A Market on the Brink: FIIs Launch an All-Out Bearish Assault In opposition to a Wall of Retail Optimism

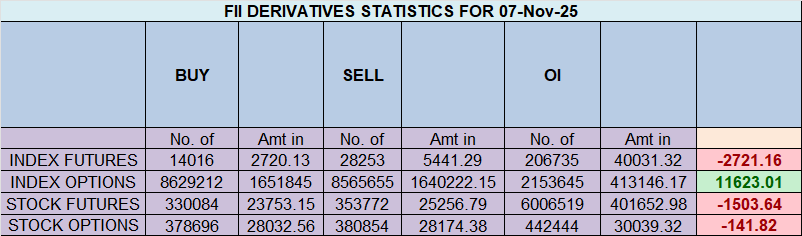

The Nifty Index Futures information from November 7, 2025, is a portrait of a market at warfare. This was not a session of straightforward trend-following; it was a high-stakes, head-on collision between two highly effective market forces with diametrically opposed convictions. Overseas Institutional Buyers (FIIs) unleashed a torrent of promoting, shorting an enormous 15,054 contracts value a staggering ₹2,884 crore.

Critically, this institutional “shock and awe” marketing campaign was met with an equal and reverse power from retail, leading to a colossal surge in Open Curiosity (OI) of 13,948 contracts. That is the final word signal of a market at its breaking level.

Decoding the Knowledge: Two Armies on Reverse Sides of a Battlefield

This information reveals a market in a state of maximum, unsustainable divergence. The rise in open curiosity confirms that this was not a session of squaring up previous positions, however one the place two armies aggressively constructed new positions for a coming battle.

1. The FII “All-In” Bearish Assault:

The FIIs’ actions had been a testomony to most bearish conviction. Their technique was surgical and brutal:

-

They added an infinite 13,987 new brief contracts, actively and aggressively betting on a market collapse.

-

They concurrently liquidated their already minimal lengthy publicity (masking 250 contracts), signaling an entire abandonment of any upside state of affairs.

Their ultimate positioning is likely one of the most excessive on report: at 13% lengthy versus 87% brief, their long-short ratio of 0.15 is at rock-bottom. This isn’t a hedge; it’s an all-in, high-conviction guess that the market is headed for a extreme decline.

2. The Unwavering Retail “Purchase the Dip” Frenzy:

On the opposite facet of this institutional onslaught stood the retail shoppers. Their conduct was a mirror picture of pure bullish optimism:

-

They bravely absorbed all of the FII promoting, including a formidable 7,179 new lengthy contracts.

-

In a transfer of supreme confidence, additionally they lined 1,536 of their present brief positions, successfully eradicating their draw back safety.

Their ultimate positioning is an image of peak optimism. At 67% lengthy versus 33% brief, their long-short ratio of 2.22 is at an excessive excessive. They’re absolutely invested in a continued rally, displaying completely no concern of the institutional promoting wall.

Key Implications for Merchants

-

A Historic and Unstable Divergence: The market is now in its most flamable state. “Good Cash” (FIIs) and “Retail Cash” (Purchasers) have taken colossal, opposing positions. The market can’t show each proper. This stage of pressure is unsustainable and virtually at all times precedes a violent transfer.

-

The Impending Volatility Explosion: The large build-up of open curiosity is like packing gunpowder right into a barrel. The eventual value transfer that resolves this battle is not going to be mild. It is going to be a pointy, high-velocity development designed to inflict most monetary ache on one facet.

-

The “Ache Commerce” is Apparent: A transfer down will set off a cascade of panic-selling from the large base of trapped retail longs. A transfer up will set off a historic brief squeeze in opposition to the massively over-leveraged FII shorts.

-

The Final Contrarian Pink Flag: It is a textbook contrarian sign flashing at most depth. When institutional and retail positioning turns into this extraordinarily polarized, historical past exhibits that the establishments are overwhelmingly more likely to be on the right facet of the approaching transfer.

