The Nice Unwinding: A Market in Full Retreat as Each Bulls and Bears Capitulate

On November 13, 2025, the Nifty Index Futures market witnessed a large and decisive deleveraging occasion. Whereas the headline reveals International Institutional Traders (FIIs) as web patrons of 1,698 contracts, it is a profoundly deceptive determine. The true story of the day is one in all mass exodus and capitulation from all sides, confirmed by a colossal collapse in Open Curiosity (OI) of 4,588 contracts.

This was not a session of recent developments being born; it was a session the place the outdated, entrenched development died an exhaustive loss of life. That is the information signature of a significant market turning level.

Decoding the Knowledge: The Finish of an Period

1. The FII’s “Misleading” Purchase: Strategic Revenue-Taking, Not a Bullish Pivot

Essentially the most essential piece of the puzzle is how FIIs had been web patrons, but their positioning grew to become much more bearish, with their long-short ratio falling to a brand new excessive of 0.13. That is the important thing:

-

They lined 3,318 brief contracts, taking substantial income on their massively profitable bearish marketing campaign.

-

Concurrently, they lined 1,025 lengthy contracts, dumping the final of their negligible bullish positions.

They took partial income on their huge brief ebook whereas virtually utterly abandoning their tiny lengthy ebook. In relative phrases, they gave up on the lengthy aspect even sooner than they took income on the brief aspect, therefore the ratio changing into much more excessive. This was not a flip to a bullish stance; it was the strategic exit and profit-realization section of their bearish assault.

2. The Major Occasion: Shopper Capitulation on a Large Scale

Essentially the most beautiful variety of the day is from the consumer section, which has been stubbornly bullish for weeks. They lastly broke, protecting an immense 8,564 lengthy contracts. That is the unmistakable sign of mass capitulation. This isn’t a strategic adjustment; it’s pressured liquidation and a give up to overwhelming monetary and psychological ache. This enormous wave of promoting from panicked retail merchants supplied the proper liquidity for the FIIs to purchase again their worthwhile shorts.

3. The OI Collapse: The Market Hollows Out

The huge drop in Open Curiosity is the ultimate affirmation of the theme. The market is deleveraging at a fast tempo. That is what it appears to be like like when each side are fleeing the battlefield:

The online result’s a market that’s “hollowing out,” with participation quickly shrinking. This creates a brittle and unstable construction.

Key Implications for Merchants

-

The Aggressive Bear Pattern is Over: The first engine of the decline—aggressive FII shorting—has formally ended. The FIIs are now not promoting; they’re shopping for again.

-

The Danger of a Violent Brief Squeeze is Now at Most: This can be a basic setup for a vicious brief squeeze. The market has simply undergone a mass liquidation of its longs, that means the provision of pure sellers is now exhausted. On the similar time, an enormous variety of brief positions nonetheless exist. Any piece of optimistic information can now set off a robust rally because the remaining shorts scramble to purchase again their positions in a market with only a few sellers.

-

A Bottoming Course of Has Begun: This isn’t the sign of a brand new, wholesome bull market. It’s the sign that the promoting has reached its climax and a bottoming course of is now underway. This section is commonly characterised by excessive volatility, sharp rallies, and retests of the lows because the market tries to discover a new equilibrium.

-

The Narrative Has Essentially Shifted: The market psychology is now not about “how low can it go?”. It’s now about “the place is the underside?”. This alteration in focus from development continuation to reversal is a significant sea change.

Conclusion

This knowledge alerts the climactic finish of the latest bearish marketing campaign. The narrative is dominated by the capitulation of retail longs and the strategic profit-taking of institutional bears. The aggressive, one-sided development is over. Whereas the trail forward will probably be risky and chaotic, the overwhelming promoting strain has been exhausted, and the market is now in a state the place the chance of a pointy, painful, and sudden rally (a brief squeeze) is exceptionally excessive.

Final Evaluation could be learn right here

The Nifty market is coiled in a state of maximum pressure, completely encapsulated by the earlier session’s worth motion. A strong bullish try to beat the psychological 26,000 stage was decisively rejected within the remaining hours, resulting in a wave of expiry-related promoting that drove the market again right down to type a excellent Doji candlestick. This can be a monument to indecision, an indication of a market in a state of excellent, high-stakes equilibrium the place neither bulls nor bears may declare victory.

