What is the Distinction Between SPX and SPY Choices?

What Is SPX?

SPX is the S&P 500 index, which is a inventory market index that measures the efficiency of 500 giant cap publicly traded firms in the US. The S&P 500 index is broadly thought to be probably the greatest measures of the general efficiency of the U.S. inventory market.

SPX is a numerical worth that represents the extent of the S&P 500 index. It’s calculated by taking the weighted common of the inventory costs of the five hundred firms included within the index, with the weights decided by the market capitalization of every firm. SPX is commonly used as a benchmark for the efficiency of enormous cap U.S. shares.

The S&P 500 index is maintained by S&P Dow Jones Indices. It is among the most generally adopted inventory market indices on the earth and is used as a benchmark by traders, analysts and monetary professionals.

What Is SPY?

The SPDR S&P 500 ETF Belief (SPY), also referred to as SPY, is an exchange-traded fund that tracks the efficiency of the S&P 500 index. The S&P 500 is a inventory market index that measures the efficiency of 500 giant cap publicly traded firms in the US.

SPY was launched in 1993 and is among the oldest and largest ETFs on the earth, with over $375 billion in belongings beneath administration as of Might 1, 2023. SPY trades on the NYSE Arca trade and may be purchased and offered like a inventory by way of a brokerage account.

Investing in SPY offers traders with publicity to a diversified portfolio of enormous cap U.S. shares, making it a well-liked selection for these seeking to put money into the U.S. inventory market. As a result of it tracks the S&P 500 index, SPY is commonly used as a benchmark for the general efficiency of the U.S. inventory market.

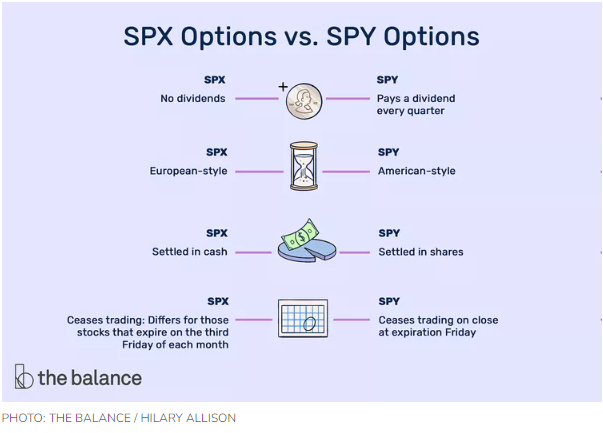

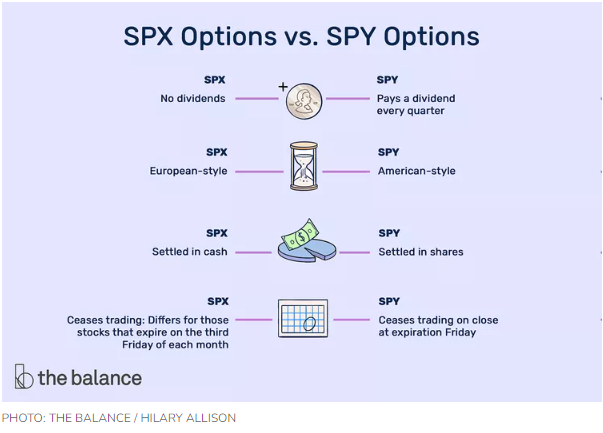

Dividends

Dividends will not be usually paid to choices holders. Nonetheless, SPY pays a dividend each quarter. That is very important as a result of in the event you commerce with in-the-money (ITM) name choices, you possibly can train them to gather the dividend. To do that, it is advisable to train your choices on SPY earlier than the ex-dividend date or personal shares and place a name (known as a coated name possibility).

You will need to be alert when buying and selling ITM calls as a result of most calls are exercised for the dividend on expiration Friday. Due to this fact, in the event you personal these choices, you can’t afford to lose the dividend.

The ex-dividend day for SPY is the third Friday of March, June, September, and December. If that day does not fall on a enterprise day, it’s pushed to the subsequent enterprise day.

Buying and selling Fashion

There are two totally different buying and selling kinds, European and American. European fashion choices can solely be exercised on the expiration date, whereas American choices may be exercised any time earlier than the expiry date.

SPY choices are American-style and could also be exercised at any time after the dealer buys them (earlier than they expire).

Expiration

SPX choices that expire on the third Friday cease buying and selling the day earlier than the third Friday (the third Thursday). On the third Friday, the settlement value is set by the opening costs of every of the index’s shares. This value is the closing value for the expiration cycle. SPY choices stop buying and selling on the shut of enterprise on expiration Friday.

Observe

All SPX choices expire on the shut of enterprise on expiration Friday. Nonetheless, people who expire on the third Friday of the month don’t.

Settlement

SPY choices are settled in shares. Whenever you train your choices, you may purchase (or promote) shares of the ETF. Money is used to settle SPX choices, so in the event you train and are within the cash, you may obtain money in your brokerage account.

Worth

An SPX possibility can also be about 10 instances the worth of an SPY possibility. For instance, on April 9, 2020, SPX closed at 2,789.82 factors, and SPY closed at $278.20.34

It is vital to know that one SPX possibility with the identical strike value and expiration is roughly 10 instances the worth of 1 SPY possibility. Due to this fact, every SPX level was the identical as $100.5

For instance, suppose SPX was at 2,660 factors, and SPY traded close to $266. One in-the-money SPX possibility offers its proprietor the precise to purchase $266,000 value of the underlying asset ($100 x 2,660).

