Like myself, maybe the Bollinger Band was one of many first indicators you found at the start of your buying and selling journey.

In spite of everything, it’s purported to make all the pieces tremendous straightforward…

…simply purchase low and promote excessive, proper!?…

Effectively, certain, there could also be some fortunate wins at first.

However as time goes on… you begin experiencing losses…

Worse but, they will come alongside way more steadily with the Bollinger Band!

So, you cease utilizing the indicator and doubtless begin studying about RSI… shifting averages…

…you begin system hopping.

I’m guessing it could be a well-recognized situation.

It was for me, anyway!

However, what if I advised you there’s a provable approach the Bollinger Band works constantly in actual markets?

Not simply in income, however statistically, too?

Effectively, that’s what I’m about to indicate you on this information.

Particularly, you’ll be taught:

- A fast refresher on how the Bollinger Band works and the way loads of merchants use it

- Timeless buying and selling ideas on the best way to construct a working Bollinger Band buying and selling system

- The foundations of the Bollinger Band buying and selling system and why they exist

- A whole metric of the outcomes of the Bollinger Band buying and selling system

You prepared?

Then let’s get began…

How the Bollinger Band works and the best way to use it

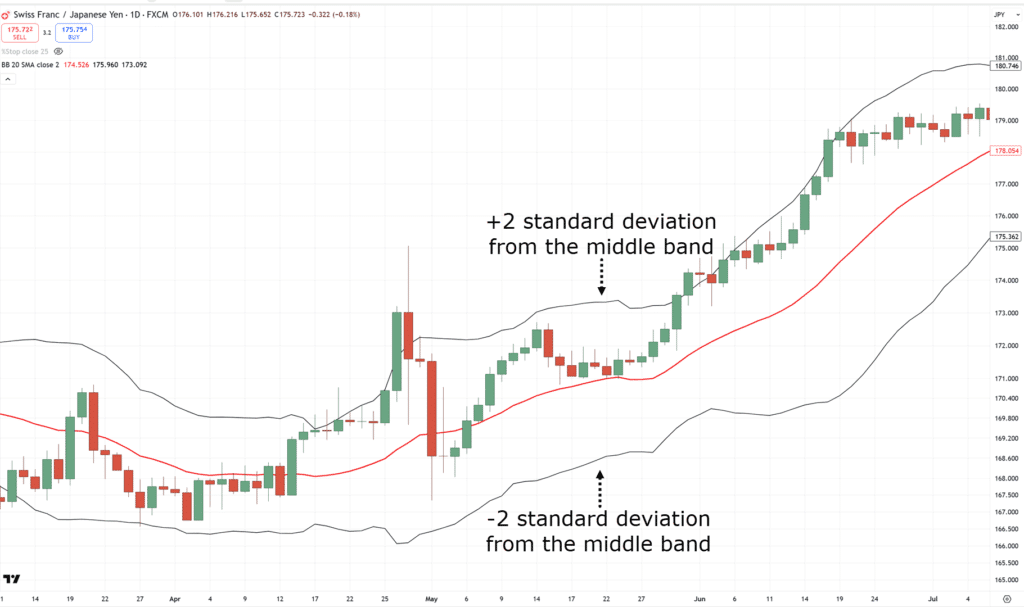

The indicator just about consists of three issues:

- Higher Band

- Center Band

- Decrease Band

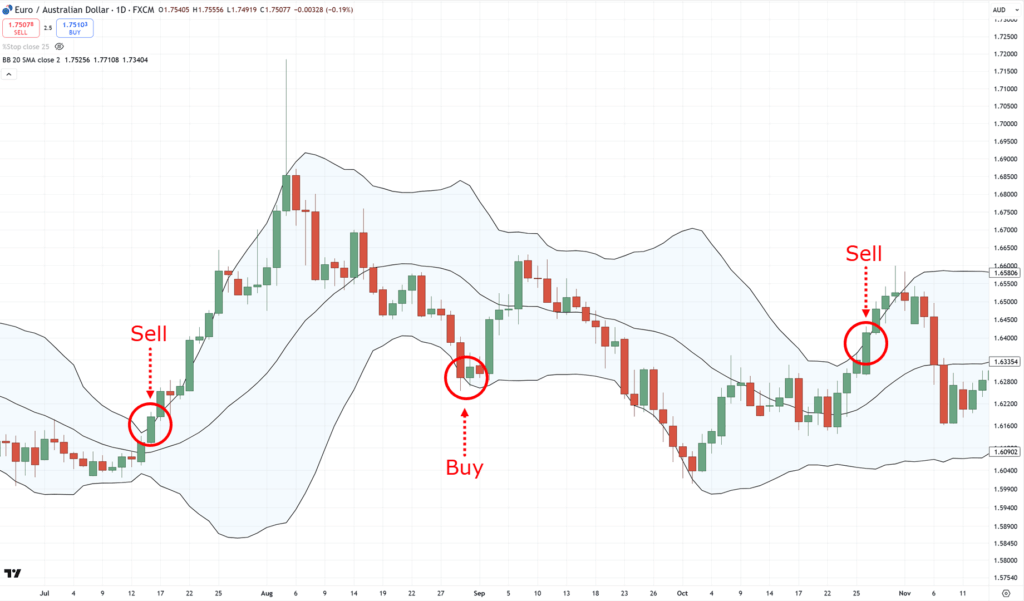

Beginning on the coronary heart of this indicator is a 20-period shifting common…

The indicator works by including a normal deviation of two to the higher band and subtracting a normal deviation of two from the decrease band…

Mainly, it provides “distance” to the shifting common on the center band.

Now, how do merchants interpret it?