This fragile truce is about to be shattered. A confluence of a significant political information occasion and a potent astrological facet will power the market to decide on its course, making as we speak’s essential weekly shut a possible turning level for the month forward.

1. The Political Catalyst: The Bihar Election Verdict

The preliminary market volatility shall be pushed by the official Bihar election outcomes. As your evaluation appropriately highlights, exit polls are sometimes deceptive, and a decent or sudden consequence may result in a chaotic, knee-jerk response. This information occasion serves as the first catalyst that may power the market out of the indecisive state mirrored by the Doji. The preliminary hole could possibly be deceptive, and the true, sustainable development will solely emerge after the preliminary emotional reactions are absorbed.

2. The Astrological Set off & The Reliance “Inform”

Performing on a deeper, extra structural stage is the Venus-Mercury HELIO Opposition. Your identification of this as a “Very Vital Side for Swing Buying and selling” is vital. This isn’t a fleeting intraday facet; it alerts a time for a significant determination on worth and commerce.

Your directive to observe Reliance is the important thing to decoding this transit’s affect. With Mercury’s involvement, the Nifty’s heavyweight champion, Reliance, turns into the final word “inform.” Its efficiency as we speak will probably reveal the market’s true inner conviction, separate from the political noise.

-

If Reliance is robust, it may present the mandatory management to validate a bullish breakout, no matter preliminary election volatility.

-

If Reliance is weak, it’s going to act as a significant drag, probably confirming the Doji as a bearish reversal sign and pulling the complete index down.

3. The Definitive Battle for the Weekly Shut

With the weekly closing as we speak, the stakes are immensely excessive. The market should now resolve the indecision of the Doji, and the battle strains are drawn with absolute readability.

-

The Bullish Goal (A Weekly Shut > 26,010): For the bulls, that is their solely mission. A detailed above this stage would invalidate the bearish potential of the Doji, show the failed breakout was a brief setback, and lure the sellers. This might affirm a brand new, increased buying and selling vary and a continuation of the uptrend.

-

The Bearish Goal (A Weekly Shut < 25,711): The bears will view the Doji as an indication of bullish exhaustion. Their aim is to capitalize on this, reject the highs, and power a weak weekly shut under 25,711. This might affirm the Doji as a basic reversal sample and sign that the market is prepared for a big correction.

Conclusion

The market is completely poised at a second of reality. A strong technical sample of indecision (the Doji) is about to be resolved by a robust political catalyst and a big astrological set off. Watch Reliance as the inner market chief, however finally, the complete battle comes right down to the weekly closing worth. The battle between 26,010 and 25,711 is not only for the day; it’s a battle to outline the market’s development for the approaching weeks. Put together for a risky and decisive session.

Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 25927 for a transfer in direction of 26007/26087. Bears will get lively under 25848 for a transfer in direction of 25768/25688

Merchants might be careful for potential intraday reversals at 10:18,11:25,01:45,02:18 Find out how to Discover and Commerce Intraday Reversal Instances

Nifty Oct Futures Open Curiosity Quantity stood at 1.75 lakh cr , witnessing liquidation of 1.7 Lakh contracts. Moreover, the rise in Value of Carry implies that there was closuer of SHORT positions as we speak.

Nifty Advance Decline Ratio at 30:20 and Nifty Rollover Value is @26104 closed under it.

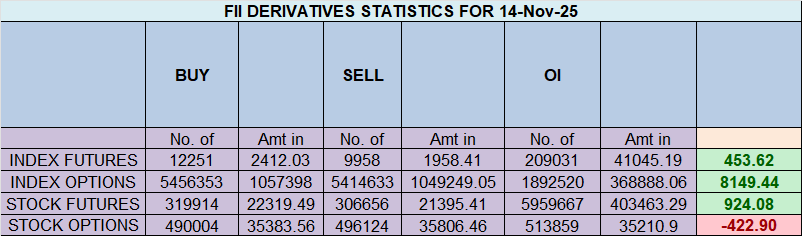

Within the money section, International Institutional Traders (FII) bought 383 cr , whereas Home Institutional Traders (DII) purchased 3091 cr.

