By RoboForex Analytical Division

The EUR/USD pair is buying and selling flat on Thursday, hovering round 1.1587, following the Home of Representatives’ approval of a short-term finances invoice that ends the longest US authorities shutdown in historical past.

The invoice now awaits President Donald Trump’s signature – a formality that may enable shuttered authorities companies to renew operations inside days.

Whereas the decision clears the best way for the publication of a backlog of delayed macroeconomic knowledge, the White Home has cautioned that key October reviews on employment and inflation should still be withheld from the general public.

Market expectations for a December rate of interest minimize by the Federal Reserve have moderated however persist. The chance of a 25-basis-point minimize has eased to 60%, down from 67% the day earlier than.

This cautious sentiment was fuelled earlier within the week by ADP knowledge, which confirmed that the US non-public sector shed a mean of 11,250 jobs per week all through October, amplifying considerations over a cooling labour market.

Technical Evaluation: EUR/USD

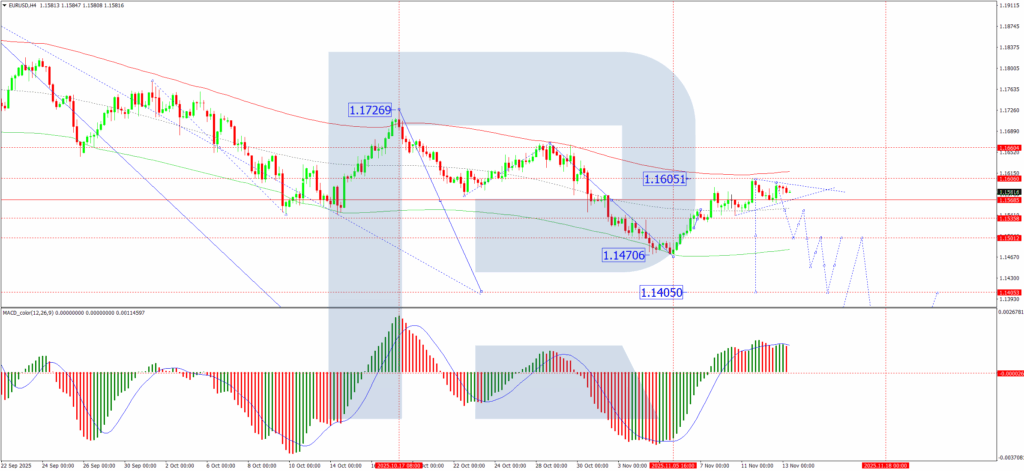

H4 Chart:

On the H4 chart, EUR/USD has accomplished a corrective wave to 1.1605 and has fashioned a good consolidation vary under this resistance stage. We anticipate a downward breakout from this vary, triggering a decline in direction of an preliminary goal of 1.1505. A breach of this stage would open the trail for an additional extension of the downtrend to 1.1405. This bearish outlook is technically supported by the MACD indicator. Its sign line is above zero however has diverged from its histogram and is pointing decisively downward, suggesting the current upward correction has run its course and bearish momentum is reasserting itself.

H1 Chart:

On the H1 chart, the pair accomplished a downward impulse to 1.1563, adopted by a corrective bounce to 1.1597. These two ranges outline the higher and decrease boundaries of a brand new consolidation vary. A downward breakout is anticipated, resulting in a resumption of the sell-off in direction of preliminary targets at 1.1538 and 1.1530. The Stochastic oscillator corroborates this view. Its sign line has turned down from under the 80 stage and is falling steadily in direction of 20, indicating that short-term downward momentum is constructing.

Conclusion

Whereas the top of the US authorities shutdown removes a key market overhang, the EUR/USD pair stays capped by underlying considerations concerning the US economic system and a still-dovish Fed outlook. Technically, the construction factors to a bearish decision. The completion of the correction close to 1.1605 suggests the pair is poised for a recent leg decrease, with key draw back targets at 1.1505 and 1.1405.

Disclaimer:

Any forecasts contained herein are based mostly on the creator’s explicit opinion. This evaluation might not be handled as buying and selling recommendation. RoboForex bears no accountability for buying and selling outcomes based mostly on buying and selling suggestions and critiques contained herein.

- EUR/USD Holds Regular as US Authorities Shutdown Ends Nov 13, 2025

- Oil costs fell sharply following OPEC’s revised expectations. The US authorities shutdown has ended Nov 13, 2025

- Buyers started actively shopping for “blue chips.” WTI crude oil costs rose to $61 per barrel Nov 12, 2025

- Pound Succumbs to Stress from Weak Labour Knowledge Nov 12, 2025

- USD/JPY Climbs to Recent 9-Month Excessive Nov 11, 2025

- The US politicians are near a funding settlement, growing the possibilities of ending the federal government shutdown this week Nov 10, 2025

- Gold Climbs to Two-Week Excessive Nov 10, 2025

- Banxico cuts rate of interest to 7.25%. Norges Financial institution holds the speed at 4% Nov 7, 2025

- USD/JPY Declines as Secure-Haven Demand Bolsters the Yen Nov 7, 2025

- The US Supreme сourt could cancel most of Trump’s reciprocal tariffs. Riksbank holds price at 1.75% Nov 6, 2025