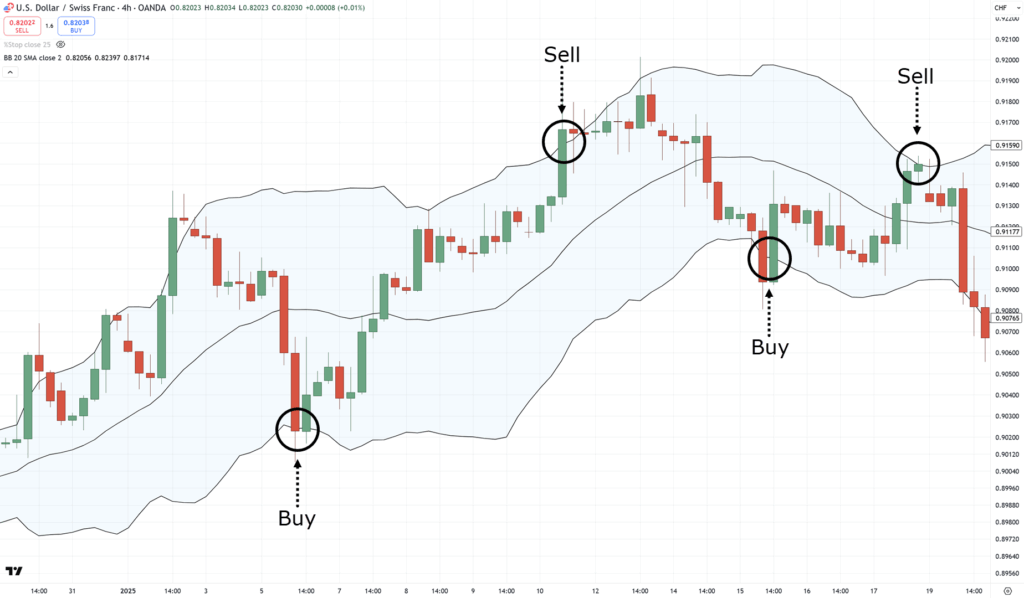

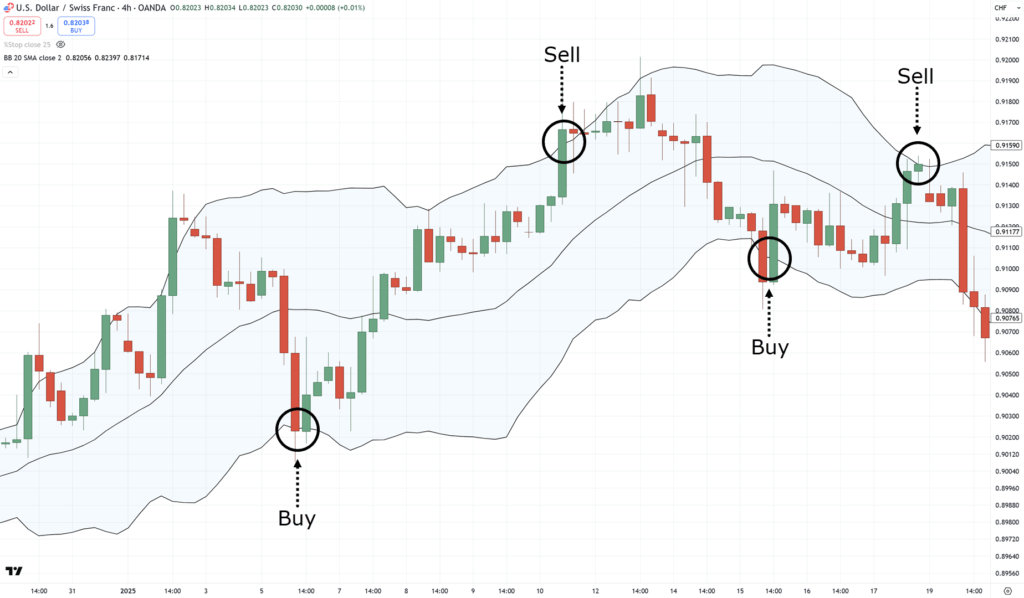

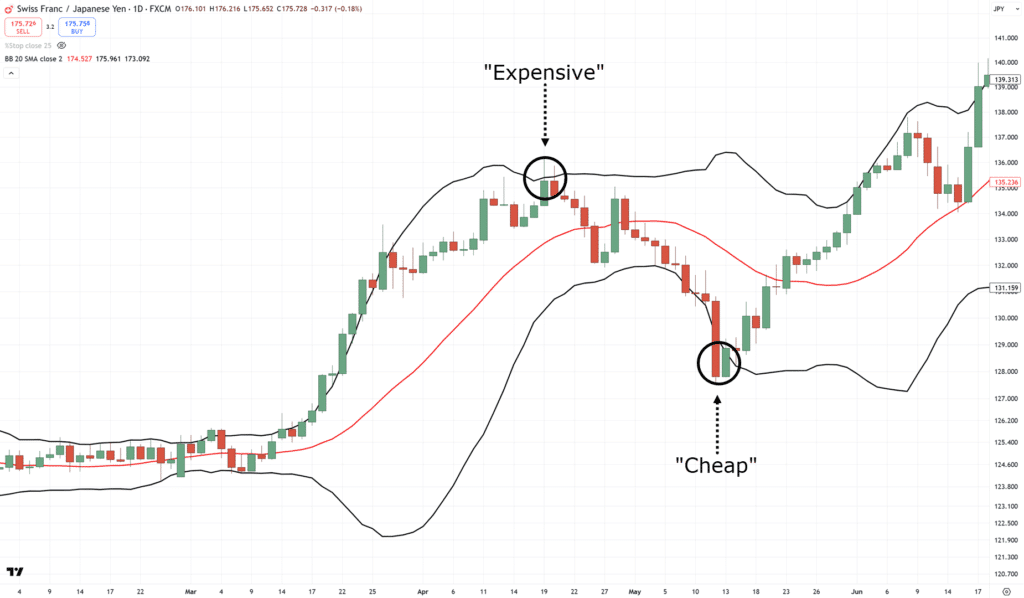

Effectively, if the value is on the higher band, it’s thought of costly, and thought of low cost when it’s on the decrease band…

These examples can then be used to introduce a few methods, reminiscent of “shopping for low and promoting excessive”…

It’s primarily the textbook strategy to utilizing this indicator.

However, whereas it sounds nice in principle…

…how does it carry out in actuality?

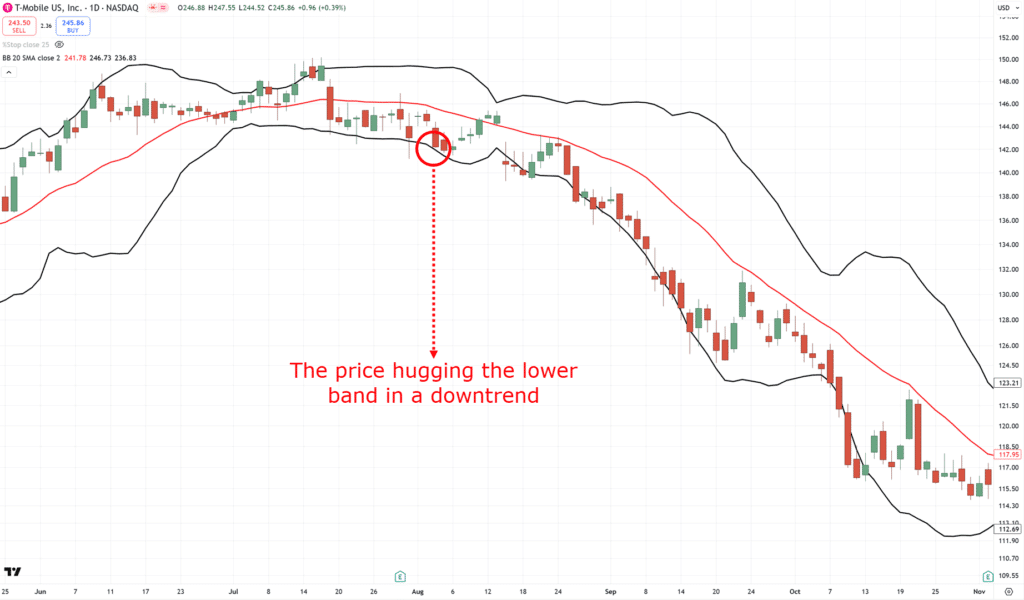

Hmm, not at all times in the way in which you’d count on!…

As you’ll be able to see, in down tendencies, the value retains getting cheaper and cheaper.

Think about if you happen to purchase on the decrease band and also you’re nonetheless holding your commerce, hoping that the value will bounce again increased… not a good time!

Which leaves you questioning once more…

“What, if the Bollinger Band doesn’t work on trending markets…”

“What’s the purpose of this information?”

“Does the indicator work in any respect?”

Effectively, indicators are solely ever a small a part of a working buying and selling technique.

In the event you focus solely on the Bollinger Band, you’ll miss out on the best way to combine it right into a worthwhile buying and selling system!

Which is why within the subsequent part…

…I’ll clarify the inspiration behind how the system I’m going to share with you made +7,605% during the last 30 years.

So, let’s take step one on studying how this technique works.

Fundamental guidelines and ideas behind the Bollinger Band buying and selling system

Let’s get straight to the purpose, lets?

The Bollinger Band buying and selling system that I’ll share with you primarily trades shares.

Why the inventory markets?

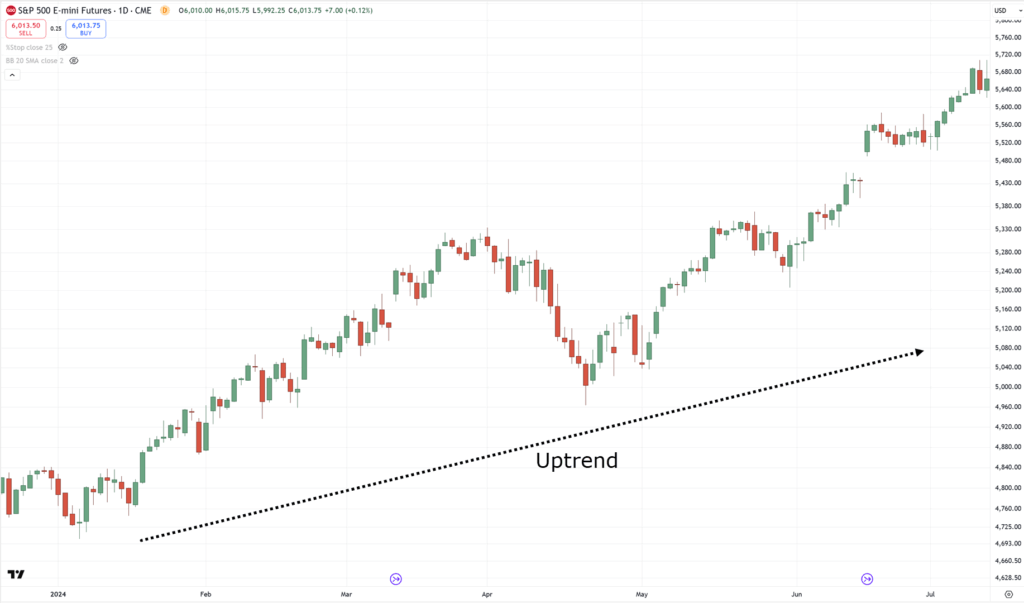

The principle cause is that the inventory market can transfer like a tide.

Which means that each time the markets are in a bull run…

…a whole bunch of alternatives come up within the inventory markets!

And that is what the created system works on: driving and profiting from these “tides” available in the market.

Now with that stated…

What sort of shares are best suited?

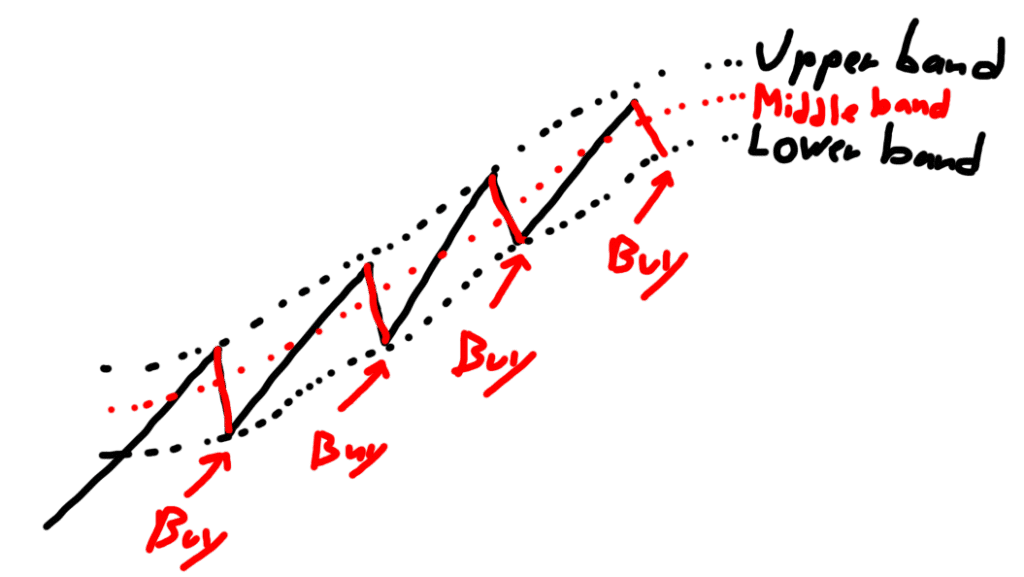

A lot of the textbook examples of the Bollinger Band indicator look one thing like this…

In order that they’re implying it’s an indicator greatest traded in a variety.

