A month in the past, we started testing the GoldBaron professional advisor utilizing the idea of synergistic buying and selling programs. The outcomes had been spectacular, however extra intensive testing and refinement are wanted. As an experiment, we assembled the same automated cluster of programs based mostly on our free “Shifting Common Cross Sign” indicator. The “2MA BlackBox” automated professional advisor is on the market. Obtain the professional utterly freed from cost . There are not any restrictions and the professional can be utilized on actual accounts.

An enormous thanks to the customers who urged enhancements to the earlier single module! We additionally respect the bugs and inaccuracies you discovered! Your suggestions and opinions on this buying and selling system are crucial to us. Please share them through non-public messages or within the indicator feedback.

To make use of the Skilled Advisor, you’ll want to obtain the free “Shifting Common Cross Sign” indicator from the MQL Market and maintain it within the MQL Market. The indicator file ought to be positioned within the “Indicators/Market” folder.

The professional advisor is configured for Gold (XAUUSD) on the H1 (1 hour) timeframe. Nevertheless, you need to use the professional advisor on any image and timeframe, after checking the leads to the tester.

Now that you’ve got all the pieces you’ll want to check the system’s performance your self, let’s transfer on to its description.

All subsystems are constructed utilizing the identical template: After the indicator’s sign arrow seems upward, we place a pending BUY STOP order at a distance from the excessive of the bar that generated the sign. To exit the place, we use STOP LOSS, TAKE PROFIT, and TRAILING STOP. All values are expressed as a share of the present image value. We maintain pending orders for just one bar (one hour in our case). If a place is open, no new positions are opened.

Buying and selling system synergy: Programs are adjusted one after the other in areas the place earlier programs carried out poorly. To regulate, we determine weak factors and improve the lot measurement in these areas. The lot measurement is elevated solely throughout adjustment; subsequently, all subsystems open the identical quantity.

Subsystems can open orders if there are already open ones from different subsystems.