One SPY possibility offers its proprietor the precise to purchase $26,600 value of ETF shares (10% of $266,000).

Liquidity

SPY has very “tight” bid/ask spreads. This helps planning as a result of one has a fairly might concept of the execution value. It additionally allows using market orders that are simpler and might execute a lot faster than restrict orders. When utilizing market orders, many brokers (I do know Constancy does) supply value enhancements that may end up in favorable execution costs.

SPX, alternatively, has a comparatively extensive bid/ask unfold when in comparison with SPY. Which means that restrict orders are a should. Which means some “bargaining” with the worth and far slower execution. It’s extra time intensive, much less exact and one by no means actually is aware of in the event that they obtained the very best value.

Some merchants want ETFs like SPY on account of higher liquidity. What they typically neglect is the truth that Index choices are 10 instances greater product, so 20 cents unfold on RUT is equal to 2 cents unfold on IWM. For instance, unfold of 10.00/10.50 on RUT could be equal to 1.00/1.05 on IWM. The slippage on RUT is often not more than 10-15 cents which is 1-1.5 cents on IWM.

Commissions

Shopping for much less contracts means a big distinction in commissions. For instance: in the event you purchase one lot of 10 strike SPX Iron Condor, you’ll commerce 8 spherical journey contracts. At $1/contract, that is $8 or 0.8% of the $1,000 margin. Purchase 10 a number of 1 strike SPY Iron Condor – and the commissions soar to $80 or 8% of the $1,000 margin.

Tax Therapy Variations

Right here there’s a substantial plus to Index choices. The IRS treats these indexes in a different way from shares (or ETFs).

The Index choices get particular Part 1256 remedy which allows the investor to have 60% of a acquire as long run (at a 15% tax price), and the opposite 40% handled as brief time period (on the common 35% brief time period capital good points price) even when the place is held for lower than a yr.

In contrast, the ETFs are handled as bizarre shares, and thus if held lower than a yr, all good points are taxed on the much less favorable 35% short-term capital good points price.

Thus the Index choices may be higher from a tax standpoint. It is best to in fact seek the advice of together with your tax advisor to see how these tax implications could or will not be vital in your scenario.

Verdict: SPX tax remedy is considerably higher than SPY. SPY has a bonus in LEAPS, however from a sensible perspective, it may well’t even come near the benefits provided SPX. Bear in mind, it isn’t what you make it is what you retain that issues.

Which Is Proper For You?

The belongings inside SPX don’t commerce, so there are not any shares available for purchase or promote. The choices are written in order that merchants can wager on the S&P 500’s value actions. SPX features as a theoretical index with a value calculated as if it have been a real index.

Observe

The five hundred particular shares within the index are rebalanced as soon as per quarter in March, June, September, and December.6 It is best to look ahead to these instances when buying and selling choices, as there may be new alternatives to enter and exit positions.

This implies it has precisely the variety of shares of every of the five hundred shares. So, whereas the SPX itself could not commerce, each futures contracts and choices based mostly on the index do. For this reason SPX choices are settled in money.

The SPY choices are settled in shares as a result of shares are being traded on an trade. Due to this fact, the choices contracts are written so that you just take possession of shares whenever you train your possibility.

Which choices are greatest for you relies upon upon your technique and objectives. If you wish to take possession of shares to carry or commerce once more, SPY may work greatest. If you happen to’d moderately commerce for worth and obtain money in your account, SPX is a wonderful selection.

Buying and selling SPY choices does convey some extra danger. For instance, on the Monday following expiration, you find yourself proudly owning shares. You may owe the worth of these shares on the expiry time, not the worth on Monday. So if the worth for the shares strikes decrease on Monday, you are paying greater than they’re value on that day. Nonetheless, if the worth strikes greater, you pay lower than the present market value.

The Backside Line

The 2 key variations between SPY vs. SPX choices are that they’re both American or European fashion, and SPY choices are on an ETF whereas SPX choices are on the costs of the index itself. It is best to perceive the distinction this makes for exercising your choices. Moreover, the distinction in worth (and settlement) makes how a lot capital it’s a must to purchase the choices essential.

SPX clearly wins the “project danger” battle, the “buying and selling prices” battle and the “taxable account” battle. It loses on flexibility and comfort. For people who commerce choices in IRAs and ROTHs, SPX needs to be very severely thought of. Typically it is higher to pay a bit of and NOT be sitting on a time-bomb.

For these with taxable accounts the tax benefits afforded SPX dwarfs any enhance in prices. In the long run it comes down to 1’s willingness to spend additional effort and time to attain tax financial savings..

If in case you have extra capital to spare and do not require dividends, SPX may be a sensible choice. Then again, SPY may be a more sensible choice in the event you’re a bit brief on funds and might use the dividends.

Mark Wolfinger has been within the choices enterprise since 1977, when he started his profession as a ground dealer on the Chicago Board Choices Trade (CBOE). Since leaving the Trade, Mark has been giving buying and selling seminars in addition to offering particular person mentoring through phone, e mail and his premium Choices For Rookies weblog. Mark has printed 4 choices buying and selling books. His Choices For Rookies e-book is a traditional primer and a should learn for each choices dealer. Mark holds a BS from Brooklyn School and a PhD in chemistry from Northwestern College.

Associated articles