However what if the Bollinger Band may benefit from an uptrend?

Effectively, let’s preserve constructing as much as that!

However for now…

Begin looking for shares that development.

That’s proper, not ranging shares, however trending ones!

Why?

As a result of shares which can be in an uptrend are already prone to proceed increased.

You wish to hop in and wager on a number one horse!

And the very best half is that everytime you spot a trending inventory, it already signifies that the general sentiment of the market in that inventory is nice.

As for the way the corporate has been managed, or how constant it’s in its earnings development…

…all (most likely) priced into the chart already!

So now, with the inventory chosen, what’s subsequent?

How do you employ the Bollinger Band, and why?

All indicators are instruments – they’re only one side of getting issues achieved.

Don’t you agree?

The primary query you could at all times ask is:

“What sort of setups are you trying to enter trades?”

Which, on this case…

…it’s shares which can be trending:..

Importantly, you additionally wish to search for pullback setups, to be able to “purchase low and promote excessive” in favour of the general development…

With that well-defined, the following query you might ask is…

“Which indicator may also help me discover these setups and entries systematically?”

Now that may be a nice query.

Fortunately, it’s going to be the Bollinger Band!

In what approach?

Merely put, by coming into pullbacks on the decrease band on high of a trending inventory…

Now, whether or not or not you employ the Bollinger Band, it’s essential to deal with all indicators as a device.

In creating any system, you need to at all times preserve your thoughts as structured as attainable.

First, work out what setup you wish to commerce, then discover the suitable indicator that can assist you search for and enter these setups.

Make sense?

Good, as a result of now comes the enjoyable half…

The Bollinger Band buying and selling system itself.

Within the subsequent sections, discover the entire guidelines of this technique, in addition to the outcomes, so you’ll be able to resolve for your self.

You prepared?

Then let’s get on with it!

The whole guidelines of the Bollinger Band buying and selling system

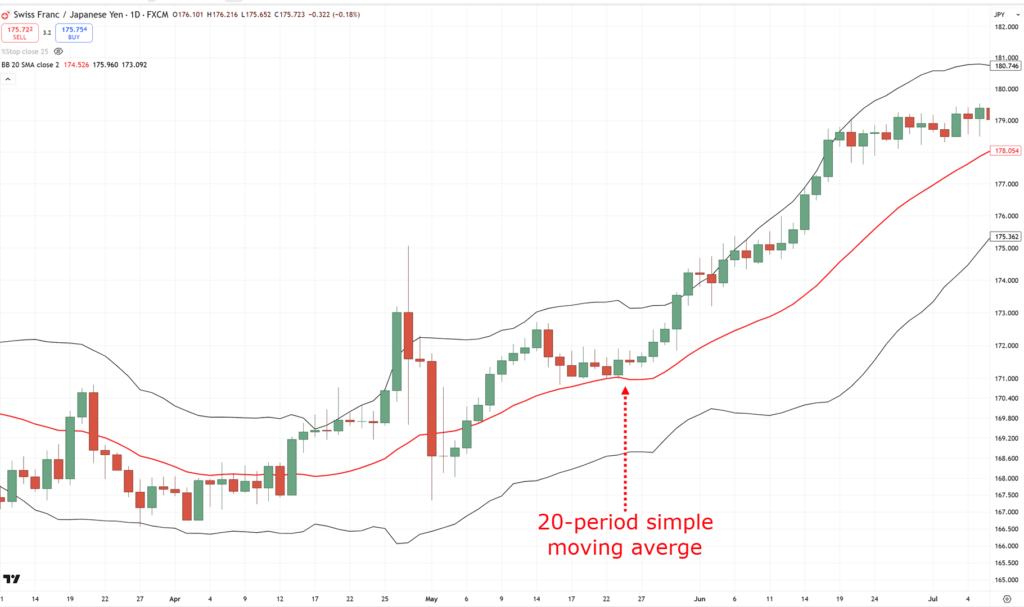

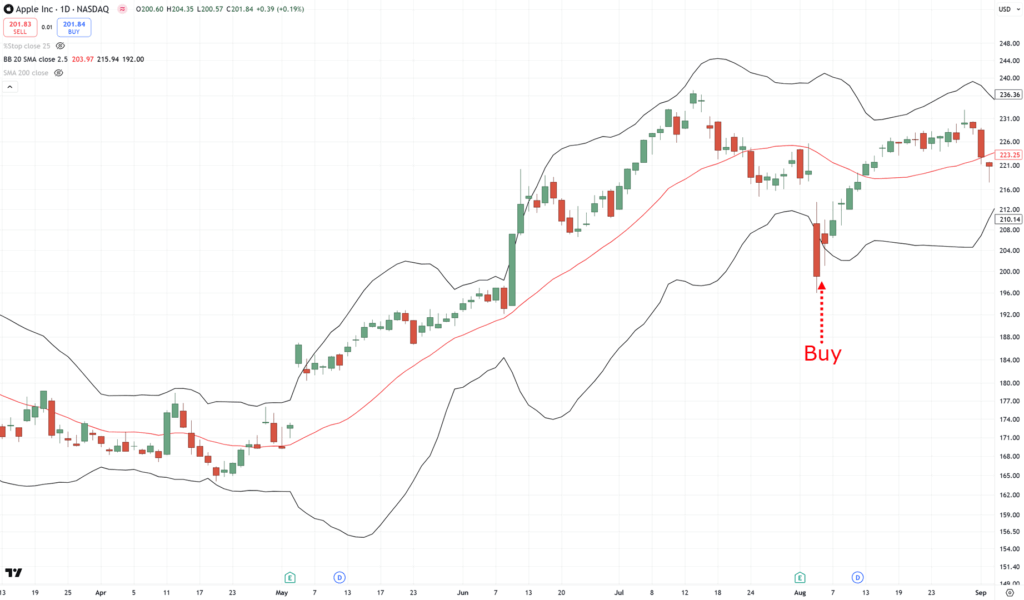

One factor to notice is that the buying and selling system you’re about to be taught is predicated on imply reversion buying and selling.

This implies you purchase shares on a pullback after which promote them on the rally.

It appears one thing like this…

With that in thoughts, listed below are the principles of this Bollinger Band buying and selling system…

Markets traded:

Shares within the Russell 1000 index

Timeframe:

Every day

Danger administration:

20% capital for every inventory and a most of 5 positions

Buying and selling guidelines:

- The inventory is above the 200-day shifting common

- The inventory closes under the decrease Bollinger Band

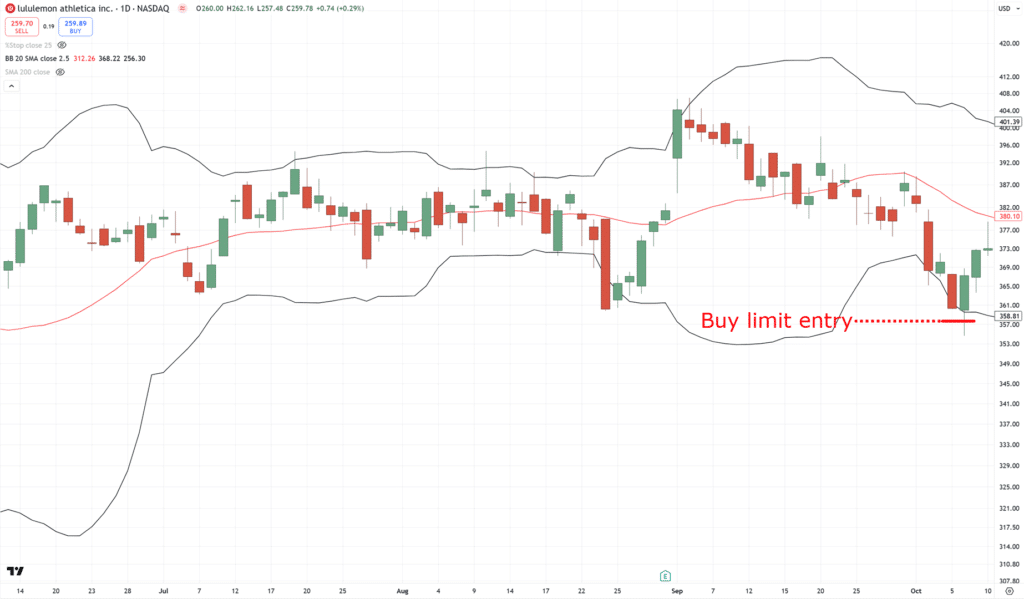

- Place a 3% purchase restrict order under the final closing worth

- If there are too many shares to select from, choose those which have elevated essentially the most in worth during the last 100 days (standards to rank shares from strongest to weakest)

- In case your order is crammed, promote when the 2-day RSI crosses above 50 or after 10 buying and selling days (standards to outline the promote sign)

And simply so as to add, the Bollinger Band settings are: 20-day shifting common and a pair of.5 normal deviation.