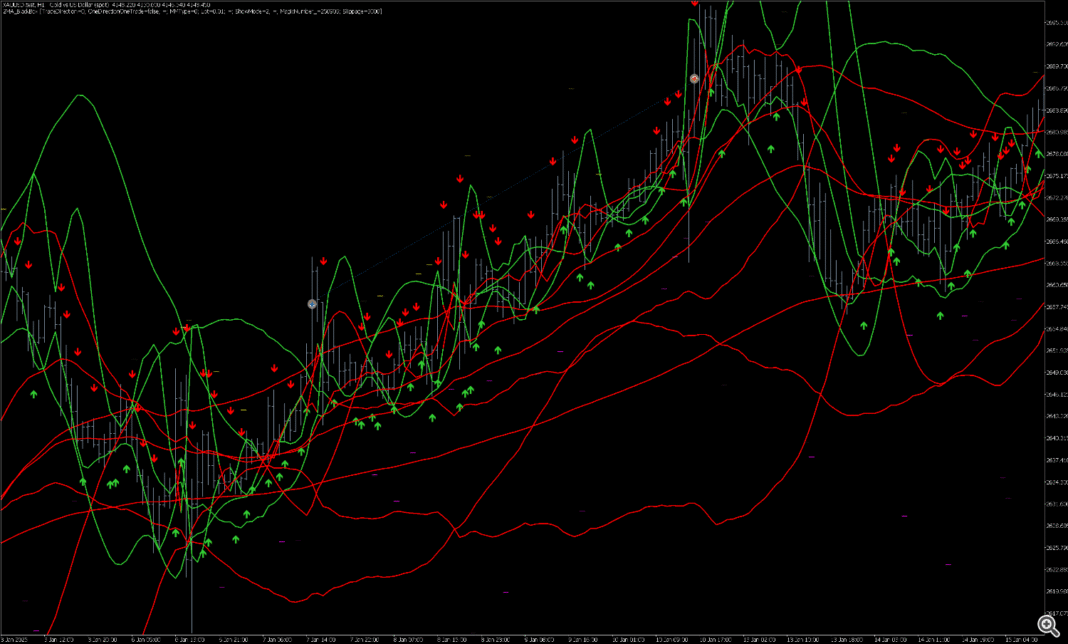

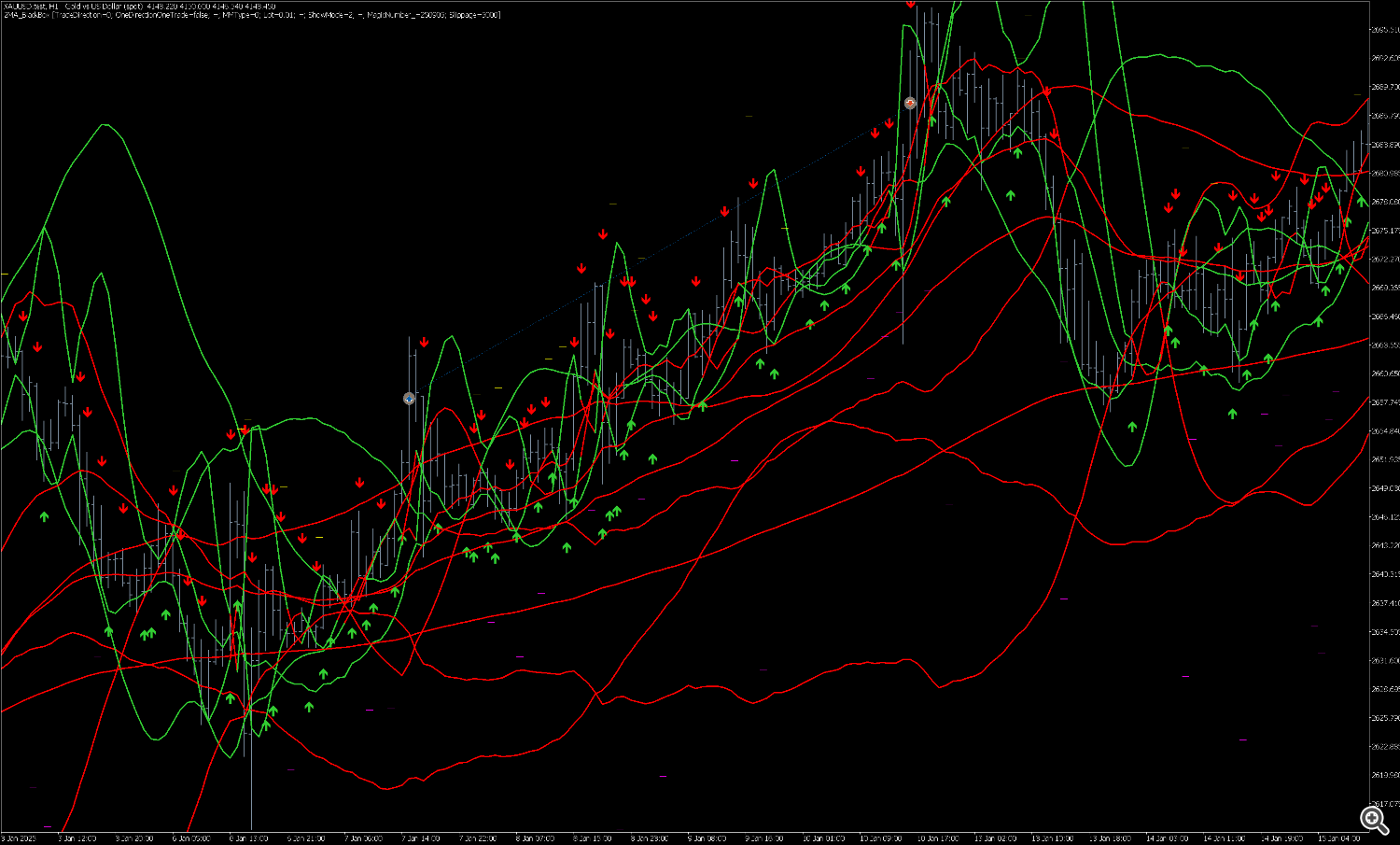

In case you do not take away the symptoms from the chart, all of it appears horrible!

