As feared every week in the past, the promoting continued this previous week. All instructed, the S&P 500 fell 1.6% final week, reversing a rally that bumped into some pretty severe technical resistance only a few days earlier. That is what you’d count on the long-overdue to appear to be at its onset.

And but, it’s nonetheless too quickly to say that correction is definitely underway. Proper earlier than closing at a large loss on Friday that will have left the market underneath some important technical help, the bulls pushed again simply sufficient to show a nasty week right into a not-quite-as-bad one. Technically talking, the bigger-picture rally remains to be alive.

It’s hanging by a thread although.

We’ll present you the deal in some element under (as at all times). First although (additionally as at all times), let’s first have a look at the financial information we bought final week regardless of the federal authorities’s ongoing shutdown.

Financial Information Evaluation

What we didn’t get final week was October’s jobs report, marking the second month-to-month jobs report we’ve not heard. For what it’s value although, economists’ had been calling for a lack of 60,000 jobs, which might nearly definitely inflate the unemployment charge as much as 4.5% (from August’s determine of 4.3%). That being mentioned, the ADP employment report advised progress of 42,000 jobs, handily topping estimates of twenty-two,000, reversing September’s lack of 29,000 jobs. Issues could also be barely higher on this entrance than feared.

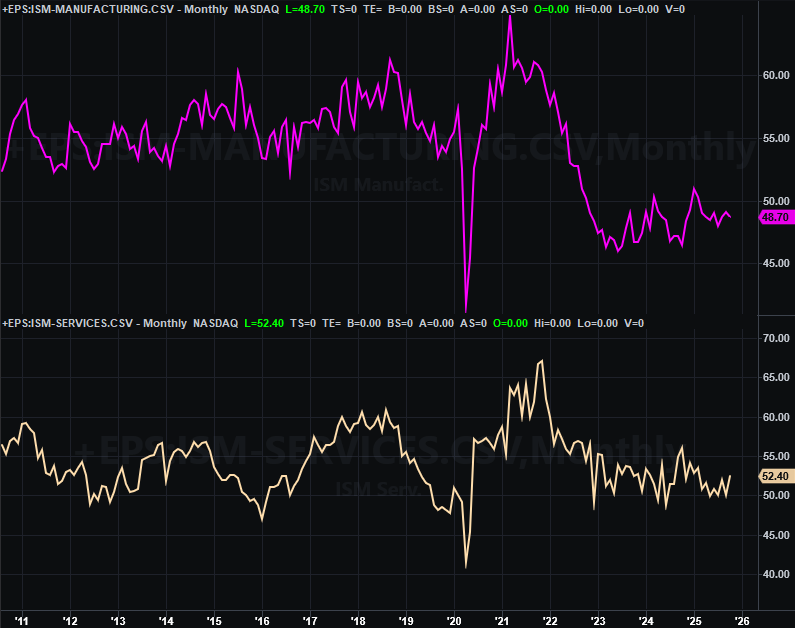

Both manner, we did hear final month’s financial exercise measures from the Institute of Provide Administration. Manufacturing exercise fell barely somewhat than inching increased as anticipated, whereas companies exercise improved measurably greater than the expectation for under a slight enhance.

ISM Providers, Manufacturing Index Charts

Supply: Institute of Provide Administration, TradeStation

Each financial barometers proceed to supply some extent of hope.

All the things else is on the grid.

Financial Information Report Calendar

Supply: Briefing.com, TradeStation

The one objects of any rea curiosity scheduled for this week are going to be of explicit curiosity. That’s Thursday’s have a look at final month’s client inflation adopted by producer inflation information on Friday, once we’re additionally supposed to listen to final month’s retail gross sales figures.

You’ll discover that client in addition to producer inflation charges stay pretty nominal by August, even when they had been edging a bit of increased then. It’s unlikely a lot has modified since then; it definitely doesn’t really feel prefer it has anyway.