I do know it’s quite a bit to soak up hastily.

So, let me stroll you thru every of these guidelines.

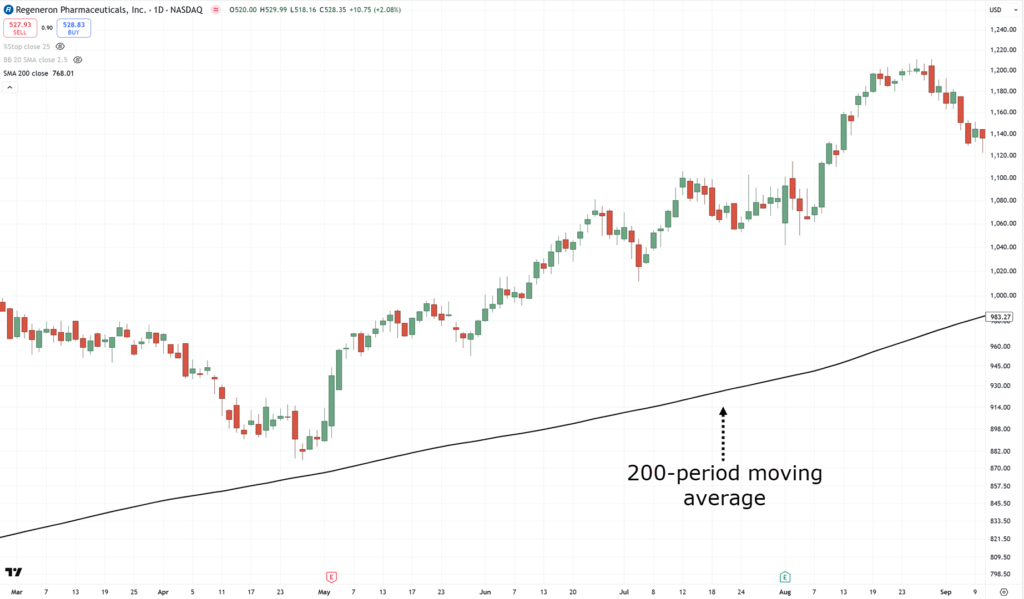

The inventory is above the 200-day shifting common

Recall that you just’re attempting to commerce pullbacks on shares which can be in an uptrend.

And as , there are 100 methods to outline what an “uptrend” is!

So to make this definition systematic, merely use a 200-day shifting common…

Meaning if a inventory’s worth is above the 200-period shifting common, it meets the primary criterion!

Add it to the record!

And if it’s under the 200-period MA?

Skip the inventory.

However, is there a straightforward approach to filter for these?

