By RoboForex Analytical Division

The USD/JPY pair rallied sharply on Monday, reaching the 153.00 degree and testing ranges not seen since February 2025. This bullish momentum is being pushed by expectations of great fiscal stimulus from Japan’s new authorities and ongoing uncertainty surrounding the Financial institution of Japan’s (BoJ) coverage path.

The yen has been below sustained strain because the election of Prime Minister Sanae Takaichi, whose administration is anticipated to pursue expansive fiscal spending whereas endorsing an accommodative financial stance. Reviews counsel a considerable stimulus bundle, valued at over ¥13.9 trillion, could possibly be unveiled as early as November. The plan goals to assist households and mitigate inflationary pressures.

Whereas the BoJ is broadly anticipated to maintain rates of interest unchanged at its assembly this week, market individuals will likely be watching intently for any communication concerning the circumstances for a future price hike ought to inflationary pressures ease. Moreover, an upcoming assembly between Prime Minister Takaichi and US President Donald Trump is being monitored for additional indicators on the route of Japan’s financial coverage.

Technical Evaluation: USD/JPY

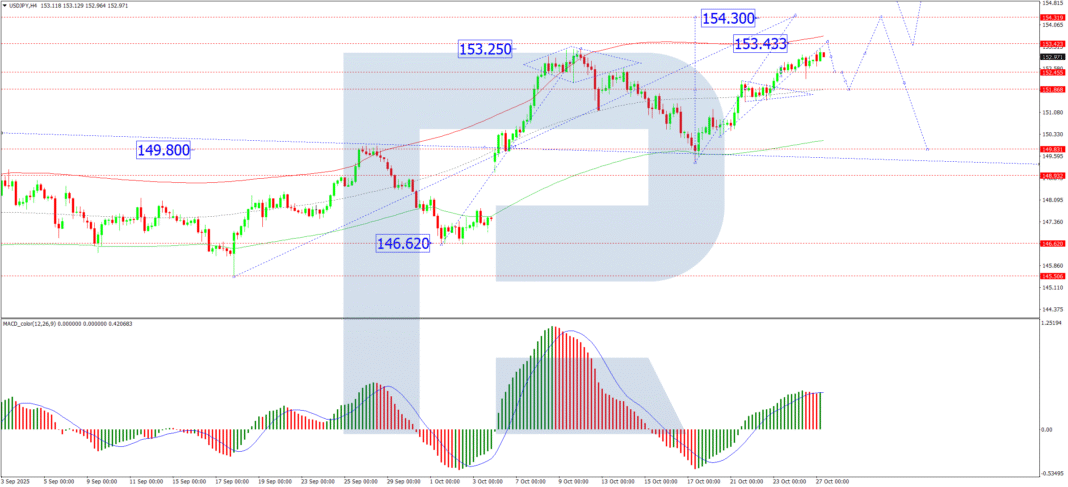

H4 chart:

On the H4 chart, USD/JPY broke out upwards from a consolidation vary round 151.80, confirming a renewed uptrend with an preliminary goal at 153.43. The pair has since accomplished a leg larger to 153.24 and is now present process a technical retracement, at the moment testing the 152.43 degree from above. We count on this pullback to be adopted by one other impulse larger in the direction of the 153.43 goal. Following that, a extra pronounced correction in the direction of 151.80 is anticipated earlier than the broader uptrend resumes, with the subsequent main goal at 154.33. The MACD indicator helps this outlook, with its sign line firmly above zero and pointing upwards, confirming sustained bullish momentum.

H1 chart:

The H1 chart reveals the completion of an preliminary development wave to 153.25. The rapid focus is on an extra push to 153.33. Upon reaching this native goal, a corrective decline to at the least 152.43 is probably going. As soon as this correction is full, the subsequent leg of the uptrend is projected to drive the pair in the direction of 154.33. This state of affairs is technically confirmed by the Stochastic oscillator, whose sign line is above 50 and trending strongly in the direction of 80, indicating that near-term bullish momentum stays intact.

Conclusion

Basically, the mixture of anticipated Japanese fiscal stimulus and a gentle BoJ continues to weigh on the yen, whereas technically, USD/JPY retains a constructive bullish bias. Whereas a short-term correction is anticipated, the trail of least resistance stays to the upside, with key targets at 153.43 and in the end 154.33.

Disclaimer:

Any forecasts contained herein are primarily based on the creator’s explicit opinion. This evaluation is probably not handled as buying and selling recommendation. RoboForex bears no duty for buying and selling outcomes primarily based on buying and selling suggestions and evaluations contained herein.

- USD/JPY Assessments Key February Highs Oct 27, 2025

- US inventory indices set worth data amid mushy inflation information Oct 27, 2025

- US authorities shutdown enters fourth week. Oil jumps amid new sanctions in opposition to Russia Oct 24, 2025

- EUR/USD Consolidates Forward of Potential Additional Losses Oct 24, 2025

- Oil costs surged following new sanctions in opposition to prime Russian oil firms. The Mexican peso stays in demand Oct 23, 2025

- The British Pound Extends Its Losses Oct 23, 2025

- The brand new Prime Minister of Japan helps a unfastened financial coverage. Canada sees rising inflation Oct 22, 2025

- Sturdy company studies assist inventory indices. EU nations supported a plan to section out imports of Russian oil and gasoline Oct 21, 2025

- EUR/USD Underneath Downward Stress Oct 21, 2025

- The US shares rise on easing commerce tensions. Bitcoin falls amid new wave of threat in world markets Oct 20, 2025