A Climactic Give up: FIIs Take Income as a Staggering 16,000 Retail Longs Capitulate

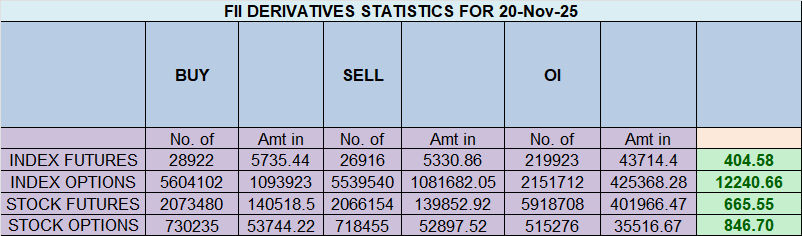

On November 20, 2025, the Nifty Index Futures market witnessed a seismic and definitive psychological breakdown. Whereas the headline deceptively confirmed International Institutional Buyers (FIIs) as web patrons of 1,993 contracts, the true, earth-shattering story was the entire and whole capitulation of the retail bulls, who liquidated a surprising 16,011 lengthy contracts in a single session.

This mass exodus was confirmed by a large collapse in Open Curiosity of two,951 contracts, signaling that this was not a battle, however a full-scale retreat that possible marks the ultimate, exhaustive finish of the current downtrend.

Decoding the Knowledge: The Anatomy of a Market Backside

1. The Primary Occasion: The Nice Retail Unwinding

Crucial market occasion in weeks is the consumer conduct. The liquidation of over 16,000 lengthy positions isn’t a strategic adjustment; it’s a full-blown give up. That is the basic sign of capitulation, the place the ache of holding shedding positions turns into insufferable, triggering a wave of panicked, compelled promoting. Critically, shoppers additionally started to flip their positions, including 3,945 new quick contracts, indicating that retail sentiment has now decisively damaged and turned bearish—a basic contrarian indicator at a possible market backside.

2. The FIIs’ “Misleading” Purchase: That is Pure Revenue-Taking

The granular FII knowledge reveals their true, masterful technique. They weren’t initiating a brand new bullish marketing campaign. As a substitute, they lined 1,980 quick contracts. They used the large wall of “promote” orders from the panicking retail shoppers as the proper liquidity to purchase again their very own extremely worthwhile quick positions with out disturbing the market worth. Their shopping for was not a vote of confidence; it was the cashing-in of successful bearish bets.

Their general positioning stays extraordinarily bearish at 12% lengthy versus 88% quick (ratio 0.14). They’ve merely secured their income; they haven’t modified their long-term bias.

3. The OI Collapse: The Battlefield Goes Silent

The large drop in Open Curiosity is the definitive proof that the warfare is over. The market is experiencing an enormous deleveraging occasion as the first members flee the scene:

The result’s a market that has been “hollowed out,” leaving a fragile and brittle construction that’s ripe for a violent reversal.

Key Implications for the Market

-

Climactic Development Exhaustion: The gas for the downtrend—the massive and hopeful base of retail longs—has simply been exhausted on this mass liquidation occasion. The promoting stress has reached its climax.

-

The Major Danger Has Inverted to a Brief Squeeze: The market is now dangerously depleted of “pure sellers.” With an enormous variety of quick positions nonetheless open (each from FIIs and newly bearish shoppers), any optimistic catalyst can now ignite a ferocious rally, as all these shorts rush to purchase in a market that abruptly has a vacuum of sellers.

-

The Bottoming Course of is Underway: The sort of capitulation occasion usually marks the value low of a development. The market will now enter a unstable “bottoming” section, characterised by sharp rallies and potential retests because it seeks a brand new equilibrium.

-

A Full Shift in Market Psychology: The narrative has simply basically shifted. The main target is now not on development continuation however on reversal.

Conclusion

Disregard the headline FII quantity utterly. The one story that issues is the historic capitulation of over 16,000 retail longs. This allowed the institutional bears to start a masterful, worthwhile exit from their successful marketing campaign. The aggressive, one-sided promoting development is now over. The market is in a extremely unstable state the place the danger of a violent quick squeeze is now exceptionally excessive.

Final Evaluation will be learn right here

The Nifty is ready of most energy, having secured a brand new all-time closing excessive at 26,200. This can be a profoundly bullish technical assertion, demonstrating a whole victory over the bears and pushing the market into uncharted “blue-sky” territory. This highly effective worth motion is now converging with a uncommon and extremely potent window of time, outlined by at this time’s “Double Lunar Date“ and tomorrow’s Gann date, suggesting the market isn’t just trending, however is being primed for a serious acceleration or “energy transfer.”

1. The Technical Posture: Unambiguously Bullish

The technical panorama is evident and decisively managed by the bulls. An all-time closing excessive signifies a market with no overhead resistance from trapped sellers, a state of pure worth discovery. The important thing ranges that may now outline this new bullish period are drawn with precision:

-

The Bullish Fortress (26,110): That is the brand new line within the sand. So long as the Nifty holds above this important degree on a closing foundation, the bulls preserve absolute and unquestioned management over the market’s development. That is the foundational assist that have to be defended.