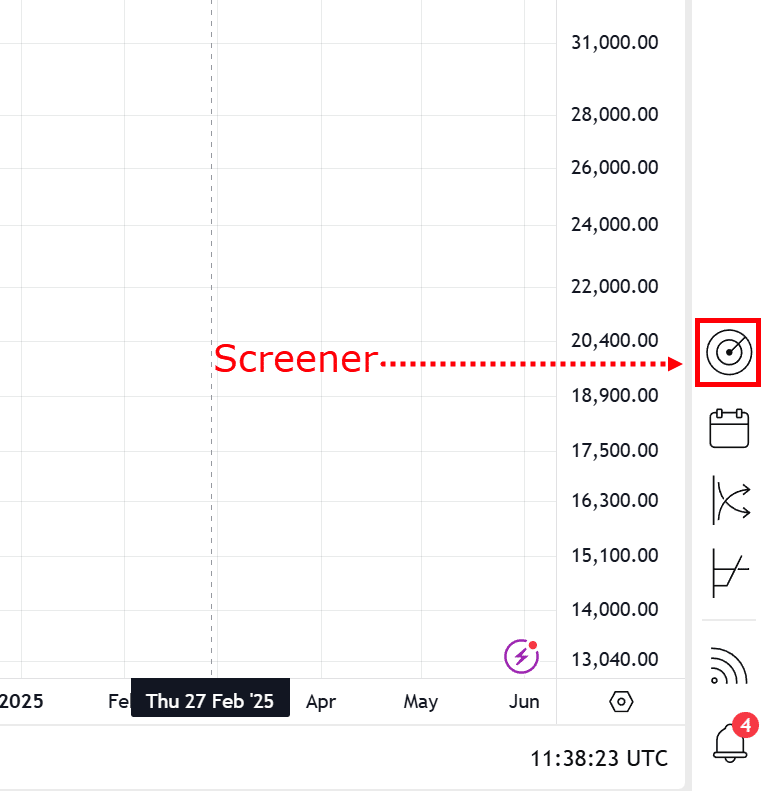

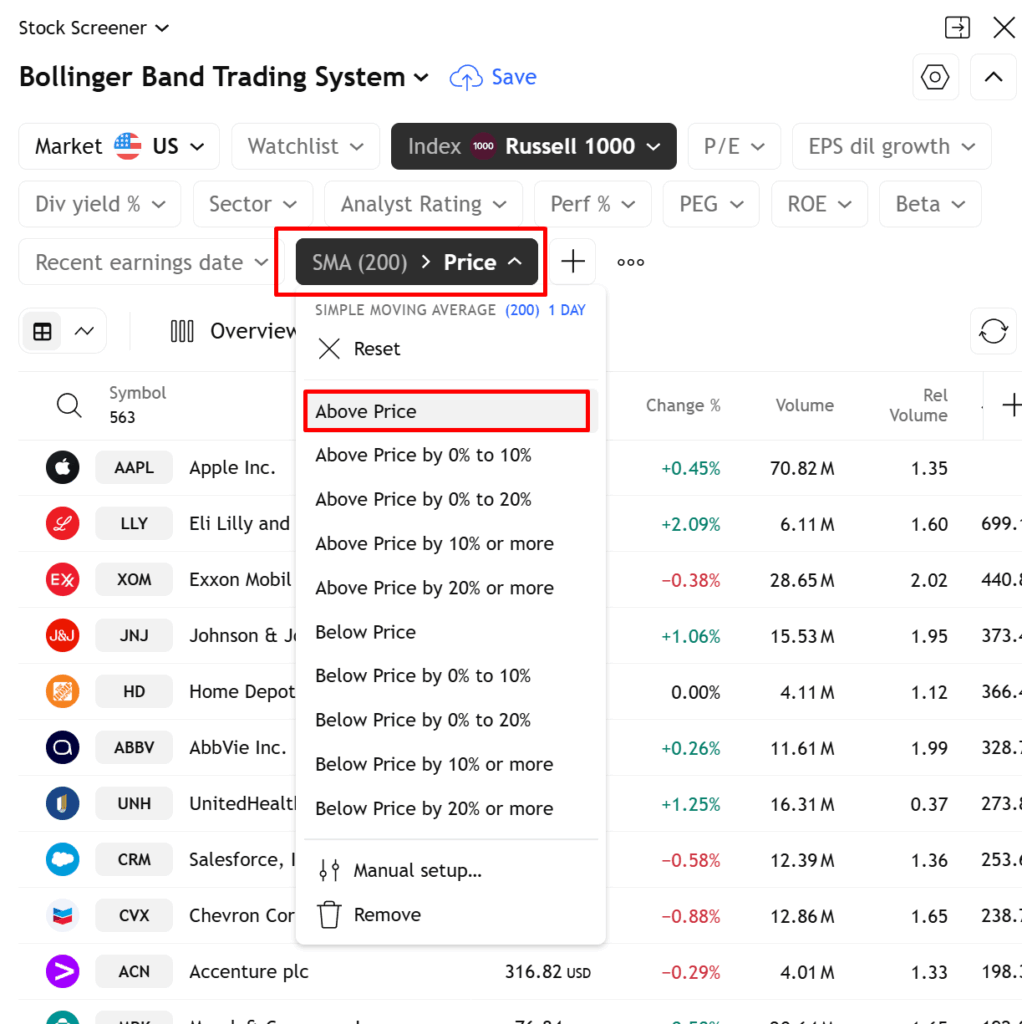

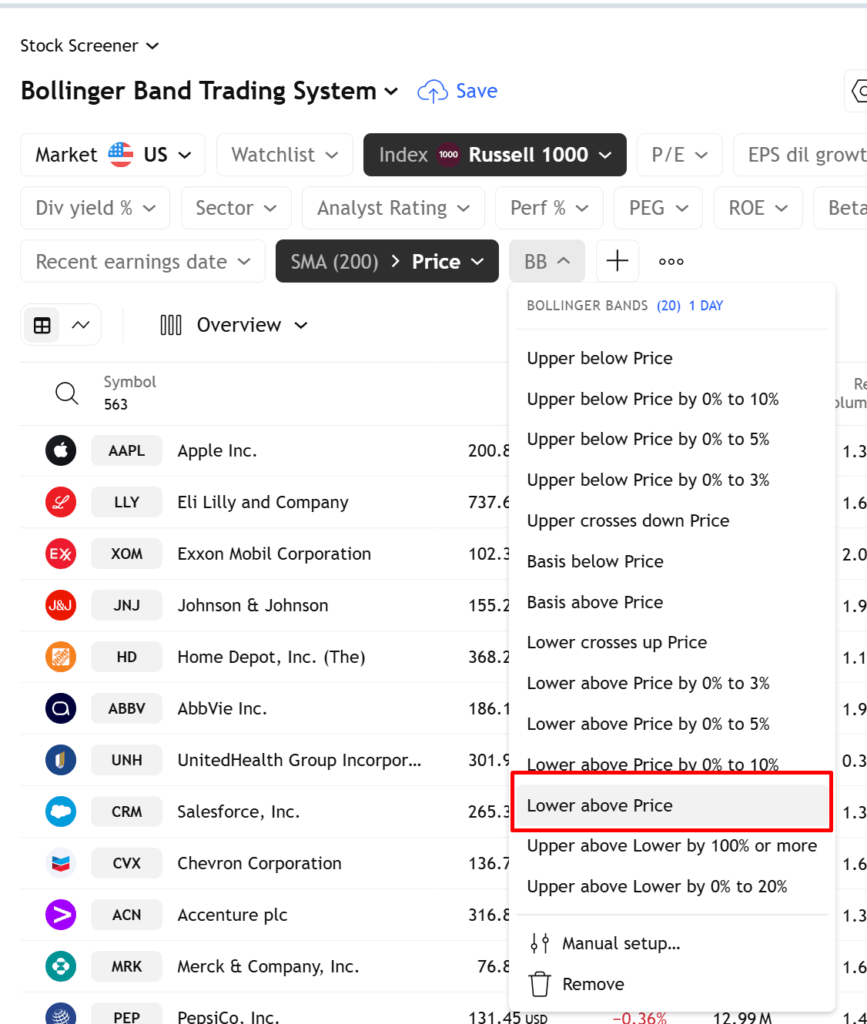

Effectively, you need to use TradingView’s free scanning device!…

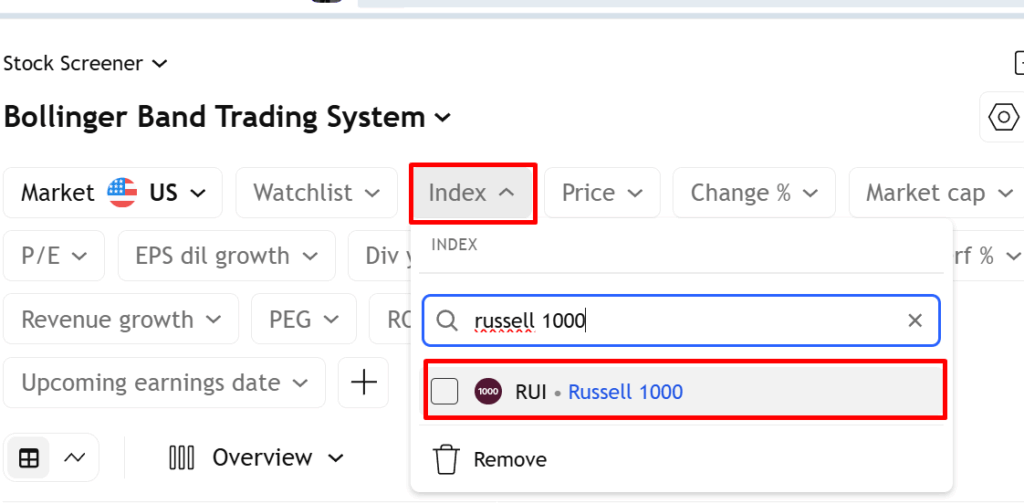

First, set your market to the Russell 1000…

And apply the shifting common filter…

Set it to 200-period, so it solely filters the right shares…

And with that, you’ve already bought a robust filter for this technique!

Now don’t fear, as I’m going by means of the principles, I’ll proceed to construct upon this screener so you’ll be able to observe.

With that stated, what’s the following factor to search for?

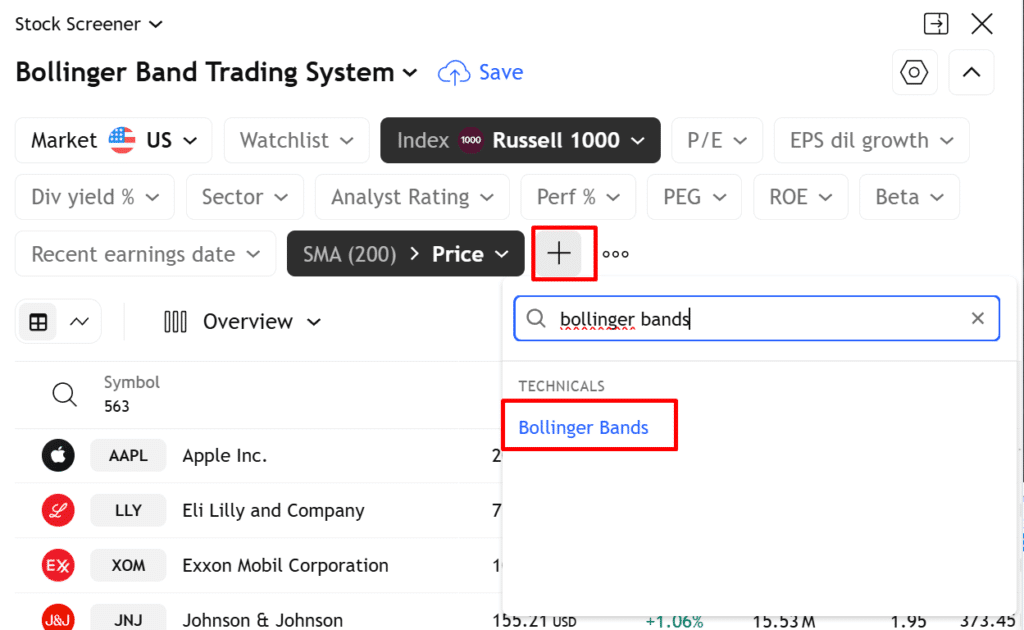

The inventory has closed under the decrease Bollinger Band

That is the place the Bollinger Band indicator is available in.

It’s used to systematically outline a pullback – ready for the value to “shut” under the decrease band…

