This text will exhibits how this works, and the way IV can have an effect on your resolution on what kind of commerce to open.

Directional Spreads

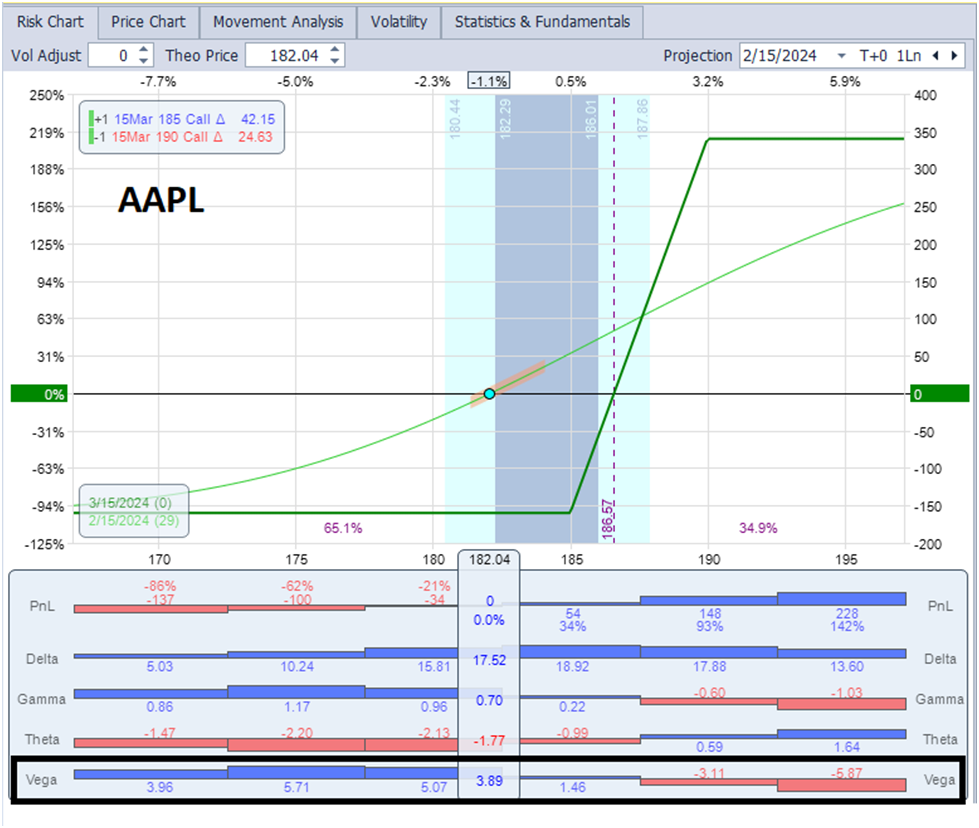

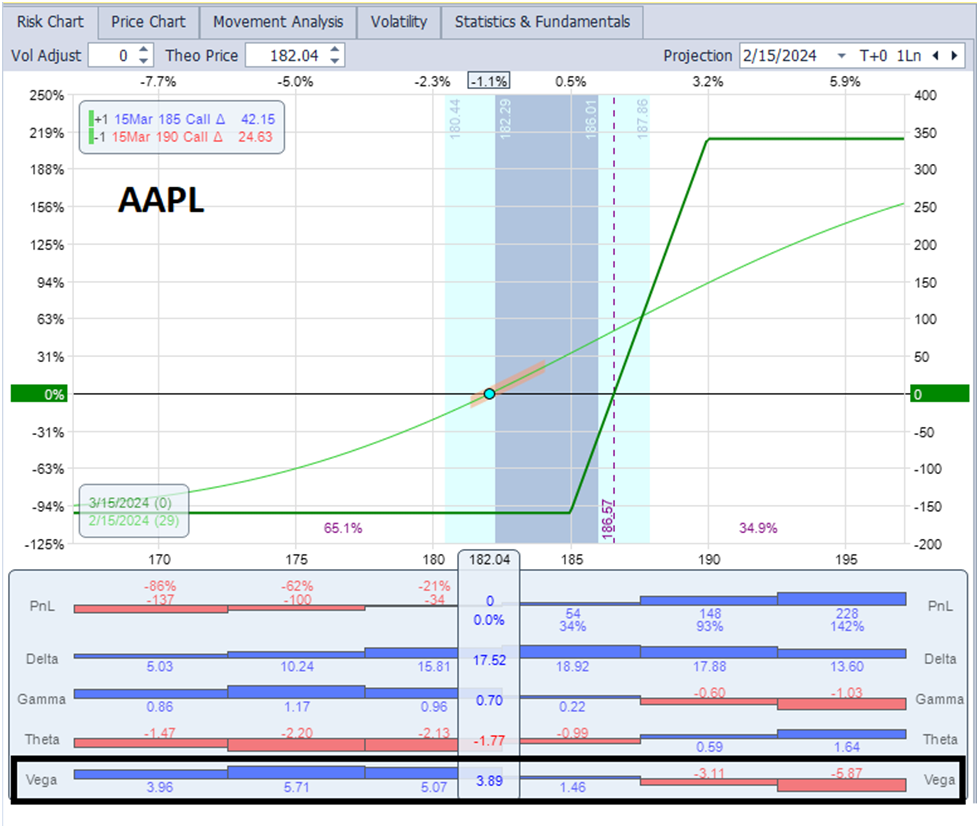

Let’s begin with the only of choices spreads, the put or name vertical unfold which is usually used as to position a commerce for a inventory to maneuver in a sure course. Right here’s a barely OTM (Out of The Cash) name vertical debit unfold on AAPL a few month away from expiration (a preferred unfold to play for inventory value to rise). The inventory value is $182 and the decision vertical is lengthy the 185 name and brief the 190 name. Word the highlighted Vega part that may illustrate some essential factors concerning IV:

-

When the unfold strikes are OTM (inventory value is beneath each lengthy and brief name strikes) the commerce is vega constructive. This implies whereas the unfold stays OTM, growing IV will assist it retain extra of its worth.

-

Because the inventory value rises towards the unfold strikes the diploma of vega constructive turns into much less. It will definitely turns into vega impartial at roughly the break-even level for the unfold at expiration.

- Because the inventory value rises even farther, approaching the upper brief strike and past, the commerce will change into vega damaging. This implies when the unfold is ITM (In The Cash), reducing IV will assist the worth get nearer to the unfold width (the max acquire).

How can this issue right into a commerce opening resolution? When opening a bullish name vertical unfold when IV is elevated it might assist to enter close to the vega impartial place with the lengthy strike ITM and brief strike OTM. This might be seemingly be a setup the place the max acquire is equal to the max loss. If the inventory value rises then you definitely’ll hit the purpose the place the unfold turns into vega damaging sooner, so any drop in IV gained’t harm. Conversely, if opening when IV is decrease you can begin out with each legs of the decision vertical being OTM. This provides you with a setup the place the max acquire is larger than the max loss, however you already know that any additional IV decline is much less seemingly and due to this fact the draw back danger as a result of dropping IV just isn’t as excessive so it may be okay regardless that it can take extra of a inventory value rise to get to the purpose the place the commerce turns vega impartial after which vega damaging.

