- The GBP/USD forecast reveals weak spot amid the UK fiscal uncertainty.

- The US greenback edged up as Chair Powell got here up with a cautious tone for a December reduce.

- Merchants await the BoE rate of interest choice and US NFP knowledge subsequent week.

The GBP/USD weekly forecast displays a persistent bearish bias, closing the week at 1.3140. The pound sterling confronted strain amid renewed UK financial considerations and a resilient buck. The US greenback was boosted as Fed Chair Powell expressed uncertainty a couple of December fee reduce, cautioning the markets.

-Are you curious about studying concerning the finest AI buying and selling foreign exchange brokers? Click on right here for details-

Nonetheless, the policymakers remained divided concerning the Fed reduce. The Cleveland Fed President Hammack expressed her lack of help for the latest Fed reduce. In the meantime, the Atlanta Fed’s Bostic famous the battle between the twin mandates of value stability and employment.

On the UK aspect, the pound was subdued because the markets grappled with the UK’s fiscal scenario. The Workplace for Funds Duty (OBR) lowered the productiveness forecast by 0.3%, aiming for a possible £21 billion improve within the price range deficit by 2030.

In the meantime, the Institute for Fiscal Research (IFS) estimated a fiscal hole of £22 billion. Chancellor Rachel Reeves is pressured to extend taxes or borrow extra within the November price range to curb this. The investor sentiment dampened barely on account of Reeve’s place. Nonetheless, PM Keir Starmer backed her, easing the scenario. In the meantime, weak inflation knowledge and rising expectations for additional easing by the BoE additional pressured the pound.

GBP/USD Key Occasions Subsequent Week

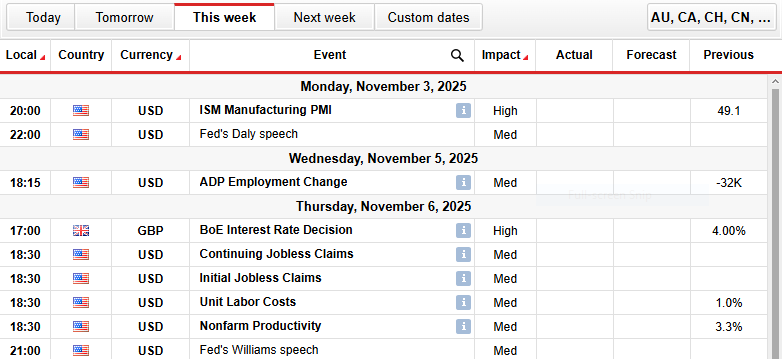

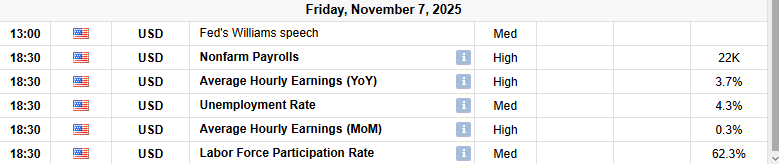

The foremost occasions within the coming week embrace:

- USD ISM Manufacturing PMI

- Fed’s Daly Speech

- GBP BoE Curiosity Charge Resolution

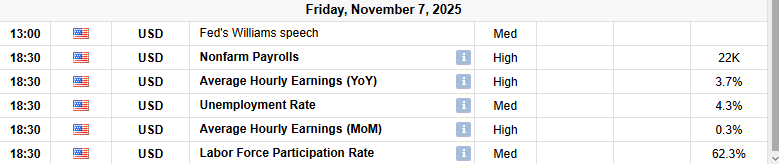

- USD Nonfarm Payrolls

- USD Common Hourly Earnings (YoY)

- USD Common Hourly Earnings (MoM)

Subsequent week, merchants anticipate the Fed’s Daly speech, the ISM manufacturing PMI, and ADP Employment. Nonetheless, the nonfarm payrolls knowledge stays the first catalyst for the markets, because the markets missed the earlier knowledge amid the shutdown.

Then again, merchants sit up for BoE rate of interest choices for insights into potential fee cuts forward. Markets are pricing in no change within the benchmark charges. Therefore, the vote cut up would be the key to look at.

GBP/USD Weekly Technical Forecast: No Respite for Bulls Till 200-DMA

The GBP/USD stays beneath strain, buying and selling round 1.3140 after pulling again from 1.3370 earlier this week. The pair is properly under the 20-day MA close to 1.3338 and the 50-day MA round 1.3432, reflecting the draw back strain. In the meantime, the 200-day MA round 1.3244 is a key help zone. The RSI at 40, above the oversold area, signifies that the draw back strain might keep intact except a reversal sign emerges.

-Are you curious about studying concerning the foreign exchange indicators? Click on right here for details-

A decisive break above 1.3330 might alter the pattern and open room for positive factors towards 1.3400 and 1.3460. Conversely, a sustained drop under 1.3100 might lengthen the draw back in the direction of 1.3050 and 1.2980.

Help Ranges

Resistance Ranges

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you may afford to take the excessive danger of shedding your cash.