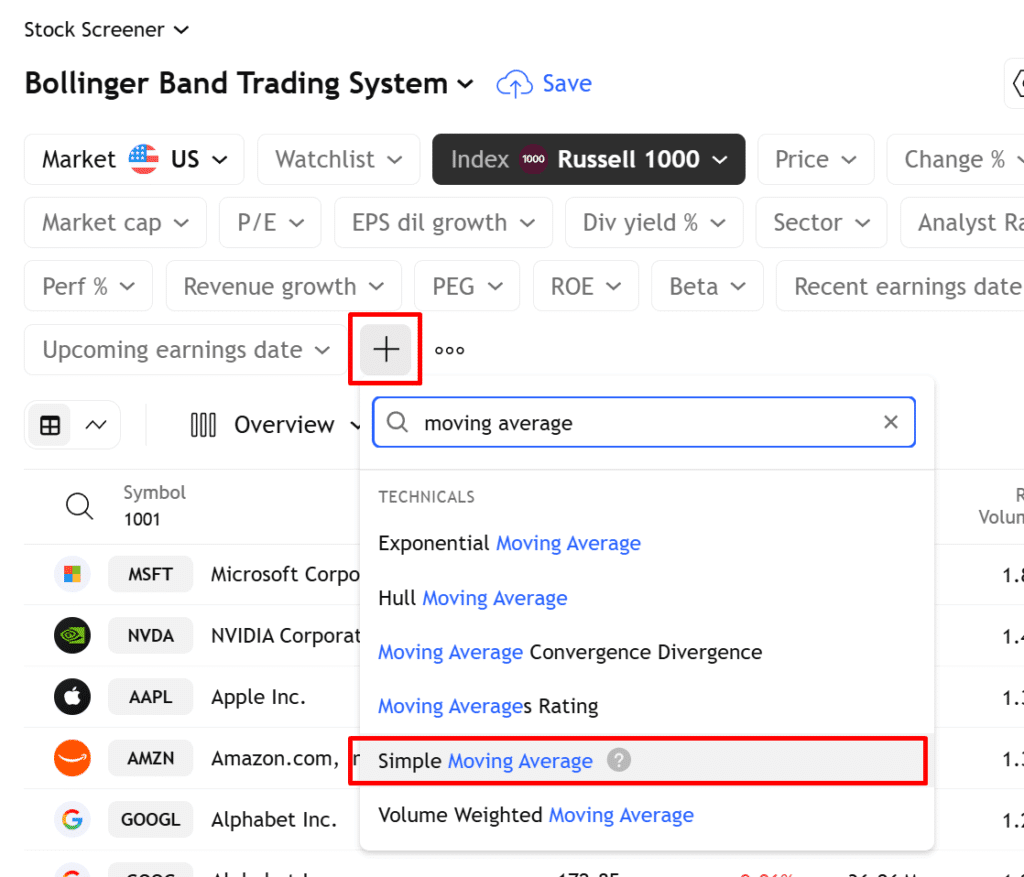

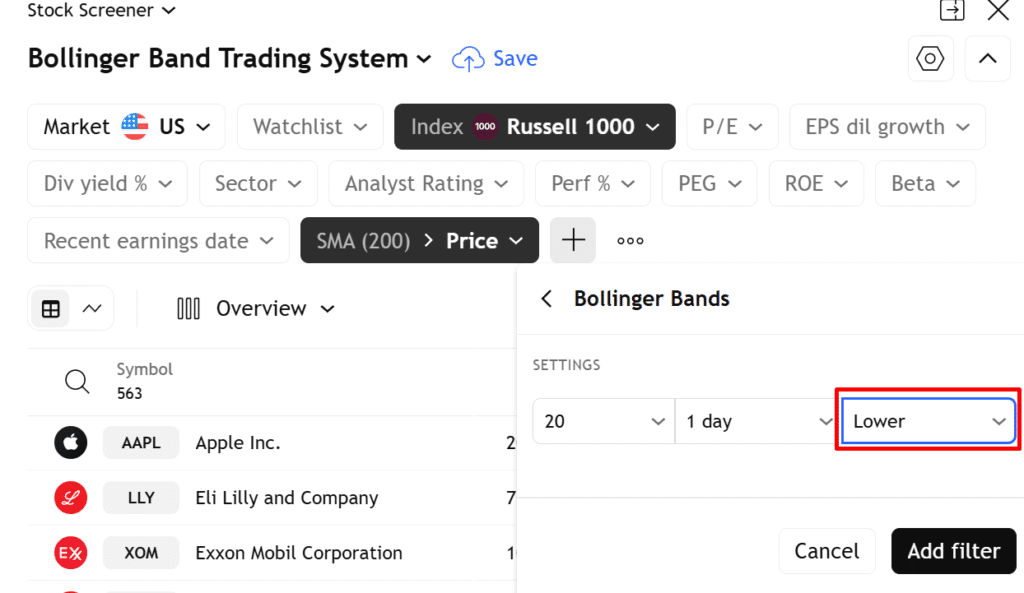

Within the TradingView screener, go forward and apply the Bollinger Band indicator filter…

And at last, set it to solely search for shares the place the value is under the decrease band…

Which means that on-top of the 200-period shifting common filter, this screener will solely search for shares if the decrease band is above the value, fairly, if the value is under the decrease band.

With that in place, if the inventory makes an in depth under the decrease band, what’s subsequent?

If there are too many shares to select from, choose those which have elevated essentially the most in worth during the last 100 days

One advantage of the inventory markets is that when issues are going nice, numerous alternatives come up.

Which means that in a bull market, shares are trending more often than not.

Nevertheless, a buying and selling portfolio can solely deal with a lot.

This results in the query… which one to purchase?

Effectively, this rule particularly solutions that!

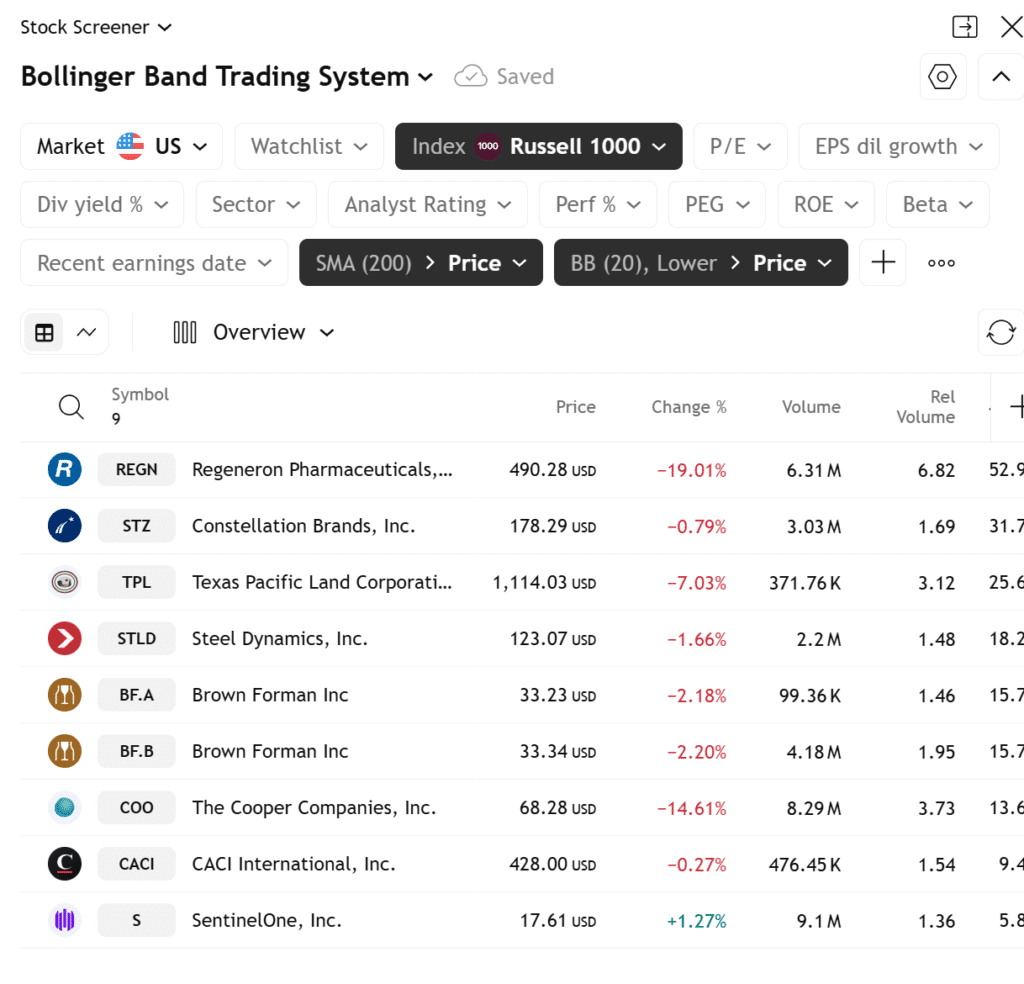

Based mostly on the screener outcomes, you’ll be able to see the next…

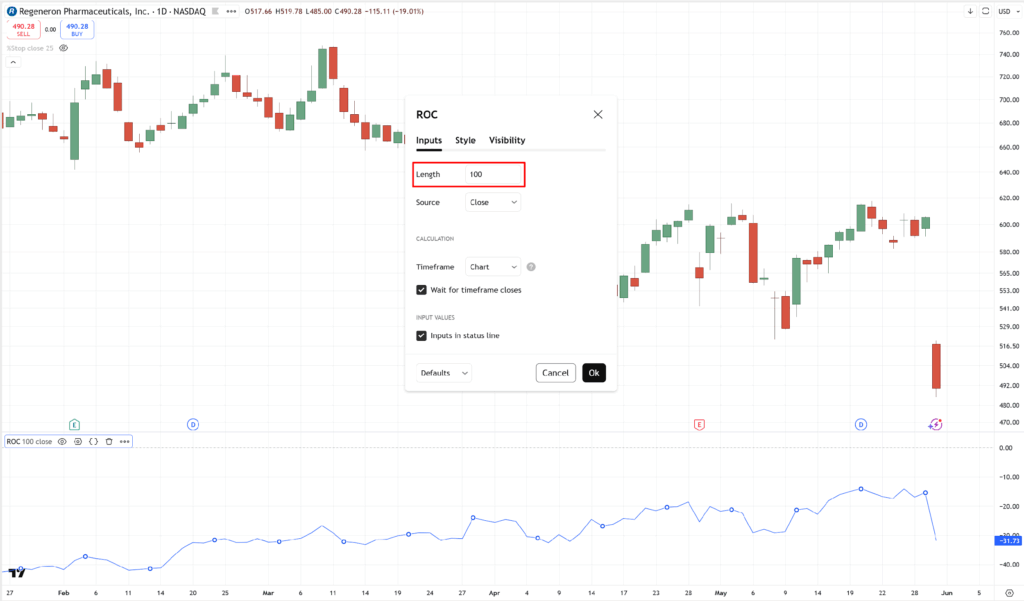

So what it’s important to do now’s get every inventory’s “price of change” worth.

Particularly, you’d have to drag up the speed of change indicator and set it at a 100-period…

Based mostly on what will be seen within the above instance, REGN has a ROC worth of -31.73

Now, though you could acquire the 100-day ROC worth for all of the shares listed in your screener outcomes your self, for the sake of this information, I’ve offered some instance values for you right here!

- REGN: -31.73

- STZ: -19.66

- TPL: -8.01

- STLD: +8.77

- A: -8.03

- COO: -7.54

- CACI: +1.87

- S: -22.8

What you could do subsequent is rank them primarily based on their values:

- STLD: +8.77

- CACI: +1.87

- COO: -7.54

- TPL: -8.01

- BF.A: -8.03

- STZ: -19.66

- S: -22.8

- REGN: -31.73

Recall, this Bollinger Band buying and selling system has a most of 5 trades.

This implies you need to allocate not more than 20% of your capital to every inventory.

So, it is a approach of discovering out which shares are most deserving of your cash!

And primarily based on the rankings on this instance…

You’d need to prioritize coming into STLD, CACI, COO, TPL, and BF.A! (and ignore the remainder.)

Now, if, for instance, you have already got 3 open trades, then all you could do is to solely enter the highest 2 on the record.