Spreads for Minimal Inventory Value Motion

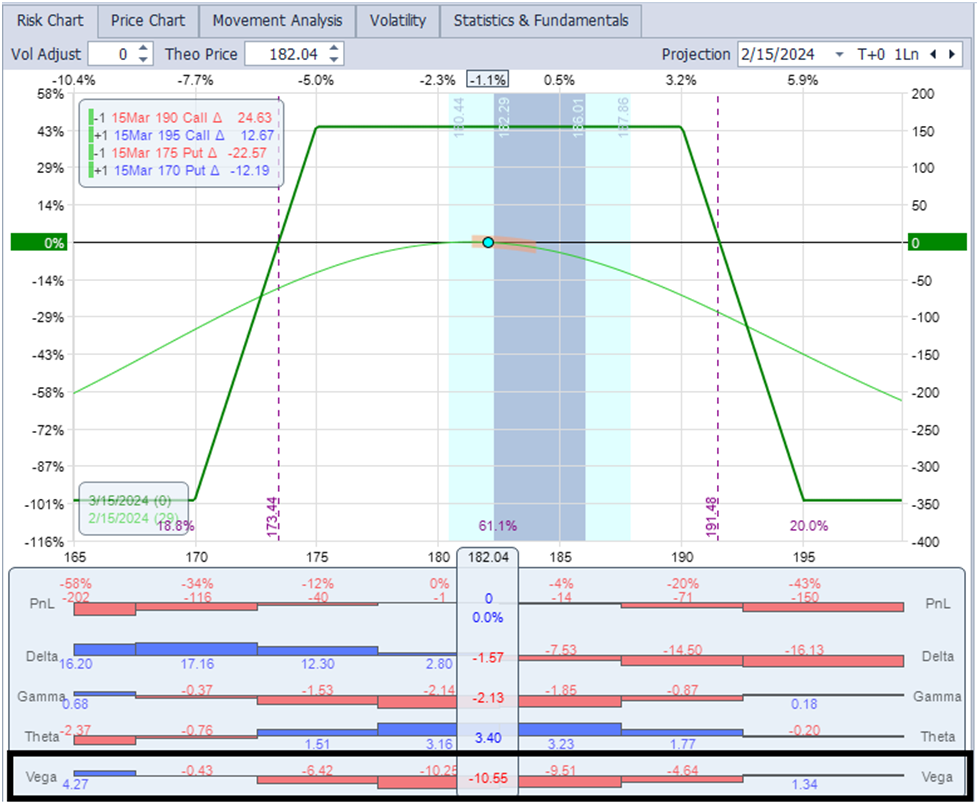

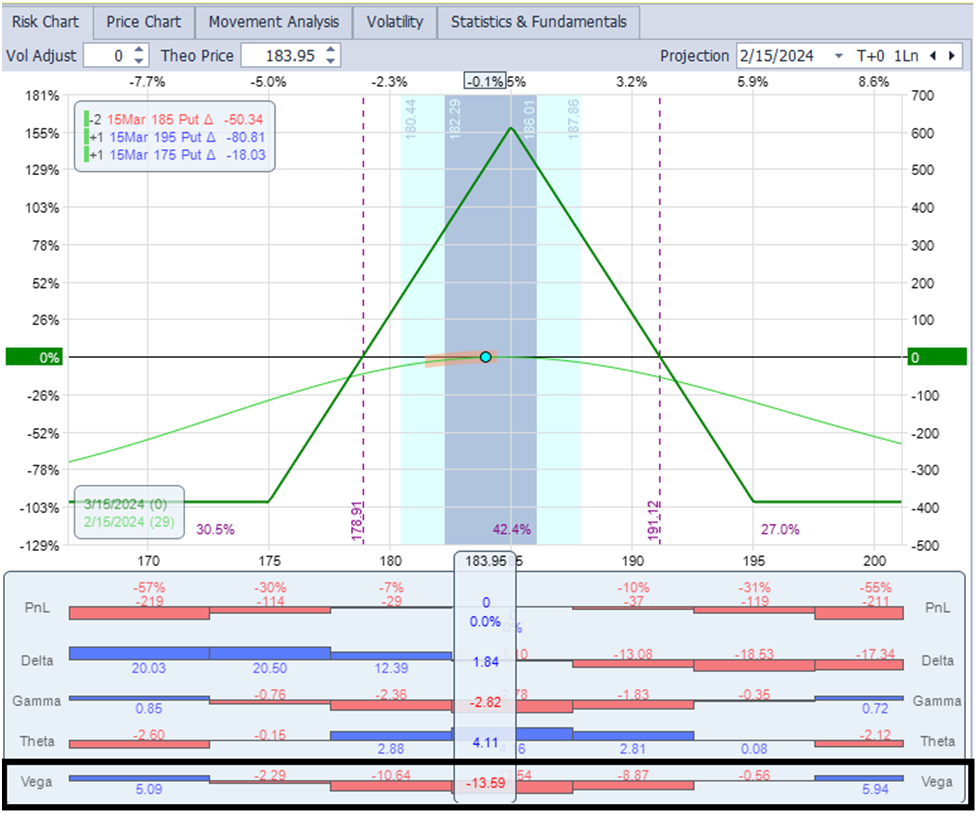

I’m now going to deal with frequent spreads to play for minimal inventory value motion. The Iron Condor (IC) is one such unfold and proven within the following chart, it consists of each an OTM put credit score unfold and an OTM name credit score unfold. When the inventory value is within the successful place between the wings it’s vega damaging which means an IV drop will speed up revenue development above the extent that simply time decay would generate. Conversely, an IV rise will decelerate revenue development. Additionally word that when the inventory value will get to the dropping zones inside and past the wings, the IC turns into vega constructive which means an IV rise would assist maintain the losses smaller.

