Editor’s Word: Inflation isn’t going away anytime quickly. However as Oxford Membership’s Chief Revenue Strategist Marc Lichtenfeld explains, one asset class has overwhelmed inflation for practically a century – small cap shares.

And in at the moment’s visitor article, Marc says a choose group of those small corporations might ship the most important beneficial properties of our lifetimes.

This week Marc and Chief Funding Strategist Alexander Inexperienced hosted The Micro Magazine 7 Summit, the place they revealed seven tiny shares which might be poised to soar as America launches the most important AI buildout in historical past.

These small caps might hand early traders 1,500% or extra within the subsequent 12 months.

Click on right here watch the replay.

– Ryan Fitzwater, Writer

Inflation might have slowed down, however nobody is celebrating. At 2.9%, it stays effectively above the Fed’s 2% goal.

And with extra rate of interest cuts and better tariffs doubtless coming, I count on inflation to speed up.

Fortuitously, there’s an asset class that has completely crushed inflation each decade for practically a century. And I guess you’ll be shocked once you discover out what it’s.

It isn’t gold.

Gold has saved up with inflation over the very long run, however that’s about it. An oz of gold primarily buys the identical quantity of products and providers at the moment because it did a millennium or two in the past.

The massive inflation beater is small cap shares.

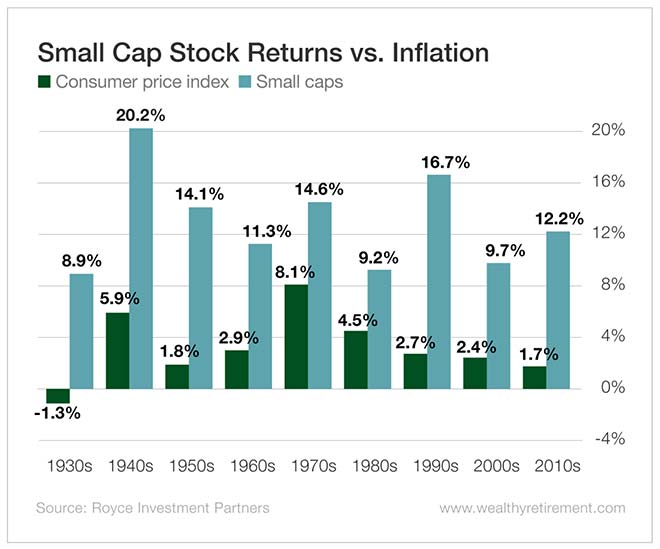

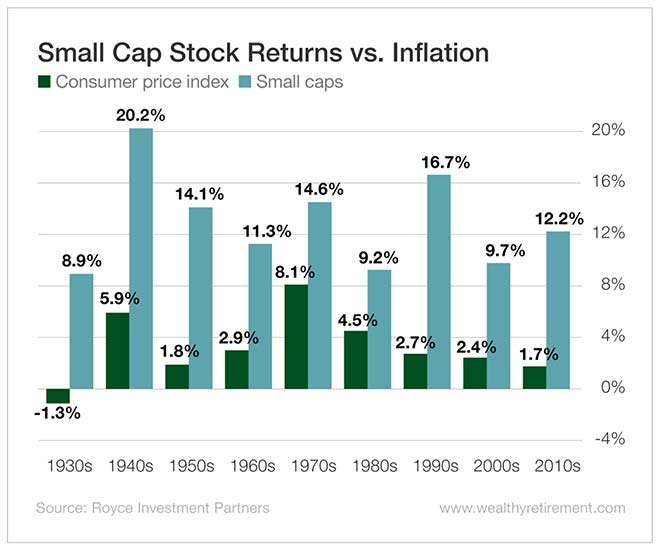

You possibly can see from the chart above that small caps strongly outpaced inflation in each decade. The smallest margin was 4.7% within the Nineteen Eighties.

On common, small caps returned 13% yearly, whereas inflation averaged 3.2% – which means small caps elevated an investor’s shopping for energy by an astounding 10% per 12 months.

That doesn’t simply imply you may have had 10% more cash every year. It means you may have purchased 10% extra items and providers every year – regardless of how excessive costs rose throughout that 12 months.

To make it clear simply how profound that is, let me provide you with an instance. Let’s say you’re a golfer and the typical spherical of golf prices you $100. You might have a finances of $1,000 per 12 months for golf (not together with tools). Meaning you possibly can play 10 occasions per 12 months.

However now think about that, attributable to inflation, a spherical of golf will value you $105 subsequent 12 months. In case your finances doesn’t improve, you’re right down to taking part in 9 occasions per 12 months. And in just a few years, if inflation stays fixed, that can decline to eight occasions.

However now think about that you just added the typical yearly return (13%) that small caps have delivered to your golf finances, rising it from $1,000 to $1,130. Not solely would you be capable of afford the annual bump in greens charges, however you’d additionally be capable of improve the variety of occasions you possibly can hit the hyperlinks to 11 per 12 months. You’d be capable of play 12 occasions the next 12 months… and so forth.

Small caps get a nasty rap. Many traders suppose they’re tremendous dangerous. And sure ones are. There are many rubbish corporations on the market.

However as an asset class, small caps have a incredible observe file that goes again a long time. And surprisingly, they assist traders improve their shopping for energy even during times of excessive inflation.

Going ahead, it is going to be necessary to have small caps in your portfolio. With massive caps buying and selling at traditionally excessive valuations (and with extra fee cuts by the Consumed the horizon), they’re prone to be the highest performers within the close to time period.

Many individuals consider small caps as speculative investments. However they’ve confirmed over practically 100 years to play a significant function in permitting traders to beat inflation and improve their shopping for energy.

![]()

YOUR ACTION PLAN

However now, there’s a completely new presentation that particulars the brand new wave of tiny shares that might soar. It’s known as the Micro Magazine 7. I hosted the dwell occasion with Alexander Inexperienced to tell Members.

Good investing,

Marc

FUN FACT FRIDAY

Company earnings begin sturdy: Regardless of jittery markets, about 86% of the primary 130 companies within the S&P 500 have beat expectations. The markets are additionally hitting new highs because of a softer-than-expected inflation print.