So to reiterate – rank shares from strongest to weakest primarily based on their 100-day price of change.

Then, prioritize buying and selling them primarily based on the rating till you attain 5 whole open trades!

With that out of the way in which, let’s now transfer on to entries and exits.

The perfect piece of recommendation I’ve is…

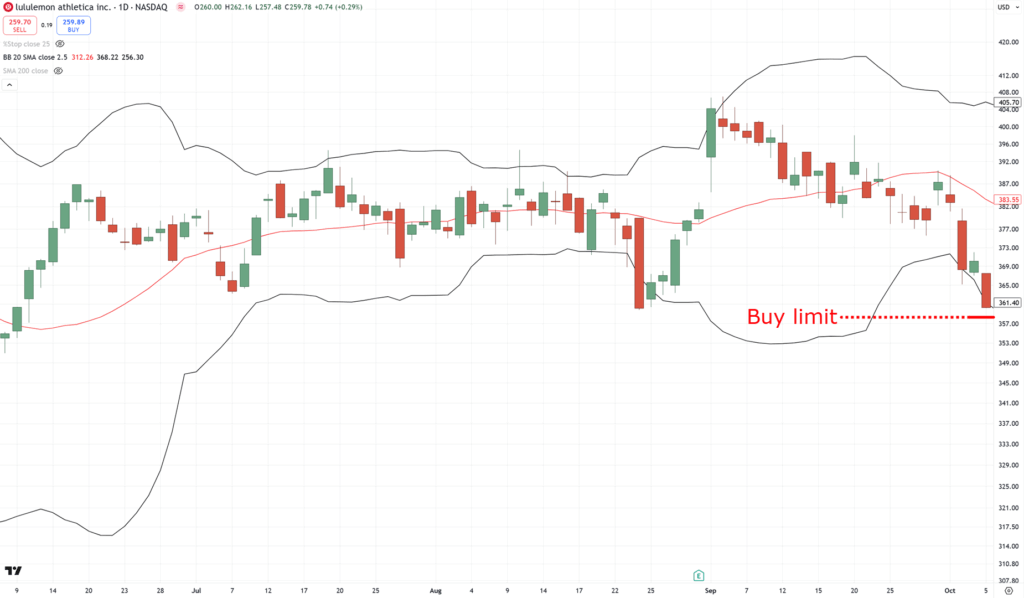

Place a 3% purchase restrict order under the final closing worth

Regardless of the final closing worth is, because the inventory closes under the decrease band…

Simply subtract 3% from the value, and then you definately get your restrict order worth!…

The rationale you do that is that you really want the inventory to return to you even additional.

There must be sellers nonetheless looking for the underside, just for the patrons to swoop the value again in like an prolonged rubber band…

Primarily, in case your restrict order didn’t get triggered…

…take the order out and do your scans once more the following day.

Be sure no restrict order lasts greater than a day!

Bought it?

Total, this rule is a fairly nice criterion to establish oversold shares.

So, now that you just’ve entered the commerce, how do you handle it?

In spite of everything, there’s no level in coming into a inventory if you happen to don’t know the best way to exit it, proper?

Importantly, no “intestine emotions” mandatory right here, both…

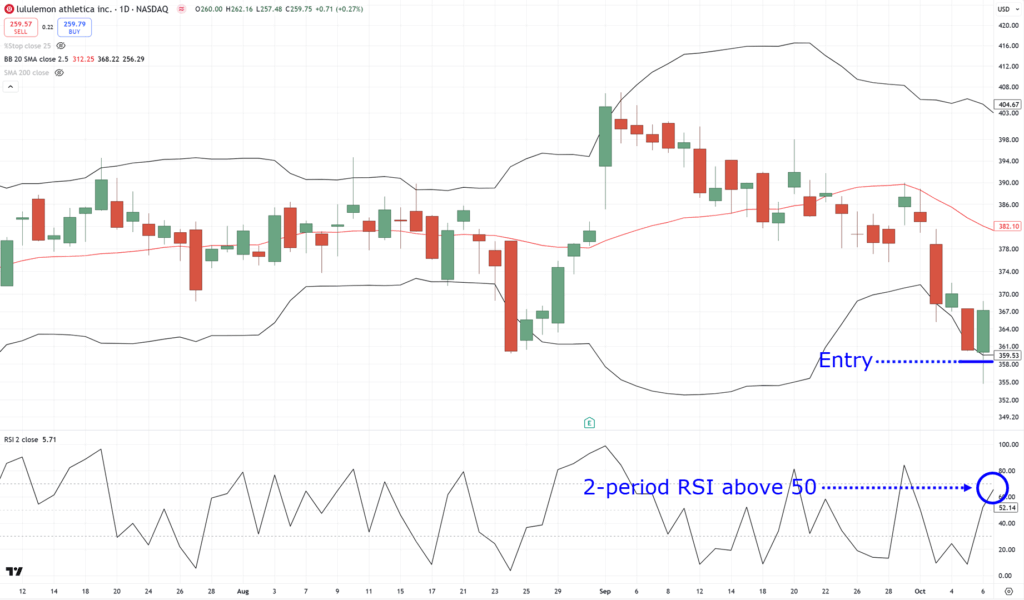

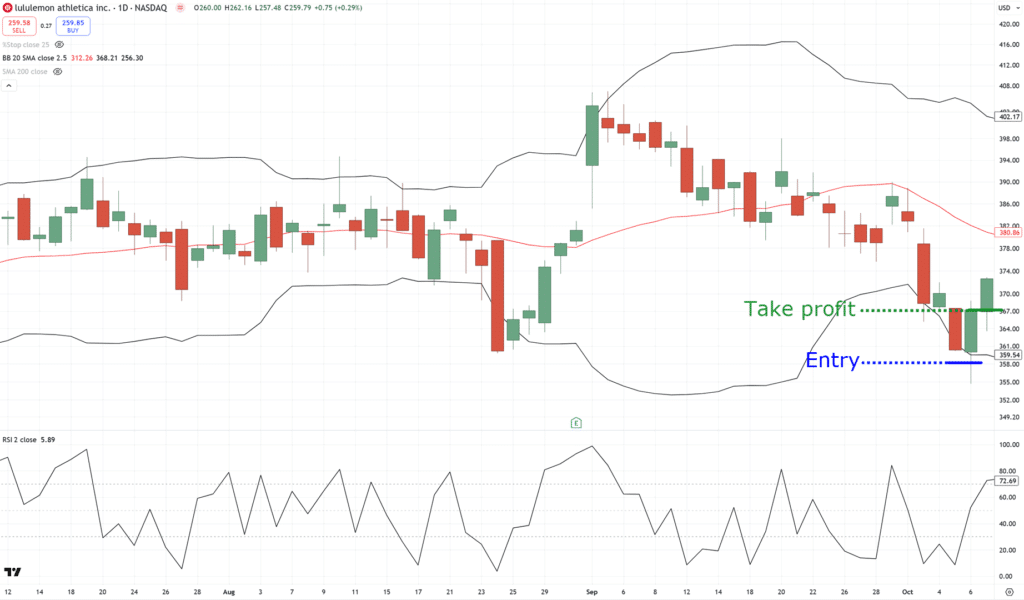

In case your order is crammed, promote when the 2-day RSI crosses above 50 or after 10 buying and selling days

I do know, this text is concerning the Bollinger Bands.

So, why the heck is the RSI sliding into this text?

Effectively, the 200-period shifting common makes certain the shares being traded are in an uptrend.

With that in place, the Bollinger Band helps you enter and search for pullback setups.

The RSI indicator helps work out exits.

Recall, the thought of this technique is to seize pullbacks…

On the identical time, you don’t wish to overstay into the commerce, and at greatest, solely seize the power of that pullback setup.”…

And this, my pal, is what the RSI indicator is for

When you’re within the commerce, look ahead to the value to shut above RSI 50…

Then, exit the following day on the market’s “opening”…

Oh, and don’t neglect plan B.

Simply in case the inventory doesn’t do something, there must also be a time-stop.

If the value doesn’t shut above the RSI 50 after 10 day?

Exit on the 11th day.

And sure, in case your restrict order will get triggered, it already counts as the primary day!

Make sense?

So now to deal with the questions lurking behind your thoughts…

Does this technique work?

If it really works, what sort of returns are you able to count on?

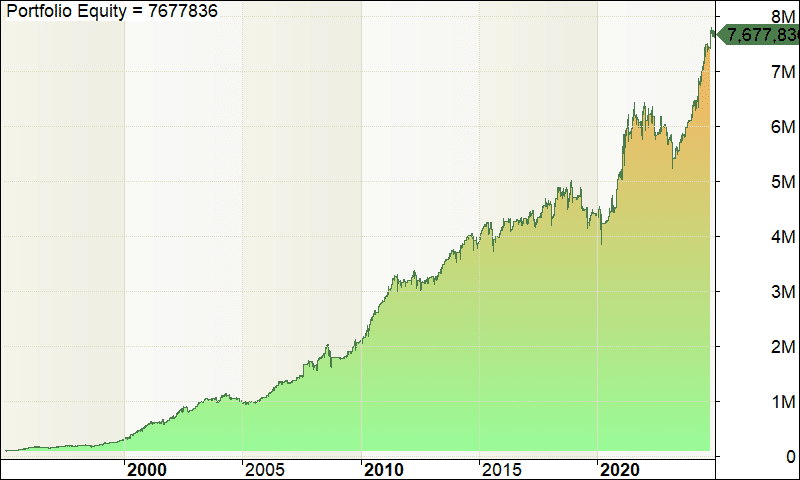

Bollinger Band Buying and selling System Outcomes

Discover how I at all times say “system” all through this information?