-

The Ultimate Frontier (26,277): That is the earlier all-time excessive watermark and the following logical goal. The bulls’ mission, particularly on a vital weekly closing, is to decisively breach this degree and set up a brand new, increased territory for the market.

2. The Cyclical Powerhouse: A Uncommon Again-to-Again Catalyst

This highly effective technical setup is now being amplified by an distinctive sequence of high-impact cyclical occasions, promising a dramatic improve in market vitality and the potential for a trend-defining transfer.

-

The Double Lunar Date (In the present day): This uncommon astrological occasion alerts a day of heightened emotional vitality and potential peak sentiment. Such dates usually coincide with main development accelerations or, much less generally, sharp reversals. Given the present momentum, it’s almost definitely to behave as a robust tailwind for the bulls.

-

The Gann Date (Tomorrow): Gann time cycles are famend for marking main market turning factors. As you appropriately famous with distinctive recall, the final Gann date on November sixth coincided completely with the market’s main backside. The truth that a brand new Gann date is arriving now, with the market at an all-time excessive, strongly suggests it should mark one other pivotal occasion—this time, a possible main upside acceleration.

The Mixed Thesis: A Market Primed for a Breakout

When a powerfully bullish technical setup aligns completely with a uncommon and potent timing window, the chance of a big directional transfer rises exponentially. The market isn’t just sturdy; it’s sturdy at a cyclically important second. The bullish development has offered the route; the lunar and Gann dates are actually offering the immense vitality wanted to gas the following main leg of this rally.

Conclusion

The stage is about for a historic weekly shut. The bulls are in full command of the value motion, with a clearly outlined assist fortress at 26,110. The highly effective confluence of the Double Lunar Date and the Gann Date means that the market is coiling for a big launch of vitality. The bulls’ goal is evident: to make use of this cyclical energy to shatter the 26,277 all-time excessive and launch the Nifty into a brand new, uncharted territory. Put together for a session of excessive vitality and conviction.

Nifty Commerce Plan for Positional Commerce ,Bulls will get energetic above 26258 for a transfer in direction of 26338/26419. Bears will get energetic beneath 26177 for a transfer in direction of 26097/26017

Merchants might be careful for potential intraday reversals at 09:54.11:34,12:17,02:20 Discover and Commerce Intraday Reversal Instances

Nifty Oct Futures Open Curiosity Quantity stood at 1.46 lakh cr , witnessing liquidation of 21.8 Lakh contracts. Moreover, the rise in Value of Carry implies that there was closuer of LONG positions at this time.

Nifty Advance Decline Ratio at 30:19 and Nifty Rollover Value is @26104 closed beneath it.

Within the money phase, International Institutional Buyers (FII) purchased 283 cr , whereas Home Institutional Buyers (DII) purchased 824 cr.

The Nifty choices market is screaming a message of overwhelming bullish conviction. A large surge within the Put-Name Ratio (PCR) to an especially excessive 1.50 alerts a whole rout of the bears. This means that the worth of open put positions is 50% better than calls, pushed by a tidal wave of assured put writing. This exercise has constructed a formidable assist construction below the market, confirming a dramatic shift in sentiment from worry to confidence.

This bullish sentiment is structurally confirmed by the Max Ache level leaping increased to 26,100, establishing a brand new, elevated pivot for the market. Possibility writers are now not defending decrease ranges however are actively constructing positions that suggest a consolidation and expiry at this increased floor.

A take a look at the participant knowledge reveals an enchanting divergence:

-

FIIs are cautiously bullish. They had been web patrons of each calls (+33K) and places (+31K). This “lengthy strangle” method reveals they’re collaborating within the rally however are additionally spending vital capital on insurance coverage in opposition to a pointy reversal, an indication {of professional} hedging.

-

Retail, in distinction, stays fearful and confused, displaying no sturdy directional conviction however leaning in direction of shopping for places for defense.

This setup creates a transparent battlefield outlined by the choices chain:

-

Resistance: The first resistance ceiling is situated at 26,200, with a extra vital wall at 26,500.

-

Assist: The 26,100 Max Ache degree acts as the brand new pivot/assist. A serious assist ground has been constructed on the essential 26,000 psychological degree, with the last word assist now at 25,800.

In conclusion, the market is firmly in a bull-controlled, “purchase on dips” surroundings. The trail of least resistance is clearly upwards, although the cautious hedging by FIIs suggests the rally might not be proof against sudden volatility.

For Positional Merchants, The Nifty Futures’ Development Change Stage is At 25923 . Going Lengthy Or Brief Above Or Under This Stage Can Assist Them Keep On The Similar Aspect As Establishments, With A Greater Danger-reward Ratio. Intraday Merchants Can Maintain An Eye On 26186, Which Acts As An Intraday Development Change Stage.

Nifty Intraday Buying and selling Ranges

Purchase Above 26222 Tgt 26270, 26300 and 26350 ( Nifty Spot Ranges)

Promote Under 26175 Tgt 26130, 26100 and 26050 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to carefully monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators