- The AUD/USD weekly forecast exhibits a range-bound momentum as the information from each side counterbalanced the worth motion.

- RBA’s unchanged fee resolution couldn’t impress patrons, whereas sellers shied amid a weaker dollar.

- Merchants sit up for the US and AUS inflation figures to discover a directional bias.

The AUD/USD weekly forecast exhibits the pair holding regular amid combined Australian and US financial indicators, preserving markets cautious forward of key inflation releases. After a softer financial indicator weakened the dollar, hopes of near-term financial easing emerged once more.

–Are you curious about studying extra about XRP worth prediction? Test our detailed guide-

In the meantime, the UoM Client Sentiment revealed the index falling to 50.3 from 53.6 in October, signaling rising considerations about fiscal uncertainty. The report steered one-year inflation expectations climbing to 4.7%, with the five-year expectations easing to three.6%. Whereas the Challenger job cuts came visiting 153,000 non-public sector layoffs.

In Australia, the Reserve Financial institution of Australia stored the money charges unchanged at 3.6% in November. In the meantime, Governor Michele Bullock said that the board didn’t talk about coverage easing amid persistent inflation stress. The Australian CPI climbed by 1.3% QoQ from 0.7%, suggesting the chances of a chronic restrictive coverage. Nonetheless, the weaker Chinese language commerce surplus and declining exports restrict Aussie upside.

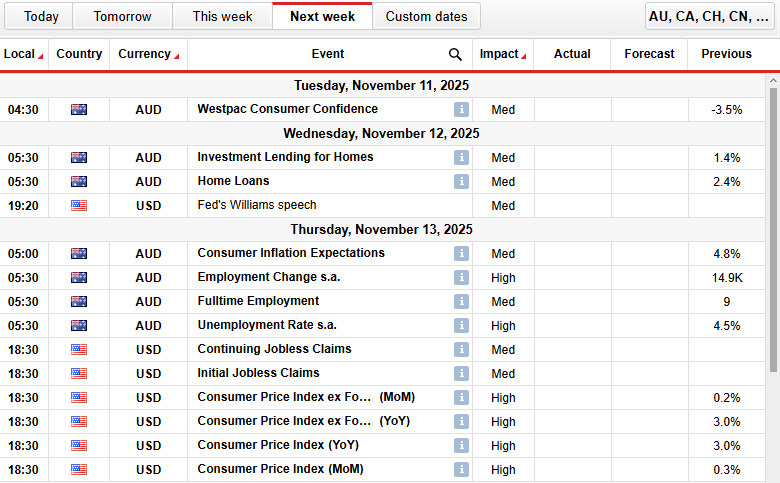

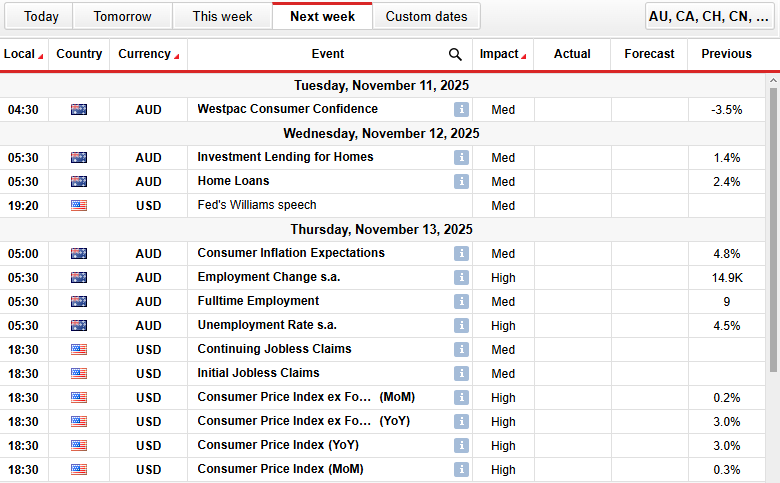

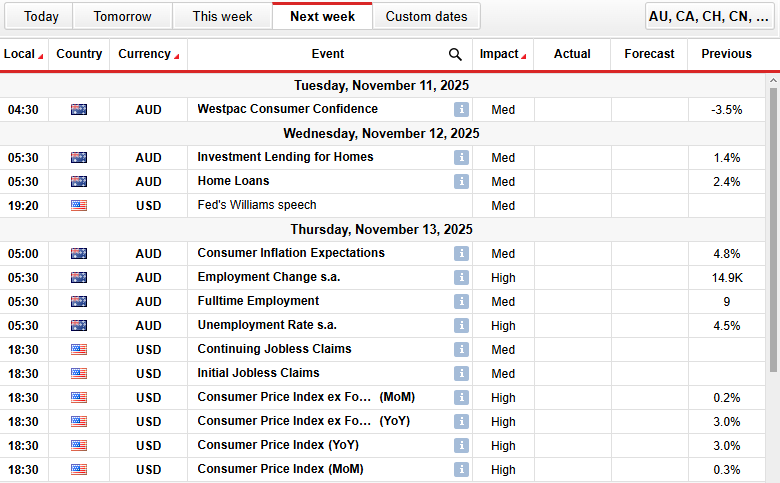

AUD/USD Key Occasions Subsequent Week

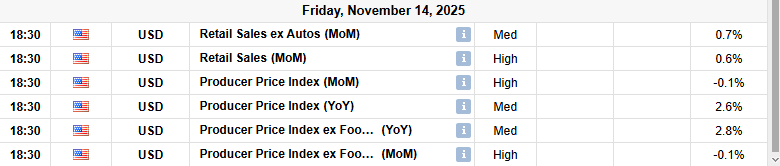

The most important occasions within the coming week embody:

- US Client Worth Index ex Meals and Power (MoM)

- US Client Worth Index ex Meals and Power (YoY)

- US Client Worth Index (YoY)

- US Client Worth Index (MoM)

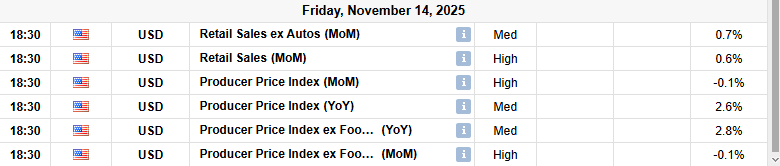

- US Retail Gross sales (MoM)

- US Producer Worth Index (MoM)

- AUD Employment Price s.a.

- AUD Employment Change s.a.

- AUD Client Inflation Expectations

Within the coming week, merchants anticipate the CPI information from each side as a key market driver, as central financial institution actions are primarily linked with inflation.

AUD/USD Weekly Technical Forecast: Sandwiched by 50- and 200-DMA

The AUD/USD day by day chart reveals the pair underneath reasonable promoting stress because it trades close to 0.6500 after repeated makes an attempt to remain above the short-term resistance ranges. The worth stays beneath the 20- and 50-day MA, reflecting sellers in management. Whereas the pair consolidates above the 200-day MA.

–Are you to study extra about low unfold foreign exchange brokers? Test our detailed guide-

The RSI is close to 43, indicating subdued momentum. A break above 0.6560 might prolong positive factors in direction of 0.6615 and 0.6650. Conversely, a drop beneath 0.6450 might set off additional draw back in direction of 0.6400 and 0.6300.

Assist Ranges

Resistance Ranges

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you possibly can afford to take the excessive threat of shedding your cash.