The present month has offered a difficult atmosphere for executing breakout trades. The prevalence of frequent intraday whipsaw actions has made it tough to successfully carry trades ahead.

All through historical past, these 5 sectors (a mix of 64% in $SPY weighting) have constantly demonstrated a better frequency of breakout alternatives. Subsequently, it’s essential to establish our present place by reviewing these sectors. I’ll prepare them within the order of their present RS scores (power stage) and put up them accordingly.

Moreover, I may even embrace my routine of easy excel tabulation with month-to-month ISM Manufacturing PMI’s report and a key trade group that’s carefully monitored by economists, buyers, policymakers and a famend hedge fund supervisor. Each of those useful resource function main indicators that supply precious insights into the general path and well-being of the broader financial system.

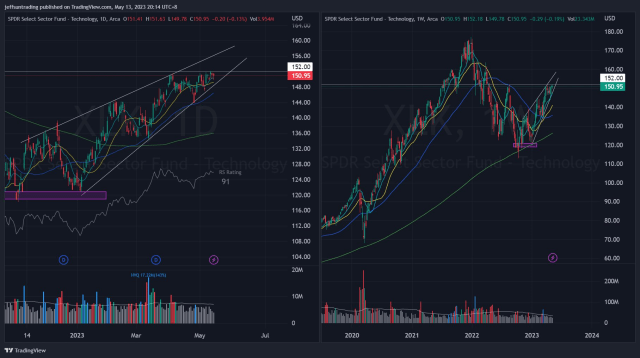

1. $XLK – Expertise (26% Weighting in $SPY)

At current, the SPDR sector exhibiting the very best power among the many eleven sectors is +34% from its 52-week low. This week, $XLK is testing its 52-week excessive at $151 from August 2022. $152 to clear. Regardless of its upward value motion since 2023, it has additionally fashioned a bearish rising wedge sample.

Word $AAPL & $MSFT exceeds 48% weighting within the sector.

2. $XLV – Healthcare (14% Weighting in $SPY)

Inside a month, $XLV skilled a noteworthy 10% rally from its low in March, which holds significance contemplating the sector’s low ADR% (0.9%). Presently, a bullish flag sample is forming, though the value motion inside the flag remains to be considerably free.

Apparently, whenever you conduct scans for the strongest efficiency over a 1-week, 1-month, and 3-month interval, the outcomes are largely dominated small and midcap names from the pharmaceutical group.

3. $XLI – Industrial (8% Weighting in $SPY)

For the reason that begin of 2023, $XLI has been characterised by free value actions. In latest weeks, now we have noticed a tightening sample forming inside a symmetrical triangle. To ensure that a bullish bias situation to be confirmed, it will be mandatory for $XLI to first reclaim the $101 stage.

Although $XLI solely stand 8% weighting in $SPY, the sector is taken into account a number one one because it pose important affect to the broader financial system as a consequence of a number of causes;

- Enterprise Funding, industrial corporations make substantial investments in CAPEX equivalent to equipment, gear and infrastructure and such improve in spending signifies confidence.

- Employment, main supply of employment and significant slice of the workforce.

- International Commerce and Manufacturing, the sector is carefully tied to international commerce in each export/import ranges, and manufacturing output.

- Authorities Spending, industrial corporations are sometimes the primary beneficiary from authorities infrastructure tasks funding ie. transportation community, utilities, and public works.

The ISM Manufacturing PMI, launched on first enterprise day of every month, additionally presents nice dataset as a number one indicator of the financial well being. It’s surveyed from the Buying Managers of commercial companies, who’ve probably the most up-to-date details about the corporate’s notion of the financial system. This makes them a key determinant of financial well-being, appearing as a number one indicator.

The excel desk are my April’s tabulation. I strongly advocate to discover this common routine as a reference to sector and trade group charts. You’ll be able to extract the month-to-month information from the hyperlink under.

https://www.ismworld.org/supply-management-news-and-reports/reviews/ism-report-on-business/

4. $XLY – Shopper Discretionary (10% Weighting in $SPY)

$XLY has proven a big improve of +17% from its 52-week low from latest December. It has been buying and selling inside a slender 4% vary over the previous three weeks, and seems to be positioning itself for a possible breakout from the ascending triangle sample it has fashioned.

Notably, the 200-week transferring common beforehand rejected this progress in early February. Nonetheless, it now seems that $XLY is making ready to make one other try at breaching this resistance.

5. $XLE – Power (4.6% Weighting in $SPY)

Just like $XLI, $XLE has a comparatively low weighting however exerts a big impression on the broader financial system. It’s because $XLE is acknowledged as a number one indicator, providing precious insights into vitality consumption, commodity costs, capital expenditure, geopolitical developments, and employment traits.

Among the many 5 sectors talked about, $XLE at present has the bottom RS Ranking, and it turns into obvious why that is the case. Since November 2022, it has been forming a sequence of decrease highs, exhibiting restricted participation within the broader rally that occurred in January. At present, it’s buying and selling under all main transferring averages, indicating a weakened place. Moreover, relative weak point has skilled one other sharp dive in latest weeks.

The one instant assist stage to look at for is the $76 stage, which was the latest March low.

BONUS: $XHB – Homebuilders (Main Trade Group)

Stanley Druckenmiller has incessantly shared his strategy of utilizing $XHB as a number one indicator to achieve insights into the path and total well being of the broader financial system in his interviews. That is primarily due to its sturdy correlation with the general financial well-being. A number of explanation why it’s seen as such, i. Financial Sensitivity, ii. Ahead-Trying Trade, iii. Ripple impact on associated sectors, iv. Employment, v. Authorities infrastructure building and so on.

It’s fascinating to notice that the holdings composition of $XHB is split between $XLI (47%) and $XLY (53%). Nonetheless, one might argue that standard knowledge suggests the inclusion of $XLB within the combine as nicely.

Thanks for taking the time to learn. In case you discovered worth on this dialogue, please take into account sharing this with others. Cheers.

PS: In case you benefit from the above curated article, you could comply with me on twitter (@jeffsuntrading) to get each day market diary, buying and selling concepts and intermittent reflection on life as a dealer.

The present month has offered a difficult atmosphere for executing breakout trades. The prevalence of frequent intraday whipsaw actions has made it tough to successfully carry trades ahead.

All through historical past, these 5 sectors (a mix of 64% in $SPY… pic.twitter.com/nuKy20Bahz

— Jeff Solar, CFTe (@jeffsuntrading) Might 13, 2023

The put up Analyzing 5 Key Sectors and Indicators for Financial Insights first appeared on .