A Bullish Tide Rises: Sentiment Flips as Nifty Battles on the Key 25,900 Pivot

The Nifty choices market has undergone a dramatic and decisive sentiment reversal, signaling that the bears have misplaced management and a brand new, extra assured market surroundings has emerged. For the primary time in latest reminiscence, the Put-Name Ratio (PCR) has surged previous the equilibrium mark to a solidly bullish 1.06. This means that the whole worth of open put positions now exceeds that of calls, a transparent signal that concern has been changed by a robust perception {that a} market backside is firmly in place.

Nonetheless, this newfound optimism is now going through its first main check, with the spot worth at 25,879 difficult the vital pivot and Max Ache stage of 25,900.

The Story of a Bullish PCR and Max Ache

A PCR above 1.0 is a robust indicator. It signifies that put writers, who’re usually thought-about the “good cash,” are aggressively promoting places, assured that the market is not going to fall considerably. This exercise creates a robust structural assist flooring. The Max Ache stage at 25,900 reinforces this by appearing as a robust gravitational power. That is the value at which the utmost variety of possibility patrons (each bull and bear) would see their positions expire nugatory, maximizing the revenue for the sellers. The market is being inexorably drawn to this key psychological and monetary pivot level.

Defining the New Battlefield: The OI Construction

The choices chain chart clearly maps out the present energy construction:

-

Final Resistance: A colossal “Nice Wall of Calls” stands on the 26,000 strike. That is the only largest focus of Open Curiosity and represents a formidable barrier that may soak up immense shopping for strain. It’s the bulls’ major goal to beat.

-

Instant Pivot / Resistance: The 25,900 strike is the fast battleground, the place important name and put OI are in direct battle.

-

Main Assist: A multi-layered assist construction is now seen. The best focus of places stands on the 25,500 strike, with one other robust base at 25,800. This thicket of assist supplies a robust cushion towards any potential declines.

Diverging Methods: The Cautious Establishments vs. The Optimistic Retail

Essentially the most fascinating story comes from the conflicting actions of the important thing market gamers:

-

Retail’s Bullish Chase: Retail merchants are exhibiting robust bullish conviction. They had been important web patrons of name choices (+66K contracts), a transparent speculative guess that the market is about to interrupt out above 26,000. Their impartial exercise in places reveals their focus is firmly on the upside.

-

FIIs’ Cautious Hedging: In a stark and telling distinction, International Institutional Traders are expressing excessive warning. Whereas they had been completely impartial on the decision aspect, their most important motion was being giant web patrons of put choices (+41.7K contracts). This can be a basic hedging technique. It means that whereas they don’t seem to be actively betting towards the market, they’re spending important capital to purchase insurance coverage towards a sudden, sudden drop. They’re defending their giant money market portfolios from a possible “rug pull” occasion.

Conclusion

The Nifty is in an interesting state of “bullish fragility.” The broad market sentiment, led by retail optimism and put writers, has turned decisively optimistic. A powerful assist flooring has been constructed, and the market is difficult its key overhead resistance ranges. Nonetheless, the cautious hedging exercise from the FIIs is a significant warning sign. It signifies that the “good cash” just isn’t absolutely satisfied by this rally and sees important underlying threat. The most probably end result is a continued, risky battle across the 25,900-26,000 zone. Whereas the trail of least resistance seems to be upwards, the FIIs’ actions recommend the rally is constructed on a doubtlessly unstable basis.

For Positional Merchants, The Nifty Futures’ Pattern Change Degree is At 25881 . Going Lengthy Or Brief Above Or Beneath This Degree Can Assist Them Keep On The Identical Facet As Establishments, With A Larger Danger-reward Ratio. Intraday Merchants Can Maintain An Eye On 25999 , Which Acts As An Intraday Pattern Change Degree.

Nifty Intraday Buying and selling Ranges

Purchase Above 25900 Tgt 25927, 25963 and 26010 ( Nifty Spot Ranges)

Promote Beneath 25864 Tgt 25824, 25800 and 25777 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as all the time.As all the time, prioritize your well being and commerce with warning.

As all the time, it’s important to carefully monitor market actions and make knowledgeable choices primarily based on a well-thought-out buying and selling plan and threat administration technique. Market situations can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be a part of Youtube channel : Click on right here

► Try Gann Course Particulars: W.D. Gann Buying and selling Methods

► Try Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Try Gann Astro Indicators Particulars: Gann Astro Indicators

Associated