Good day fellow merchants. On this technical article we’re going to check out the Elliott Wave charts charts of CADJPY Foreign exchange pair revealed in members space of the web site. As our members know CADJPY is bullish towards the 105.166 pivot and we favor the lengthy aspect. Not too long ago the pair made a transparent three-wave correction. The pull again accomplished as Elliott Wave Double Three sample and made rally as anticipated. On this dialogue, we’ll break down the Elliott Wave sample and forecast.

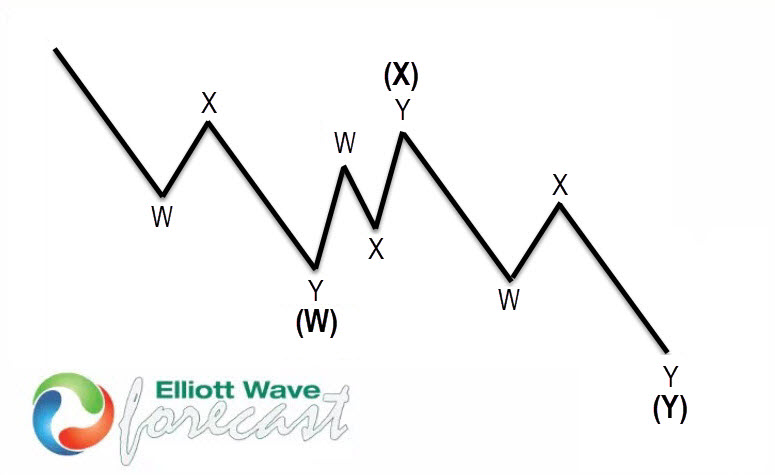

Elliott Wave Double Three Sample

Double three is the widespread sample out there , also called 7 swing construction. It’s a dependable sample which is giving us good buying and selling entries with clearly outlined invalidation ranges.

The image under presents what Elliott Wave Double Three sample appears to be like like. It has (W),(X),(Y) labeling and three,3,3 inside construction, which suggests all of those 3 legs are corrective sequences. Every (W) and (Y) are made of three swings , they’re having A,B,C construction in decrease diploma, or alternatively they’ll have W,X,Y labeling.

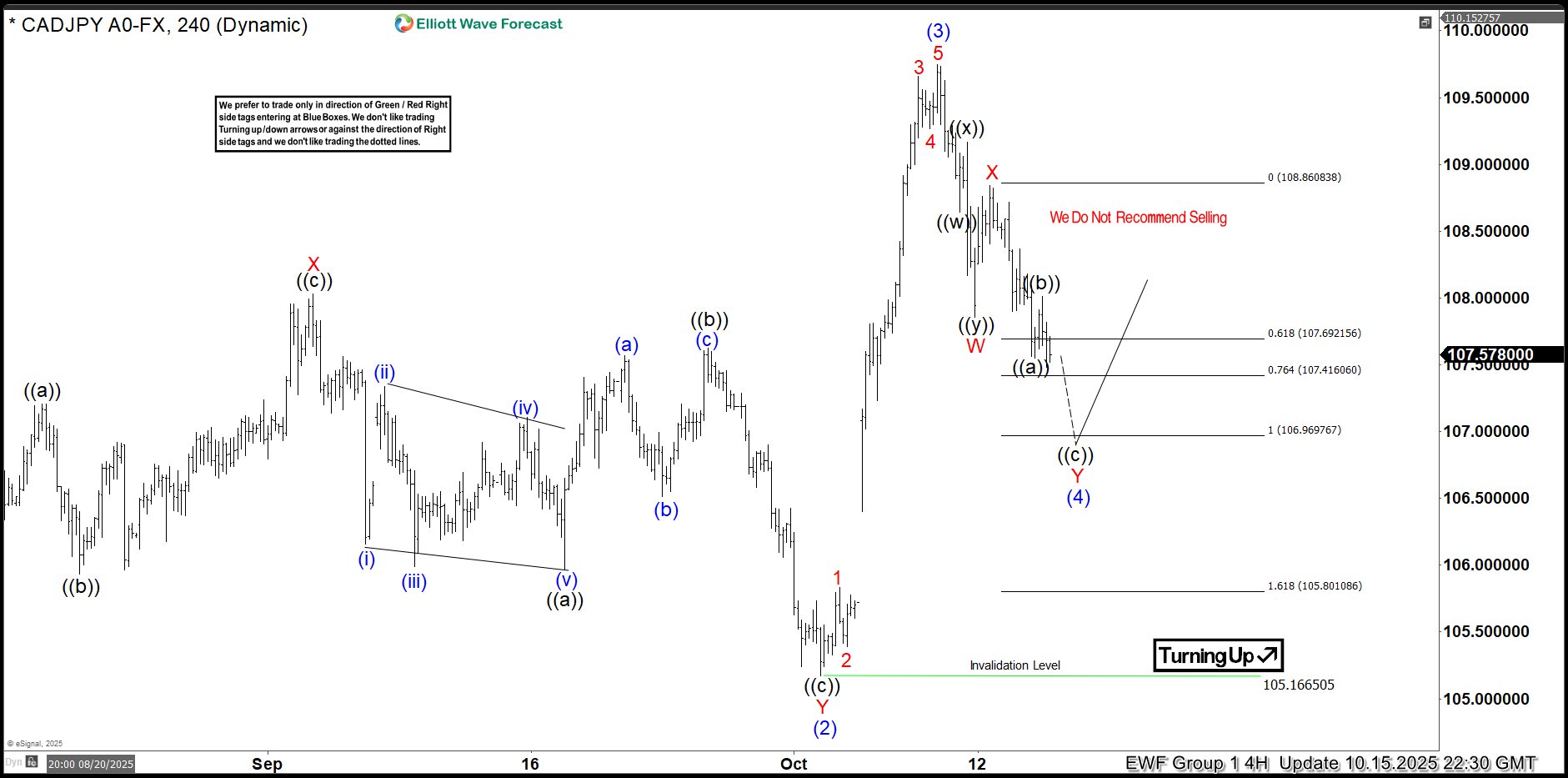

CADJPY Elliott Wave 4 Hour Chart 10.15.2025

CADJPY is forming a pullback towards the 105.166 low. The correction stays incomplete at the moment. The primary leg exhibits a transparent 3-wave construction ((w))–((x))–((y)) in black, adopted by a 3-wave bounce within the crimson X leg. We count on to see one other leg decrease to finish the 3-wave sample throughout the crimson Y leg as effectively. We advise towards promoting $CADJPY and as a substitute favor the lengthy aspect.

Do you know ? 90% of merchants fail as a result of they don’t perceive market patterns. Are you within the high 10%? Check your self with this superior Elliott Wave Check

Official buying and selling technique on Methods to commerce 3, 7, or 11 swing and equal leg is defined in particulars in Academic Video, out there for members viewing contained in the membership space.

CADJPY Elliott Wave 4 Hour Chart 10.30.2025

CADJPY discovered consumers as anticipated. The foreign exchange pair has reacted strongly and finally we obtained a break towards new highs. Now, intraday pull backs ought to ideally maintain discovering consumers so far as 106.195 pivot holds.

Remember the fact that market is dynamic and offered view might have modified in the meanwhile. You’ll be able to verify most up-to-date charts with goal ranges within the membership space of the location. Finest devices to commerce are these having incomplete bullish or bearish swings sequences. We put them in Sequence Report and greatest amongst them are proven within the Dwell Buying and selling Room

New to Elliott Wave ? Take a look at our Free Elliott Wave Academic Internet Web page and obtain our Free Elliott Wave E-book.