Conclusion

Disregard small value actions. The one story that issues from this session is the gargantuan buildup in open curiosity fueled by an epic battle between institutional bears and retail bulls. The FIIs have declared warfare in the marketplace’s uptrend, whereas retail merchants have defiantly purchased each contract provided.

The battle strains have been drawn, the positions have reached a historic excessive, and a interval of calm is now the least possible end result. Put together for a significant, trend-defining transfer that may show one facet spectacularly proper and the opposite spectacularly incorrect.

Final Evaluation may be learn right here

The Nifty has flawlessly tracked our analytical map, finishing its downward trajectory to the 25,318 low, thereby attaining our goal zone of 25,345. The market has now arrived at a stage of profound technical and cyclical significance: the 25,345 Gann octave level. That is now not only a value goal; it’s the new battleground, a essential fulcrum upon which the market’s subsequent main development might be determined.

This technical drama is unfolding beneath a extremely potent and unstable celestial sky. With each Mercury and Jupiter—two planets of immense significance to the Nifty—going retrograde, the stage is ready for a interval of traditional retrograde chaos: reversals, re-evaluations, and a dramatic growth in volatility. The indecisive, grinding value motion is probably going over, and the market is getting ready for a collection of high-velocity, trend-defining strikes within the coming week.

The Bearish State of affairs: Breakdown Beneath the Gann Octave

The bears have efficiently pushed the market to their goal, and now they’re positioned to provoke the subsequent section of the decline. Their path ahead is evident:

-

The Breakdown Set off (A Shut Beneath 25,345): This Gann octave level is the definitive line within the sand. A weekly shut beneath this stage could be a significant technical victory for the bears, confirming a structural breakdown. That is anticipated to unlock a quick, downward transfer, with the subsequent logical targets being 25,156 and the key psychological assist at 25,000.

The Bullish Final Stand: Reclaiming the Excessive Floor

For the bulls, the scenario is perilous. To reverse the present downtrend and switch this bearish breakdown into an enormous “bear entice,” they’ve one clear goal:

-

The Bullish Reversal Set off (A Shut Above 25,636): This stage represents the important thing overhead resistance. A decisive transfer and shut above 25,636 would invalidate the complete bearish setup. It might sign that the transfer right down to the Gann level was a ultimate capitulation low, not a continuation. Such a transfer would possible set off a violent brief squeeze because the trapped bears rush to cowl their positions.

Conclusion

The Nifty is completely poised for a significant, volatility-driven transfer. The arrival on the 25,345 Gann octave level has outlined the central battlefield. The highly effective twin retrograde cycles of Mercury and Jupiter are offering the explosive gas. The course of the market’s subsequent main development might be decided by which facet can seize management of the battlefield.

The parameters for the approaching week at the moment are crystal clear: the bears personal the development so long as the market stays beneath 25,345, whereas a transfer above 25,636 would sign a dramatic and highly effective bullish reversal. Count on something however a quiet market.

Nifty Commerce Plan for Positional Commerce ,Bulls will get lively above 25562 for a transfer in direction of 25642/25722. Bears will get lively beneath 25481 for a transfer in direction of 25401/25321

Merchants might be careful for potential intraday reversals at 09:52,10:45,11:41,12:20,01:36 Find out how to Discover and Commerce Intraday Reversal Instances

Nifty Oct Futures Open Curiosity Quantity stood at 1.85 lakh cr , witnessing addition of 8.7 Lakh contracts. Moreover, the rise in Value of Carry implies that there was addition of SHORT positions as we speak.

Nifty Advance Decline Ratio at 30:20 and Nifty Rollover Value is @26104 closed beneath it.

Within the money phase, Overseas Institutional Buyers (FII) purchased 4581 cr , whereas Home Institutional Buyers (DII) purchased 6674 cr.

Nifty at a Crossroads: Establishments Guess on Volatility as Retail Leans Bearish

The Nifty choices market is in a state of excessive pressure and profound divergence, coiling like a spring on the essential 25,500 pivot. A big enchancment within the Put-Name Ratio (PCR) to 0.88 signifies that the extraordinary concern of current classes has subsided, changed by a tense neutrality. Nevertheless, beneath this calmer floor, the actions of institutional and retail gamers reveal two starkly completely different bets in the marketplace’s future, signaling {that a} main, high-volatility transfer is imminent.