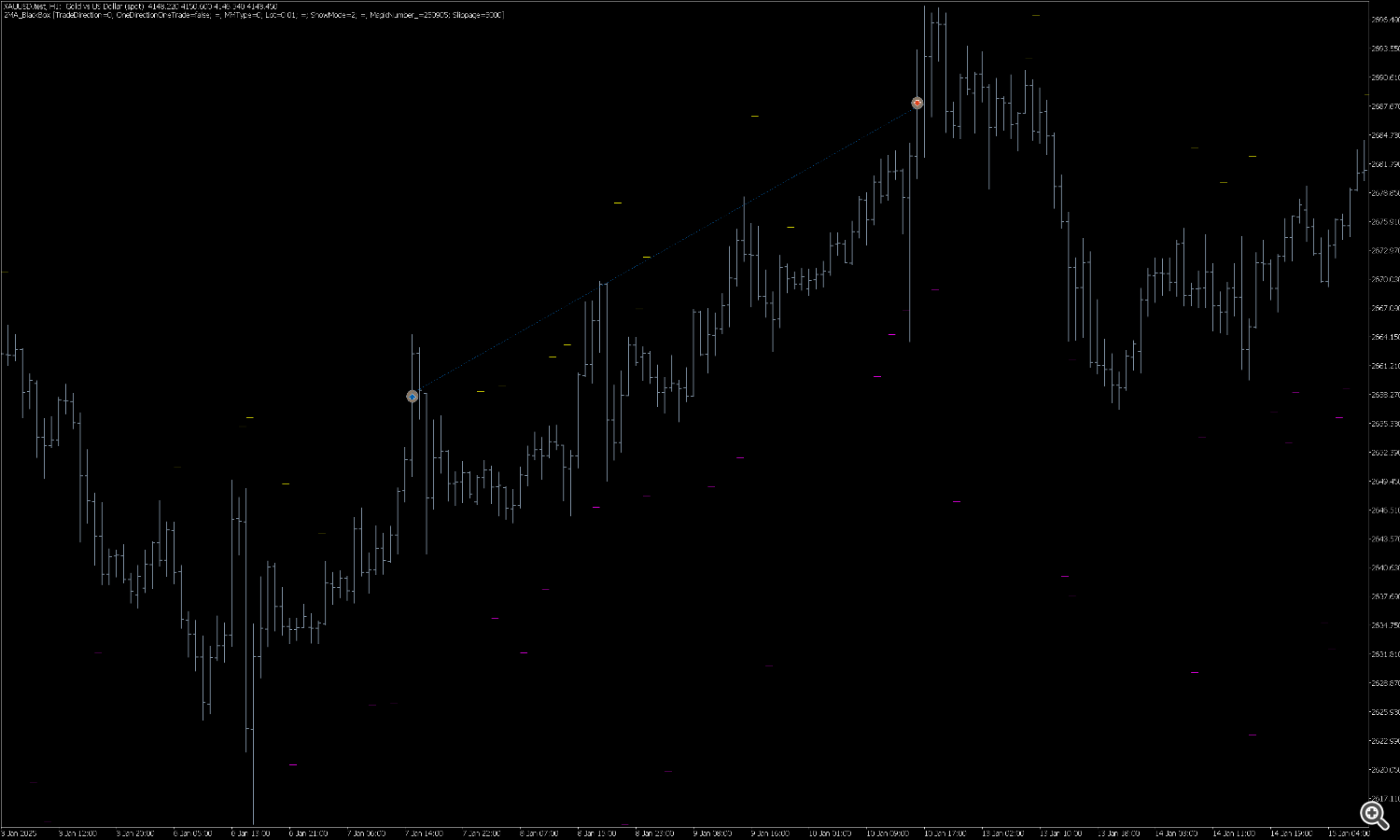

Issues are wanting higher after eradicating the symptoms! Yellow and purple dashes point out failed cease orders.

That is how the system works within the technique tester.

Conclusions concerning the operation of the synergistic buying and selling system

1. Optimistic points and strengths:

-

Synergy and diversification: The important thing concept behind the system isn’t merely utilizing a number of copies of the indicator, however quite customizing them (probably by totally different parameters or offsets) to function in numerous market situations. This permits the system to stay lively in each trending and flat markets, the place a single technique may in any other case result in dropping streaks.

-

Automation and self-discipline: The system is totally automated, eliminating the emotional issue and strictly following the desired entry and exit guidelines.

-

Clear guidelines: The logic is clear: indicator sign -> pending order placement -> order lifetime restrict (1 bar) -> place administration through Cease Loss, Take Revenue, and Trailing Cease. This makes the system simple to check and replicate.

