The investing world is as soon as once more paying shut consideration to Michael Burry, the legendary investor who famously predicted and profited from the 2008 housing market collapse. His newest portfolio strikes, revealed by means of his quarterly 13F submitting, have despatched shockwaves by means of monetary markets and raised critical questions in regards to the sustainability of the present AI-driven inventory market rally.

With roughly $1.1 billion guess in opposition to two of the market’s most outstanding synthetic intelligence shares, Burry seems to be sounding the alarm on what he could view as the following main market bubble.

1. The Investor Who Noticed It Coming

Michael Burry earned his place in monetary historical past by means of his prescient name on the subprime mortgage disaster. Because the founding father of Scion Capital, he was one of many first traders to acknowledge the systemic issues within the housing market.

He took huge quick positions in opposition to mortgage-backed securities. His story was immortalized in Michael Lewis’s e book “The Massive Brief” and the following Oscar-winning movie, the place Christian Bale portrayed his contrarian funding method and deep analytical strategies.

What makes Burry’s funding selections significantly noteworthy is his observe report of figuring out asset bubbles earlier than they burst. He doesn’t comply with the group and infrequently takes positions that appear counterintuitive to prevailing market sentiment.

When Burry makes a major transfer, particularly one as concentrated as his present positioning, institutional traders and retail merchants alike take discover. His investing philosophy facilities on deep elementary evaluation and a willingness to face alone when his analysis contradicts fashionable narratives.

2. The Newest 13F Submitting Revelation

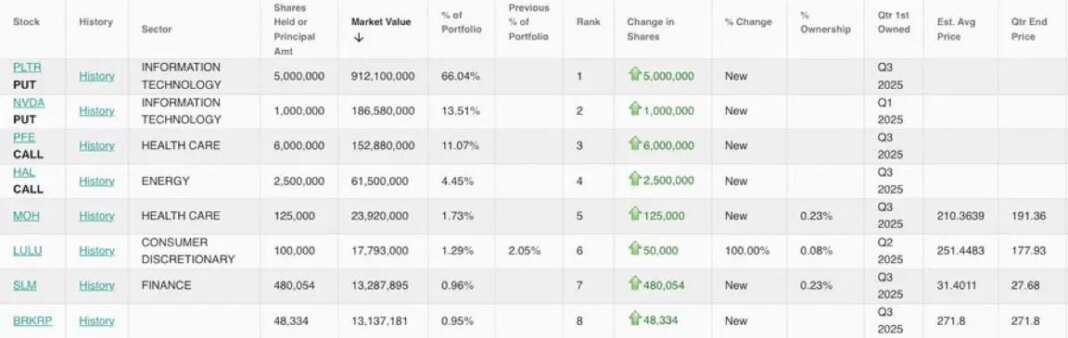

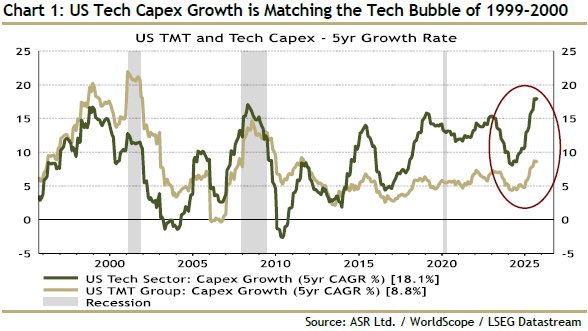

Scion Capital’s most up-to-date 13F submitting with the Securities and Trade Fee revealed a shocking portfolio allocation that has caught the eye of market observers worldwide. The submitting disclosed that Burry has taken substantial put possibility positions on Nvidia and Palantir Applied sciences, two firms on the forefront of the bogus intelligence revolution.

The numbers are staggering of their scale and conviction. Burry bought put choices on a million Nvidia shares, valued at roughly $186.6 million, and put choices on 5 million Palantir shares, value roughly $912.1 million. Mixed, these two positions signify about $1.1 billion in bearish bets, accounting for about 80 p.c of Scion Capital’s whole portfolio. This isn’t a hedge or a minor contrarian place—this can be a concentrated guess that displays deep conviction about future market course.

3. Understanding Burry’s Bearish Wager Towards AI Fundamentals

“These aren’t the charts you might be on the lookout for. You may go about what you are promoting.” – Michael Burry X Put up November 3, 2025.

