Gold’s latest pullback under $4,000 after reaching $4,400 has many traders questioning if the metals bull market is over. In my latest dialogue with Craig Hemke for Sprott Cash’s Valuable Metals Projections, I defined why this correction may very well be a wholesome setup earlier than the following main rally. Traditionally, these retracements usually happen simply earlier than a strong breakout. Based mostly on present technical patterns, gold might be positioning for a transfer towards $5,200, with silver probably climbing again above $60 as soon as momentum shifts once more.

This kind of consolidation is a pure a part of the emotional investing cycle, the place concern and doubt floor simply earlier than confidence returns. Technical evaluation, sentiment, and intermarket conduct all counsel energy is quietly constructing beneath the floor. For traders centered on long-term traits, these dips usually current alternative quite than danger, because the broader bull cycle in valuable metals continues to develop.

Join my free Investing e-newsletter right here

The matters Craig and I mentioned embody:

- 00:00 Valuable Metals Projections Overview

- 01:36 Gold hits goal, pulls again

- 03:55 Fibonacci ranges and subsequent gold targets

- 05:39 Investor concern and market sentiment

- 08:46 Silver retracement zones and outlook

- 11:28 Parabolic danger and alternative

- 15:04 Gold miners response and emotion

- 16:56 GDX and assist retests

- 18:52 Seasonality for gold and silver

- 20:47 Yr-end rally expectations

Able to be taught extra about what I do to remain calm throughout chaos? Click on the hyperlinks under!

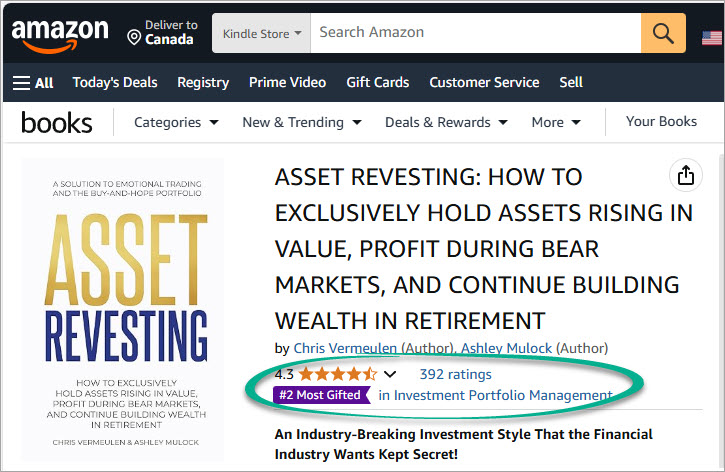

CHRIS VERMEULEN’S PREMIUM ASSET REVESTING SIGNALS:

https://thetechnicaltraders.com/investment-solutions/

Espresso cheers!

Chris Vermeulen

Chief Funding Officer

TheTechnicalTraders.com

Disclaimer: This e-mail is meant solely for informational and academic functions and shouldn’t be construed as personalised funding recommendation. Technical Merchants Ltd. and its associates are not registered funding advisers with the U.S. Securities and Trade Fee or any state regulator. The content material offered doesn’t represent a suggestion to purchase, promote, or maintain any safety, commodity, or monetary instrument. All opinions expressed are these of the authors and are topic to vary with out discover. Any monetary devices talked about could also be held by Technical Merchants Ltd. or its associates on the time of publication, and such positions could change at any time with out discover. Readers are solely chargeable for their very own funding selections. We strongly encourage consulting with a licensed monetary skilled earlier than making any buying and selling or funding selections. Efficiency outcomes referenced could embody each dwell buying and selling knowledge and backtested or hypothetical efficiency. Hypothetical efficiency outcomes have many inherent limitations and don’t replicate precise buying and selling. No illustration is being made that any account will or is prone to obtain income or losses much like these proven. Testimonials and endorsements included on this communication will not be consultant of all customers’ experiences and aren’t ensures of future efficiency or success. We could obtain compensation from affiliate hyperlinks or promotional content material on this communication. Any such compensation doesn’t affect our editorial integrity. By studying or subscribing, you acknowledge that the content material offered is normal market commentary and never tailor-made to any particular person’s monetary scenario. Previous efficiency will not be indicative of future outcomes. Investing includes danger, together with the potential lack of capital.