How can this affect a commerce opening resolution? Opening an IC when IV is low signifies that you’ll have to make use of nearer to ATM strikes to get the identical opening credit score in comparison with occasions when IV is larger when you may get the identical credit score with farther OTM strikes. Additionally, when opening with low IV an additional IV decline is much less seemingly, so that you gained’t get the accelerated revenue development when IV drops. Opening an IC when IV is considerably elevated means to can go farther out with strikes (so a much bigger inventory value transfer is required to get to the dropping zones) and any IV decline can speed up revenue development offered the inventory value doesn’t make a major transfer.

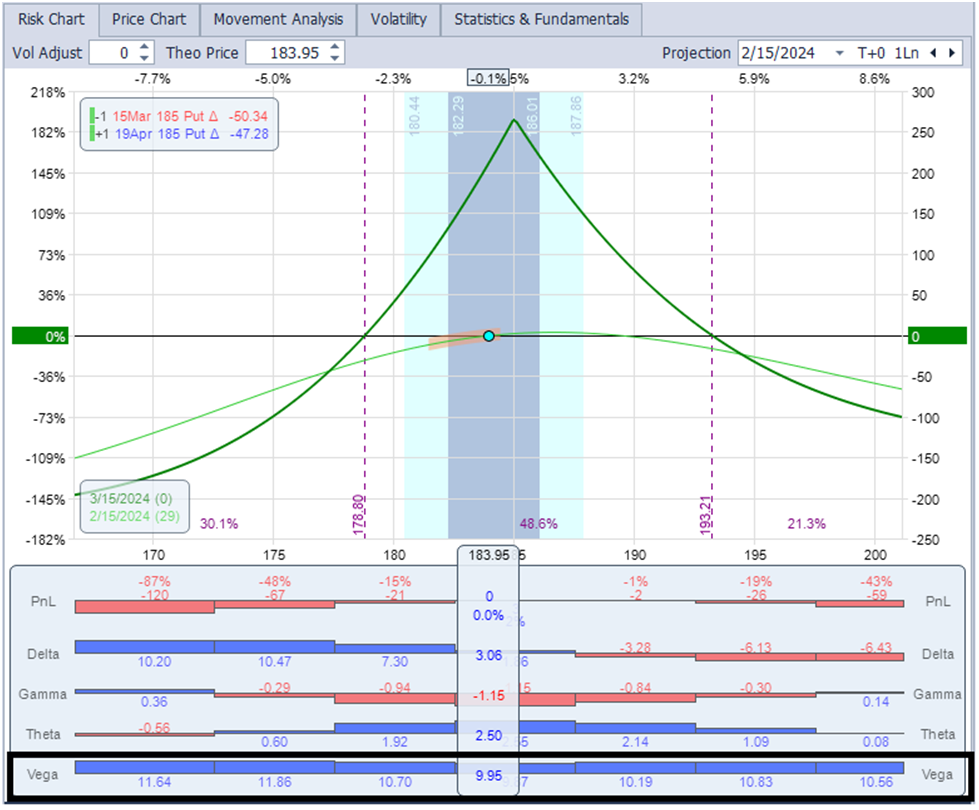

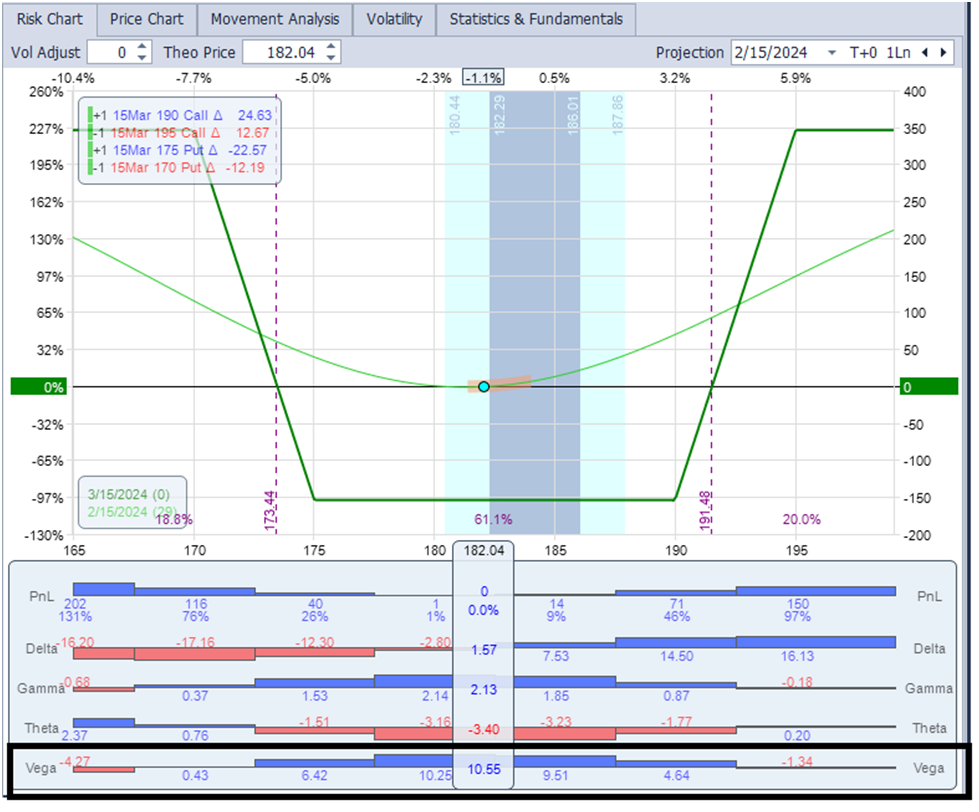

Many individuals don’t like Iron Condors as a result of their danger vs reward the place the max loss is larger than the max acquire. Let’s have a look at two different frequent spreads to play for minimal inventory value motion which have extra equal danger vs reward and the way IV can issue into which one to make use of. The primary is the calendar unfold, which generally makes use of the ATM strike when taking part in for minimal inventory value motion. The first acquire catalyst is theta decay (and minimal inventory value motion) however IV can even think about. As proven on the chart beneath, its vega constructive in all places which means that rising IV will at all times assist the commerce. Rising IV will each enhance the acquire potential and widen the revenue tent. Declining IV will decrease the acquire potential and tighten the revenue tent.

The opposite frequent unfold to play for minimal inventory value motion is the butterfly unfold. Its PnL chart appears to be like similar to that of the calendar with a balanced danger vs reward and related break-even factors. The first acquire catalyst is similar because the calendar, theta decay and minimal inventory value motion. However there may be one essential distinction, the butterfly is vega damaging when within the successful zone which means that declining IV will enable features to develop at a faster price.

