By RoboForex Analytical Division

The GBP/USD pair declined to 1.3149 on Friday, hovering close to a seven-month low. The sell-off was triggered by the federal government’s abrupt abandonment of plans to lift revenue tax charges forward of the Autumn Assertion on 26 November.

In line with the Monetary Instances, Prime Minister Keir Starmer and Chancellor Rachel Reeves have scrapped the beforehand debated will increase to primary and better tax charges. As an alternative, they’ll search extra oblique measures to deal with a funds deficit estimated at £30 billion.

This coverage reversal has sparked vital market nervousness over the brand new cupboard’s fiscal self-discipline and long-term technique, resulting in a broad sell-off in sterling-denominated property and exerting upward stress on authorities bond yields.

Furthermore, latest macroeconomic knowledge have been weak, additional compounding the political unease. Third-quarter financial progress was muted, with month-to-month GDP contracting in September. This follows earlier studies displaying unemployment rising to a four-year excessive and wage progress slowing to its weakest tempo since early 2022. Consequently, market expectations for a Financial institution of England fee minimize in December have intensified.

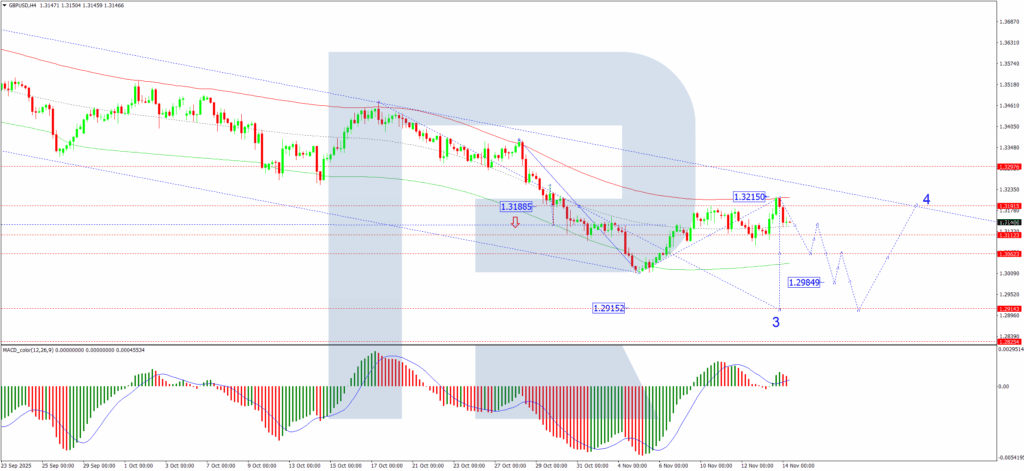

Technical Evaluation: GBP/USD

H4 Chart:

On the H4 chart, GBP/USD has accomplished a corrective wave at 1.3215. A decline in direction of 1.3062 is anticipated, prone to be adopted by a minor rebound to 1.3131. This stage is predicted to kind resistance inside a brand new consolidation vary. A subsequent downward breakout from this vary would sign a resumption of the first downtrend, opening the trail in direction of 1.2985, with an extra potential decline to at the very least 1.2915. This bearish situation is supported by the MACD indicator. Its sign line, whereas above zero, has diverged bearishly from its histogram, suggesting the latest corrective bounce has ended and a brand new downward impulse is forming.

H1 Chart:

On the H1 chart, the pair has fashioned a consolidation vary round 1.3153. We count on an preliminary decline to 1.3090, adopted by a technical retracement to retest the 1.3153 stage from under. This retest is prone to current a promoting alternative earlier than the downtrend extends in direction of 1.3013. The Stochastic oscillator aligns with this view. Its sign line is deep in oversold territory on the 20 stage, which, reasonably than suggesting a rebound, sometimes signifies sustained downward momentum in a robust pattern.

Conclusion

The pound stays below heavy stress, caught between political missteps that undermine fiscal credibility and a deteriorating financial backdrop that factors to financial easing. Technically, the pair maintains a transparent bearish construction. Any near-term stability is prone to show short-term, with the trail of least resistance pointing in direction of a take a look at of help at 1.2985 and doubtlessly 1.2915.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s specific opinion. This evaluation will not be handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- GBP/USD Mired at Seven-Month Lows Amid Political and Fiscal Issues Nov 14, 2025

- EUR/USD Holds Regular as US Authorities Shutdown Ends Nov 13, 2025

- Oil costs fell sharply following OPEC’s revised expectations. The US authorities shutdown has ended Nov 13, 2025

- Traders started actively shopping for “blue chips.” WTI crude oil costs rose to $61 per barrel Nov 12, 2025

- Pound Succumbs to Strain from Weak Labour Knowledge Nov 12, 2025

- USD/JPY Climbs to Contemporary 9-Month Excessive Nov 11, 2025

- The US politicians are near a funding settlement, growing the possibilities of ending the federal government shutdown this week Nov 10, 2025

- Gold Climbs to Two-Week Excessive Nov 10, 2025

- Banxico cuts rate of interest to 7.25%. Norges Financial institution holds the speed at 4% Nov 7, 2025

- USD/JPY Declines as Protected-Haven Demand Bolsters the Yen Nov 7, 2025