Shopper, Producer Inflation Charges

Supply: Bureau of Labor Statistics, TradeStation

Retail gross sales additionally doubtless continued their regular uptrends by final month as effectively, even when a measurable quantity of this enhance displays still-rising costs. Customers seem like doing their half to maintain the financial system buzzing (except the current surge in layoffs proves to crimp spending).

Retail Gross sales

Supply: Census Bureau, TradeStation

In fact, we gained’t be getting any of this info of the federal authorities stays shut down despite the fact that we got September’s client inflation figures so the Social Safety Administration might announce its COLA for 2026.

Inventory Market Index Evaluation

We kick issues off this week with a close-up view of the weekly chart of the S&P 500, because it’s necessary to color the larger image first. As you’ll be able to see, after testing the higher boundary of an intermediate-term channel (yellow, dashed) a pair weeks in the past, final week the index fell again to that channel’s decrease boundary (purple, dashed)… however with out falling underneath it. Technically talking, the advance since Might remains to be totally intact.

S&P 500 Weekly Chart, with MACD and VIX

Supply: TradeNavigator

Right here’s the each day chart of the index, which provides us one other curious element. Notice Friday’s bar. The S&P 500 briefly slipped under the 50-day shifting common line (purple) on Friday earlier than snapping again above that mark; the intraday swing after sliding underneath an necessary technical indicator line is definitely noteworthy, even when not precisely rock-solidly convincing.

S&P 500 Each day Chart, with Quantity and VIX

Supply: TradeNavigator

And the each day chart confirmed us one thing else that was type of fascinating… form of. That’s the form of the volatility index, or VIX, on the backside of the graph. It began to check an necessary technical ceiling at 23.9 (white, dashed) earlier than peeling again, mirroring the transfer made by the S&P 500 itself. Testing this resistance is an efficient first bearish step, however clearly the bears didn’t get the job completed on both spot on the chart.

The NASDAQ Composite’s charts look about the identical, and inform the identical fundamental story. We had been involved two weeks in the past that the index’s encounter with a few well-established resistance traces (purple and light-weight blue, dashed) would set the stage for some corrective profit-taking. Final week’s 3.0% stumble — the largest weekly loss for the NASDAQ since April — underscores this vulnerability.

NASDAQ Composite Weekly Chart, with MACD and VXN

Supply: TradeNavigator

Nonetheless, because the weekly chart additionally exhibits (and the each day chart under will element), the composite is discovering some technical help proper the place it’s have to. On the similar time, the NASDAQ’s volatility index – the VXN – additionally examined an necessary technical ceiling at 28.5 with out really shifting above it. The bears are prepared. They’re simply not committing sufficient to push the composite over the sting. On this similar vein, discover on the each day chart that the NASDAQ solely needed to kiss its 50-day shifting common line (purple) at 22,665 for the index to reverse course fairly convincingly even when it did slip a bit under the rising help line (yellow, dashed) that’s been steering it increased since Might. Once more, the bears are prepared.

NASDAQ Composite Each day Chart, with Quantity and VXN

Supply: TradeNavigator

The patrons are nearly definitely going to attempt to construct on Friday’s intraday swing headed into the brand new buying and selling week. And if for some purpose the federal government shutdown finish within the week forward, that can present them with loads of inspiration.

The market’s technical ceilings which were in place for some time now had been affirmed final week although. The indexes may take a look at them once more quickly, however someway it nonetheless seems to be, appears, and feels just like the market’s susceptible to a correction right here. An finish to the shutdown may additionally find yourself being a “promote the information” type of second.

The excellent news is, these traces within the sand are clearly, and have confirmed themselves as effectively. That’s principally the 50-day shifting common traces, or the straight-line help close to the 50-day averages. That simply makes any break underneath all of them the extra significant. Conversely, the percentages of a meltup — a break above the established ceilings examined and verified final week — nonetheless appear fairly skinny.

Grasp tight. We would not get solutions this week. We needs to be getting them earlier than later although. One thing simply must pressure the difficulty.