How can this affect a commerce opening resolution. When IV is decrease, additional IV decline is much less seemingly so utilizing a calendar is an effective alternative as any rise in IV can assist the commerce. Nevertheless, when IV is elevated and IV decline is extra seemingly then a butterfly could be a good selection as any decline in IV can assist the commerce.

Spreads for Inventory Value Motion in any course

I’m now going to deal with frequent spreads to play for vital inventory value motion, both up or down. A lengthy straddle or lengthy strangle consists of solely lengthy legs, so they’re at all times vega constructive. Rising IV will reduce the affect of damaging theta, falling IV will add extra value lower to that of damaging theta alone. This is the reason straddles and strangles are usually used within the timeframe earlier than earnings the place you’ve gotten the nearly assured IV enhance to counteract a number of the damaging theta.

A reverse iron condor (RIC) is the inverse of the iron condor. It consists of and OTM name debit vertical unfold and an OTM put debit vertical. How far-off from ATM you go impacts the chance vs reward setup. Word that the RIC is vega constructive when within the dropping zone between the put and name wings, so any IV decline will speed up losses. The commerce turns into vega damaging when the inventory value strikes right into a successful zone, so when you get the inventory value to maneuver then you’re assured to have a successful commerce no matter what occurs with IV.

There are actually extra advanced commerce setups to make use of in any of those eventualities, however I’ve lined a number of the hottest trades and you may see how present IV can affect your resolution to make use of one commerce setup as an alternative of one other.