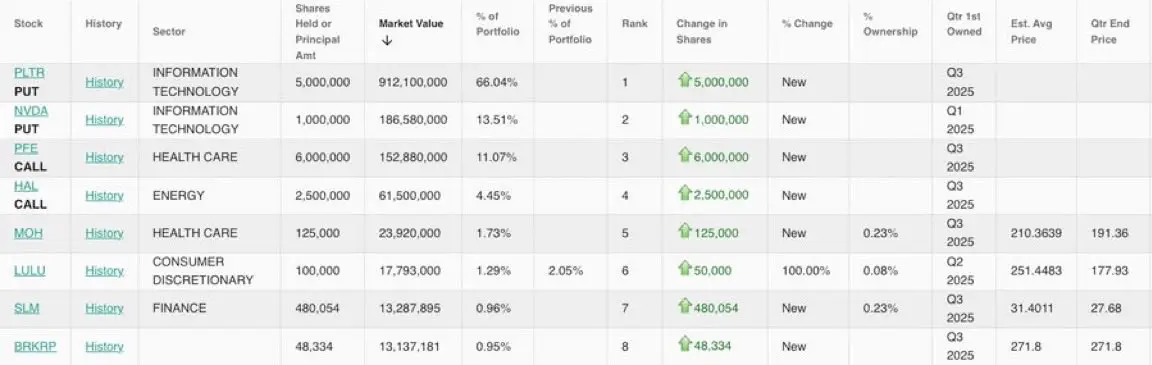

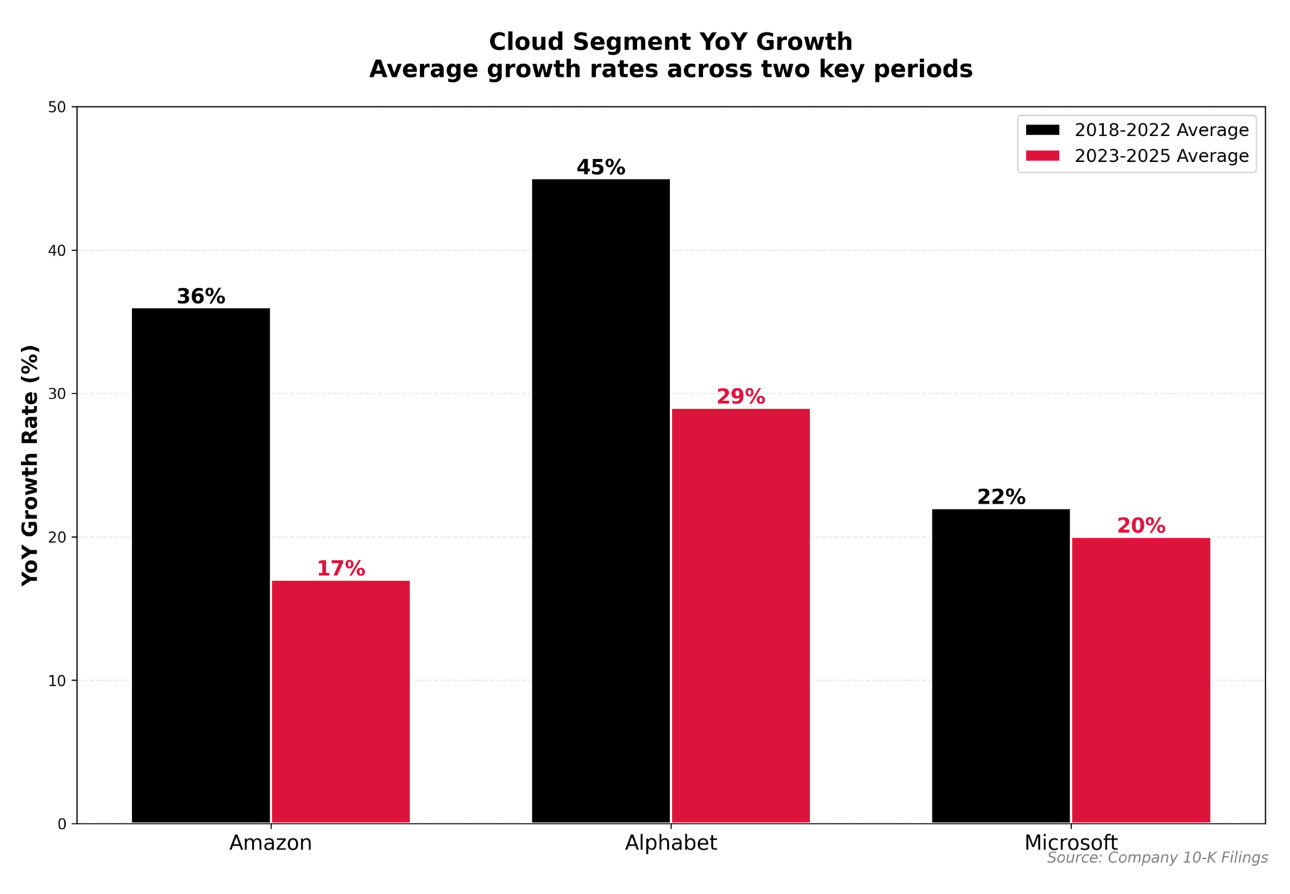

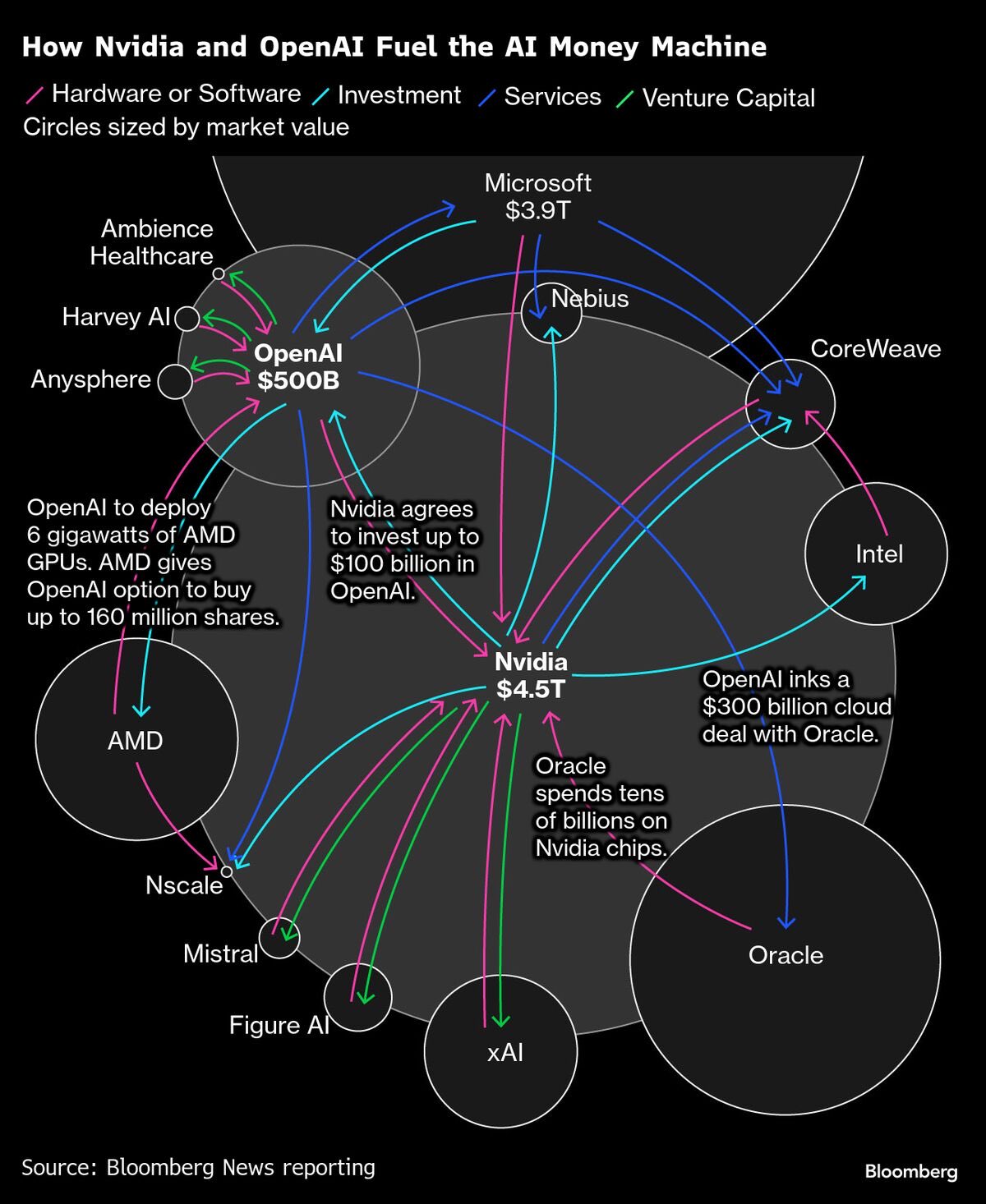

These are the elemental charts of the AI sector that Michael Burry shared on his X publish, which he has based mostly his bearish put choices bets on.

