away from danger property throughout international capital markets, gold has but to see important safe-haven inflows.

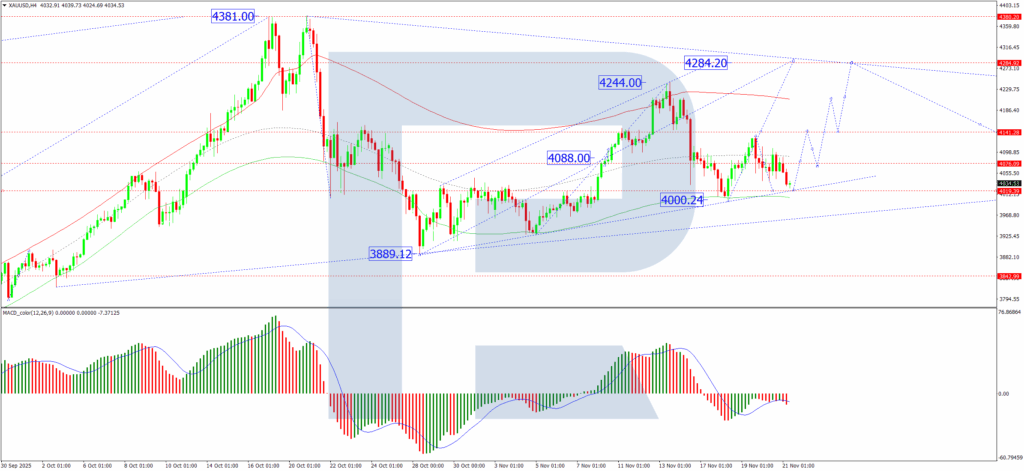

Technical Evaluation: XAU/USD

H4 Chart:

On the H4 chart, XAU/USD is forming a consolidation vary round 4,076 USD. The pair might first lengthen this vary downward towards 4,019 USD earlier than resuming an upward transfer to 4,141 USD. A decisive break above this stage would open the trail for a fifth wave of progress focusing on 4,285 USD. The MACD indicator helps this view, with its sign line beneath zero, suggesting the present correction has additional to run earlier than the following leg greater.

H1 Chart:

On the H1 chart, the market has established a consolidation vary round 4,075 USD. A downward wave is predicted to develop towards at the least 4,020 USD, which might full the primary section of a bigger sample. This could be adopted by a progress wave towards 4,131 USD, a correction again towards 4,020 USD, after which a remaining advance focusing on 4,263 USD. The Stochastic oscillator aligns with this outlook, with its sign line at 20 and starting to show upward, suggesting potential for a near-term bounce.

Conclusion

Gold stays range-bound as conflicting labour market information and diminished charge lower expectations counterbalance its conventional safe-haven enchantment. The technical image suggests additional consolidation is probably going, with a possible dip towards 4,019–4,020 USD providing a shopping for alternative for a subsequent transfer towards 4,141 USD and past. The steel’s lack of ability to draw important safe-haven flows regardless of fairness market weak point stays a priority for bulls, leaving the near-term trajectory closely depending on upcoming US financial information and Fed communications.

Disclaimer:

Any forecasts contained herein are primarily based on the writer’s specific opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- Gold Treads Water Amid Combined Indicators Nov 21, 2025

- The PBOC stored rates of interest unchanged as anticipated. Nvidia’s report beat projections and eased considerations about AI investments Nov 20, 2025

- GBP/USD Weakens Quickly Amid Dovish Knowledge and Exterior Pressures Nov 20, 2025

- German DAX (DE40) fell to a 5‑month low. Traders stay cautious forward of key financial releases Nov 19, 2025

- Gold Dips in Wholesome Correction Nov 19, 2025

- Oil costs stay underneath strain. Canada’s inflation fell to the Financial institution of Canada’s goal stage Nov 18, 2025

- September NFP, Nvidia & Bitcoin in focus Nov 18, 2025

- EUR/USD Declines as Market Awaits Key US Employment Knowledge Nov 18, 2025

- The Swiss franc is at its highest stage since 2011. Bitcoin misplaced 5% on Friday Nov 17, 2025

- USD/JPY Extends Positive factors as Japanese Authorities Advocates for Dovish Coverage Nov 17, 2025