-

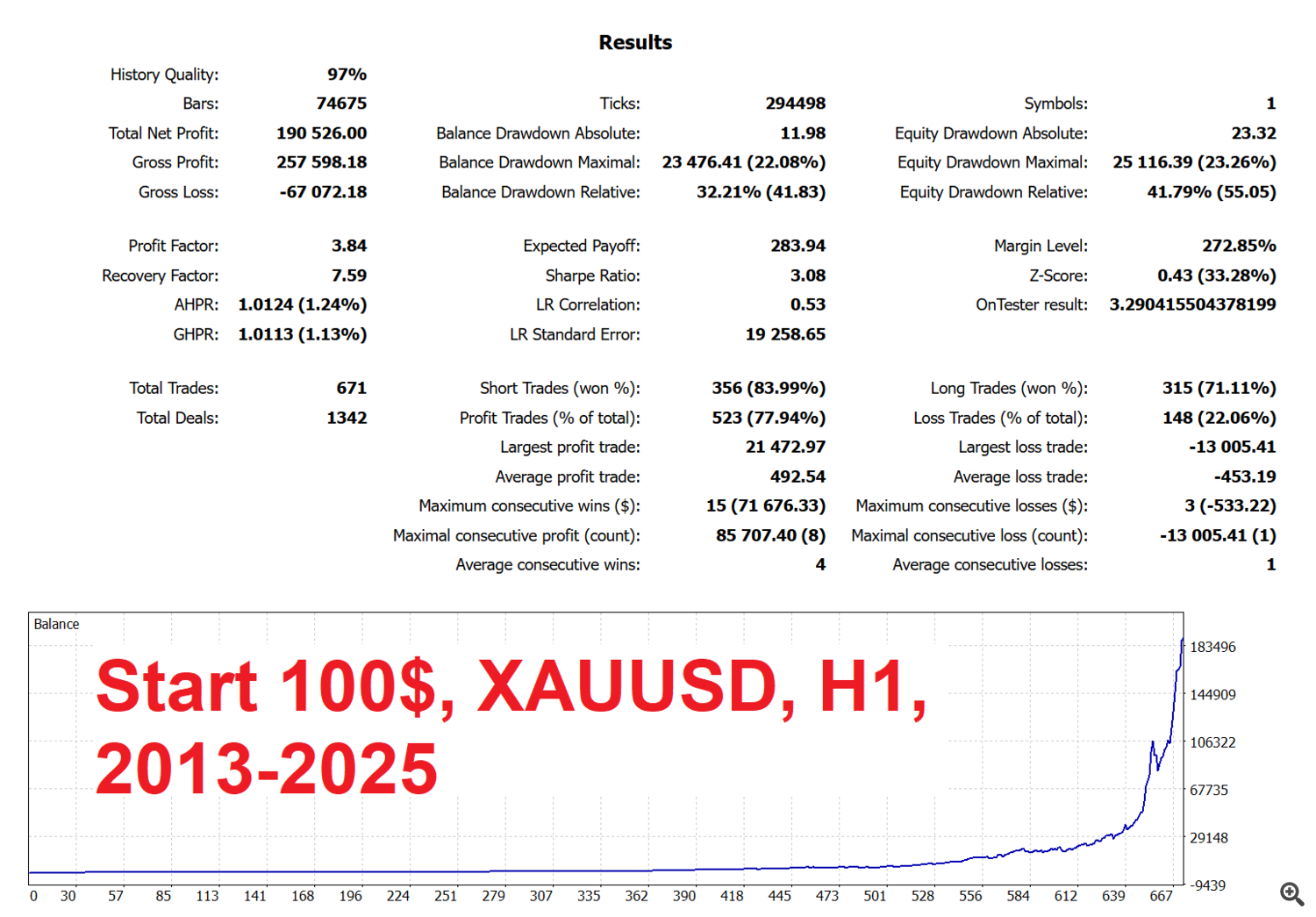

Visible affirmation of effectiveness: The technique tester chart exhibits regular deposit development with durations of correction, which is typical of a working trend-following system. The steadiness curve doesn’t have any sharp, uncontrollable dips, indicating manageable danger.

2. Potential dangers and areas for enchancment:

-

Threat of “over-optimization”: Adjusting programs in areas the place earlier programs carried out poorly can result in overfitting. A system could present glorious outcomes based mostly on previous information, however fail to carry out properly in actual buying and selling on new information. Lengthy-term and ahead testing are required.

-

Complexity of study: As has been appropriately famous, the simultaneous operation of a number of subsystems with indicators creates “visible noise”, making it tough to manually analyze and perceive which subsystem is presently producing a sign.

-

Place accumulation and danger: The flexibility to open orders from totally different subsystems whereas positions are already open will increase total market publicity. During times of excessive volatility or counter-trend actions, this will result in important simultaneous drawdowns throughout a number of positions. Cautious monitoring of the system’s habits throughout such durations is required.

-

Dependence on value habits on the 1-hour bar: The technique of putting a pending order at a distance from the sign bar’s excessive/low and its brief lifespan (1 bar) makes the system delicate to particular value habits throughout the hour. A powerful false breakout can result in a sequence of unfilled orders or slippage.

3. Suggestions and conclusion:

Introduced A cluster system based mostly on the Shifting Common Cross Sign appears extraordinarily promising . It demonstrates the precept that diversification not throughout devices, however throughout variations of a single technique, can result in sustainable outcomes.

To modify to actual accounts, we advocate:

-

Proceed testing on the utmost obtainable historical past, together with durations of various market regimes (sturdy traits, extended flats, disaster occasions).

-

Conduct a ahead check (testing on information unfamiliar to the system) on a demo account for no less than 2-3 months.

-

Analyze the utmost drawdown (Max Drawdown) and guarantee that its degree is psychologically and financially acceptable for you.

Consequence: The workforce has carried out a fantastic job of making, testing, and, importantly, distributing the system freely. The outcomes justify additional in-depth examine and refinement of the strategy. This is a superb instance of the evolution from a easy technique to a posh, but extra sustainable, synergistic system.