It’s intentional, as a result of clearly there’s a couple of side concerned right here.

Nevertheless, the principles are goal and clearly outlined, that means it may be simply examined.

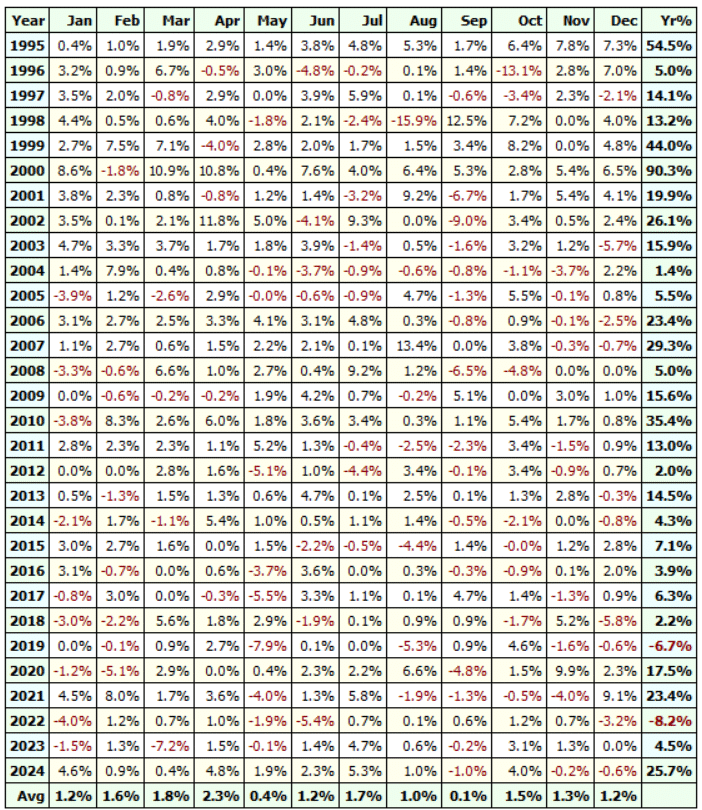

On this case, let’s backtest it from 1995 to 2024.

This set of knowledge signifies that the technique will present its efficiency, even by means of a number of monetary crises!

And naturally, this technique operates within the Russell 1000 universe.

P.S. the info additionally consists of shares which can be already delisted in addition to shares that got here out and in of the Russell 1000 index.

So, listed below are the outcomes…

- Internet revenue: +7,577.84%

- Variety of trades: 1365

- Common Annual return: +15.56%

- Most drawdown: -23.20%

- Profitable price:94%

- Payoff ratio:74

As you’ll be able to see, this technique solely had 2 shedding years out of all 30, and if you happen to have a look at the statistics, this technique has a win price of 66%.

That’s one heck of a system!

I imply, certain, there are some mediocre years…

However general, it’s clear the system has an edge within the markets.

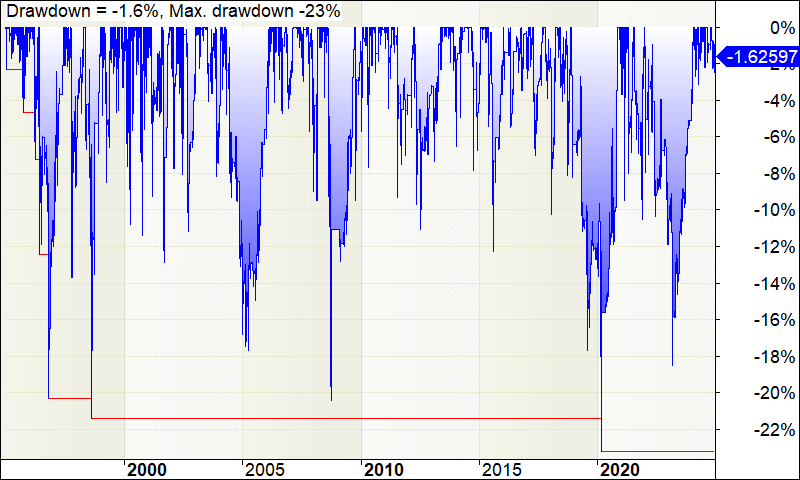

Nevertheless, as with all methods, there are weaknesses.

Any methods may have their shedding streaks.

So, for transparency, right here’s an underwater fairness curve of this technique…

Mainly, it reveals how usually the Bollinger Band buying and selling system goes right into a shedding streak and for the way lengthy it stays there earlier than it breaks even once more.

And there you go!

A whole Bollinger Band buying and selling system that works within the markets!

Now at this level, all that’s left is so that you can apply the system, which admittedly is the toughest half.

As a result of as time goes on, you could develop a full understanding of this technique.

Which, at this level, you may begin questioning…

“Why this indicator?”

“Would the system nonetheless work if I modified the settings?”

“How about buying and selling this technique within the S&P 500? Will the system nonetheless work?”

Relaxation assured, I’ve created an FAQ part, which doubtless accommodates the solutions!…

Ceaselessly Requested Questions

Some generally requested questions concerning the Bollinger Bands buying and selling system…

What sort of order do I take advantage of to enter the commerce?

As per the principles of the technique, at all times use a restrict order.

In case your restrict order doesn’t get triggered for in the present day’s session, for instance, then the restrict order should expire.

Mainly, no purchase restrict order lasts greater than in the future.

Why do you employ the Russell 1000 as an alternative of the S&P 500?

There’s no specific cause.

You should utilize the S&P 500, and the buying and selling system will nonetheless work!

On the subject of the 200-period shifting common, do I take advantage of a easy or exponential shifting common?

I take advantage of a easy shifting common however to be trustworthy, it doesn’t matter.

You should utilize an exponential or weighted common, and the buying and selling system will nonetheless work!

The idea behind it’s what issues, not the parameters.

I’d be apprehensive if a buying and selling system broke down merely due to a parameter change!

Does the Bollinger Band buying and selling system work for brief promoting utilizing an reverse set of buying and selling guidelines, that means you brief shares on the higher band?

I’ve backtested this extensively, and sadly…

It doesn’t work.

Would this buying and selling system work for Foreign exchange markets?

Totally different markets have completely different behaviours.

So, if you wish to commerce this technique on different markets, these markets should have a mean-reverting behaviour or it received’t work.

What does place dimension 20% imply?

It means 20% of your capital can be used to purchase a inventory.

For instance, let’s say you might have $100,000 capital and you could purchase shares A, B, C, ,D and E.

This implies you’ll allocate $20,000 to shares A, B, C, D, and E.

After which, all of your buying and selling capital can be used up, and also you’ll not take any new positions (even when there’s a sound setup).

Isn’t it harmful to commerce and not using a cease loss?

Though you’re buying and selling and not using a cease loss, you might have a time cease of 10 buying and selling days.

So, if the exit sign will not be met inside 10 buying and selling days, you’ll exit the commerce on the open of the eleventh buying and selling day.

Additionally, so that you can lose all of your buying and selling capital, each inventory you purchase should drop to $0.

It’s attainable however unlikely as you’re buying and selling shares within the Russell 1000 (that are the 1000 largest shares within the USA).

You rank shares in accordance with their Charge of Change (ROC). Is there a minimal ROC worth you’re ?

No, there’s no minimal worth for it.

If the screener outcomes present a inventory with a damaging price of change, do I nonetheless take the commerce?

Sure, you continue to take the commerce despite the fact that the inventory has a damaging price of change

How a lot beginning capital do you could begin buying and selling with this technique?

It’s best to have at the very least $3,000 to commerce the Bollinger Band buying and selling system.

But when your dealer permits you to commerce fractional shares, then you’ll be able to open an account smaller than $3,000

What if the inventory worth hole is greater than 3% decrease? Do I nonetheless purchase the inventory?

Sure, you’ll nonetheless purchase the inventory, albeit at a lower cost (under your restrict order).

Additionally, flip OFF pre-market buying and selling. Most platforms have it turned off by default, but when yours is on, please swap it to OFF. If not, you’ll find yourself shopping for the inventory at a better worth.

Now, right here’s one secret that I wish to inform you:

That is simply one of many working techniques.

What was mentioned right here is mean-reversion buying and selling; nevertheless, there are additionally trend-following techniques and breakout buying and selling techniques.

All with an edge within the markets!

Now, think about if you happen to may commerce a number of (uncorrelated) buying and selling techniques that work.

It’s like having a number of streams of long-term earnings, proper?

So, if you wish to be taught extra about it, then there’s a brand new guide being launched referred to as Buying and selling Techniques That Work.

On this guide, you’ll get the total package deal.

It accommodates the system I shared with you in the present day however a lot improved, and likewise three different techniques.

In the event you’re , then you’ll be able to test it out right here.

With that stated…

I wish to know what you suppose.

Do you suppose that techniques buying and selling is the “best” approach to discover an edge available in the market?

In that case, do you intend to develop your system sometime?

Or attempt to commerce one which already works after which work from there?

Let me know your ideas within the feedback under!