The Market Panorama: A Tentative Steadiness

The headline information suggests a market discovering its footing. The PCR of 0.88 is a considerable restoration from the deeply bearish ranges seen beforehand, displaying that put writers are extra lively and the one-sided concern has evaporated. The Max Ache stage is pegged at 25,500, which acts as a robust gravitational middle for the index. With the market hovering close to this level, it’s completely positioned on the epicenter of economic strain for the utmost variety of possibility consumers.

Decoding the Participant Knowledge: A Basic Divergence

Probably the most telling story comes from the conflicting methods of the market’s two largest gamers:

-

FIIs Guess on an Explosion: Overseas Institutional Buyers have positioned an interesting and highly effective guess. By being internet consumers of each calls (internet +32K) and places (internet +31K), they aren’t betting on a particular course. That is the signature of a guess not on course, however on an enormous growth in volatility. It’s a macro-level “lengthy strangle” technique, indicating that FIIs consider the market is about to make an enormous, decisive breakout in both course. They’re positioning themselves to revenue from chaos.

-

Retail Bets on a Stalemate: In stark distinction, retail merchants are taking a cautiously bearish stance. They had been vital internet sellers of name choices (internet -62K), betting that any rally will fail and that the market’s upside is capped. On the identical time, they had been internet consumers of put choices (internet +62K), including insurance coverage in opposition to a possible decline. This reveals a cautiously bearish stance; they’re promoting the rally and shopping for insurance coverage, a method that earnings most in a range-bound or declining market.

Defining the Key Battleground:

This institutional-versus-retail battle creates very clear and important value ranges:

-

Final Resistance: The main psychological stage of 26,000 continues to carry an enormous wall of Name OI, serving as the final word ceiling for any rally.

-

Instant Resistance / Pivot: 25,500 – 25,600. This zone, containing the Max Ache stage, is the place retail name sellers are defending their positions. That is the first battleground.

-

Instant Assist: 25,500. This stage can be a essential assist ground, bolstered by a major variety of put writers. A break beneath right here could be a significant victory for the bears.

-

Final Assist: The 25,000 strike stays the ultimate line of protection, holding the most important focus of Put OI.

Conclusion

The Nifty is in a state of misleading calm. The panic has handed, however the market is now wound into a good coil of conflicting bets. The establishments are positioned for a violent breakout, whereas the retail phase is positioned for a continued grind. The market is pinned on the 25,500 fulcrum, and it can’t keep there indefinitely. The FIIs’ volatility guess is essentially the most highly effective sign: the interval of consolidation is probably going a prelude to a major, trend-defining transfer.

For Positional Merchants, The Nifty Futures’ Development Change Degree is At 25903. Going Lengthy Or Quick Above Or Beneath This Degree Can Assist Them Keep On The Similar Facet As Establishments, With A Greater Threat-reward Ratio. Intraday Merchants Can Maintain An Eye On 25535, Which Acts As An Intraday Development Change Degree.

Nifty Intraday Buying and selling Ranges

Purchase Above 25500 Tgt 25530, 25585 and 25630 ( Nifty Spot Ranges)

Promote Beneath 25412 Tgt 25385, 25323 and 25285 (Nifty Spot Ranges)

Wishing you good well being and buying and selling success as at all times.As at all times, prioritize your well being and commerce with warning.

As at all times, it’s important to intently monitor market actions and make knowledgeable selections primarily based on a well-thought-out buying and selling plan and threat administration technique. Market circumstances can change quickly, and it’s essential to be adaptable and cautious in your method.

► Be part of Youtube channel : Click on right here

► Take a look at Gann Course Particulars: W.D. Gann Buying and selling Methods

► Take a look at Monetary Astrology Course Particulars: Buying and selling Utilizing Monetary Astrology

► Take a look at Gann Astro Indicators Particulars: Gann Astro Indicators

Associated