Put choices give the holder the appropriate to promote shares at a predetermined value, making them worthwhile when inventory costs decline. By buying places slightly than immediately shorting the shares, Burry limits his potential losses to the premium paid for the choices whereas sustaining vital upside if these shares expertise sharp declines. This technique gives leverage and outlined danger, permitting him to faucet outstanding positions with out limitless draw back publicity.

The focus in simply two AI shares is especially noteworthy. Palantir represents roughly 66 p.c of his portfolio, whereas Nvidia accounts for about 13.5 p.c. These aren’t diversified bearish bets throughout a number of sectors—they’re explicitly targeted on firms which have turn into synonymous with the AI funding thesis.

Palantir, which gives information analytics platforms and has positioned itself as a pacesetter in AI software program, and Nvidia, the dominant producer of AI chips, have each seen their valuations soar as enthusiasm for synthetic intelligence has swept by means of the markets.

The submitting additionally revealed that Burry maintains some bullish positions, together with name choices on Halliburton and Pfizer, in addition to share positions in Molina Healthcare, Lululemon, and SLM Corp. This demonstrates that he’s not merely bearish on all the market, however as a substitute has particular issues about AI-related valuations.

4. The AI Bubble Issues

The comparability to earlier market bubbles is tough to disregard. Each Nvidia and Palantir have skilled extraordinary appreciation, primarily pushed by the narrative surrounding AI. Nvidia’s inventory value has multiplied a number of instances over as demand for its graphics processing models has exploded amongst firms constructing AI methods. Palantir has equally benefited from positioning itself as important infrastructure for AI implementation throughout authorities and industrial sectors.

The valuations of those firms have reached ranges that some analysts take into account disconnected from conventional metrics. Whereas income and earnings have grown, inventory costs have typically grown sooner, increasing valuation multiples to ranges which have traditionally preceded corrections. The passion round AI has created an setting the place traders have been prepared to pay premium costs based mostly on future progress expectations slightly than present fundamentals.

Burry seemingly sees parallels to earlier know-how bubbles the place revolutionary applied sciences created real enterprise worth but in addition led to unsustainable valuations. The dot-com bubble of the late Nineteen Nineties demonstrated that transformative know-how doesn’t robotically justify any value degree. Many web firms that failed throughout that crash had been engaged on respectable enterprise fashions, however their inventory costs had run too far forward of actuality.

5. What This Means for Buyers

The crucial query for traders is whether or not Burry’s positioning represents prophetic perception or untimely pessimism. His observe report calls for consideration, however timing market corrections is notoriously tough even for essentially the most expert traders. The market can stay irrational longer than traders can stay solvent, because the well-known saying goes, and put choices have expiration dates that add timing stress to the equation.

For particular person traders, Burry’s strikes shouldn’t be interpreted as a directive to promote AI shares or rush to purchase places instantly. His institutional fund operates with completely different constraints, time horizons, and danger tolerances than most particular person portfolios. What his positioning does counsel is that critical traders with confirmed analytical capabilities see significant draw back danger in AI valuations at present ranges.

The broader implication is that market contributors ought to fastidiously consider their publicity to AI-related investments and take into account whether or not present valuations adequately mirror potential dangers. This doesn’t essentially imply avoiding the sector totally, however as a substitute approaching it with applicable warning and place sizing. Recognizing that even transformative applied sciences can expertise vital drawdowns is essential for reaching long-term funding success.

Conclusion

Michael Burry’s huge guess in opposition to Nvidia and Palantir represents one of the vital contrarian positions taken by a outstanding investor in recent times. With roughly 80 p.c of his portfolio positioned to revenue from declines in these AI leaders, he’s making a press release that may’t be ignored about his view of present market circumstances.

Whether or not this proves to be one other prescient name that cements his legacy or one other latest misstep from a legendary investor stays to be seen. What’s sure is that his positioning serves as a warning that valuations within the AI sector have reached ranges that refined traders view as unsustainable.

For market contributors, this represents a chance to reassess their very own assumptions and guarantee their portfolios are positioned appropriately for no matter comes subsequent. The investor who noticed the housing crash coming is now warning about AI—and prudent traders could be clever to know not less than why.